In our dynamic financial landscape, a strong credit score is paramount for unlocking opportunities. The advent of technology for credit repair software has ushered in solutions at our fingertips, and Client Dispute Manager Software stands out.

This software claims to revolutionize credit repair by addressing discrepancies and engaging with credit bureaus, but does it truly deliver on its promise?

In this exploration, we probe the effectiveness of Client Dispute Manager Software. Navigating the nuances of credit reporting, we delve into the mechanics of this tool to reveal its potential for elevating credit scores.

Join us as we peel back the layers, discerning whether this software is a game-changer or a mere addition to the complex world of credit repair.

Understanding Credit Repair Software

In the realm of credit repair, technology has cast its transformative spell, giving birth to a new player on the field: credit repair software.

These digital tools promise a streamlined approach to achieving a healthier credit score but understanding their inner workings is crucial before embarking on the journey of credit rehabilitation.

Dissecting the Mechanisms

Credit repair software operates on the principle of automating and simplifying the credit repair process. It scans credit reports with a fine-tooth comb, ferreting out inaccuracies, errors, and inconsistencies that might be dragging down the score.

Armed with algorithms and automated dispute generation, these tools take the lead in confronting credit bureaus and creditors, demanding rectification where necessary. This marks a significant departure from the traditional, time-consuming methods of manual credit repair.

The Power of Data Analysis

At the heart of credit repair software lies its data analysis prowess. These programs can swiftly identify patterns and anomalies across credit reports, recognizing red flags that might be impacting the score.

By efficiently identifying areas of concern, users are equipped with insights that can inform their strategic decisions, helping them prioritize actions that could yield the most substantial score improvement.

User Empowerment

One of the most significant benefits of credit repair software is the empowerment it offers to users. With real-time access to their credit information and ongoing dispute progress, individuals can actively participate in the credit repair process.

This transparency fosters a sense of control and accountability, allowing users to actively collaborate with the software in achieving their credit goals.

Limitations to Acknowledge

While credit repair software presents a promising solution, it’s essential to acknowledge its limitations. Not all credit issues can be resolved through automated disputes, especially in cases where the problems are complex or require legal intervention.

Additionally, while software can assist in challenging inaccuracies, users must remember that the ultimate decision lies with credit bureaus and creditors.

In the ever-evolving landscape of credit repair, understanding the fundamentals of credit repair software is paramount. As we delve deeper into the intricacies of these digital solutions, we shall uncover the true extent of their ability to ensure an elevated credit score.

The Factors Weaving the Tapestry of Credit Scores

Credit scores, those numerical representations of our financial standing, wield considerable influence over our financial lives. They play a pivotal role in determining our eligibility for loans, interest rates, and even job opportunities.

To explore the veracity of credit repair software’s claims to elevate credit scores, one must delve into the intricate web of factors that influence these scores.

Payment History

At the heart of every credit score lies the payment history. This factor is a reflection of an individual’s consistency in making payments on time. Creditors and lenders view this aspect as a testament to one’s reliability in repaying debts.

Missed or late payments cast shadows on this history, potentially sending credit scores spiraling downward.

Credit Utilization

Another crucial facet is credit utilization, which gauges how much of one’s available credit is being utilized. Responsible credit usage involves maintaining a healthy balance between credit limits and the amount owed.

High utilization ratios may hint at financial strain or over-reliance on credit, both of which can impede the journey towards an elevated credit score.

Length of Credit History

The longevity of one’s credit history also holds sway. A longer credit history provides creditors with a more comprehensive understanding of an individual’s financial behavior, thus building a foundation of trust.

Credit repair software that aims to bolster credit scores must address this dimension, as time remains an irreplaceable factor in the credit score equation.

Types of Credit in Use

A diverse portfolio of credit accounts showcases an individual’s ability to manage different types of credit, such as credit cards, mortgages, and installment loans.

A judicious mix can indicate financial adeptness, but excessive or haphazard credit applications might raise red flags for lenders.

New Credit Inquiries

Each time a potential creditor pulls an individual’s credit report, a new credit inquiry is generated. Multiple recent inquiries can indicate a heightened risk of overextending credit, potentially leading to a dip in credit scores.

Credit repair software should be scrutinized for its capacity to advise users on managing inquiries judiciously.

Public Records and Collections

Bankruptcies, tax liens, and collections are the darkest marks on a credit report. These public records reveal instances of financial turmoil or irresponsibility. Any credit repair software aspiring to make a substantial impact on credit scores must offer actionable strategies for rectifying these stains.

The Main Claims of Client Dispute Manager Software

Credit repair software has rapidly evolved in recent years, offering consumers powerful tools to manage, track, and elevate their credit scores.

Among these tools, Client Dispute Manager Software stands out, but what exactly does it claim to offer, and what are the realities behind those claims? Let’s dive deep into the offerings of this software to discern fact from fiction.

