Have you ever sent a dispute letter to fix a mistake on your credit report, only to get a “verified” response that didn’t solve anything? Or maybe you’re new to the credit repair business and just don’t know where to start.

If that sounds like you, you’re not alone. Credit errors are frustrating, and fixing them takes the right tools and the right strategy. That’s where the Client Dispute Manager Software comes in.

In this article, we’re going to walk through 12 powerful dispute flows that are built right into the software. These flows are designed to guide you step-by-step, helping you send the right dispute letter at the right time to challenge credit report inaccuracies effectively.

Whether you’re an entrepreneur looking to automate your credit repair business, or just someone who wants to understand how to challenge inaccurate information, this guide is for you.

Let’s dive in.

Start Today and Explore the Features Firsthand!

Step-by-Step Dispute Flow for Credit Repair Beginners

Starting a credit repair journey can feel overwhelming, especially for new entrepreneurs. This step-by-step dispute flow gives you the foundation you need to send effective dispute letters and organize every round of communication clearly within the Client Dispute Manager Software.

How This Dispute Flow Helps New Credit Repair Professionals Stay Structured?

The step-by-step dispute flow gives you a clear roadmap. It walks you through each round of disputes, helping you stay on track. Each round includes a recommended dispute letter that targets the issue based on previous responses.

You won’t have to guess your way through the process. It’s structured, efficient, and ideal for small credit repair businesses looking to scale through credit repair automation.

What to Include in Your First Dispute Letter?

When you send your first dispute letter, you need to keep it simple, accurate, and based on facts. The Client Dispute Manager Software walks you through each step and helps you make smart choices fast.

It ensures that each dispute letter is tailored for the issue you’re facing and follows all rules under FDCPA and FCRA.

Here’s what to focus on when preparing that first dispute letter:

- Identify the type of account you’re disputing (collection, charge-off, late payment, etc.)

- Choose the correct dispute reason based on what’s inaccurate, incomplete, or unverifiable

- Select a professionally written letter from the software that aligns with that dispute reason

- Ensure FDCPA and FCRA compliance to protect your client and your business

- Track the bureau’s response so you’re ready for the next round of your dispute flow

Verified Response Dispute Flow: How to Respond When a Credit Bureau Verifies the Account

This dispute flow inside the Client Dispute Manager Software is designed to help you respond when a credit bureau claims an account is “verified.” It gives you strategic options so you don’t feel stuck.

Many users struggle with this scenario, but this feature gives you clarity, structure, and the right dispute letter to send each time.

Why Verified Accounts Are a Common Roadblock in Credit Bureau Disputes?

When a credit bureau “verifies” an account, it means they contacted the furnisher (usually a creditor) and confirmed the data. But that doesn’t always mean the data is accurate or complete.

That’s why the Client Dispute Manager Software includes 15 response strategies you can use to push back.

15 Response Strategies to Challenge a Verified Dispute Letter

With these strategies built into the Client Dispute Manager Software, you can confidently respond to a verified dispute letter and push back with strength. This helps you address credit report inaccuracies that the bureau may have overlooked or failed to investigate properly.

You’ll have multiple response formats that align with FDCPA compliance and FCRA standards, so your efforts stay professional and legal. These options give both beginners and experienced users powerful tools to stay organized and move efficiently through the dispute flow.

Whether you’re running a credit repair business or handling your own report, this system simplifies how to challenge inaccurate information with purpose and clarity.

Start Today and Explore the Features Firsthand!

Stall Letter Dispute Flow: Handling Credit Bureau Delay Tactics with a Dispute Letter

When a credit bureau sends a stall letter, they may be trying to delay or avoid a proper investigation. This dispute flow gives you 24 different response strategies inside the Client Dispute Manager Software, so you always have a strong reply ready with the right dispute letter.

Stall letters can confuse clients and waste valuable time, especially if you’re running a credit repair business.

These built-in responses help you stay compliant with FDCPA guidelines while making sure every letter aligns with your overall dispute flow strategy.

It’s a simple but powerful way to keep your momentum and continue challenging credit report inaccuracies effectively.

Understanding Stall Letters from Credit Bureaus

Stall letters are often used to slow down the process or intimidate consumers. But you have rights and with the right tools, you can respond effectively. Inside the Client Dispute Manager Software, you’ll find powerful resources that help you create a strong dispute letter designed to stop these delay tactics.

Whether you’re just starting out in the credit repair industry or running an established credit repair business, having access to structured dispute flows gives you a clear way to keep challenging credit report inaccuracies.

This makes it easier to follow the right process, stay within FDCPA compliance, and build trust with your clients.

