Hello my friends. If you are trying to restore your own credit or if you are a credit restoration company, then this guide using credit repair software when disputing is definitely for you. Now, in this guide, I’m going to show you six ways on how to dispute inaccurate information. I’m going to show you how to dispute with the credit bureaus first, and then I’m going to show you how to dispute with the collection agencies, and lastly, I’m going to show you how to dispute with the creditors.

Now, I’m going to show you everything that I used to do when I ran a credit restoration company and I’m going to show you how to do it using our new Client Dispute Manager 2.0. Are you ready? Let’s go! using a credit repair software

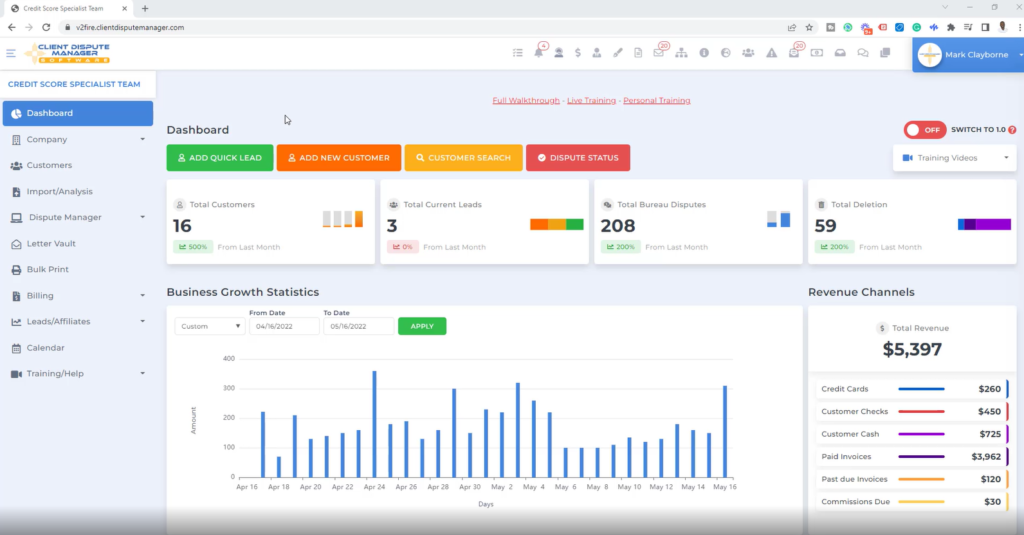

Below you can see the dashboard of the software.

As you can see, on the dashboard of the software, one of the first things we want to do is when we first do our first dispute using the Client Dispute Manager . We’re going to come over to the Dispute Manager screen and we’re going to click on Dispute Manager option on the right-hand menu window.

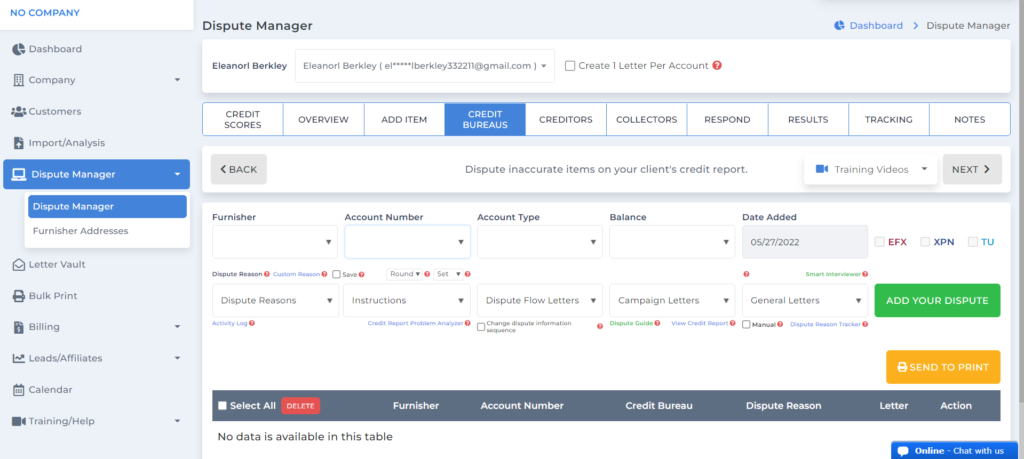

When we click on Dispute Manager, it’s going to take us to the Credit Score Screen. From there, then we’re going to go right to the Credit Bureau Screen.

