In the intricate web of financial services, credit repair businesses emerge as vital facilitators, aiding individuals in navigating the complexities of credit improvement. The efficacy of these businesses isn’t solely measured by their ability to dispute inaccuracies on credit reports; it’s significantly influenced by their adherence to and measurement against Key Performance Indicators (KPIs).

This article delves into the essence of KPIs within the credit repair sector, underscoring their pivotal role in steering these businesses toward sustainable success and growth.

Start Today and Explore the Features Firsthand!

Understanding KPIs

KPIs, or Key Performance Indicators, are quantifiable measures used to evaluate the success of an organization in achieving key business objectives. They offer a clear lens through which the performance across various facets of the business can be assessed, from operational efficiency to client satisfaction and financial health.

The Significance of KPIs in Business Success

The strategic application of KPIs transcends mere performance tracking; it is a linchpin for informed decision-making, strategic planning, and identifying areas ripe for improvement. In the context of a credit repair business, KPIs serve as the north star, guiding the navigation through the competitive landscape of financial services.

Industry-Specific KPI Variations

While the core essence of KPIs remains consistent, their specific applications and prioritizations can vary dramatically across industries. For credit repair businesses, the KPIs are intricately tied to the nuances of financial services, emphasizing client outcomes, operational efficiency, and regulatory compliance.

Key KPIs for Credit Repair Businesses

The success of a credit repair business can be dissected into several critical KPIs:

- Number of Clients Onboarded: This KPI tracks the growth in the business’s client base, reflecting its market reach and brand trust.

- Success Rate of Credit Disputes: A pivotal measure of effectiveness, indicating how successfully the business can improve clients’ credit reports.

- Average Credit Score Improvement: This KPI quantifies the average impact on clients’ credit scores, a direct reflection of service value.

- Client Retention Rate: A measure of satisfaction and service quality, indicating the percentage of clients who remain with the business over time.

Revenue Growth: Tracks the financial health and growth trajectory of the business. - Cost per Acquisition: A critical financial metric that measures the cost involved in acquiring each new client.

Start Today and Explore the Features Firsthand!

Client Acquisition Metrics

The journey of client acquisition in credit repair businesses is laden with challenges and opportunities. Metrics such as lead generation methods, conversion rates, cost per lead, and average time to close a lead are indispensable for strategizing and optimizing the client acquisition process.

Operational Efficiency KPIs

Operational efficiency within credit repair businesses is monitored through KPIs like average resolution time for disputes, disputes processed per employee, client to staff ratio, and the utilization rates of technology and software. These indicators help in streamlining processes and enhancing productivity.

Financial Performance Indicators

Financial health is the backbone of any business, with KPIs such as monthly and annual revenue, profit margins, operating expenses, and cash flow status offering a comprehensive overview of a credit repair business’s financial status.

Client Satisfaction and Retention

Client-centric KPIs like Net Promoter Score (NPS), churn rate, repeat business rate, and client testimonials play a crucial role in gauging client satisfaction and loyalty, directly impacting the business’s reputation and long-term success.

Employee Performance and Satisfaction

Employees are the lifeblood of any organization. KPIs related to turnover rate, training opportunities, satisfaction surveys, and productivity metrics offer insights into the workforce’s health and its impact on the business’s overall performance.

Start Today and Explore the Features Firsthand!

Marketing and Branding Effectiveness

The digital footprint of a credit repair business is scrutinized through KPIs like social media engagement, website traffic and conversion rates, email marketing performance, and brand recognition surveys. These metrics are instrumental in evaluating marketing strategies and their effectiveness in building a strong brand presence.

Compliance and Legal KPIs

Given the regulatory landscape of financial services, compliance audits, regulatory compliance rates, and legal dispute resolutions are critical KPIs that safeguard the business against potential legal and compliance risks.

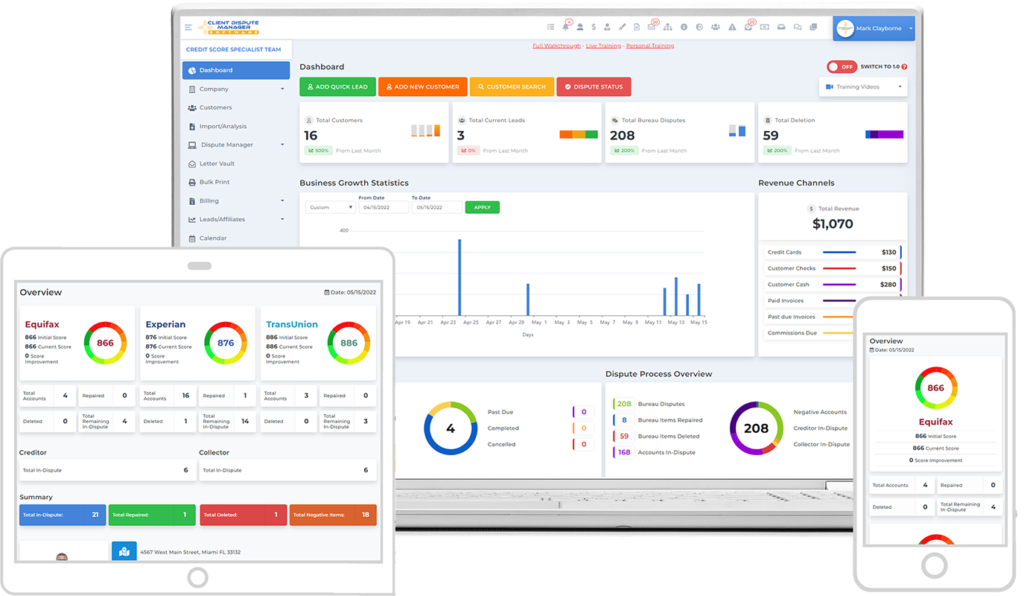

Leveraging Client Dispute Manager Software in Credit Repair Businesses

In the rapidly evolving landscape of credit repair, businesses are increasingly turning to technological solutions to streamline operations, enhance efficiency, and deliver superior client outcomes. Among these technological innovations, Client Dispute Manager Software stands out as a cornerstone tool for credit repair agencies.

This specialized software is designed to automate and manage the intricate process of disputing credit report inaccuracies, a core service offered by credit repair businesses. Below, we explore the pivotal role of Client Dispute Manager Software and its impact on credit repair operations.

Automation and Efficiency

Client Dispute Manager Software automates the dispute process, from identifying inaccuracies in credit reports to drafting and sending dispute letters to credit bureaus. This automation significantly reduces the manual workload on staff, allowing them to focus on more strategic aspects of client service.

The efficiency gained through automation not only accelerates the dispute resolution process but also increases the capacity to handle more clients without compromising quality.

Enhanced Accuracy and Compliance

Accuracy in dispute letters and compliance with legal standards are non-negotiable aspects of credit repair services. Client Dispute Manager Software comes equipped with templates and tools that adhere to the legal requirements set forth by entities like the Fair Credit Reporting Act (FCRA).

These tools ensure that all disputes are accurately documented and submitted in compliance with relevant laws and regulations, thereby minimizing the risk of legal challenges and enhancing the credibility of the credit repair business.

Improved Client Communication and Satisfaction

The software often features client portals that provide real-time updates on the status of credit disputes, empowering clients with visibility into the progress of their cases. This transparency fosters trust and improves client satisfaction, as clients are not left in the dark about the services they have enlisted.

Moreover, automated communication features allow for timely updates and reminders to be sent to clients, ensuring they remain engaged and informed throughout the dispute resolution process.

Conclusion

The strategic implementation and monitoring of KPIs are fundamental to the success and growth of credit repair businesses. By meticulously measuring performance across various dimensions—client acquisition, operational efficiency, financial health, client satisfaction, and beyond—business owners can make informed decisions, adapt to changes, and pave the way for sustainable growth. As the industry evolves, staying attuned to the latest trends and KPIs will be crucial for staying ahead in the competitive landscape of credit repair services, ensuring a future marked by success and positive client outcomes.