24 Dispute Letter Templates to Respond to Stall Tactics

In the Client Dispute Manager Software, there are 24 built-in dispute letter templates designed to combat stall tactics. These templates are tailored for different scenarios and help you maintain momentum in your dispute flow.

Whether you’re responding to vague bureau requests or defending your client’s rights, these letters give you the clarity and structure needed to move forward.

They also help you stay aligned with FDCPA compliance while effectively addressing credit report inaccuracies using proven credit repair dispute strategies.

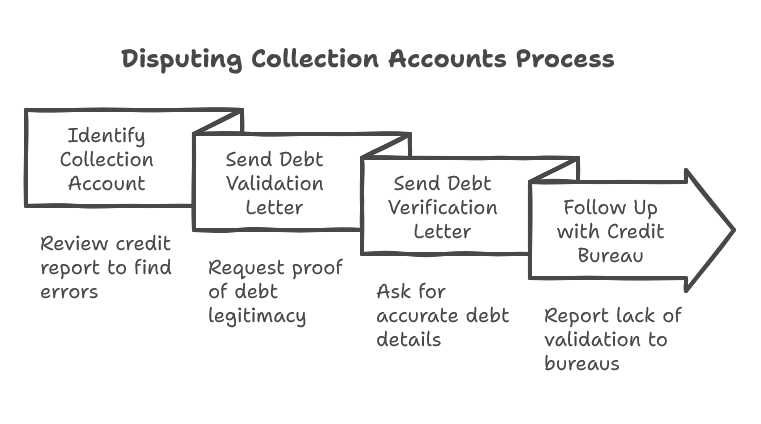

Double Attack Dispute Flow: Disputing with Collector and Credit Bureau Together

Sometimes one dispute isn’t enough. This dispute flow helps you double your efforts by sending dispute letters to both the credit bureau and the collector. It’s designed for users who want to apply pressure from two sides and get results quicker using the Client Dispute Manager Software.

How to Challenge Inaccurate Information from Two Sources at Once?

This flow allows you to send a dispute letter to both the credit bureau and the collector. It’s a dual-approach strategy that increases pressure on both parties to respond accurately and quickly.

By targeting the collector directly, you can uncover documentation gaps that the credit bureau might have missed.

This not only strengthens your overall dispute flow but also ensures that your case is supported by both legal compliance and tactical outreach. It’s especially helpful in a credit repair business where fast, effective results matter.

Start Today and Explore the Features Firsthand!

Why Disputing with Collector Can Strengthen Your Case?

Collectors often have weaker documentation. Hitting them first gives you an edge. When you start disputing with collectors, you can expose incomplete or unverifiable records they may not have legally validated.

This makes your dispute letter even more effective, especially when you’re using the structured templates provided by the Client Dispute Manager Software.

It’s a smart part of your overall credit repair dispute strategy, helping you move forward when the bureau alone isn’t giving results.

Double Attack Creditor and Bureau Dispute Flow: Fixing Errors Faster

If an error starts with the creditor, why not go straight to the source while also contacting the bureau? This dispute flow lets you send dispute letters to both parties and is ideal for resolving deeper issues that may not be fixed through a credit bureau alone.

It ensures that you’re addressing all possible sources of credit report inaccuracies, rather than relying on just one channel.

This approach is especially effective for professionals using credit repair automation to streamline their work and deliver faster results for clients.

It’s a critical part of a smart, multi-layered credit repair dispute strategy that gives you full control over how to challenge inaccurate information.

Why You Should Send a Dispute Letter to Both Parties?

Some inaccuracies start with the creditor. This flow helps fix the root cause. By going directly to the creditor, you’re tackling the source of the credit report inaccuracies before they are even reported to the bureau.

The Client Dispute Manager Software provides the right tools and pre-built dispute letter templates so you can challenge the errors with confidence.

This strategy is an important part of credit repair automation and is especially effective when used alongside other credit repair dispute strategies.

It also supports full FDCPA compliance, giving you peace of mind while helping your clients improve their credit faster.

Start Today and Explore the Features Firsthand!

Leveraging FCRA Laws in This Dispute Flow

The Fair Credit Reporting Act allows you to challenge both the furnisher and the bureau. This means you are not limited to just sending a dispute letter to the credit bureau—you can also go straight to the creditor who reported the error.

This dual approach is essential in advanced credit repair dispute strategies and gives your dispute flow more leverage. When used with the Client Dispute Manager Software, it ensures you’re fully compliant with FDCPA and are following legal procedures while effectively resolving credit report inaccuracies.