We already have a sample customer. The data is not the actual data but a sample just for you to see how it looks. Just think of this as being you working on your own credit or you are working on a customer’s credit, for example.

The first thing we’re going to do, anytime you are working on disputing a credit report, is you always want to send out the first initial dispute round to the credit bureau. Let me guide you on how to do that.

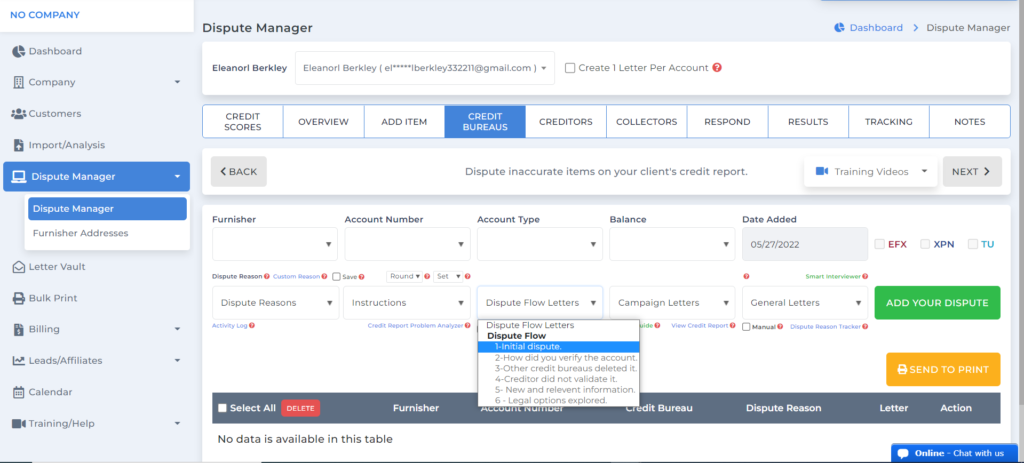

All right, so while on the credit repair software, what you need to do is select the first account you want to work on and the very first dispute letter I’m going to send is what I call the Initial Dispute.

Send Out Your Initial Dispute

Now, this is what I call the Initial Dispute. In this dispute, whether you’re doing it for your own credit or you’re working for someone else, is that in this dispute letter you are pretty much telling the credit bureau that there are items on your credit report that are inaccurate, incomplete, or just completely wrong. You want them to investigate and fix this information because it’s actually damaging your credit report.

Just assume that we prepared a letter here in the software, we picked a dispute reason and we picked some instructions, and then we sent this letter out to the credit bureau.

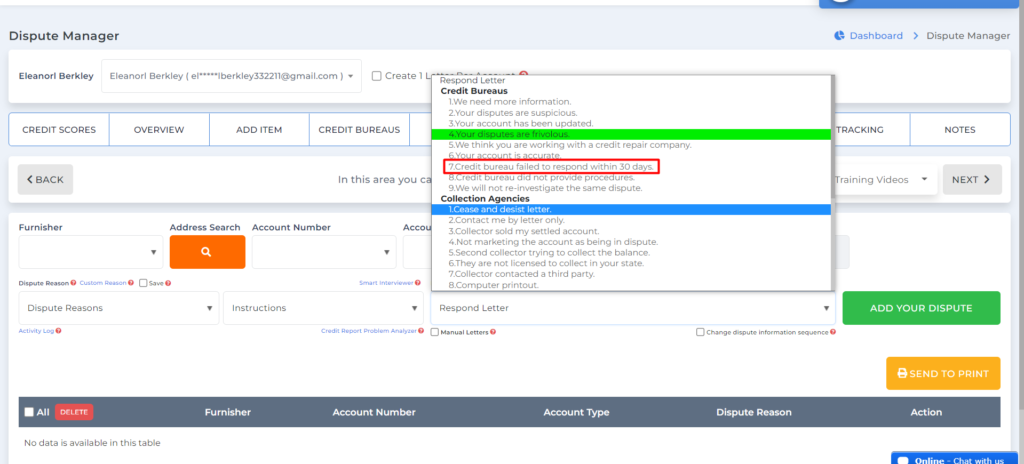

Credit Bureau Failed to Respond

The credit bureau has 30 days to investigate your dispute and then get back with you with results. Usually you give them 40 days, five days for the mail to go to them and five days for the mail to come back so a total of 40 days exactly. But what happens if the credit bureau does not respond to your initial dispute?

