This content is a transcript of the video above.

In this article, we are going to discuss 10 simple steps for running a credit repair business, right from the comfort of your home. Now, what I’m going to do is I’m going to take you behind the scenes, and I’m going to show you how simple it is for you to run your credit repair business, using the Client Dispute Manager software.

Table of Contents

But before we get started, here’s what I want you to do. I want you to ask me any questions you want to ask me pertaining to these 10 simple steps on how to run a successful credit repair business step by step. So I’m going to show you how a lot of credit repair companies do it in Client Dispute Manager.

So one of the first things that you want to do once you start your credit repair business, and before you actually start taking on clients, you got to prepare your contract. So I’m going to show you inside of Client Dispute Manager right now, exactly where you can build, or you can upload your own contract, or you can use our starter contract to get started. So let me show you that right now.

Step 1: Get Your Contract Ready

So one of the first things that you want to do once you start your credit per business, and before you actually start taking on clients, you got to prepare your contract. So I’m going to show you inside of Client Dispute Manager right now, exactly where you can build, or you can upload your own contract, or you can use our starter contract to get started.

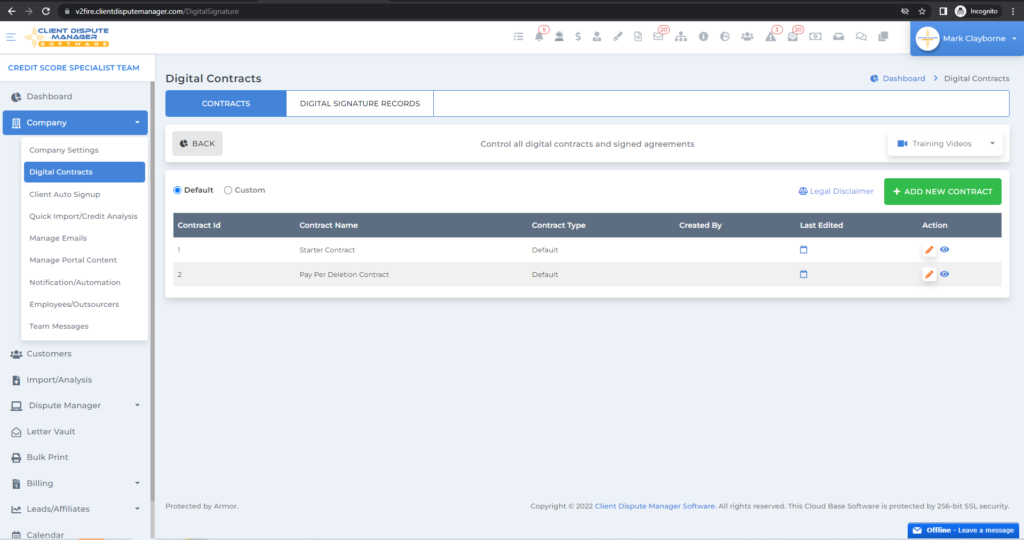

So let me show you that right now. So I’m already in the Client Dispute Manager right here, as we see. We’re on a dashboard, so what I’m going to do is I’m going to go over to the company right here, and I’m going to click on that, and I’m going to click on digital contracts.

So right here is the digital contract section. Now, right here, we have a starter contract, and we have a pay-per-deletion contract.

Now if you’re just starting out in the industry, what you want to do is you want to use our starter contract, and the starter contract already has basic clauses and basic terminology for you to get started.

So what I recommend you to do is to modify the starter contract, to fit your own particular state. And then once you modify the contract, I recommend you take that contract, you send it to a lawyer, some sort of contract lawyer to read it, to make sure that it has all the right clauses in the contract for your particular state and for your particular company.

Now that’s the first step. That’s the first thing you are going to do before you take on your first customer when you’re running a successful credit repair business.

Step 2: Set Up Client Auto Signup

When running a successful credit repair business, is creating what we call your client auto signup form. Now the client auto signup form will basically allow you to have customers sign up for your credit restoration services automatically, while you are sleeping.

And how do you do this? You build a simple form, you put it on your website and when customers come to your website, they can automatically sign up for your credit restoration services while you’re asleep. And then they’re going to go through what we call the client auto-sign up.

So they’re going to onboard themselves while you sleep. So you’ll be getting customers while you’re sleeping by simply putting this one form on your website and allowing the customers to come to your website and sign up.