Triple Dispute Flow: Creditor, Collector, and Bureau All at Once

The triple dispute strategy is a high-pressure method that reaches the creditor, collector, and bureau at once.

This dispute flow is perfect for challenging tough credit report inaccuracies where multiple parties are involved. It maximizes your client’s legal protection and results.

With this flow, you’re sending a dispute letter to each entity, forcing all sides to respond and back up their claims.

The Client Dispute Manager Software makes it easy to manage this process while staying compliant with FDCPA and delivering professional results through automated workflows.

How Triple Disputes Create Maximum Pressure?

Each party gets a letter. If one fails to respond properly, it can help your case. This approach allows you to create accountability from every angle—creditor, collector, and bureau—making it harder for them to ignore or delay your requests.

Using this strategy inside the Client Dispute Manager Software, you send carefully crafted dispute letters that follow strict legal standards under FDCPA compliance.

This method also improves your ability to remove credit report inaccuracies faster and with more authority.

It’s a key element of aggressive but legal credit repair dispute strategies used by professionals who want results and compliance in one system.

Staying in Line with FDCPA Compliance

This method follows all laws under the FDCPA and CROA. The software makes sure you stay compliant. Each dispute letter in this flow is written to align with the standards of these laws, so you never have to worry about stepping out of bounds.

This is crucial for credit repair professionals who are scaling their business and need reliable tools that support credit repair automation.

When you’re disputing with collectors, creditors, and bureaus all at once, having an automated, legally sound system in place makes all the difference.

That’s what the Client Dispute Manager Software delivers—efficiency, accuracy, and full compliance in your dispute flow process.

Factual Creditor Dispute Flow: Targeting the Source of Credit Report Inaccuracies

When the credit bureau isn’t resolving the issue, it’s time to go straight to the creditor. This dispute flow provides a six-round system to send strong, factual dispute letters directly to the source of the problem using the Client Dispute Manager Software.

Each round is designed to escalate your argument and keep the pressure on the creditor to correct the credit report inaccuracies.

This strategy is especially helpful when you’re not getting meaningful results from the bureau and need to take the issue to the original data furnisher.

It’s a great example of how credit repair dispute strategies can be adapted using automation to create consistent, legal, and results-driven communication with creditors.

Start Today and Explore the Features Firsthand!

When to Bypass the Bureau and Focus on the Creditor?

If the bureau isn’t cooperating, the creditor might be the weak link. In many cases, the creditor is the original source of the credit report inaccuracies, and targeting them directly can lead to faster resolution.

This approach gives you another chance to highlight missing or incorrect data in your dispute letter and build a stronger case.

The Client Dispute Manager Software allows you to easily manage these direct disputes and guides you through each round with precision.

It’s a smart move for any credit repair business that wants to stay in control and follow proven credit repair dispute strategies.

FDCPA Collector Laser Dispute Flow: Advanced Strategy for Disputing with Collectors

If a collector is reporting inaccurate info, you can challenge it under FDCPA compliance. This dispute flow gives you laser-focused letters designed specifically for debt collectors.

It’s another smart tool in the Client Dispute Manager Software arsenal. These letters are crafted to push back on incomplete or invalid claims made by collectors, helping you remove harmful credit report inaccuracies.

Whether you’re running a growing credit repair business or helping yourself, this flow gives you the power to send precise, legally-sound dispute letters while keeping your dispute flow on track.

Using FDCPA Compliance to Your Advantage

This flow uses the Fair Debt Collection Practices Act to push back on collection agencies. It empowers you to demand accountability from collectors by challenging the accuracy, completeness, or legality of their claims.

When a collector fails to validate the debt properly, your dispute letter can force them to remove the item from the report.

This process is an essential part of credit repair dispute strategies, especially when disputing with collectors becomes the only route left.

With the tools in the Client Dispute Manager Software, you’ll stay organized, compliant with FDCPA, and fully equipped to fix credit report inaccuracies effectively.