What happens if you sent out the letter and you wait 40 days and the credit bureau does not respond? Well, according to the Fair Credit Reporting Act the credit bureau has 30 days to respond. If they don’t respond in that 30 days, then technically, they didn’t do their investigation and they have to delete the item from the credit report. If they don’t respond in those 30 days, choose the letter in the credit repair software that says they fail to respond in 30 days.

In order to use that letter directly from the software, what you want to do is you want to go to the dispute reason section. Look for the letter you need that corresponds to the reason you want to use.

Credit bureau failed to respond within 30 days is the most appropriate with the scenario given. Now, this is the letter that you automatically send from the software. It’s absolutely very simple to manage your own credit or if you’re working on someone else’s credit to manage their information right here in the Client Dispute Manager 2.0. We made it very convenient for you to do.

What we did really quick is that I guided you on how to send out your first initial dispute letter to the credit bureau. Then, I told you about the 30-day wait time, and then what you’re supposed to do if the credit bureau doesn’t respond within 30 days. You you go to the response section of the software and you send out a respond letter.

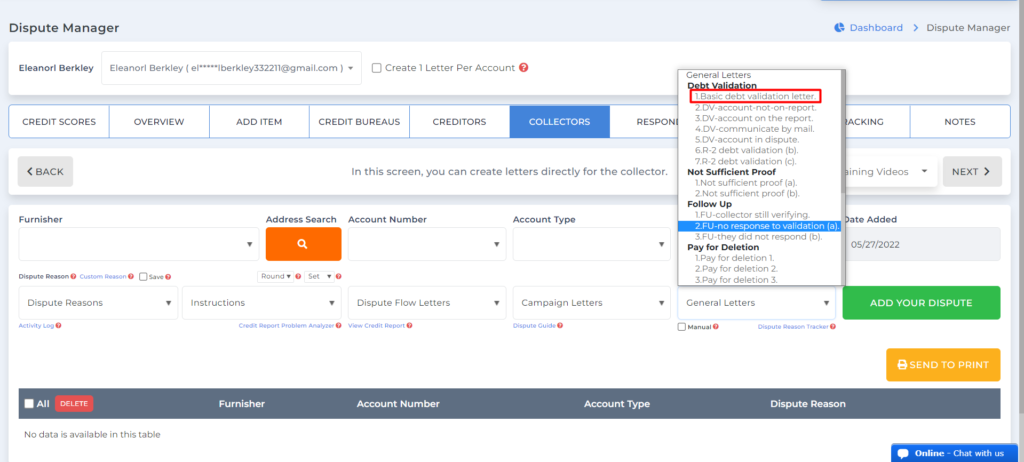

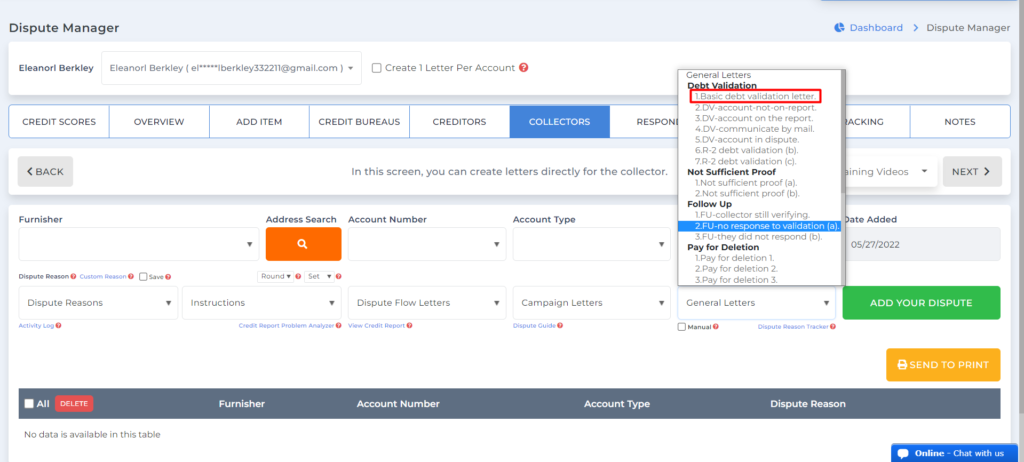

Now, the next thing is I want to show you how to dispute with a collection agency through the credit repair software. Same example, you see a collection account on your credit report that you feel that’s inaccurate or you say it’s not mine. You are disputing it because you don’t know where this collection account came from, it’s wrong, or this sort of thing.

Inside the Client Dispute Manager 2.0, I’m going to show you where to go to send the first initial letter out to the collection agency.

All right, so what we want to do is we want to go to the section where it says collector, and I’m going to click on the collectors tab. Then, we want to go over the section where it says general letters. We want to send what we call the basic debt validation letter so that is what we are going to select.

