Have you ever found a late payment on your credit report and wondered what to do next? Many people face this problem and ask how to write a dispute letter for late payment or whether they can use an online tool or app to help fix it. A late mark can lower your credit score and make everyday goals harder, so knowing your rights matters.

The Fair Credit Reporting Act gives you the right to dispute late payment information that is wrong or not verified. You can send a dispute letter on your own, upload one through a credit bureau website, or use a digital tool that creates and tracks your letters. Some people look for free templates or platforms that guide the process, and you will learn how to choose safe options.

This guide explains how late payments affect your credit, how to dispute a late payment on your credit report, what the investigation looks like, and which tools can help you stay organized. It is written for anyone fixing their own credit or learning how the credit repair process works in a simple and clear way.

Let’s start with how a late payment impacts your credit before you send a dispute.

Key Takeaways:

- You can dispute a late payment when the information is wrong, incomplete, or not verified.

- A strong dispute letter for late payment includes your account details, a short explanation, and clear proof.

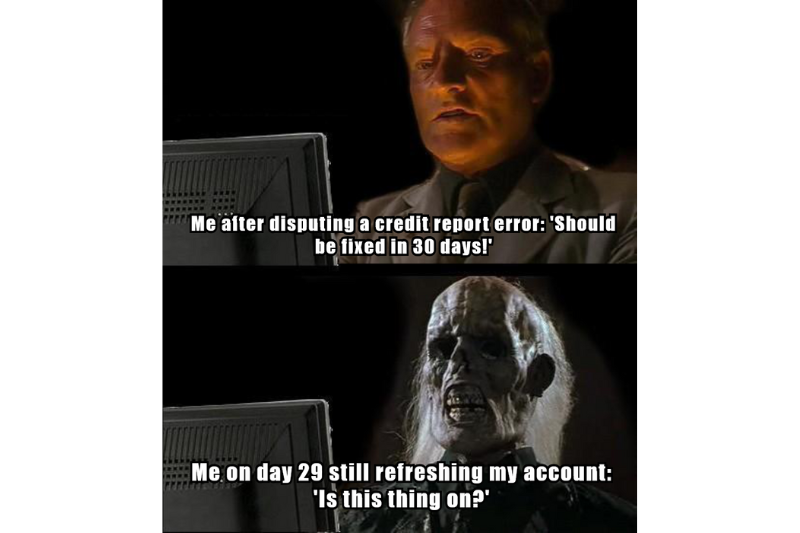

- Credit bureaus have about 30 days to review your dispute and contact the company that reported the late mark.

- Digital tools and credit repair software can help you create letters, store documents, and track the status of each dispute.

- You have the right to request corrections, remove unverified late payments, and get a free updated credit report after the investigation.

Start Today and Explore the Features Firsthand!

How a Late Payment Impacts Your Credit Before You Start the Dispute Process?

Have you ever seen a late payment on your credit report and wondered why your score dropped so fast? A single late mark can change your credit in a big way because payment history is one of the most important scoring factors. Before you send a dispute letter for late payment, it helps to understand how this mark affects you.

A late payment can lower your score because lenders view it as a sign that you may pay bills after the due date. The impact depends on how late the payment is. A 30 day late mark may lower your score by several points. A 60 or 90 day late mark can drop it even more. This is why people often ask how long companies take to respond to a dispute letter for a late payment. A quick response can help you move forward and fix the mistake faster.

A late payment can also limit your access to credit. You may notice higher interest rates, lower approval chances, or new account denials. Some readers ask about customer support options for disputing late payments with lenders or service providers. Most companies offer phone support, email support, or online portals. These options can help you understand why the late mark appeared and what steps you can take before sending your dispute.

You should know that a late payment stays on your credit report for up to seven years. This is why the dispute process matters. If the late payment is wrong or cannot be verified, you have the right to challenge it and request a correction. Learning how it impacts your credit helps you see why the dispute late payment process is worth your time.

