The financial journey of credit repair is riddled with complexities, and having the right software can simplify the path. In today’s digital age, credit repair software has become an essential tool for many. But the pressing question remains: Are there reliable free options available?

This article dives into the world of free professional credit repair software, examining its viability and comparing it to premium solutions like Client Dispute Manager Software. Join us as we decipher the options in this vital segment of financial technology.

What is Credit Repair Software?

Credit repair software is a tool that helps individuals and businesses rectify any inaccuracies found in their credit reports. These software solutions are designed to identify, dispute and monitor errors such, as payments or potential fraud that can have an impact on credit scores. For those who prefer a do it yourself approach there are software options that offer step by step guides, free templates and user friendly tools to manage credit health effectively.

On the hand professionals like credit counselors often rely on comprehensive solutions that provide automated tracking detailed analysis of credit reports and advanced error correction features. One notable option in this space is Client Dispute Manager Software which offers a range of features for both beginners and experts alike. The key, to making the most of credit repair software lies in selecting the solution tailored to your needs.

The Rise of Credit Repair Software

In today’s digital age, the prominence and necessity of financial tools have seen an exponential growth, and standing prominently among these is professional credit repair software. These tools, which have evolved significantly over time, now serve a broad spectrum of users, from individuals aiming for DIY credit improvement to businesses providing professional credit repair services.

Evolution and Significance

Historically, credit repair was a tedious process, requiring manual effort, persistent follow-ups, and often an in-depth understanding of financial regulations. However, with the dawn of DIY credit repair software, individuals found empowerment in taking control of their credit destinies.

This movement spurred the growth of more specialized tools like professional credit repair software and credit report dispute software, streamlining the process even for businesses and affiliates. Today, the significance of cloud-based credit repair software solutions lies not just in simplifying credit repair but in also equipping users with advanced tools.

These range from credit dispute automation tools that expedite the dispute process to credit report tracking software that offers continuous monitoring of credit status. With options available for both individuals and businesses, it’s evident that the landscape of credit management has been revolutionized.

Are There Free Credit Repair Software Options Available?

In todays age of technology the search, for software solutions to assist with professional tasks continues to expand. One particular area where assistance is sought in the domain is credit repair. As individuals become more knowledgeable about their finances, there has been an increase in the demand for DIY credit repair software options. This leads us to wonder; are there any professional credit repair software choices in the market?

Availability of Free Options

Yes, there are several free credit repair software options available in the market. These software solutions typically offer basic features that allow users to monitor and manage their credit reports, challenge discrepancies, and keep track of disputes. Often, these free versions are designed for individuals who want to get a basic understanding of their credit situation or for those who are just starting their credit repair journey.

Pros of Using Free Credit Repair Software

Free credit repair software presents an enticing option for novices entering the credit repair realm. These tools eliminate the barrier of initial investment, providing essential functionalities to kickstart the process. In essence, they offer a cost-effective way to gain basic insights and begin the journey towards improved credit.

No Initial Cost

Free credit repair software entices users with its zero initial cost. It provides essential tools without financial commitment, making it attractive for those on a budget or newcomers to credit repair, allowing a risk-free exploration of the process.

Basic Functionalities Available

Free credit repair software acts as an entry point by offering fundamental features. Users can monitor credit reports and initiate disputes with credit bureaus, giving them a foundational experience in credit management before exploring advanced tools.

Good for Personal Use or Beginners

Individuals who are just starting to understand the intricacies of their credit report or those who have basic credit repair needs might find free software perfectly adequate.

Cons of Using Free Credit Repair Software

Free credit repair software, despite its initial appeal, often comes with inherent limitations. These tools typically offer basic functionalities, lacking the comprehensive features needed for thorough credit repair. Users might find themselves without advanced tools or robust customer support, and there’s a potential risk regarding data security due to limited investments in protective measures.

Limited Features

The age-old adage, “you get what you pay for,” rings true here. Free credit repair software options often come with limited functionalities, meaning users may not get some of the advanced tools or resources that premium software solutions might offer.

Lack of Advanced Tools

To effectively manage and improve a credit score, advanced tools such as detailed analytics, trend tracking, and integrations with other financial platforms can be crucial. Unfortunately, these tools are often missing in free software versions.

No Customer Support

One major drawback of many free software options is the lack of customer support. This can be particularly challenging if a user encounters a technical issue or has questions about a particular feature.

Potential for Data Insecurity

While this isn’t a universal truth for all free software options, there is sometimes a risk associated with data insecurity. It’s essential to ensure that any professional credit repair software, free or paid, has robust security measures in place to protect user data.

While free credit repair software options exist and offer fundamental features at no cost, users must carefully weigh the benefits against the potential downsides. For businesses like Client Dispute Manager Software, understanding the nuances of these free options can provide valuable insights into the market’s demands and expectations.

AI-Powered Credit Repair Software: The Future of Credit Repair

Artificial Intelligence (AI) has transformed the way credit repair businesses operate by offering more automated and accurate solutions. The integration of AI into credit repair software has made the entire process quicker and more efficient for both consumers and businesses.

The Benefits of AI Credit Repair Software

One of the major advantages of AI credit repair software is its ability to automate the identification of errors on credit reports. The best AI credit repair software uses algorithms to scan through credit reports and quickly detect inaccuracies, saving time for both individuals and professionals. For those searching for the best credit repair software, AI technology can offer faster results compared to traditional methods.

Credit Repair Software for Businesses

For credit repair businesses, AI-powered tools streamline operations by automating repetitive tasks such as generating dispute letters and tracking client progress. With credit repair business software, companies can manage larger client bases while improving the accuracy and efficiency of dispute handling. AI credit repair software also integrates features such as data security and automated communication, which are essential for business owners.