It’s very easy. You can pick your dispute reasons, your instructions, and click add your dispute, and then it’ll send it to the print area.

Debt Validation Letter

Let me explain what that is. If you see something on your credit report, and it’s a collection account and you’re not sure what it is. When you send this basic debt validation letter to the debt collector it’s just a general request for the debt collector.

It’s just asking them to send you everything, every item, any type of paperwork that they have on this particular debt, that’s all it is. It’s just asking them to send you information about the debt because of what you want to do.

You’re not sure of this debt yourself. You’re like, “Why is this collection on my credit report? What is this? I don’t believe I owe this balance, why are they reporting that?”

What you want to do is you want to look over all the information that the debt collector sent you and you want to compare it with your credit report. You want to have your credit report up. You want to have the information that the debt collector sent you, and then you want to compare it to make sure that it’s either accurate or inaccurate.

What you’re doing, you’re looking for problems, you’re looking for things that don’t match. Like, for example, the collector may say that you owe this amount of money but then you look at the credit report and you say, “No, that’s wrong. That’s not the amount of money that I owe.” Or the account number may be wrong or something that the collection agency sent you does not match what’s on your credit report.

Remember, what the Fair Credit Reporting Act states, that everything in your credit report must be 100% accurate.

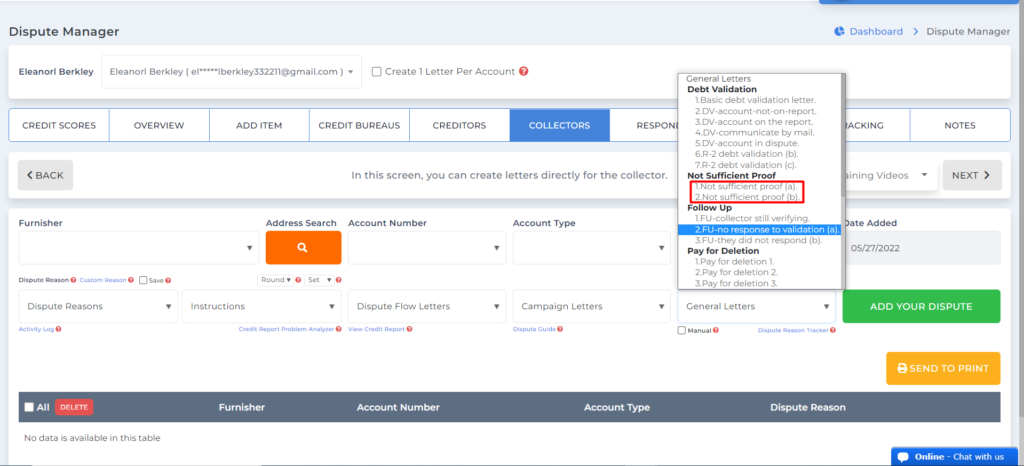

Now we understand that so you send this debt validation, this information request to the collection agency. They send you something basic back. Now, this is how you can respond to them if they don’t send you what you need.

Say, for example, they don’t send you the information you’re asking for so here’s what you do. What you want to do is you want to go back to the collection section on the software.

Not Sufficient Proof Letter

You want to go back here and you want to send a not sufficient proof letter from the templates we have. What you’re doing in this letter is you’re telling the collection agency that what you sent them is not sufficient proof.