Once you understand the effects, you can start the next step, which is knowing your rights under the Fair Credit Reporting Act.

Your FCRA Rights When You Dispute a Late Payment on Your Credit Report

Many people worry that disputing a late payment will be hard or confusing. The Fair Credit Reporting Act protects you and gives you clear rights during the dispute late payment process. These rights help you fix errors and understand what credit bureaus and lenders must do.

Some readers ask what legal language should be included in a dispute letter about late payment or what formats credit bureaus accept. These details matter because your dispute must follow the correct rules to start an investigation.

Below are the rights that guide the process and support you when you send a dispute letter for late payment.

Your Right to Accurate Credit Reporting Under the FCRA

You have the right to see only accurate and complete information on your credit report. This means a late payment must be correct, must belong to you, and must show the right dates. If the information does not follow these rules, you can dispute late payment records and request a review.

Some people ask what wording they should use in a dispute letter for a late payment with a billing company or loan provider. The key is simple and clear language that states why the information is wrong and what you want corrected. You do not need special legal terms. You only need to explain the mistake and include proof.

Your Right to File a Dispute Letter for Late Payment

The FCRA gives you the right to send a dispute letter for late payment to any credit bureau. You can do this by mail or online. Many readers want to know if they can use apps or digital tools to submit disputes.

Some tools help you write letters, upload documents, or track progress, but the choice is yours. The important part is that your dispute reaches the credit bureau so it can start the investigation.

You can also dispute a late payment with your lender. Some lenders let you submit disputes through a customer service portal. For example, people often ask if they can use a portal for their credit card issuer or billing company. If the company offers this option, you can use it to send your concerns. The lender must then review your claim.

Start Today and Explore the Features Firsthand!

Your Right to a 30 Day Credit Report Investigation

Once the credit bureau receives your dispute, they must investigate within about 30 days. This timeline is one of the most common questions people ask when starting the late payment dispute process. The bureau will contact the lender and ask them to check their records.

During this time, you may wonder how to track the status of your dispute. Many bureaus offer online tracking through your account. Some digital tools also help you follow each step. The goal is to keep you informed as the bureau reviews your case.

Your Right to Removal of an Unverified Late Payment

If the lender cannot confirm the late payment, the bureau must remove it. This is one of the strongest protections you have. Some readers ask how companies respond when a dispute letter challenges a late payment or what happens if the lender fails to answer in time. If the lender does not respond or cannot prove the information, the late mark must be corrected.

This rule also applies when the dates do not match or when the account does not belong to you. If the lender cannot verify the details, the late payment cannot stay on your credit report.

Your Right to a Free Updated Credit Report After a Dispute

When the investigation is complete, the credit bureau must give you an updated report. This report shows whether the late payment was removed, corrected, or kept. Many people ask how long it takes for the update to appear. The timing can vary, but it usually updates soon after the bureau sends the results.

This free report helps you confirm the outcome and plan your next steps. If the late payment stays and you believe it is still wrong, you can send more proof or file a second dispute.

When You Should Dispute a Late Payment on Your Credit Report?

Not every late payment should be disputed, but many are. Before you send a dispute letter for late payment, you should look closely at the entry and decide if it follows the facts. A dispute works best when the information is wrong, missing details, or not verified by the lender.

Many people ask how to draft a dispute letter for a loan account or what wording to use when writing to a billing company. These questions come up because different accounts can report errors in different ways.

You should think about disputing a late payment when:

- The payment was made on time but marked late.

- The date of the late payment is wrong.

- The account does not belong to you.

- You were in a payment dispute with the company that caused the confusion.

- You were affected by fraud.

- The lender agreed to fix the record but did not.

These situations are common across credit cards, car loans, mortgages, utility bills, and medical bills. Some readers ask how to dispute a late payment charge through an online billing service or a medical bill through a patient portal. If the company offers an online dispute tool, you can use it before or after you contact the credit bureaus.

You may also want to dispute a late payment if you notice problems with your lender’s reporting system. For example, some people send a payment through their bank and the company posts it late. Others use autopay, but the system fails. In these cases, a dispute can help correct the mistake.

