Welcome to the new era of credit repair, where advanced technology meets financial management. This article explores the revolutionary role of AI in enhancing credit repair software, a dynamic tool reshaping how we approach credit restoration. With AI-driven solutions, the once complex and time-consuming task of repairing credit is now more efficient and accurate.

Dive into the world of AI credit repair software with us and discover how it’s changing the game for individuals and professionals, making credit repair more accessible and effective than ever before.

The Evolution of Credit Repair

Credit repair has come a long way from its humble beginnings. From manual, paper-heavy processes to the latest advancements in technology, the journey of credit repair reflects a significant transformation. This section takes you through the evolution of credit repair, highlighting the shift from traditional methods to modern, sophisticated credit repair software, and ultimately to the cutting-edge AI-driven solutions that are reshaping the industry today.

A Journey Through Time: Credit Repair Then and Now

Long before the sleek screens and smart solutions we have today, credit repair was a journey filled with mountains of paperwork and slow-moving processes. It was all about manually sifting through credit reports, spotting errors, and writing countless letters to credit bureaus. This old-school way wasn’t just time-consuming; it was also overwhelming for many.

The Game-Changer: Rise of Credit Repair Software

Then came a big shift. As technology evolved, so did the tools for fixing credit. Enter: credit repair software. This was a game-changer. Suddenly, managing credit reports became easier. These software solutions helped automate many of the tedious tasks involved in credit repair. From tracking disputes to organizing client information, credit repair software started to make life a lot easier for those looking to improve their credit scores.

Stepping into the Future: AI Takes the Lead

But the evolution didn’t stop there. The real magic began with the transition to AI-driven credit repair solutions. Imagine software that not only helps you manage credit repair tasks but also thinks and learns like a human brain! This AI-powered credit repair software is now leading the charge, offering smarter, faster, and more accurate credit repair solutions.

By analyzing data and learning from patterns, these AI systems are taking the guesswork out of credit repair, making the process smoother and more effective than ever before.

Understanding AI Credit Repair Software

In today’s digital age, AI credit repair software represents a significant leap in managing and improving credit scores. This type of software harnesses the power of Artificial Intelligence (AI) to offer a smarter, more efficient approach to credit repair. Unlike traditional methods, AI credit repair software can analyze credit reports rapidly, identify errors accurately, and suggest the most effective strategies for credit improvement.

Its ability to learn and adapt to individual credit situations makes it an invaluable tool for those seeking to enhance their financial standing. By combining speed, precision, and personalized strategies, AI credit repair software is not just a tool but a game-changer in the credit repair industry.

Key Features of AI-Powered Credit Repair Software

The leap from traditional methods to AI-driven credit repair software brings with it a host of advanced features:

Automated Credit Report Analysis

AI credit repair software excels in quickly and thoroughly reviewing credit reports, ensuring no detail is missed. It breaks down complex reports into understandable insights, highlighting key areas that need attention. This level of detailed reporting is crucial for a comprehensive understanding of your credit status.

Smart Dispute Management:

The AI system streamlines the dispute process with credit bureaus. It not only efficiently files disputes on your behalf but also creates tailored dispute letters, significantly enhancing the chances of successful credit corrections. This smart management is a critical component in effectively handling credit report inaccuracies.

Personalized Credit Repair Strategies:

Unlike one-size-fits-all solutions, AI software provides customized advice based on your unique credit situation. It constantly learns and adapts, optimizing strategies to offer the best possible guidance for improving your credit score. This personalized approach ensures that strategies are specifically tailored to your individual needs and credit history.

Why AI Beats Traditional Methods?

The integration of AI into credit repair software brings a host of improvements over the traditional methods:

Enhanced Speed and Efficiency

AI’s rapid processing capabilities revolutionize the speed at which credit repair can be achieved. With AI, tasks that used to take days or weeks can now be completed in a fraction of the time. This efficiency is not just about saving time; it’s about seeing improvements in your credit score much faster than before. This quick turnaround is especially beneficial for those needing timely credit repair for important financial decisions.

Unmatched Accuracy in Identifying and Correcting Errors

One of the most significant advantages of AI in credit repair is its unparalleled precision. AI algorithms can scan through credit reports, identifying errors and inconsistencies with a level of accuracy that human analysis might not achieve. This precision reduces the chances of missing crucial errors, ensuring that every aspect of your credit report is thoroughly scrutinized and accurately corrected.

Adaptive Learning Ability for Personalized and Improved Strategies

AI systems in credit repair software are designed to learn and improve over time. The more they are used, the more data they gather about specific credit repair cases, allowing them to refine and enhance their repair strategies. This means that the AI system becomes more adept at handling unique credit situations, offering more personalized and effective credit repair solutions as it learns from each case it processes.