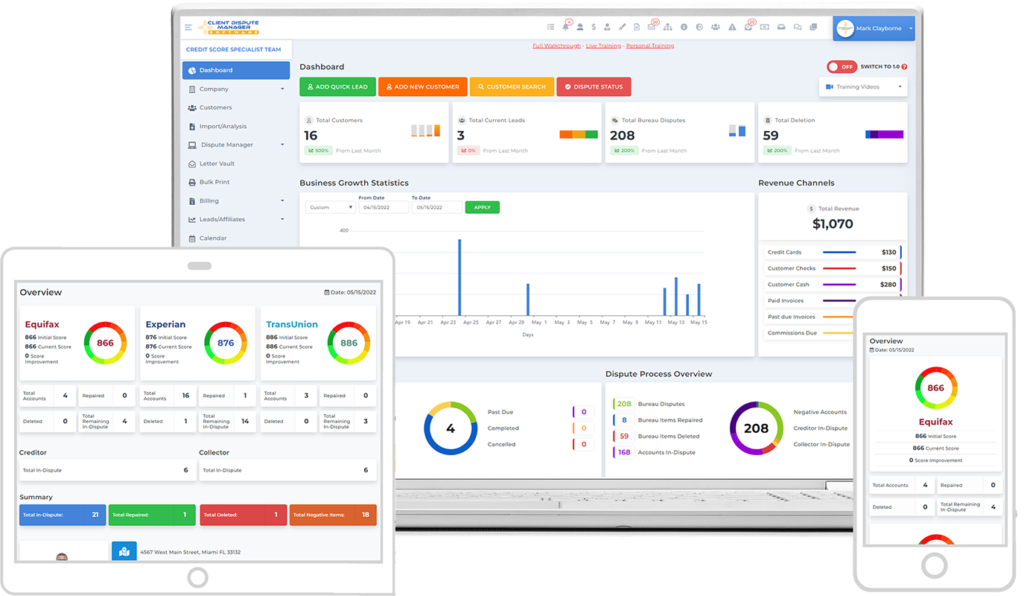

Comprehensive Credit Dispute Management

Client Dispute Manager Software prides itself on offering a streamlined and integrated approach to credit disputes. The software not only helps in initiating disputes but also in tracking their progress.

The question remains, does having a streamlined process directly correlate with a successful dispute?

Customizable Templates

One of the software’s highlighted features is its customizable templates. These templates, tailored to address specific credit report inconsistencies, provide a level of personalization that ensures users can articulate their concerns with precision.

But does a well-crafted letter guarantee a positive resolution?

Integration with Major CRAs

By promoting seamless integration with key credit reporting agencies (CRAs), the software aims to make the dispute submission process less cumbersome for its users. How much time can this save, and does this integration result in a more favorable dispute outcome?

Enhanced Data Protection

In the digital age, data security is paramount. Client Dispute Manager Software’s claims around robust encryption and security protocols suggest a commitment to safeguarding user data. But how does this relate to the actual credit repair process?

The Importance of Financial Education

In the ever-evolving landscape of personal finance, credit scores hold a distinct position of influence. They are not just numbers; they are gateways to financial opportunities, determining the terms of loans, interest rates, and even eligibility for rental agreements and job applications.

It is within this context that credit repair software like Client Dispute Manager emerges as a valuable tool, promising to elevate credit scores and reshape financial futures.

However, it’s essential to recognize that while such software can be a powerful ally, its effectiveness is intrinsically tied to the user’s understanding of financial principles. This makes the role of financial education indispensable.

Empowering Users through Knowledge

Financial education serves as the bedrock upon which the efficacy of credit repair software stands. Think of the software as a high-tech tool in the hands of an artisan: it can craft exquisite works, but only if wielded with skill and precision.

Likewise, Client Dispute Manager Software can indeed expedite the credit repair process and automate dispute management, but it’s the user’s grasp of financial fundamentals that truly amplifies its potential.

When users are equipped with a comprehensive understanding of credit, they are better poised to navigate the intricacies of the credit repair journey. Financial education enlightens them about the factors that influence credit scores, the significance of payment histories, the impact of credit utilization, and the role of credit inquiries.

Armed with this knowledge, they can effectively interpret credit reports, identify errors, and strategically target areas for improvement using the software.

Safeguarding Against Missteps

In the pursuit of an elevated credit score, it’s easy to succumb to the allure of quick fixes and superficial solutions. Financial education acts as a protective shield against such pitfalls. It empowers users to distinguish between reputable credit repair practices and potentially harmful tactics that could backfire in the long run.

Armed with knowledge, users can identify legitimate avenues for dispute resolution, understand the nuances of credit laws, and make informed decisions about the steps they take to repair their credit.

A Holistic Approach

Client Dispute Manager Software, while a potent tool, is only a piece of the puzzle. Achieving a robust credit score requires a holistic approach, where financial education complements software-driven solutions.

Users armed with financial literacy can not only leverage the software effectively but also take proactive steps to maintain a healthy credit profile beyond dispute resolution.

They can make informed choices about credit card management, debt reduction strategies, and responsible financial behaviors that contribute to long-term creditworthiness.

Conclusion

In wrapping up our exploration of credit repair software’s role in achieving an elevated credit score, it’s evident that while these tools hold immense potential, they’re not a guaranteed shortcut. Credit repair software serves as a valuable aid, streamlining dispute processes and providing insights.

However, the true catalyst for success remains the user’s commitment – understanding credit reports, addressing discrepancies, and practicing responsible financial habits.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.