If the late payment is accurate, you should not dispute it. Instead, you can focus on building better payment habits or asking the lender for help. Many people still ask what wording to use in a dispute letter for late payment even when the late mark is correct. You should send a dispute only if the information is wrong.

Knowing when to dispute helps you save time and avoid frustration. Once you know the late payment qualifies for a dispute, the next step is learning how to file the dispute in a way that supports your claim.

Start Today and Explore the Features Firsthand!

How to Dispute a Late Payment With the Credit Bureaus Step by Step?

Many people ask how to dispute a late payment on a credit report and where to start. The process can feel big at first, but when you break it into simple steps, it becomes more manageable. Before you send a dispute letter for late payment, you should pull your reports, collect proof, write a clear letter, and decide how you will submit it.

Some people want to send a dispute letter for late payment to a credit bureau online, while others prefer mail. Both can work as long as you follow the steps below.

Pull Your Credit Reports Before Sending a Dispute Letter

Your first step is to see exactly how the late payment appears on each report. A late mark may show up on one bureau or all three.

Here is what to do:

- Visit the official site where you can get your credit reports each year.

- Download or print your reports from Equifax, Experian, and TransUnion.

- Look for any late payment entries that seem wrong or do not match your records.

Many people skip this step and jump right into writing. That makes it hard to explain the problem. Your dispute works better when you know the exact account name, account number, and date of the late payment that you want the bureau to fix.

Gather Evidence for Your Late Payment Dispute

Next, you need proof to support your dispute. Credit bureaus and lenders look at your documents when they review your claim.

Useful documents include:

- Bank or card statements that show the payment date

- Screenshots of online payments or confirmation numbers

- Email messages from the company showing an agreement or correction

- Letters from the lender about a system error or adjustment

People often ask how to dispute a late payment charge with an online billing service or how to dispute a late payment on a medical bill through a patient portal.

In those cases, you can usually download billing history, messages, or receipts from your online account. Save these as PDF files or clear screenshots. You can attach them when you send your dispute to the credit bureau or the company.

Write Your Dispute Letter for Late Payment

Now you can write your dispute letter. Many people ask how to write a dispute letter for a late payment on a credit report or what wording they should use. You do not need legal training. You only need to be clear and honest.

Your letter should include:

- Your full name, address, and phone number

- The last four digits of your Social Security number

- The name of the credit bureau

- The name of the creditor or company

- The account number and date of the late payment

- A short statement of what is wrong and why

- A clear request, such as remove or correct the late payment

- A list of the documents you are sending as proof

Some people like to use a late payment dispute letter template to save time. You may search for templates online or use tools that create a letter for you. When you pick a template, make sure it lets you add your own facts and does not promise results.

The best templates are simple, easy to edit, and follow your FCRA dispute rights by focusing on accuracy and proof.

Start Today and Explore the Features Firsthand!

Send Your Dispute to the Credit Bureaus

Once your letter is ready, you must decide how to send it. Many people ask how to send a dispute letter for late payment to a credit bureau online. Most bureaus offer three main methods:

- Online submission through the bureau website

- Mail to the bureau address

- Phone support, which they may use to start a dispute but still ask you for documents

Online: You can create an account on each bureau’s site and upload your dispute letter and proof. This is helpful if you want a quick way to send files and check status.

Mail: Many credit repair specialists still recommend sending disputes by mail with certified tracking. This gives you proof that the bureau received your letter and when they got it.

In some cases, you may also contact the company that reported the late payment. People often ask if they can dispute a late payment through a customer service portal for a credit card issuer, email a dispute letter for a late payment to a utility company, or use a portal for a medical bill.

If the company offers these options, you can send a written dispute there too. This is called disputing with the furnisher, and it can support your bureau dispute.

Wait for the Credit Bureau Investigation

After the bureau receives your dispute, they must start an investigation, usually within about 30 days. Many readers ask how long it takes for companies to respond to a dispute letter for a late payment. The bureau will contact the lender or service provider and ask them to review their records and confirm the information.