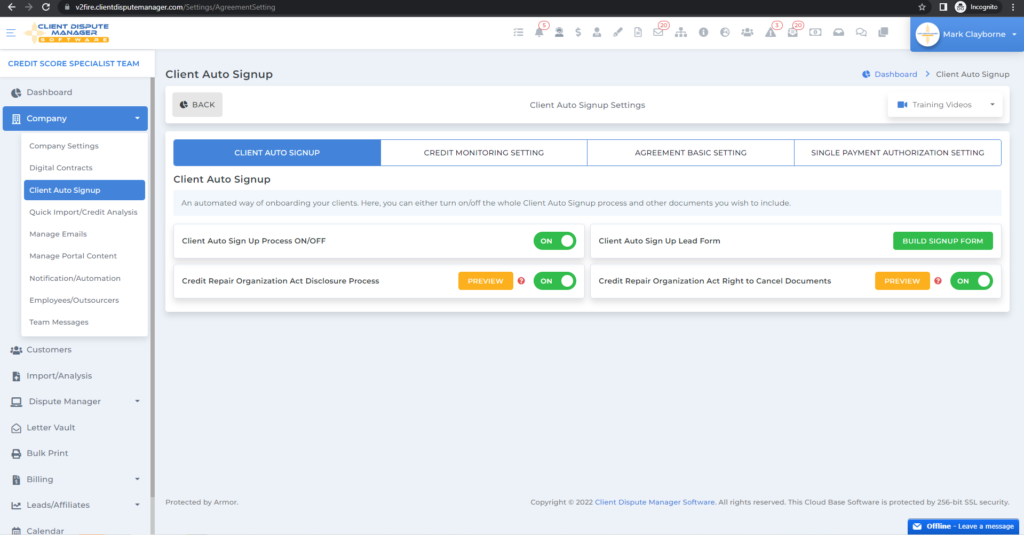

So what we’re going to do is we’re going to we’re on the dashboard again. So I’m going to go over to the company and then I’m going to click on client auto-sign up and right here on the client auto signup, this is the back end of the client auto signup form.

And this is where you set up your full onboarding system. Now over here, it says, “Build a signup form.” And this is where you’re going to build your form. And you’re going to take this form right here, and you’re going to place it on your website. Now, once you place the form on your website, whenever you drive traffic to your website, customers will see your offer.

They will see your form, and they can sign up right there on your website. And then once they sign up, they’re going to go through the onboarding. They’re going to go through our client auto sign-up onboarding step by step automatically.

And then they will be able to sign up for your services while you’re sleeping. So that is step two of running a successful credit repair business. The first step is to get your contract ready.

Once your contract is ready, the second step is to build your form, place it on the website, and set up your client auto sign-up in the back end, using the Client Dispute Manager. And then while you’re sleeping or while you’re travelling, clients can sign up automatically for your credit restoration service.

Step 3: Build A Credit Analysis

We’re going to talk about building the credit analysis. What is credit analysis? Is basically an overview of your customer’s credit report. It’s a short version, an audit version of your customer’s credit report.

It tells you all the inaccurate information on the customer’s credit report, it tells you their credit score, and it also gives you a brief summary of what you’re going to do next for your customer. So once you build a credit analysis, you want to email it to your customer, and you can do it very easily inside of the Client Dispute Manager software.

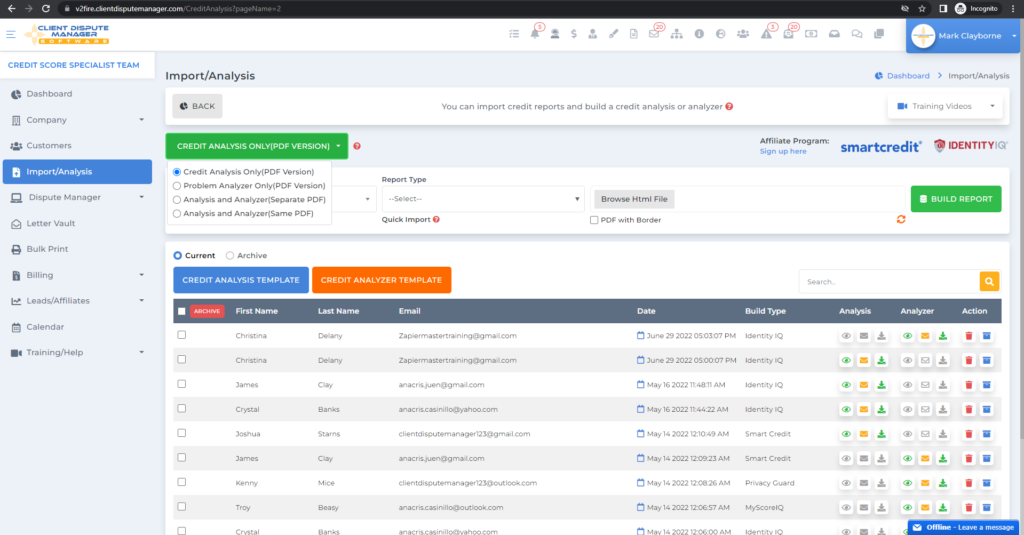

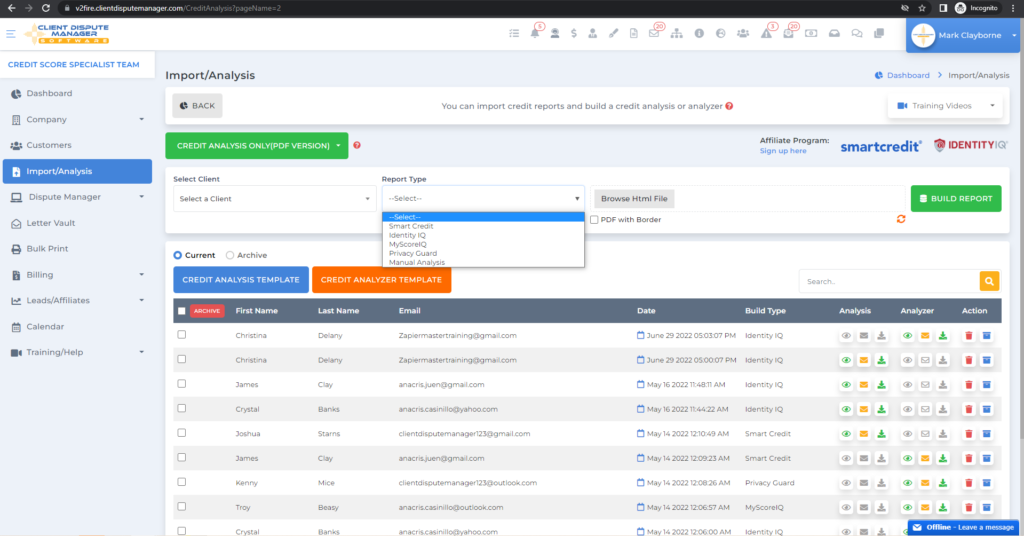

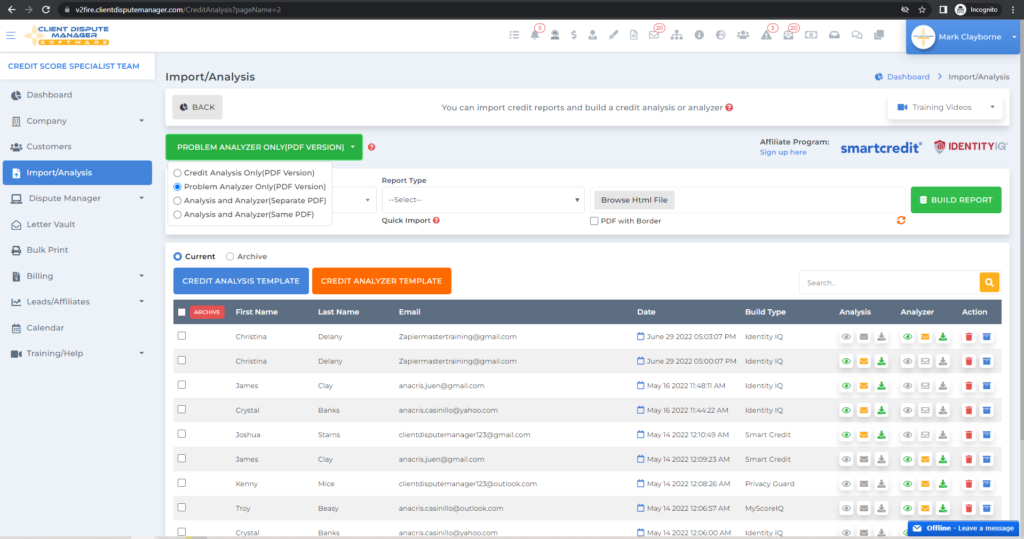

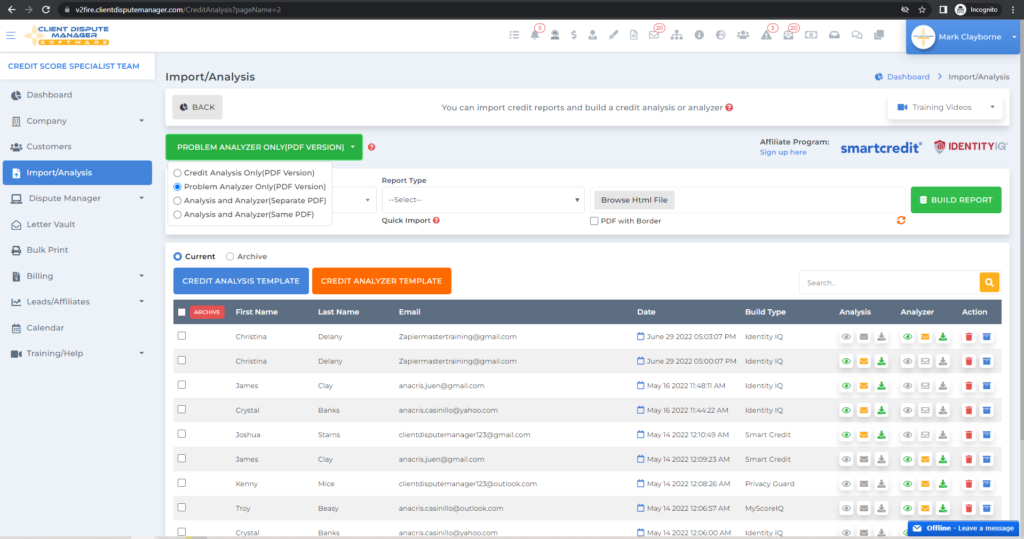

And let me show you how to do that right now. We’re on the dashboard. And on the left-hand side, it says “Import an analysis.” Let’s go ahead and click on that. So as you can see, I’ve already built a lot of credit analyses here. So in order to build your credit analysis, right here, says “Run an analysis on the analyzer,” you would simply select credit analysis only, PDF, and you would select your customer from here and you would select your credit monitoring.