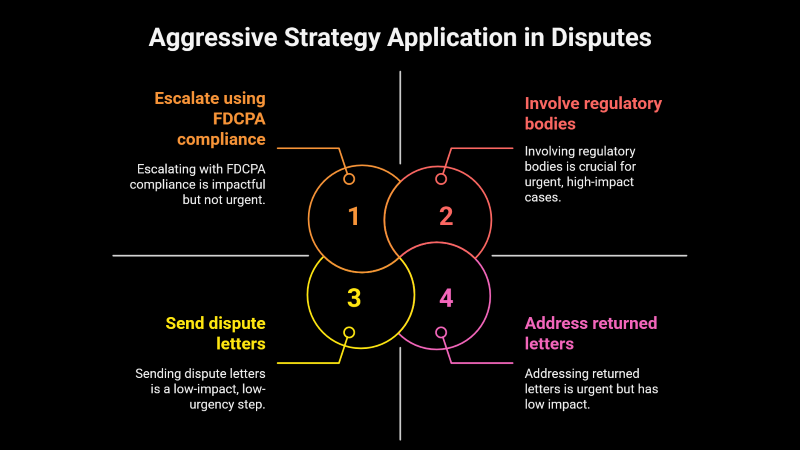

Aggressive Four-Point Dispute Flow: When You Need to Escalate Credit Bureau Disputes

If you’ve tried everything and nothing is working, this flow is for you. The aggressive four-point strategy combines dispute letters with legal escalation options, including educating your customer about filing complaints with regulatory bodies.

This dispute flow is built for serious cases where credit bureaus, creditors, or collectors are violating laws and refusing to correct credit report inaccuracies.

The Client Dispute Manager Software helps guide you through this process with structured templates that align with FDCPA compliance.

You’ll also learn how to work with your client so they can take the lead in filing formal complaints with agencies like the CFPB, ensuring you’re acting within legal boundaries while getting real results.

It’s one of the most powerful tools for anyone operating a credit repair business or learning how to challenge inaccurate information aggressively and effectively.

Start Today and Explore the Features Firsthand!

When to Use the Aggressive Strategy?

This flow is ideal when:

- Your client’s rights are being violated

- Bureaus or creditors refuse to correct errors

- You’re facing repeated stall tactics or ignored requests

- Dispute letters are being returned without investigation or with vague responses

- You want to escalate your dispute flow using FDCPA compliance and involve regulatory bodies to support your case

Metro 2 Dispute Letters Flow: Automating Credit Repair with Metro 2 Compliance

The Metro 2 format gives your dispute letters technical power. This flow inside the Client Dispute Manager Software helps automate your credit repair process while aligning with credit industry reporting standards.

It breaks down exactly how to use Metro 2 letters in a structured, step-by-step dispute flow that simplifies even the most complex cases.

Whether you’re new or experienced in the credit repair business, this format helps you identify and correct credit report inaccuracies using data compliance and precise timing.

With built-in support for credit repair automation, the software ensures you’re sending legally sound dispute letters in the proper sequence, all while staying compliant with FDCPA and industry regulations.

Why Metro 2 Letters Are a Game-Changer?

They help pinpoint technical inaccuracies and force compliance. Metro 2 dispute letters follow strict credit reporting guidelines, which makes it easier to challenge and remove errors that don’t meet those standards.

By aligning with industry protocols, this strategy improves your success rate while keeping your dispute flow structured and professional.

For anyone in the credit repair business, especially those using credit repair automation, this method provides a reliable and legally grounded way to address credit report inaccuracies.

It’s a major advantage when you’re looking to scale your services using the Client Dispute Manager Software.

AI Workflow Dispute Flow: Using AI Credit Repair Tools for Smart Dispute Letters

This is where tech meets precision. The AI credit repair tools built into the Client Dispute Manager Software help you create the right dispute letters at the perfect time.

It’s ideal for credit repair professionals who want smarter, faster results with automation. These tools take the guesswork out of the process by suggesting the most appropriate dispute flow based on the issue at hand.

Whether you’re challenging credit report inaccuracies or looking to scale your credit repair business, AI gives you a faster and more reliable way to get results.

Start Today and Explore the Features Firsthand!

Step-by-Step AI Dispute Flow

- Choose your template based on the type of credit report error you’re disputing

- Follow the letter sequence recommended by the AI for maximum impact

- Let the AI help you stay on track with smart suggestions and built-in automation to speed up your dispute flow

- Use the system to ensure your dispute letters stay compliant with FDCPA and FCRA

- Get real-time insights that help you improve your credit repair dispute strategies while saving time

Final Thoughts: Take Control of Credit Report Inaccuracies Today

You don’t need to guess your way through the credit repair process anymore. With these 12 dispute flows, the Client Dispute Manager Software gives you the power to send the right dispute letter every time.

Each flow is built to solve a specific challenge, from verified responses to aggressive disputes involving all parties.

The software makes it easy for entrepreneurs, beginners, and even advanced users to follow clear, compliant credit repair dispute strategies.

With powerful features like AI credit repair tools, Metro 2 dispute letters, and full FDCPA compliance, you’re fully equipped to tackle credit report inaccuracies head-on.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: