Are you wondering how to fix your own credit? You’re not alone. Many people struggle with poor credit scores, which can affect their ability to secure loans, rent apartments, or even obtain certain jobs. The good news is that you can take control of your financial future by learning how to fix your own credit.

In this comprehensive guide, we’ll walk you through the process step-by-step, helping you understand how to fix your own credit, boost your credit score, and improve your financial standing.

Understanding Your Credit Report and Why It Matters

Before diving into the specifics of how to fix your own credit, it’s important to understand what a credit report is and why it matters. Your credit report is a detailed record of your financial history, including information about your credit accounts, payment history, and any legal matters related to your finances.

This report is used by lenders, landlords, and sometimes employers to assess your financial responsibility and creditworthiness. Learning how to fix credit report issues is essential for maintaining a strong financial profile.

Your credit score, a numerical representation of the information in your credit report, is a critical factor in many aspects of your financial life. It affects loan approvals, interest rates, rental applications, and insurance premiums. Understanding how to fix the credit score and fix credit report is crucial for improving your financial health.

How to Fix Your Own Credit: A Step-by-Step Guide

Now that we’ve covered the basics, let’s explore the practical steps you can take to improve your credit. This guide will walk you through the process of credit repair, empowering you to take control of your financial future.

Step #1: How to Fix Your Own Credit by Getting Free Credit Reports?

The first step in how to fix your own credit is understanding what you’re dealing with. By law, you’re entitled to one free fix credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every year. You can request these reports at Annual Credit Report. Review each report carefully for errors or discrepancies, as these can affect your score.

This is a crucial step when learning how to fix your own credit because identifying potential issues on your fix credit report will help you develop a targeted plan to improve your credit score.

Step #2: How to Fix Credit Report Errors by Identifying and Disputing Them?

One of the fastest ways to improve your credit score is by disputing any errors you find on your fix credit report. Common errors include incorrect account information, misreported late payments, or accounts that don’t belong to you. These inaccuracies can significantly hurt your score, so identifying and fixing them is a crucial step.

To dispute these errors, gather supporting documents that prove the information is incorrect. File a dispute with the credit bureau(s) reporting the inaccuracies. This process is a significant part of how to fix your own credit and ensures you address incorrect details impacting your score.

Step #3: Fix the Credit Score by Addressing Past-Due Accounts

Late payments and delinquent accounts can have a severe impact on your credit score. To fix the credit score, make a list of all your past-due accounts and contact your creditors to negotiate payment plans or settlements. Many creditors are willing to work with you, especially if you show a commitment to paying off your debts.

Setting up automatic payments for future bills can help you avoid missing payments. Addressing past-due accounts is a critical component of how to fix your own credit and will lead to gradual improvements over time. It is one of the most effective ways to fix the credit score long-term.

Step #4: How to Fix Your Own Credit by Paying Down Debts

High credit utilization negatively affects your credit score. To improve it, focus on paying down your credit card balances. There are two methods that can help: the “debt avalanche” (paying off high-interest debts first) and the “debt snowball” (paying off smaller debts first). Both methods contribute to learning how to fix your own credit.

While working on reducing your debt, avoid opening new credit accounts. Paying down your debt is one of the most impactful steps you can take in your journey to fix the credit score and maintain a healthier credit profile.

Step #5: Improve Credit by Keeping Old Accounts Open

The length of your credit history plays an important role in your credit score. Many people believe that closing old credit accounts helps their score, but in most cases, it doesn’t. Instead, keep old accounts open, even if you don’t use them regularly, as this helps maintain a longer credit history.

Keeping old accounts open is a crucial part of how to fix your own credit and will help with overall credit stability. Ensuring your old accounts remain active can positively influence your efforts to fix the credit score.

Step #6: How to Be Strategic About New Credit When Fixing Your Credit Report

Applying for new credit accounts results in hard inquiries on your credit report, which can temporarily lower your score. If you’re actively trying to improve your credit, be cautious about applying for new credit. Only apply for new accounts if absolutely necessary, as this can hinder your progress to fix credit report issues.

If you need new credit, consider a secured credit card or becoming an authorized user on someone else’s account. These are safer options for those working on how to fix your own credit without adding hard inquiries.