And right now we work with Smart Credit, Identity IQ, My Score IQ, Privacy Guard. And you can do a manual credit analysis as well. So you want to build your credit analysis and then you want to click on where do we send the email?

You want to send, it because I’ve already built the credit analysis, as you can see right here, we want to send it by email. Simply send the credit analysis by email right here. And when you send that credit analysis by email, your customer will get the credit analysis pretty.

So that’s step three in the process of running a successful credit per business. And this is what you do, every day, you’re going to repeat these steps or you’re going to outsource this, or you’re going to let a VA do this, but this is what you do every single day, running a credit repair business. Now let’s go ahead and go to step four.

Step 4: Build A Credit Analyzer

Now credit analyzer is different from the credit analysis. The analysis just basically gives you a summary of the credit report. It tells you all the inaccurate information in a list, but the analyzer’s different.

The analyzer will go through the credit report and find all of the problems with the credit report. That’s the analyzer. It will go through the credit report and find all the problems with the credit report. And it will pinpoint, it’ll show you everywhere there are inaccuracies on the credit report.

It’s very powerful. You also want to send that one to your customer as well, and you want to get your customers ready for the interview. You want to get them ready for the interview. So you want to send them the credit analysis, and you also want to send them the credit analyzer. And let me show you how to find a credit analyzer.

We’re on the same page right here. So what you want to do is you want to select the client and then right here says “Problem analyzer.” You want to select that. And once you select that, you pick your credit monitoring report and you pretty much click on build a report.

And over here is the credit analyzer right here. You see, right here? And you click to send an email and that’s going to send your customer the credit analyzer.

We’re going to get your customer ready for the interview. And that’s number four. So we talked about the first four and we’re going to continue until we get all the way to 10 simple steps to running a successful credit repair business.

Step 5: Credit Report Interview

We’re going to talk about the interview. We’re going to talk about the credit report interview. Now, what is the credit report interview? This is one of the most important parts of running a credit repair business because you got to interview your customer.

You can’t just start disputing your customer without interviewing them and finding out what’s wrong, from their perspective. They need to tell you what’s wrong with these inaccurate items on a credit report. You can’t just assume that you know what’s wrong with a credit report.

So you need to do this credit report interview after the customer signs up for your credit repair services. So you need to conduct this interview.

You can do it in two ways. You can do it in the old style, which is the manual way, in which you’re sitting in front of the computer with your customer on a zoom call, or you can do it with them over the phone.

So you need to have their credit report up and they need to have their credit report in front of them. Because you’re going to go over this together. And when you go over this together, you’re going to ask them line by line, tell me what’s wrong with this account.

Or then tell me what’s wrong with that account. Tell me what’s wrong with that account. Tell me what’s wrong with that account. And then you’re going to be writing your notes.

You’re going to be taking notes exactly as they tell you what’s wrong with the account. So you’re going to do this in zoom call or you can do it on a phone. That’s called the credit report interview, it’s the credit interview. You got to do this before you start disputing.

This is step five of the process. So you got to do this. You cannot skip this process. You got to do this before you start disputing, or else you’re going to be disputing blind. And how can you send out disputes, if you don’t get the feedback from the customer. So you got to do that first.

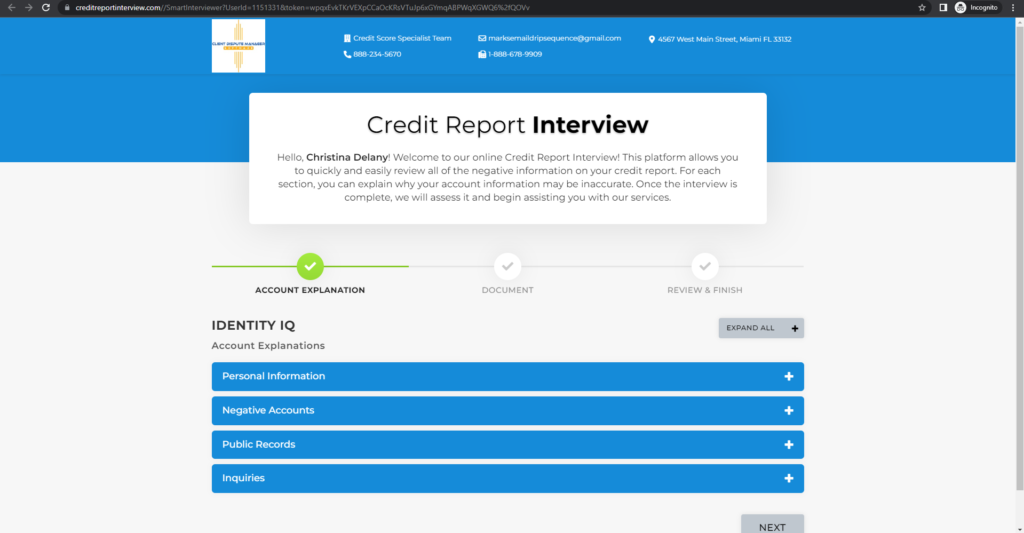

Now, if you don’t want to do it manually, you can do it the automated way. We have the Smart Interviewer inside of the software that will interview the customer for you.

So if the customer, if you can’t make time to meet with the customer, then you can use the smart interview. You send them a simple link. You send them a simple email and then let the customer onboard themselves. Let them do the interview by themselves without you. So let me show that to you right now.

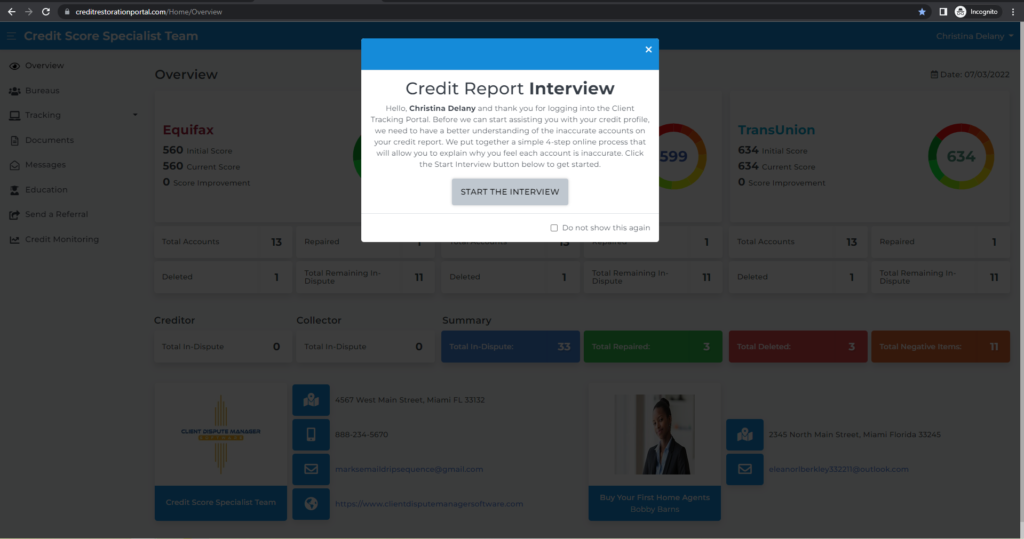

So when the customer logs into the client tracking portal, they’re going to see this pop up just like this. And then when you click on it, it’s going to take them to the smart interviewer. And this is where your customer can start the interview on their own. They don’t need you.

They can go through this interview in three steps, and tell you everything that’s wrong with their credit report. And they can click submit and end, and all that information will come to you inside of the software, without you even being there.

So the customer will do the interview on their own. The software will interview your customer, saving you so much time, so much frustration. And it’s just completely crazy.

It’s an automated interview and it’s called the Smart Interview. So again, you can do it in two ways. You can do it manually through zoom or over the phone. This is after your customer has signed up with you. Or you can send them one link and let them do it on their own at their own particular time. Very, very powerful and very, very important.

Step 6: Dispute Manager

So now we are at step six of the process. And step six is very important because step six is all about disputing. So now you’ve gone through the interview with the customer. The customer told you all the inaccurate information that was wrong on the credit report.

You got the information from your customer and now you are ready to prepare your first dispute round. So look, this is the process. You’re going to go through one through 10, every single customer. You’re going to process every single customer this way when you’re running a credit repair business.

Trust me, I used to have a credit repair business, and this is exactly what I did. And we have a lot of customers and this is the process that they go through all the time.

So it’s not as hard, as difficult as you thought it would be. Is it? You just got to know the steps. So now we got their information, and now we want to prepare their first disputes. So let me show you exactly how to do that inside the Client Dispute Manager.

