In today’s financial landscape, your credit score plays a pivotal role in determining your ability to access favorable loans, secure housing, and even land that dream job. A strong credit history is like a passport to financial opportunities, while a tarnished one can hinder progress and limit possibilities.

From dispute management tools to new credit card solutions, a credit repair software packages provide all-in-one solutions for repairing and managing your credit. We’ll explore the fundamental concepts, demystify the terminology, and provide a comprehensive overview to help you make informed decisions about harnessing the power of credit repair software .

How Credit Repair Software Works?

At the heart of the credit repair process lies the intricate web of algorithms, data analysis, and strategic interventions that define the functioning of credit repair software. These software solutions are designed to streamline and amplify the credit improvement journey, offering individuals and professionals a digital toolkit to navigate the complexities of credit reporting agencies, credit bureaus, and credit scores.

But how exactly does this software operate? Let’s delve into the mechanics that power these technological marvels and unravel the mystery of their transformative effects.

Data Aggregation and Analysis

Credit repair software begins its journey by pulling in vast amounts of credit-related data from multiple sources. This data encompasses credit reports from various bureaus, payment history, outstanding debts, and more. Advanced algorithms then analyze this data to identify inconsistencies, errors, or negative entries that might be dragging down the individual’s credit score.

Error Detection and Dispute Generation

One of the primary functions of credit repair software is the identification of errors within the credit report. These errors could range from inaccurate personal information to misreported payment histories. Once these discrepancies are identified, the software generates automated dispute letters on behalf of the user.

These letters are meticulously crafted to adhere to legal guidelines and regulations, highlighting the errors and requesting their rectification. This process streamlines what can be a cumbersome manual task, increasing efficiency and effectiveness.

Monitoring and Progress Tracking

Credit repair is not an overnight endeavor; it’s a journey that requires persistence and patience. Credit repair software aids in this journey by providing real-time monitoring of progress. Users can track the status of disputes, changes to their credit report, and improvements in their credit score. This feature not only keeps individuals informed but also provides a tangible sense of accomplishment as they witness positive changes unfolding.

Personalized Action Plans

Different credit situations demand tailored strategies. Credit repair software often offers personalized action plans based on the user’s specific credit history. These plans may suggest actions such as paying down certain debts, diversifying credit types, or addressing specific negative entries. By guiding users toward actions that have the greatest potential to improve their credit, these software solutions act as virtual credit advisors.

Educational Resources

Empowerment through education is a hallmark of effective credit repair software. Many platforms include educational resources that empower users with insights into credit management, the factors affecting credit scores, and how to build healthy credit habits. This knowledge equips users not only for immediate credit repair but also for long-term financial success.

Communication and Engagement

Effective communication between users, credit repair companies (if applicable), and credit bureaus is vital. Credit repair software often facilitates seamless communication by providing interfaces for users to interact with the dispute resolution process. It also automates follow-ups, ensuring that disputes are actively pursued until resolution.

Types of Credit Repair Software

Some credit repair software options offer different types to cater to various user needs. Here are the main types available:

- Cloud-based: This type allows users to access the software from any device with an internet connection. It offers flexibility and convenience, as you can work on your credit repair tasks from anywhere.

- Desktop Applications: These types of credit repair software need to be installed on a computer or laptop. While they require installation, they often provide robust features and functionalities that can assist in managing your credit repair process effectively.

- Online Platforms with Comprehensive Services: In addition to providing credit repair software, some online platforms offer comprehensive credit repair services. These platforms combine their software with expert guidance, educational resources, and personalized assistance to help you navigate the complexities of improving your credit.

Choosing the right type of credit repair software depends on your preferences and specific requirements. Cloud-based options like Client Dispute Manager Software are great for those who value accessibility and mobility, while desktop applications may be preferred by individuals who prioritize advanced features.

Factors to Consider When Choosing Credit Repair Software

When choosing credit repair software, there are several factors that you should consider. By keeping these factors in mind, you can find a software platform that meets your individual needs and helps you improve your credit score effectively.

- User-Friendly Interface: Look for software with a user-friendly interface that makes it easy for beginners to navigate. It should have intuitive features and a straightforward layout to ensure a smooth experience.

- Key Features: Consider the features offered by different credit repair software options. Look for dispute letter templates, progress tracking tools, and educational resources that can guide you through the credit repair process.

- Detailed Reporting Capabilities: Check if the software provides detailed reporting capabilities. This feature allows you to monitor your progress and track changes in your credit score over time.

- Price and Cost: Compare pricing plans offered by different providers before making a decision. Take into account any additional costs or hidden fees associated with the software.

- Customer Reviews: Read customer reviews to get an idea of other users’ experiences with the software. Their feedback can provide valuable insights into its effectiveness and reliability.

By considering these factors – user-friendly interfaces, key features, detailed reporting capabilities, price, and customer reviews – you can make an informed choice when selecting credit repair software that suits your specific needs and budget.

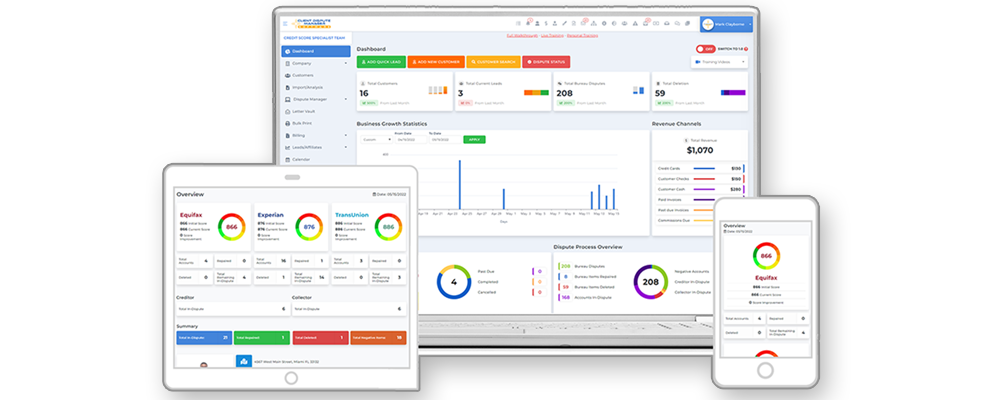

When evaluating credit repair software options, one particular type that deserves significant attention is the Client Dispute Manager Software. This specialized category of credit repair software is designed with a strong focus on managing client interactions, dispute generation, and progress tracking.

As you embark on the journey of choosing the right credit repair software for your needs, understanding the features and benefits of Client Dispute Manager Software can be pivotal.

Tips for Effective Utilization of Client Dispute Manager Software

Integrating a Client Dispute Manager Software into your credit repair toolkit is a strategic move that can elevate your efficiency and enhance the outcomes of your credit repair efforts. However, harnessing the full potential of this specialized software requires a combination of technical expertise, strategic planning, and effective communication. Here are some unique tips to ensure you make the most of your Client Dispute Manager Software:

Customization for Personalized Strategy

Every client’s credit situation is unique, and so should be their credit repair strategy. Leverage the customization features of your Client Dispute Manager Software to tailor dispute letters, communication templates, and action plans to the individual needs of each client. This personal touch not only enhances your professional credibility but also increases the likelihood of successful outcomes.

Regular Software Updates

Software evolves to stay current with industry trends, regulatory changes, and technological advancements. Ensure that you regularly update your Client Dispute Manager Software to access the latest features and improvements. These updates could include enhanced dispute algorithms, improved communication interfaces, or even new educational resources to offer your clients.

Data Security and Privacy

Credit repair involves handling sensitive personal and financial information. Prioritize data security and privacy when using your Client Dispute Manager Software. Ensure that the software provider adheres to industry-standard security practices, and consider encrypting client data stored within the software.

Communication Integration

Effective communication is the backbone of successful credit repair. Integrate the communication features of your software with your client interactions. Use the software to track communication history, schedule follow-ups, and automate reminders. This seamless integration not only saves time but also ensures that clients feel engaged and informed throughout the process.

Conclusion

Credit repair software is the modern ally in the quest for better credit health. By automating dispute processes, tracking progress, and offering tailored strategies, it transforms credit repair into an efficient and effective endeavor.

Remember, while technology is a potent tool, its success lies in your understanding of credit intricacies. Whether an individual or a professional, credit repair software, coupled with knowledge, creates a path toward achievable credit improvement. As you journey forward, let technology and expertise harmonize to lead you to credit success.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.