Choosing the Best AI Credit Repair Software

When selecting a credit report repair software, look for solutions that leverage AI to provide not just error detection but also detailed analytics on credit health. AI-enhanced tools can help users identify areas for improvement, offering actionable insights that were previously difficult to obtain. Additionally, the best credit repair software for business includes automation features to track disputes, manage clients, and offer secure data handling.

Introducing Client Dispute Manager Software

When delving into the realm of credit repair, one name stands out for its comprehensive approach and robust features: Client Dispute Manager Software. As a leading cloud-based credit repair software solution, it is designed to cater to a wide range of needs, from individuals seeking DIY credit repair software to businesses requiring professional credit repair software.

Standout Features of Client Dispute Manager Software

Client Dispute Manager Software emerges as a game-changer in the professional credit repair software domain. With its unique blend of user-friendly design and advanced technology, it caters comprehensively to both businesses and individual users. This platform not only streamlines the credit repair process but also ensures precision and efficiency, setting new benchmarks for the industry.

Cloud-Based Platform

Leveraging the power of cloud technology, Client Dispute Manager offers a cloud-based credit repair software experience, ensuring accessibility from anywhere and real-time updates.

Advanced Dispute Automation

With state-of-the-art credit dispute automation tools, the software makes it seamless for users to initiate, track, and manage disputes.

Integrated Client Portal

The credit repair client portal software feature enables businesses to maintain transparent communication with clients, allowing them to track their progress, upload documents, and liaise effectively.

Affiliate Management

For businesses that collaborate with partners, the professional credit repair software for affiliates features streamlines lead tracking and commission management.

Why A Trial of Client Dispute Manager Software is Worth It

Navigating the world of credit repair can be challenging. However, with the right tools, the process becomes notably easier. Enter the 30-day trial of Client Dispute Manager Software, a feature-rich platform that’s designed to transform your credit repair journey.

Here’s a deep dive into the invaluable offerings packed into this trial:

Efficient Onboarding for Immediate Results

Client Dispute Manager Software is distinguishable in the market due to its adeptness in automating the client sign-up process. This efficiency is particularly pronounced for businesses, as they can seamlessly onboard and process their initial client, achieving a remarkable turnaround time of just 15 minutes. This rapid processing not only demonstrates the software’s prowess but also its commitment to optimizing user experience and productivity.

One-Click Credit Report Management

Client Dispute Manager Software simplifies credit report integration, allowing users to effortlessly import reports with a single click for both clients and themselves. Enhanced by advanced built-in tools, the software swiftly conducts credit analysis, pinpointing and diagnosing discrepancies. This blend of convenience and precision establishes it as a standout tool in credit management.

Extensive Template Access for Customization

Client Dispute Manager Software offers users a vast library of nearly 300 letter templates, including dispute letters and contracts. Each template is thoughtfully designed for diverse credit repair situations and can be tailored to individual needs, ensuring effective and personalized communication in the credit repair journey. This expansive and customizable range sets the software apart in the industry.

Empower Clients & Affiliates with Dedicated Portals

Client Dispute Manager Software provides 24/7 access, enabling clients to continually monitor their credit repair progress. Simultaneously, affiliates are equipped with a dedicated portal, streamlining the management of referrals and transparent tracking of their commissions. This dual approach ensures both clients and affiliates benefit from tailored tools and transparency.

Optimal Team Management & Personalized Training

The software allows precise customization of team permissions, ensuring optimal access and data security. Additionally, the personal touch of a one-on-one live session with a support specialist ensures users fully tap into the platform’s capabilities, enhancing their credit repair efficiency.

Seamless Integration & Automation for Advanced Operations

In an era where automation is king, the software’s integration with over a thousand apps via Zapier transforms efficiency. Users can effortlessly connect tools, turning tasks that once took hours into minutes. This powerful integration optimizes time and simplifies the credit repair process, marrying technology with convenience.

In a nutshell, the Client Dispute Manager Software’s trial isn’t merely a preview; it’s an immersive experience into what’s possible in credit repair with the right tools at your disposal. The 30-day journey is not just enlightening but might just revolutionize how you perceive and conduct credit repair.

Conclusion

Credit repair is complex, and the right tools are essential. While free software exists, they often lack comprehensive features, support, and security. Client Dispute Manager Software offers a powerful suite tailored for results. As the demand for effective credit management grows, quality software is crucial. In the credit landscape, the right software choice can be pivotal for financial advancement.

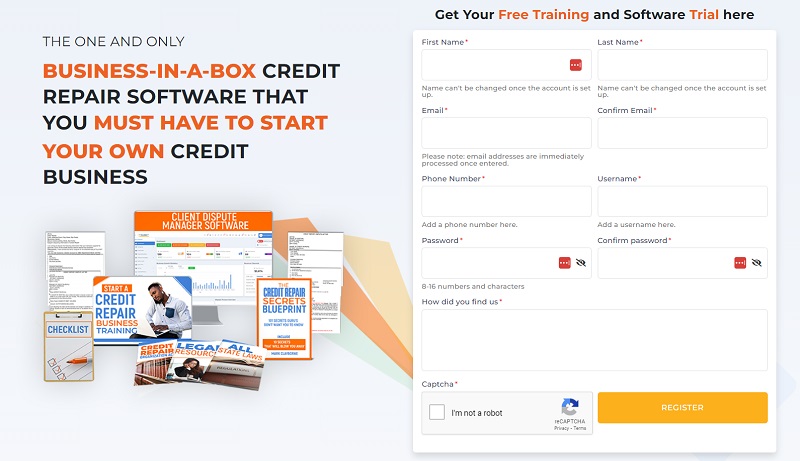

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.