Step #7: Who Can Help Me Fix My Credit? Considering Credit Repair Companies

Although you can fix your own credit, some people prefer to work with credit repair companies. If you choose this option, it’s essential to research thoroughly. Avoid companies that promise quick fixes or guaranteed results, as legitimate credit repair takes time and effort.

When considering who can help me fix my credit, look for reputable professionals. Be cautious and ensure the company you choose is legitimate. Many people successfully improve their credit independently, so professional services aren’t always necessary.

However, if you’re asking who can help me fix my credit and feel overwhelmed, credit counselors or advisors may offer guidance.

How to Fix Credit After a Car Repossession: Steps You Can Take

Dealing with a car repossession can be overwhelming, but it’s possible to recover. If you’re focused on how to fix credit after a car repossession, start by negotiating with the lender to settle any remaining balance. One option to consider is a “pay for delete” agreement, where the lender agrees to remove the repossession from your credit report in exchange for payment.

Disputing any inaccuracies related to the repossession is also important. As you focus on how to fix credit after a car repossession, rebuilding credit with positive payment histories is essential for long-term recovery.

Rebuilding After a Repossession: How to Fix Credit After a Car Repossession

In addition to settling with your lender, rebuilding positive credit habits is crucial. If you’re learning how to fix credit after a car repossession, using tools like secured credit cards or credit-builder loans can help establish positive payment histories and demonstrate financial responsibility.

Remember that a repossession will stay on your credit report for up to seven years, but it doesn’t affect your score forever. Taking proactive steps to learn how to fix credit after a car repossession will mitigate the long-term impact and help you recover.

How to Fix Credit to Buy a House: Essential Steps

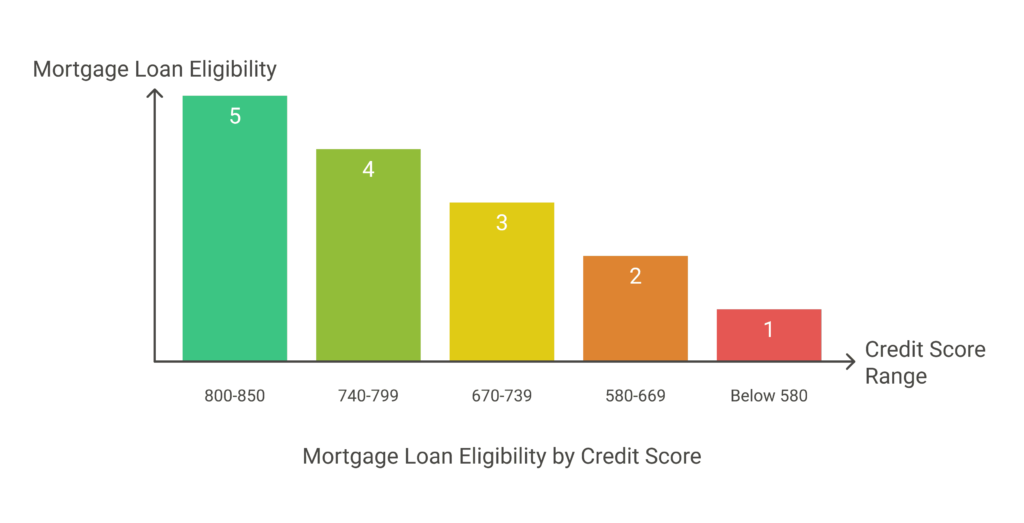

If you’re preparing to purchase a home, learning how to fix credit to buy a house is crucial. Most mortgage lenders require a minimum credit score of 620 for conventional loans, but FHA loans offer more lenient requirements. Nevertheless, the higher your credit score, the better your terms and interest rates will be.

While improving your credit, save for a larger down payment. A significant down payment can compensate for a lower credit score when learning how to fix credit to buy a house and improve your mortgage options.

Preparing for Homeownership: How to Fix Credit to Buy a House

As you focus on how to fix credit to buy a house, avoid taking on new debt while working to improve your credit. New debt can raise your debt-to-income ratio, making mortgage approval more difficult. Maintaining stable credit habits is a core component of how to fix credit to buy a house successfully.

Work with a mortgage professional to receive personalized advice on how to fix credit to buy a house based on your financial circumstances. A steady approach will improve your chances of securing a home loan at favorable terms.