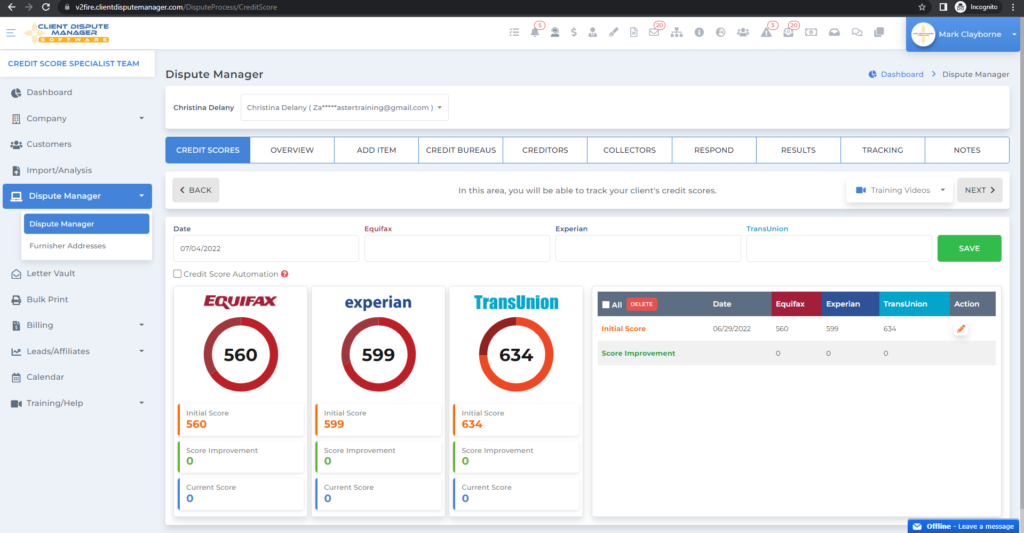

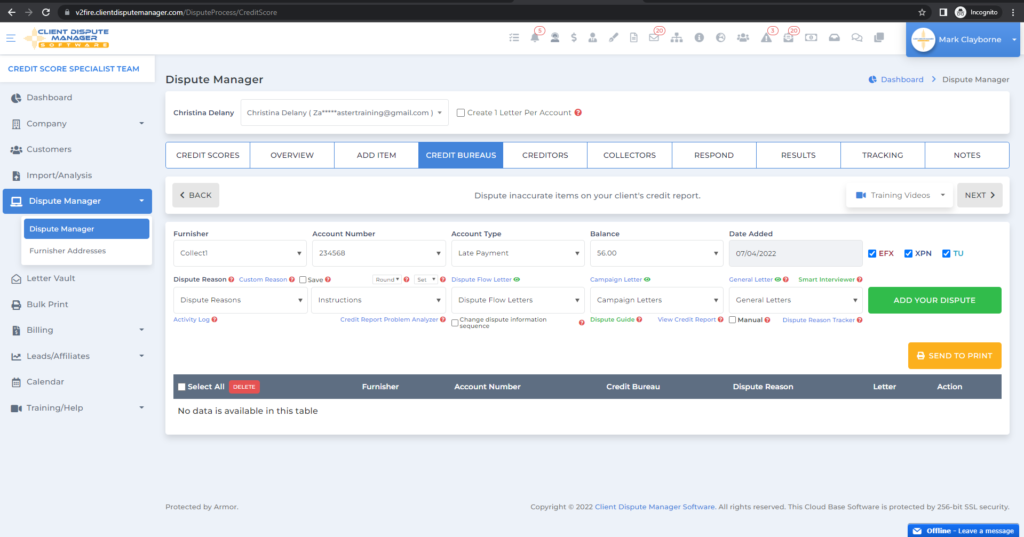

Now I’m on the credit score screen, and I’m going to go right to the credit bureau screen because I’ve already loaded some inaccurate items for this customer. Now, this is all fake data, it’s not real.

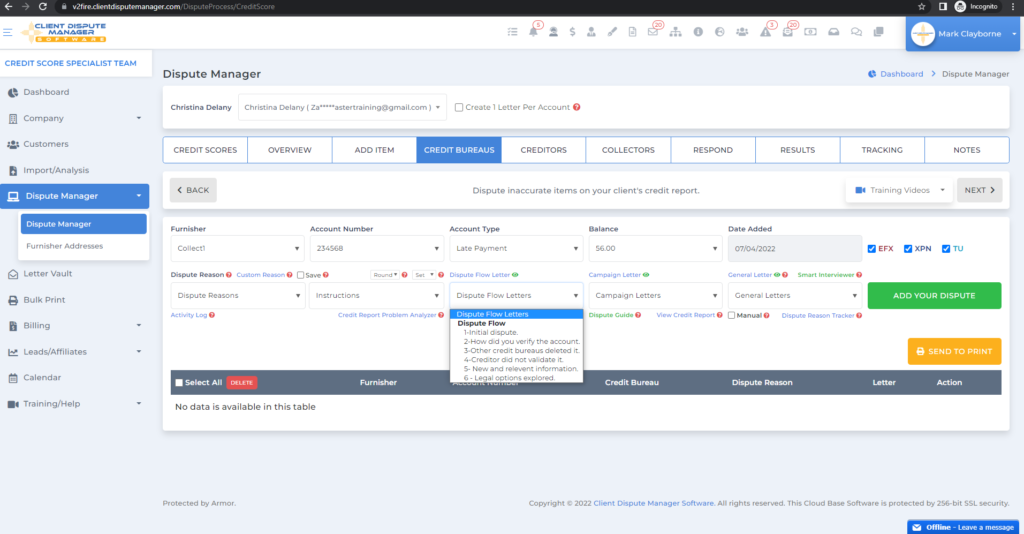

So safe example. This is your dispute reason. So what we’re going to do, the first thing we’re going to do when we prepare the disputes, we’re going to pick a dispute letter.