You may wonder how to track the status of a late payment dispute after sending a letter. If you filed online, you can usually log in and see updates. If you sent your dispute by mail, you may receive letters or emails from the bureau as they move through the process.

Some digital tools and apps also help you track disputes by storing dates, letters, and responses in one place.

Review the Results of Your Late Payment Dispute

When the investigation is done, the credit bureau must send you the results. They may tell you that the late payment was removed, corrected, or verified and left as is. This is the moment when many people ask what follow-up actions companies recommend after sending a dispute letter for late payment.

If the late payment is removed or fixed, keep copies of the results and your updated report. This helps you if there are problems later.

If the late payment is verified and you still believe it is wrong, you have options:

- Send a second dispute with stronger or clearer documents.

- Dispute directly with the lender if you have not done so yet.

- Add a short consumer statement to your report that explains your side.

This step-by-step process helps you move from confusion to a clear plan. Once you know how to send and follow a late payment dispute, you can focus on what to do if a dispute is denied and how to protect your credit long term.

What to Do When a Late Payment Dispute Is Denied?

It can feel discouraging when a credit bureau denies your dispute, but a denial does not mean the process is over. Many people ask what follow up actions they should take after sending a dispute letter for late payment. The next steps depend on the reason for the denial and the documents you have.

Start by reading the bureau’s letter. The notice explains why the late payment stayed on your report. You may see a note saying the lender verified the information. This means the lender told the bureau that the late mark matched their records.

If you believe the late payment is still wrong, you can try again. Here are simple steps that can help.

- Review your documents. Check if you missed a receipt, statement, or message that can support your claim.

- Collect stronger proof. Some people go back to their bank or billing service and download clearer records.

- Write a second dispute. Be direct about why you believe the information is wrong. Attach every piece of proof you have.

- Contact the lender. Many lenders offer email support, phone support, or a customer service portal where you can dispute the late payment directly.

- Keep a timeline. Note when you sent your letters and when you received replies. This helps if you need to show your efforts later.

People often ask if they can use a portal for their credit card issuer or an online billing service to dispute a late payment again. Yes, you can. Some companies answer faster through their online system. Others may respond through email or secure message.

If the lender still confirms the late payment and you cannot prove the information is wrong, you can add a short consumer statement to your credit report. This statement explains your side and helps future lenders understand what happened.

A denial does not close the door. It only means you need a new plan, better proof, or a direct conversation with the company that reported the late payment.

Start Today and Explore the Features Firsthand!

Sample Dispute Letter for Late Payment You Can Use

Many people ask how to write a dispute letter for a late payment on a credit report and what wording to use. A simple letter works best. You do not need legal terms. You only need to explain the problem and show your proof.

Some readers also look for the best templates for a late payment dispute letter or want to know how to draft one for a loan account, a billing company, or a utility provider. The letter below gives you a clean starting point.

Sample Dispute Letter for Late Payment

Your Name

Your Address

Your City, State, ZIP

Your Phone Number

Date

Credit Bureau Name

Credit Bureau Address

Re: Dispute of Late Payment Reporting

Account Number: [Insert Account Number]

To Whom It May Concern,

I am writing to dispute a late payment reported on my credit report for the account listed above. I believe this late payment is incorrect.

The payment in question was made on time. I attached proof that shows the correct payment date, including statements and confirmation records. Please review the attached documents and update my credit report to reflect accurate information.

I request that the late payment be removed or corrected based on the evidence provided. Please complete the investigation within the required time and send me an updated copy of my credit report.

Thank you for your attention.

Sincerely,

Your Name

This letter can be sent by mail or uploaded online. Some people ask how to email a dispute letter for a late payment to a utility company or send one through a customer service portal. Many companies allow uploads through their website, and this same letter can be used there too.