It’s not sufficient information for them to continue reporting the information on your credit report. Then from there, what you do, because the collection agency couldn’t provide you with sufficient information in that initial letter, then you go back to the credit bureau, say, “Look, I asked the collection agency to send me some information. They only sent me basic information.

They didn’t send me sufficient information to substantiate the reporting on the credit report. Also, while I was reviewing the information that they sent me, I noticed that the information that they have is inaccurate. It’s not matching the information that’s on my credit report for this collection account so I believe that the collection account balance is incorrect. Please correct or remove this inaccurate information off of my credit report.”

All right, so that is how you deal with a collection account on your credit report. This is how you dispute it using the Client Dispute Manager 2.0 credit repair software.

Now the next thing I want to show you is I want to show you how to send a letter directly to the creditor because the creditor is the furnisher. The creditor is the one. Everything starts with the creditor. They’re the ones who put the information initially.

The debt started with the creditor. If you didn’t pay, either they can put it on your credit report or they can sell it to a debt collector and the debt collector can put it in the credit report.

Say, for example, you have a charge off on your credit report, it didn’t go to the debt collector yet and you believe that the reporting date or the date last open or the balance that they have on the charge off is inaccurate. You want to send a direct dispute to the creditor and you want to ask them for an investigation.

Let me show you how that works.

Disputing With Creditors

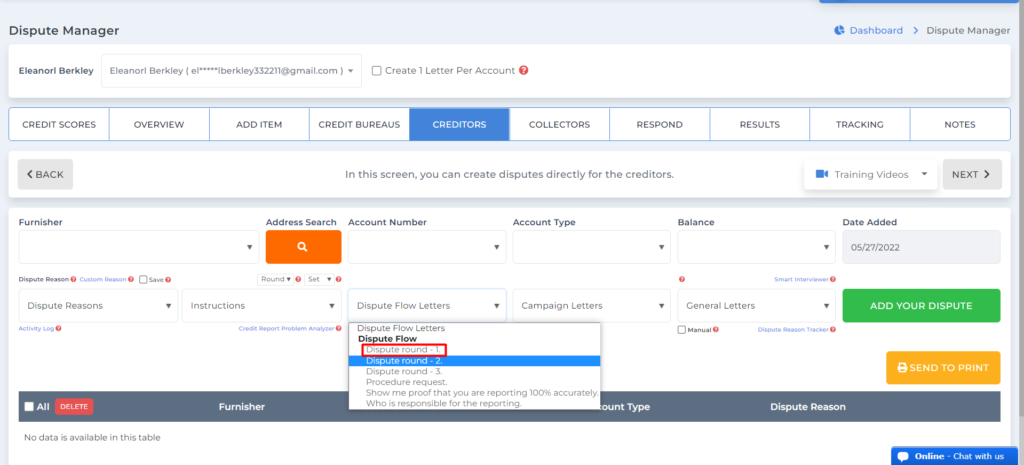

All right, so what we’re going to do, we’re going to go to the creditor tab on the Dispute Manager section of the software. Then go where it says dispute flow letters, and then we’re going to click on round one.

Now, in round one what you’re doing, you’re not disputing anything with the creditor, you’re just asking the creditor for an investigation. You’re asking them to start an investigation and then you tell them what the problem is.

You believe that the balance on this charge off is inaccurate and here’s the reason why, creditor, I believe it’s inaccurate. You want to tell them that this balance is inaccurate.