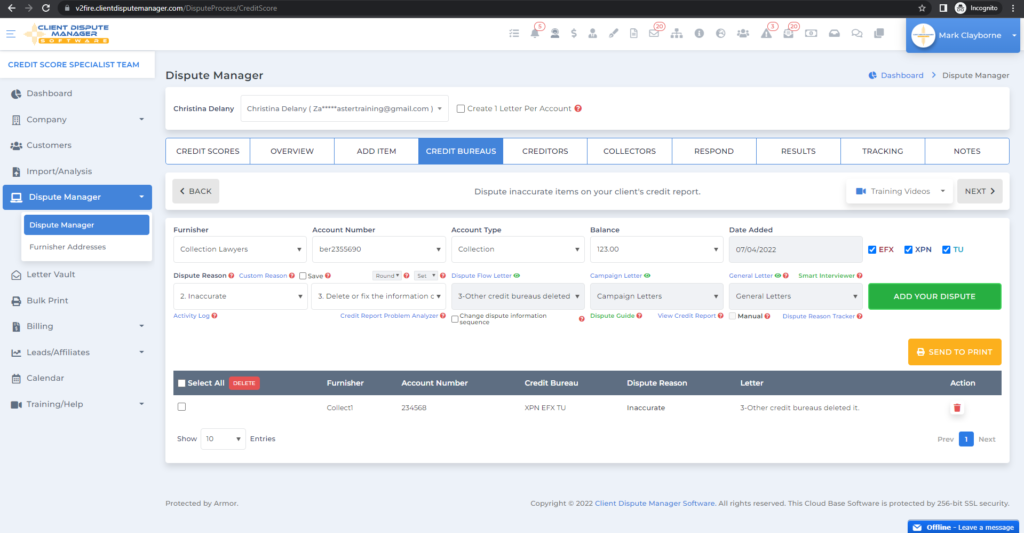

So I’m going to say the initial dispute, I’m going to pick a dispute reason. And then some dispute instructions. And I’m going to click on, add your dispute, just like that. So let me move this down here. I’m going to do another one. Another dispute reason and dispute instructions.

Add your dispute. Now let’s just say that the customer said that these are the problems with their credit report. I’m just doing this for example. And we just adding an account number. We adding dispute reason, dispute instructions and add your dispute. It’s that simple. It’s not as difficult as you think it is.

The customer told you that the past due was wrong and inconsistent. So that’s what you pick. And then we pick a instruction, which you were telling the credit bureau what to do, “Past due needs to be updated, repaired, or fixed,” and add your dispute. And then from there you just click send to print. That’s it, really.

Because you’ve already talked to your customer. They told you the issue, so you’re ready. You know the software very well. The software has your dispute reasons. It has your dispute instructions. It has custom reasons. You can write exactly what your customer said.

And then you prepare your letter. You pick your letter and you click simply send to dispute. It’s that simple. This is what I’m trying to explain to you. A lot of people try to make it very complicated and stuff like that, but it’s not. It’s a very streamlined process. You’re helping your customer out. They don’t have time to do this. So they said, “Well, we’re going to bring you on board because we want you to do it.

You understand the law, you studied the law. We want you to do it for us.” There’s inaccurate information on the credit report. It’s misleading, it’s wrong. You’re just using a tool or technology, like any other tool, to help facilitate the process and make it faster. So that’s step number six. And now we’re going to move on to step seven.

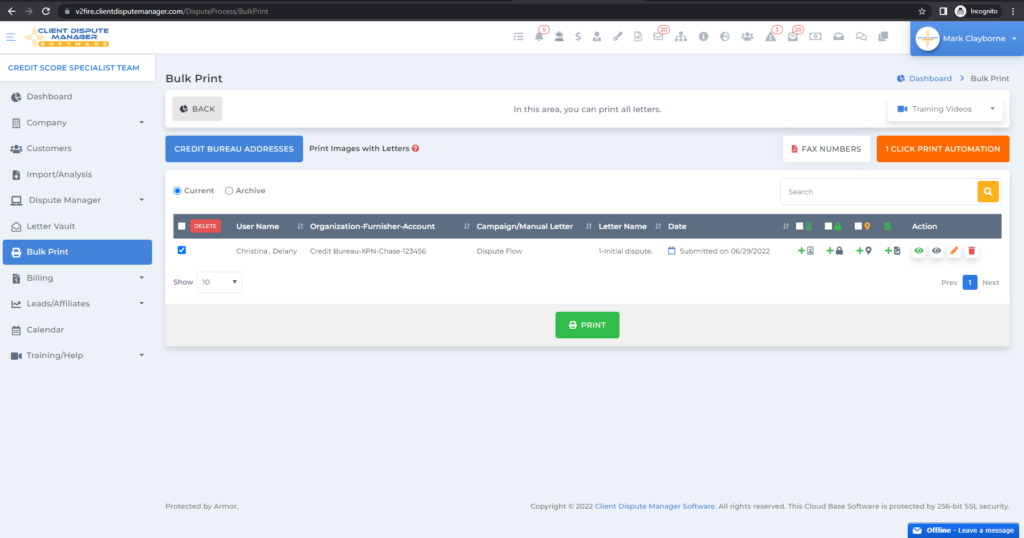

Step 7: Bulk Print

On this screen, for step seven. And this screen is what we call the bulk print screen. Now the bulk print screen is where you push all of your dispute letters to the bulk print screen. And then you can hit one button and it will print all the letters for you.

Now, once you print the letters, you got to get the letters. You got to put them in an envelope. You got to print the customer’s copy of their social security card, and a copy of their ID. You got to copy their ID, copy their social security card, and proof of address. And you put it in a letter and then you mail it out to the credit bureaus.

So I’m going to show you the bulk print screen on how you do that. But I just wanted to show you what you do, once you finish your disputes, you’re going to send them to the bulk print screen. And this is what the bulk print screen looks like right here. And this is the same customer that we’ve been working on right here.

