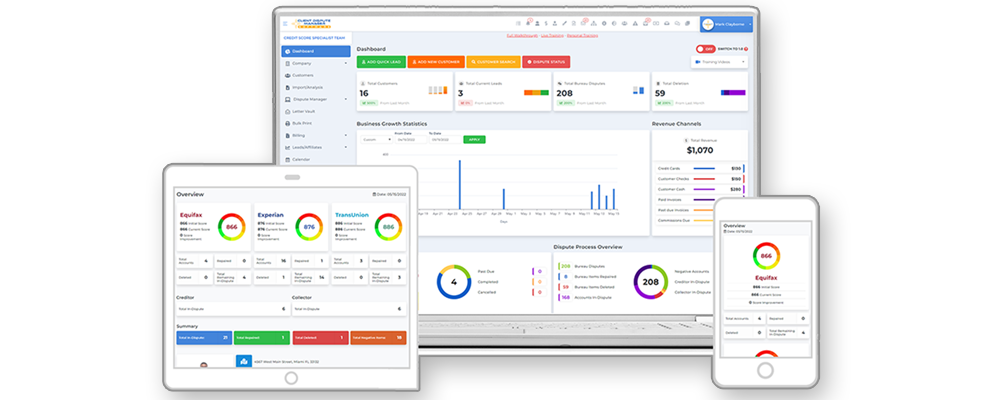

Are you tired of struggling with debt management and improving your credit scores? Looking for a game-changer that can simplify and accelerate the credit repair process for loans? Client Dispute Manager Software is your ultimate ally in achieving financial freedom. With its remarkable capabilities in customer support, this program revolutionizes how you tackle credit issues, saving you precious time and effort.

Client Dispute Manager Software, a leading provider of cutting-edge credit repair software, offers an all-in-one solution for efficient debt management. Equipped with training videos and expert guidance, their platform ensures you have everything you need for effective customer support and service. Say goodbye to tedious paperwork and endless phone calls!

Unlocking the potential of credit repair software is like having a personal assistant dedicated to boosting your creditworthiness and helping you manage your accounts and debt. Let’s dive into the strategies that will help you harness this tool effectively, with your bank’s support, and transform your financial futures using the best credit repair software for business.

Benefits of Client Dispute Manager Software for Improving Credit Scores

Client Dispute Manager Software offers several benefits for managing your accounts, improving your credit scores, and achieving your financial goals. This tool can streamline the process of reviewing and repairing your credit, making it more efficient and effective. The software also integrates with different payment processors, providing a seamless experience.

Learn 10 Ways Credit Repair Software Elevates Your Business Growth

- Identifying and Disputing Errors: The client Dispute Manager simplifies identifying errors on your credit report. It scans your report, highlighting any inaccuracies or discrepancies that could negatively impact your credit score. With this information, you can easily initiate disputes with the relevant credit bureaus or creditors to rectify these errors.

- Automated Reminders and Notifications: Keeping track of deadlines and progress is crucial. Client Dispute Manager Software provides automated reminders and notifications, ensuring you stay updated on important tasks such as submitting dispute letters or following up on investigations. This feature helps you stay organized and ensures you don’t miss any critical steps in the credit repair process.

- Overall Financial Health Impact: Using a business credit repair software such as Client Dispute Manager Software can positively impact your overall financial health. Addressing errors on your credit report and improving your credit scores increases your chances of qualifying for better interest rates, loans, or even rental applications. A good credit score opens various financial opportunities and can save you money in the long run.

Key Features of Client Dispute Manager Software

Client Dispute Manager Software can help customers improve their credit scores and resolve common issues. Choosing the appropriate software tools that offer essential features and services at a reasonable price is important. Here are some key features to look for when selecting credit repair software.

- Customizable Dispute Letters: Look for software that allows you to create personalized dispute letters tailored to your specific credit situation. This feature enables you to effectively address inaccuracies and negative items on your credit report.

- Tracking Tools: Client Dispute Manager Software provides tracking tools that allow you to monitor your disputes’ progress and track any changes made to your credit report. This helps you stay organized and informed throughout the credit repair process.

- Document Management Systems: Our software offers a document management system where you can securely store and manage all relevant documents related to your credit repair journey. This ensures easy access to important files whenever needed.

In addition to these essential features, other factors contribute to the overall effectiveness of credit repair software. These factors include the total score, services, system, and price.

- User-Friendly Interface: Opt for software with a user-friendly interface that makes navigation intuitive and workflow efficient. A simple interface saves time and reduces frustration when using the software.

- Integration with Financial Tools: Consider software that integrates with other financial tools, such as budgeting apps or personal finance management platforms. These integrations enhance the functionality of the credit repair software by providing a holistic view of your financial health.

By utilizing these key features, you can make the most out of your chosen credit repair services, improving your payment history, resolving common credit issues, and ultimately achieving a good total score. These features are essential for businesses and companies looking to improve their credit.

Learn Maximize Credit Repair: Top Software Strategies

Tips for Optimally Using Client Dispute Manager Software

Set Goals, Prioritize Tasks, and Track Progress

- Establish clear goals for your credit repair journey, such as improving your credit score or resolving specific negative items. These goals will help you determine the appropriate software tools and services to use from companies that meet your criterion.

- Prioritize tasks based on their impact on your credit profile’s total score. Focus on addressing high-priority issues first to improve your creditworthiness. This will help you choose the best services and companies that can assist you in meeting the criterion for a better credit profile.

- Utilize the task management features of the credit repair software to effectively organize and track your progress in improving your credit score. This will help you stay on top of your business tasks and ensure that you maximize the software services’ benefits.

Regularly Update Personal Information

- Ensure that your personal information is updated within Client Dispute Manager Software. This includes accurate details like name, address, and contact information. It is important to keep this information current when utilizing credit repair services or working with professionals. Following these credit repair tips can help improve your credit score.

- Keeping this information current enables businesses and companies to report accurate data to creditors and bureaus, enhancing the effectiveness of your credit repair efforts. This helps improve the total score and ensures the cloud-based software functions efficiently.

Utilize Data Analytics for Insight

- Leverage the data analytics capabilities provided by cloud-based credit repair software. These tools can help businesses identify patterns or trends impacting their credit score.

- Analyze the data using appropriate software tools to gain insights into factors affecting your total creditworthiness and make informed decisions about improving your financial standing. This is especially important for companies using business software to evaluate their creditworthiness.

By implementing a systematic approach, regularly updating personal information, and utilizing data analytics within credit repair software options, companies can maximize their effectiveness in improving their business’s credit profile. Remember that each step contributes towards achieving better results throughout the credit repair process and helps increase the total score.

Learn Effective Tips for Maximizing Results Using Client Dispute Manager Software

Enhancing Client Relationships with Client Dispute Manager Software

Client Dispute Manager Software can greatly enhance client relationships for businesses and companies. It provides the necessary tools to communicate and address their specific needs effectively. By leveraging the features offered by personal credit repair software, credit repair professionals can establish transparency, maintain regular contact, and offer tailored solutions to clients. This can ultimately improve the total score.

- Regular Communication: One of the key benefits of credit repair software is its communication features. Take advantage of these tools to stay in touch with your clients regularly. Whether it’s through email or text notifications, keeping them informed about progress and updates will help build trust and confidence in your services.

- Client Portals: Personalize interactions by utilizing client portals within the software. These portals provide transparency and allow clients to access real-time updates on their credit repair journey. They also offer secure document-sharing options, ensuring sensitive information remains protected.

- Tailored Solutions: Every client has unique credit repair needs. Leverage the capabilities of the software to address these specific requirements effectively. Use the data provided by credit bureaus and credit detailers to identify areas that need improvement and then offer personalized solutions based on this analysis.

By following these tips for maximizing the effectiveness of Client Dispute Manager Software, companies can strengthen their client relationships while efficiently managing their credit repair business. Implementing these strategies can improve the total score of your credit repair business.

Remember that successful credit repair companies rely on efficient communication, transparency through client portals, and tailored solutions to improve their total score. These solutions can be provided by professional software like Client Dispute Manager Software or other reputable providers in the industry.

Unlocking the Full Potential of Client Dispute Manager Software

Improve Financial Literacy

- Take advantage of our credit repair services and educational resources to improve your credit version. Learn how to repair and manage your credit items effectively.

- Enhance your understanding of credit repair and financial management.

- Access guides, tutorials, and articles on credit repair services to boost your financial literacy and improve your credit items. Learn how to use the leading business credit repair software, Client Dispute Manager software, to fix errors and discrepancies in your credit version.

Automate Repetitive Tasks

- Optimize efficiency by automating time-consuming tasks.

- Generate dispute letters with just a few clicks.

- Track progress updates effortlessly using the software’s tracking feature.

Gain Deeper Insights

- Explore advanced features offered by the powerful platform.

- Utilize score simulators to understand how certain actions affect your credit score in the business world. These tools can be helpful for individuals and companies looking to improve their credit standing.

- Analyze trends in your credit profile using trend analysis tools to track your total score. This can be helpful for both individuals and businesses, as it allows you to monitor changes in your creditworthiness over time. By utilizing these tools, companies can gain valuable insights into their credit profile and make informed decisions based on the data.

By maximizing the effectiveness of Client Dispute Manager Software, businesses, and companies can streamline their credit repair journey and achieve better results. Improve your financial literacy through the software’s educational resources, empowering yourself with credit repair and financial management knowledge.

Automate repetitive tasks such as generating dispute letters or tracking progress updates, saving valuable time that can be invested in improving your credit.

Conclusion

In conclusion, maximizing the benefits of credit repair software requires understanding its advantages, utilizing key features effectively, following essential tips, managing clients efficiently using relationship-building strategies, and leveraging bank support. By implementing these practices consistently, you can significantly improve your clients’ credit scores while establishing yourself as a trusted expert in the field.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.