Additional Tips on How to Fix Your Own Credit

To further enhance your efforts in how to fix your own credit, consider the following strategies:

- Monitor Your Credit Regularly: Sign up for free credit monitoring services to track your score and any changes. Monitoring your credit closely will help you spot errors or potential issues quickly, which is critical to learning how to fix your own credit.

- Create a Budget: Understanding your income and expenses is a crucial part of credit repair. A solid budget will help you avoid overspending and missing payments, two factors that significantly affect your credit score.

- Consider a Secured Credit Card: If you’re struggling to qualify for traditional credit, a secured credit card can help you rebuild your credit. This can be an effective tool when learning how to fix your own credit.

- Be Patient: Fixing your credit takes time, so don’t expect immediate results. However, with consistency and persistence, you’ll gradually see improvements in your credit score.

Avoiding Credit Repair Scams

While working on how to fix your own credit, it’s important to avoid credit repair scams. Beware of companies that promise to “fix” your credit overnight or remove accurate negative information from your report. The Federal Trade Commission (FTC) advises consumers to steer clear of companies demanding upfront payments or guarantees.

Instead, focus on legitimate ways to fix credit report issues. By negotiating settlements or using credit-builder loans, you can make real progress. Keeping your credit mix healthy is another excellent strategy to improve your credit score.

The Impact of Good Credit

Understanding how to fix your own credit and improving your credit score can have a lasting impact on your financial life. Higher credit scores unlock better loan terms, lower interest rates, and more opportunities, from housing to job prospects. With the right approach, how to fix your own credit becomes the key to a stronger financial future.

Good credit can also reduce insurance premiums and improve your chances of getting rental properties. When you know how to fix the credit score, you are taking control of your financial stability.

How Client Dispute Manager Software Can Help You Fix Your Own Credit

Start Today and Explore the Features Firsthand!

When you’re working to fix your own credit, having the right tools can make all the difference in the success and efficiency of your credit repair efforts. Client Dispute Manager Software is a comprehensive credit repair solution that can simplify and streamline the process of disputing errors, tracking progress, and managing your overall credit health.

Streamline the Credit Dispute Process

One of the most challenging aspects of credit repair is managing disputes with credit bureaus. With Client Dispute Manager Software, you can automate much of this process. The software offers a user-friendly interface to help you:

- Easily identify errors in your credit report.

- Generate dispute letters to send to credit bureaus.

- Track the status of your disputes in real-time.

Whether you’re addressing inaccuracies that are hurting your score or negotiating with creditors, Client Dispute Manager Software makes it easy to stay organized and focused on improving your credit.

Track Your Progress Toward Credit Repair Goals

Monitoring your progress is crucial when you’re learning how to fix your own credit. The Client Dispute Manager Software allows you to keep track of your credit scores and the impact of each dispute or credit improvement action you take.

The software helps you stay motivated by visually displaying improvements in your credit score over time, showing you how each correction or adjustment brings you closer to your financial goals.

Educational Resources and Guidance

In addition to dispute management, Client Dispute Manager Software offers a wealth of educational resources. Whether you’re looking to better understand how to fix the credit score or need guidance on negotiating with creditors, the platform provides tools and tips to help you navigate the process confidently.

With this software, you’ll not only fix your current credit issues but also gain the knowledge to maintain a healthy credit profile in the future.

Client Dispute Manager Software for Professionals and Individuals

Whether you’re a credit repair professional or someone looking to fix your own credit, Client Dispute Manager Software offers solutions tailored to your needs. It helps individuals take control of their financial future and enables professionals to manage multiple clients efficiently, ensuring that everyone benefits from comprehensive, streamlined credit repair services.

Incorporating Client Dispute Manager Software into your credit repair journey can significantly simplify the process, allowing you to focus on your long-term financial goals with greater efficiency and ease.

Conclusion

Fixing your credit may seem daunting, but with the right steps, persistence, and tools like Client Dispute Manager Software, it’s entirely possible. Whether you need to fix credit after a car repossession or fix credit to buy a house, the key is to stay consistent and patient.

By taking control of your credit, you’ll unlock better financial opportunities and set yourself on the path to long-term financial stability. Start today and watch your credit improve over time.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Below Is More Content For Your Review:

- Step-by-Step Guide: How to Remove an Eviction from Your Record Quickly

- Navigating the Path to Prosperity: Credit Repair Strategies for Immigrants