User-Friendly Interface

Despite their advanced capabilities, AI credit repair software tools are developed with a focus on user experience. They are designed to be intuitive and easy to navigate, even for those who may not be tech-savvy. This user-friendliness ensures that a wider range of people can benefit from AI credit repair, making sophisticated credit repair assistance accessible to everyone, not just tech experts or credit professionals.

How AI Credit Repair Software Works?

Have you ever wondered how AI credit repair software does its thing? It’s like having a super-smart robot that’s really good at fixing credit scores. Here’s the simple version: AI credit repair software uses special computer programs that can read, learn, and make decisions. These programs look at your credit reports, find mistakes, and figure out the best way to fix them. They’re so smart that they get better at their job the more they do it!

AI Credit Repair in Real Life

Let’s talk about how this cool tech works in real life. Imagine someone, let’s call her Sarah, who has a few mistakes on her credit report. Sarah uses AI credit repair software, and it quickly finds errors like wrong account details or outdated information. The software then helps Sarah fix these issues with the credit bureaus. It’s like having a personal credit expert who works super fast and knows exactly what to do.

Better and Faster Credit Repair

The best part about AI credit repair software is how accurate and efficient it is. Unlike humans, who might get tired or overlook small details, this software doesn’t miss a thing. It works 24/7, checking and rechecking, making sure everything on your credit report is just right. This means you can trust it to do a thorough job, and because it’s so fast, your credit score starts improving sooner than you might expect.

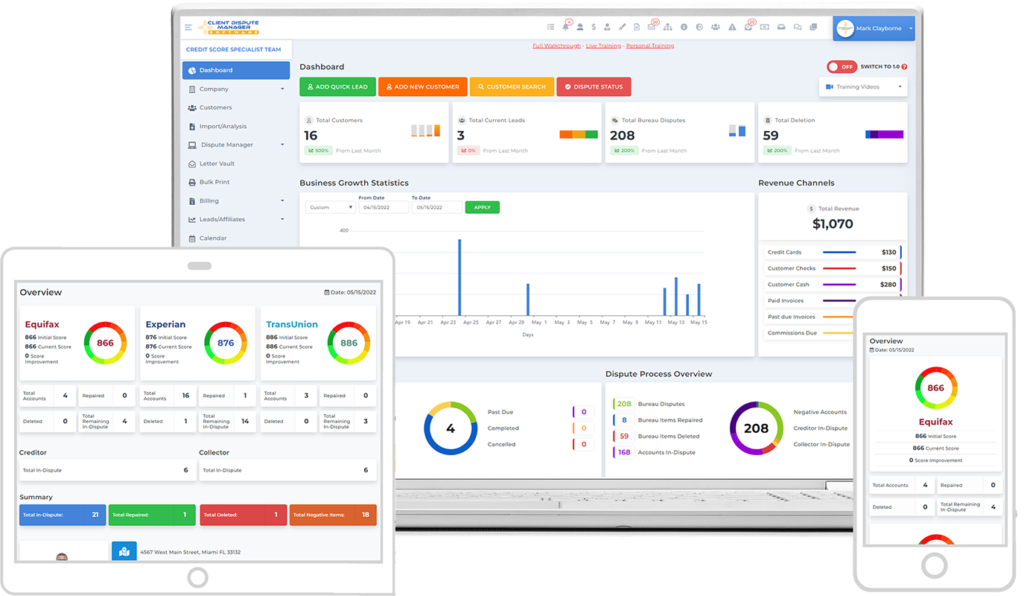

Client Dispute Manager Software: A Case Study

Let’s take a closer look at a specific kind of credit repair software that’s making waves – the Client Dispute Manager Software. It’s like a toolbox packed with everything you need to fix your credit score. This software is designed for folks who need a little help managing their credit disputes. It’s like having a personal assistant who knows all about credit repair and can help make the process easier.

What Makes Client Dispute Manager Special?

Client Dispute Manager Software isn’t just any credit repair tool. Here’s what makes it stand out:

Easy Tracking

One of the coolest things about this software is how it organizes all your dispute information. No more getting lost in a sea of papers and emails. It neatly keeps track of every step taken and what’s left to do. This feature is a real time-saver and helps you stay on top of your credit repair journey without feeling overwhelmed.

Automatic Dispute Letters

Writing dispute letters can be a real headache, but not with Client Dispute Manager Software. It’s equipped to automatically generate well-crafted dispute letters tailored to your specific issues. This means you can send out letters quickly, without the hassle of writing each one from scratch. It’s like having a personal letter-writing assistant who knows exactly what to say.

Credit Report Importing

This feature is a game-changer. The software can directly pull your credit reports into its system, giving you a clear and comprehensive view of your credit situation. With this, you can easily spot errors and track changes over time. It’s like having a magnifying glass that points out every important detail on your credit report.

Education Resources

Besides fixing credit issues, this software also focuses on teaching you about credit repair. It comes loaded with resources and guides that help you understand the ins and outs of credit scores, what affects them, and how you can keep improving them. It’s not just about fixing problems; it’s about empowering you with knowledge for the long run.

Standing Out in the AI Credit Repair World

In a sea of credit repair software, Client Dispute Manager Software really stands out. It’s not just because it has great features, but also because it’s user-friendly. You don’t have to be a computer genius to use it. Plus, it’s powered by AI, which means it gets smarter the more you use it. This software is a great example of how AI can make credit repair simpler and more effective.

The Benefits of Using AI Credit Repair Software

In the world of fixing credit scores, AI credit repair software is like having a secret superpower. It’s not just helpful for people working in credit repair, but also for anyone trying to improve their credit score. Let’s dive into why this software is such a big deal.

Time-Saving Wonders

First up, time is precious, right? AI credit repair software knows this and works super fast. For credit repair pros, this means they can help more clients in less time. And for folks fixing their own credit, it means spending less time worrying about credit scores and more time enjoying life. This software does the heavy lifting, sorting out credit issues in a flash.

Spot-On Accuracy

Mistakes on credit reports can be tricky to find, but AI software is like a detective that never misses a clue. It scans through reports with eagle eyes, spotting every error. This means a much better chance of getting those scores up without any mistakes holding you back. For credit specialists, it’s a relief knowing they’re giving their clients the best service. And for individuals, it’s peace of mind that their credit report is in good hands.

Predictive Analytics: Peeking into the Future

This might sound like sci-fi, but it’s real: AI credit repair software can predict future credit trends. It looks at heaps of data and patterns to guess what might happen with credit scores. This helps both credit repair experts and their clients make smart decisions, like when to apply for a loan or how to avoid credit pitfalls.

Challenges and Considerations in AI Credit Repair Software

Even the coolest tools have their challenges, and AI credit repair software is no different. Let’s talk about some things to keep in mind.

Not Always Perfect

First off, while AI is super smart, it’s not perfect. Sometimes, it might miss a unique credit issue or get confused by complex credit situations. This means there’s still a need for a human touch – someone to double-check the work and make sure everything’s on track.

Legal and Ethical Stuff

When we talk about credit repair, there are lots of legal rules to follow. AI software is programmed to know these rules, but it’s always changing. It’s super important to make sure the software stays updated with the latest credit repair laws. Plus, using this software means handling personal credit info, so keeping that info safe and private is a big deal.

Picking the Right Tool for You

Not all credit repair software is created equal. Some are better for professionals who help lots of people with their credit. Others are made for individuals working on their own credit. When choosing the right software, think about what you need: Do you want something simple or something with a bunch of features? Do you need something that gives lots of guidance, or are you a credit repair pro who just needs the basics?

The Future of Credit Repair: AI's Growing Role

Thinking about the future is always exciting, especially when it comes to AI and credit repair. So, what can we expect from AI credit repair software down the road? Let’s take a peek into the future.

AI Gets Even Smarter

One thing’s for sure: AI is only going to get smarter. This means credit repair software will become even more efficient at spotting errors and fixing credit reports. It’s like having a super-smart friend who gets smarter every day. This friend doesn’t just fix problems but also helps you avoid new ones by giving you smart tips about your credit.

A Big Impact on the Money World

AI in credit repair isn’t just good news for people fixing their credit scores; it’s big news for the whole financial sector. Banks, lenders, and even insurance companies use credit scores to make decisions. With more accurate and fair credit reports thanks to AI, these companies can make better choices. This could mean easier loan approvals and fairer interest rates for everyone.

Making Credit Repair Accessible to All

Another cool thing about the future of AI credit repair software is that it’s going to make fixing credit scores easier for more people. This software is not just for credit experts but for anyone who wants to get their credit score on track. It’s like having a credit repair guide in your pocket, ready to help anytime, anywhere.

Conclusion

As we’ve explored throughout this article, AI credit repair software, including tools like Client Dispute Manager, represents a significant advancement in the way we approach credit repair. These technologies not only streamline the process but also bring a level of accuracy and personalization previously unattainable. From rapid processing and pinpoint accuracy to adaptive learning and user-friendly interfaces, AI is undoubtedly setting a new standard in the industry.

Whether you’re a credit repair professional seeking to enhance your services or an individual looking to improve your financial standing, embracing these innovative tools can make a substantial difference. As the landscape of credit repair continues to evolve, staying informed and utilizing these cutting-edge solutions will be key to achieving the best outcomes in credit restoration.