You can also adjust the letter for different situations. For example:

- When disputing a medical bill through a patient portal

- When disputing a mortgage late payment through a lender app

- When disputing a billing company error online

Use this template to guide your writing, then attach the strongest proof you have.

How Client Dispute Manager Software Supports Your Late Payment Dispute Process

Client Dispute Manager Software gives you tools that help you handle each part of the late payment dispute process. Many readers search for online platforms that offer dispute letter templates customized for late payments, digital tools to manage inaccurate records, and systems that help them track updates. This software brings these features into one place so you can manage your credit repair steps with clarity.

You can create your dispute letter for late payment inside the software by choosing from simple templates. The system guides you through the wording so you can explain the problem in a clear way. This helps when you want strong support for your claim. You can attach proof such as bank statements, screenshots, or billing records, and the software stores them in an organized way.

Some people also ask how to generate a formal dispute letter for a late payment using AI tools. Client Dispute Manager Software offers smart tools that help you build letters fast based on the issue you describe. This saves you time and gives you a clean letter you can print, mail, or upload online.

Tracking your dispute is one of the most important parts of the process. Inside the software, you can track when you sent each letter, which bureau received it, and what response you are waiting for. You can log updates and create reminders so you never miss a step. This helps when you want to know how long companies take to respond or when to follow up.

The software also supports people who want to handle disputes for clients, making it useful for anyone learning the credit repair industry or building a credit repair business. It keeps records organized so you follow FCRA rules and maintain a clear process for each account.

Client Dispute Manager Software works for many types of disputes, including:

- Credit card late payments

- Loan late payments

- Utility bill late payments

- Mortgage late payments

- Medical bill errors

It gives you a complete system to manage your disputes from start to finish. With everything in one place, you stay confident, organized, and ready for the next step of your credit repair journey.

Start Today and Explore the Features Firsthand!

How Do I Write a Dispute Letter for a Late Payment on My Credit Report?

You write a clear statement that explains why the late payment is wrong. You include your account number, dates, and proof. You also ask the credit bureau to correct the information after reviewing your documents. A short, simple letter works better than a long one.

What Are the Best Templates for a Late Payment Dispute Letter?

The best templates include space for your name, account number, payment date, error explanation, and proof list. These templates help you stay organized and avoid missing important details.

Choose one that lets you edit the text so you can explain the issue in your own words. A flexible template saves time and keeps your message clear.

How Can I Generate a Formal Dispute Letter for a Late Payment Using AI Tools?

AI tools can create a draft after you explain the issue. You should still review the letter, add your own details, and attach your proof before sending it. AI can save time, but it cannot check your documents or confirm your facts. Always make sure the final letter is accurate.

How Long Does It Take for Companies to Respond to a Dispute Letter for a Late Payment?

Credit bureaus usually finish the investigation in about 30 days. The bureau sends the results once the lender confirms or updates the information. Some lenders respond faster, especially if you submit your dispute through their online portal.

The timeline can vary, but the bureau must stay within the required time.

What Are the Most Effective Dispute Letter Formats Recognized by Major Credit Reporting Agencies?

Bureaus accept typed letters that include your contact information, account number, payment date, explanation of the error, and your proof.

A short and clean layout is more effective than a long letter. The bureau needs clear facts so they can investigate your claim quickly. Staying focused helps your case.

Conclusion

Fixing a late payment on your credit report starts with knowing your rights and understanding the dispute process. When a late mark is wrong or not verified, you have the power to challenge it and ask the credit bureaus to review your proof.

A clear dispute letter for late payment, sent with the right documents, helps you correct mistakes and protect your credit history.

You also learned that you can send disputes online, by mail, or through portals offered by lenders and service providers. Digital tools and credit repair software can make the process easier by helping you build letters, store proof, and track updates. These tools help you stay organized and confident while you work through each step.

If you are fixing your own credit or learning the credit repair industry, the most important thing is to follow a simple plan and stay consistent. Keep your documents, watch your timelines, and use the laws that protect you. When you take control of your credit report, you take control of your financial future.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: