Are you struggling with a past eviction haunting your credit report? Don’t let this mistake hold you back from securing your dream home or pursuing financial opportunities. In this comprehensive guide, we’ll walk you through the process of removing an eviction from your record, empowering you to take control of your credit and unlock a brighter future.

Understanding the Impact of an Eviction on Your Credit Report

Before diving into how to remove an eviction, it’s crucial to understand its impact. Evictions can severely affect your credit score and rental prospects, making it essential to address them promptly. An eviction on your credit report can have far-reaching consequences.

Landlords, lenders, and even potential employers may view it as a red flag, making it difficult for you to secure housing, loans, or job opportunities. However, it’s essential to understand that you have the power to change your situation and remove that eviction from your record.

The Long-Term Effects of a Credit Report Eviction

An eviction can remain on your credit report for up to seven years, serving as a constant reminder of a past financial struggle. During this time, you may face:

- Higher security deposits when renting a new apartment

- Difficulty securing approval for mortgages or car loans

- Increased interest rates on credit cards and other financial products

- Challenges when applying for certain jobs, particularly those involving financial responsibility

Understanding the long-term impact of an eviction can motivate you to take action and start the eviction removal process as soon as possible.

Assessing Your Eviction Removal Situation

Before diving into the removal process, take a moment to assess your unique eviction situation. Consider the following questions:

- How long ago did the eviction occur?

- Was the eviction filed in court, or was it merely a threat from your landlord?

- Have you attempted to resolve the issue with your former landlord?

Understanding the details of your eviction will help you determine the most effective course of action for removing an eviction from your record.

Statute of Limitations on Rental History Correction

It’s crucial to understand the statute of limitations on evictions in your state. This refers to the time period during which a landlord can legally file an eviction against a tenant.

Once the statute of limitations has passed, the landlord can no longer pursue legal action, and the eviction may become easier to remove from your record. Rental history correction can be a critical step in this process, helping to ensure your rental history is accurate and reflects the removal of outdated evictions.

Research the specific statute of limitations for evictions in your state, as they can vary significantly. In some states, the statute of limitations may be as short as one year, while in others, it can extend up to six years or more.

Gathering Evidence to Support Your Eviction Removal Case

In addition to understanding the timeline of your eviction, it’s essential to gather any evidence that may support your case for eviction removal. This can include:

- Proof of payment for past-due rent or damages

- Communication records with your landlord showing attempts to resolve the issue

- Documentation of any extenuating circumstances, such as job loss or medical emergencies, that may have contributed to the eviction

Having a clear picture of your eviction situation and supporting evidence will strengthen your case when disputing eviction with credit bureaus or negotiating with your former landlord.

Gather Necessary Documentation for Eviction Removal

To successfully remove an eviction from your record, you’ll need to arm yourself with the right documentation. Collect the following:

- Your lease agreement

- Correspondence with your landlord

- Court documents related to the eviction

- Proof of any payments made to your landlord

Having these documents readily available will streamline the eviction removal process and strengthen your case.

Obtaining Your Credit Reports for Rental History Correction

The first step in removing an eviction is to thoroughly review your rental history. Obtain a copy of your tenant screening report to identify any inaccuracies or outdated information. You are entitled to one free credit report from each bureau every 12 months, which you can request through Annual Credit Report.

Review your credit reports carefully, paying close attention to the sections related to rental history and collections. Identify any entries related to your eviction, and make note of the details provided, such as the landlord’s name, the date of the eviction, and any associated account numbers.

Organizing Your Documentation for Disputing Eviction

Organize your eviction-related documents in a dedicated folder, including your lease agreement, rent payment receipts, correspondence with your landlord, court documents, and proof of any settlements or payment arrangements made with your landlord.

Having your documentation well-organized and easily accessible will streamline the process of disputing eviction entries on your credit report. Create a timeline of events related to your eviction, including the date of the initial missed payment, any communication with your landlord, court dates, and any payments made or agreements reached.

This timeline will help you present a clear and compelling case when disputing eviction entries with credit bureaus or negotiating with landlords for eviction removal.

Crafting Your Eviction Removal Dispute Letter

When disputing eviction with credit bureaus, it’s essential to craft a clear and concise dispute letter. Your letter should include:

- Your full name, address, and Social Security number

- The specific eviction entry you are disputing.

- A brief explanation of why you believe the eviction is inaccurate or unfair.

- A request for the bureau to remove the eviction from your credit report.

- Copies of any supporting documentation, such as proof of payment or correspondence with your landlord

Be sure to send your dispute letter via certified mail with a return receipt requested to ensure a paper trail of your communication with the credit bureaus.

Following Up on Your Eviction Removal Dispute

After submitting your dispute, the credit bureaus have 30 days to investigate and respond to your claim. During this time, it’s crucial to follow up with the bureaus to ensure they are processing your dispute in a timely manner.

If the bureaus determine that the eviction entry is indeed inaccurate, they will remove it from your credit report and notify you in writing. However, if they find the eviction to be valid, they will inform you of their decision and provide instructions on how to proceed.

Negotiate with Your Former Landlord for Eviction Removal

In some cases, directly negotiating with your former landlord can lead to a mutually beneficial resolution. Consider the following approach:

- Reach out to your landlord and express your desire to resolve the eviction.

- Offer to pay any outstanding rent or damages in exchange for their agreement to have the eviction removed.

- If an agreement is reached, get it in writing and ensure both parties sign the document.

- Submit the agreement to the credit bureaus as evidence to support the removal of the eviction.

Remember, open and honest communication is key when negotiating with your former landlord.

Documenting the Eviction Removal Agreement

If you successfully negotiate an agreement with your former landlord, it’s crucial to get the details in writing. Draft a simple agreement that outlines the terms of your settlement, including:

- The amount you will pay to settle any outstanding rent or damages

- Your landlord’s agreement to have the eviction removed from your record

- A timeline for when the payment will be made and when the eviction will be removed

Ensure that both you and your landlord sign and date the agreement, and keep copies for your records. This written agreement will serve as valuable evidence when submitting your case to the credit bureaus for eviction removal.

Seek Legal Assistance for Eviction Removal

If your attempts to remove the eviction through disputes and negotiations prove unsuccessful, it may be time to seek legal assistance. A skilled attorney specializing in landlord-tenant law can provide valuable guidance and represent your interests in court.

Consider the following when seeking legal help:

- Research attorneys in your area with experience in eviction cases.

- Schedule consultations to discuss your case and determine the best course of action.

- Provide your attorney with all relevant documentation and information.

- Follow your attorney’s advice and attend all court proceedings, if necessary.

Remember, investing in legal assistance can be a powerful tool in removing an eviction from your record.

Understanding the Legal Process for Eviction Removal

If your eviction case goes to court, it’s essential to understand the legal process involved. Your attorney will guide you through each step, but familiarizing yourself with the general process can help you feel more prepared and empowered.

Typically, the legal process for eviction cases involves:

- Filing A Complaint: Your attorney will file a complaint with the court, outlining your case for removing the eviction from your record.

- Discovery: Both sides will have the opportunity to request and review relevant documents and evidence related to the case.

- Pre-trial Motions: Your attorney may file pre-trial motions to have certain evidence excluded or to request a summary judgment in your favor.

- Trial: If the case proceeds to trial, both sides will present their arguments and evidence before a judge, who will then issue a ruling.

Throughout the legal process, it’s crucial to maintain open communication with your attorney and provide any requested documentation or information in a timely manner.

Exploring Alternative Dispute Resolution for Eviction Removal

In some cases, pursuing alternative dispute resolution methods, such as mediation or arbitration, may be a more cost-effective and efficient way to resolve your eviction case.

Mediation involves a neutral third party who facilitates a discussion between you and your former landlord to reach a mutually agreeable solution. Arbitration is a more formal process in which a neutral third party hears arguments from both sides and makes a binding decision on the case.

Discuss these alternative dispute resolution options with your attorney to determine if they may be appropriate for your specific situation.

Rebuilding Your Credit After Eviction Removal

Once you’ve successfully removed the eviction from your record, it’s crucial to take proactive steps to rebuild your credit. Consider the following:

- Make timely payments on all your bills and obligations.

- Obtain a secured credit card and use it responsibly.

- Become an authorized user on someone else’s credit card with a strong payment history.

- Monitor your credit report regularly to ensure accuracy and catch any potential issues early.

By consistently demonstrating responsible financial behavior, you can gradually improve your credit score and open doors to better housing and financial opportunities.

Establishing Positive Rental History After Eviction Removal

In addition to rebuilding your credit, it’s essential to establish a positive rental history moving forward. This can help counteract the negative impact of your past eviction and demonstrate to future landlords that you are a responsible tenant.

Consider the following tips for establishing positive rental history:

- Always pay your rent on time and in full.

- Maintain open communication with your landlord and address any concerns or issues promptly.

- Take good care of the rental property and report any maintenance needs in a timely manner.

- Be a respectful neighbor and follow all community guidelines and rules.

By consistently demonstrating responsible rental behavior, you can build a strong rental history that will serve you well when seeking future housing opportunities.

Monitoring Your Credit Progress After Eviction Removal

As you work to rebuild your credit after removing an eviction, it’s crucial to monitor your progress regularly. This will allow you to catch any potential errors or inaccuracies on your credit report and ensure that your hard work is paying off.

Consider the following tips for monitoring your credit progress:

- Take advantage of your annual free credit reports from each of the three major credit bureaus.

- Sign up for a reputable credit monitoring service that alerts you to any changes or suspicious activity on your credit report.

- Regularly review your credit score and track its improvement over time.

- Address any errors or inaccuracies on your credit report promptly by disputing them with the appropriate credit bureau.

By staying proactive and engaged in monitoring your credit progress, you can ensure that your efforts to rebuild your credit after removing an eviction are as effective as possible.

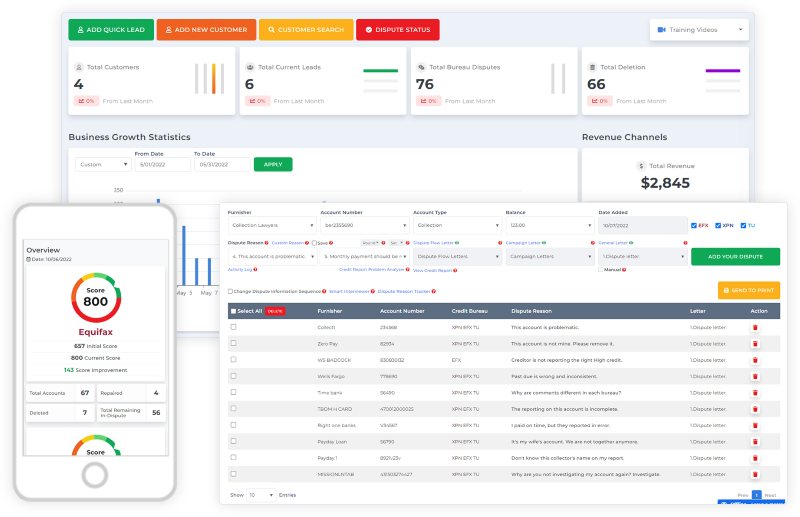

Streamline Your Eviction Dispute Process with Client Dispute Manager Software

When working to remove an eviction from your credit report, staying organized and keeping track of your disputes and communications with creditors, landlords, and credit bureaus is essential. This is where Client Dispute Manager Software can be an invaluable tool.

Client Dispute Manager Software is designed to help individuals and credit repair professionals manage the dispute process more efficiently and effectively. This software typically offers features such as:

- Dispute Letter Generation: The software can help you create customized dispute letters based on your specific situation and the type of dispute you are filing. This can save you time and ensure that your letters are professional, accurate, and compliant with relevant laws and regulations.

- Document Management: Client Dispute Manager Software allows you to securely store and organize all of your eviction-related documents, including lease agreements, rent payment records, correspondence with landlords and creditors, and dispute letters. Having all of your documents in one centralized location can make it easier to access the information you need when communicating with creditors or updating your disputes.

- Dispute Tracking: The software can help you keep track of the status of your disputes, including when letters were sent, when responses were received, and any deadlines or follow-up actions required. This can help you stay on top of your disputes and ensure that you are making progress toward your goal of removing the eviction from your credit report.

- Credit Bureau Integration: Some Client Dispute Manager Software programs offer direct integration with the major credit bureaus, allowing you to submit disputes and receive updates electronically. This can streamline the dispute process and reduce the time and effort required to manage your disputes.

- Reporting and Analytics: The software may provide reporting and analytics tools that help you track your progress over time, identify areas where you may need to focus more attention, and measure the effectiveness of your dispute strategies.

By leveraging the power of Client Dispute Manager Software, you can take control of your eviction dispute process and work more efficiently and effectively towards your goal of removing the eviction from your credit report and achieving long-term financial success.

Frequently Asked Questions (FAQs)

How Long Does An Eviction Stay On My Credit Report?

An eviction can remain on your credit report for up to seven years from the date of filing. This means that during this time, landlords, lenders, and other entities that review your credit report will be able to see the eviction, which could negatively impact your ability to secure housing or access credit.

How to Remove An Eviction From My Record On My Own, Or Do I Need Professional Help?

While it is possible to remove an eviction on your own, seeking professional assistance from a credit repair specialist or attorney can increase your chances of success. The process of removing an eviction from your record can be complex and time-consuming, requiring knowledge of credit reporting laws, debt collection practices, and landlord-tenant regulations.

Will Removing An Eviction From My Credit Report Guarantee Approval For Future Housing?

While removing an eviction from your credit report can significantly improve your chances of securing future housing, it is not a guarantee. Landlords consider a variety of factors when evaluating rental applications, including income, employment history, references, and overall credit health.

How Long Does The Eviction Removal Process Typically Take?

The timeline for removing an eviction varies depending on your specific situation and the methods used. It can range from a few weeks to several months, depending on factors such as the complexity of your case, the responsiveness of creditors and debt collectors, and the workload of the credit bureaus.

If you are disputing the eviction with the credit bureaus, they are required by law to investigate and respond to your dispute within 30 days. However, if the bureaus request additional information from you or if you need to escalate your dispute, the process can take longer.

Can I Still Rent An Apartment While I'm In The Process Of Removing An Eviction?

It may be challenging to secure housing while an eviction is still on your record, but it is not impossible. Some landlords may be willing to overlook a past eviction if you can demonstrate that you have taken steps to address the issue and improve your financial situation.

When applying for housing while in the process of removing an eviction, be upfront and honest about your situation. Explain to potential landlords the circumstances that led to the eviction and the steps you have taken to resolve the issue, such as disputing the eviction with the credit bureaus, negotiating with your former landlord, or seeking legal assistance.

Conclusion

Removing an eviction from your record may seem daunting, but with the right knowledge, tools, and perseverance, it is achievable. By following this step-by-step guide and seeking professional assistance when needed, you can take control of your credit and open the door to a brighter financial future.

Remember, your past mistakes do not define your future. Take action today and start the journey towards removing that eviction and rebuilding your credit. With determination and the right strategies, you can overcome this obstacle and achieve your housing and financial goals.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Below Is More Content For Your Review:

- Can Credit Repair Software Guarantee a Higher Credit Score?

- Starting a Credit Repair Business in North Carolina