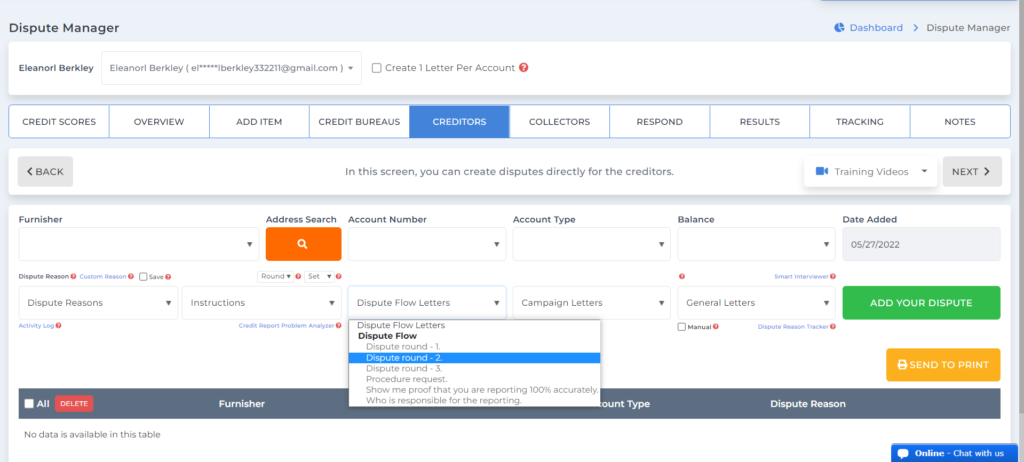

What if the creditor responds back to you and they say that we believe that everything we’re reporting on your credit report is sufficient and it’s accurate. What you want to do is you have to send a response to their letter.

This is the time you select the round-two letter.

Disputing With Creditors Round Two

What you’re saying in round two is you’re literally asking the creditor to provide you with proof of their reporting. “Okay creditor, so you’re saying that you are reporting 100% accurate. Now, show me what proof do you have that the charge-off that you’re reporting on the credit bureau is accurate?

Show me the documents, show me the proof that I owe the amount that you say that I owe. Because see, I’m disputing the amount with you. I’m asking you for an investigation and I’m asking you to investigate your reporting to the credit bureaus. I don’t agree with the reporting because that’s my right so I want you to show me the proof, show me proof that you have. Because you’re reporting this so I want to know the proof.”

Then what’s going to happen is the credit bureau is going to start another investigation with the creditor, so there you go. Now you know how to dispute with the credit bureau, the creditor, and the collector, and I showed you some of the reasons on why you would do this and how you would do it.

You can see how easy it is to do disputes with the Client Dispute Manager 2.0. Now, this is good if you’re working on your own credit or if you are a credit restoration company trying to help someone else improve their credit.

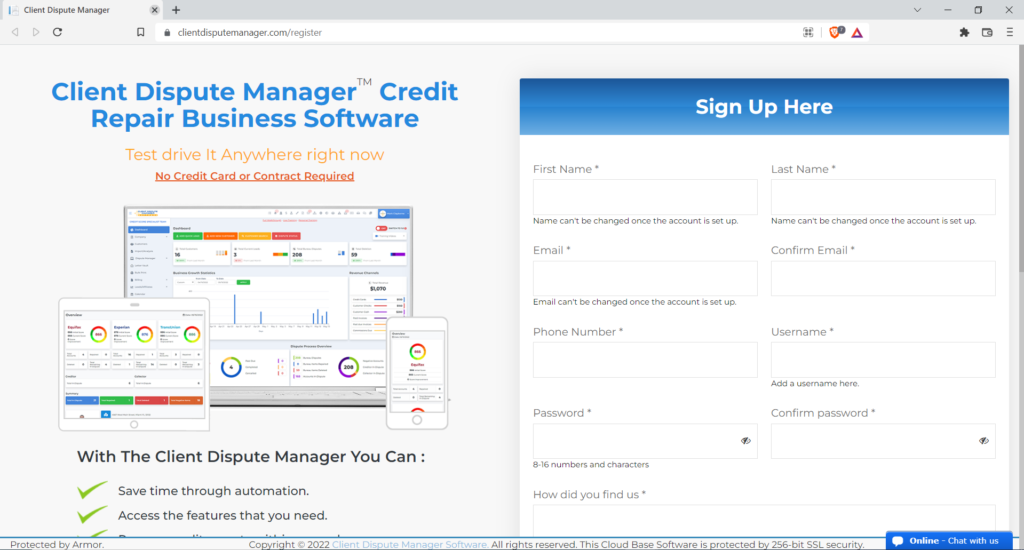

You can get a free 30-day trial of the Client Dispute Manager Software 2.0. All you have to do is click the image below to start your free trial today. No credit card is required, no commitments, easy access and it comes with a downloadable 101 Credit Secrets Gurus Don’t Want You to Know guide.

Hope to welcome you soon as part of our credit repair software family.