This is the same customer. And these are all the disputes that I prepared for the customer, simple disputes. That’s going to go out to the credit bureau. Nothing fancy, just very simple disputes.

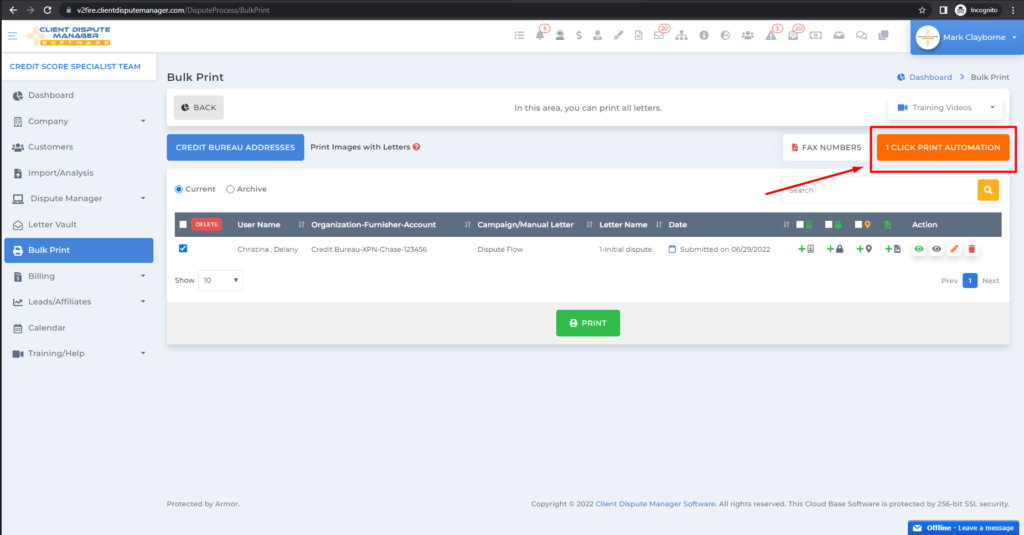

Now there are two ways you can do this with bulk printing. You can do it the hard way, which is by printing and stuffing envelopes. That’s the hard way. Or you can do it the easy way, which is the automated way. So we’ve teamed up with Letter Stream which would automatically mail your letters for you. They will automatically mail your letters to you.

For a small little amount, you can send your letters, right from the Client Dispute Manager with one click and the letter stream will mail the letters out for you. So you don’t even have to go to the post office. You don’t have to lick stamps. You don’t have to lick the envelopes.

None of that. Just one click, it goes over to Letter Stream, they will prepare your letters for you and mail them out for you. And let me show you what I’m talking about. Here it is, right here. One-click print automation’s right here on the right. Very simple, straight to the point, one-click automation.

And it just makes life so much easier for you when you’re running a credit repair business, especially if you’re trying to scale the credit repair business. You can’t be like you are doing it old school, printing letters and then putting them in the envelope and then taking them to the mailbox.

That’s just a lot of work. One-click, print, turn on the automation, and watch the magic happen for you. So that’s what you want to do when you are mailing. And that’s step seven. Again, as I said, we’re moving through the steps and that is step seven.

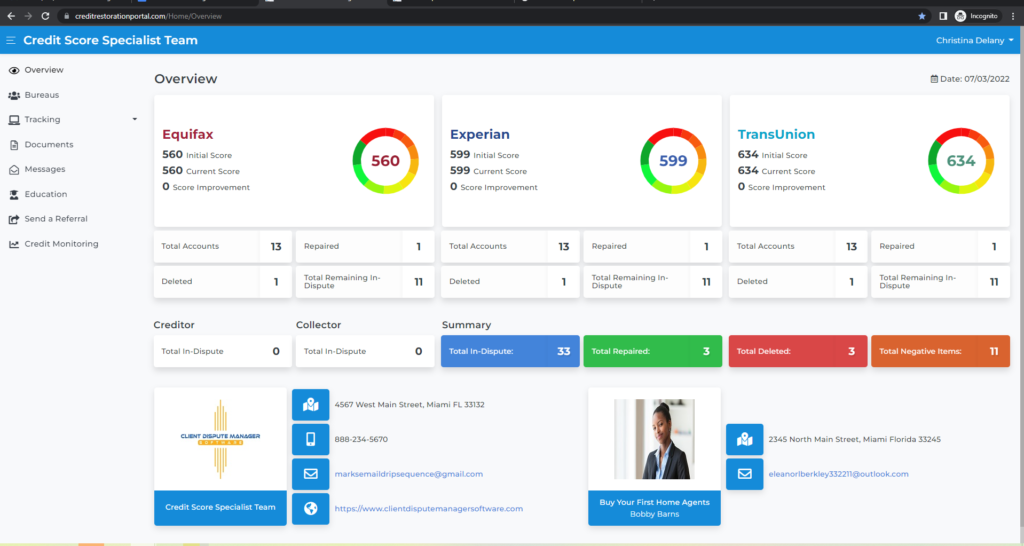

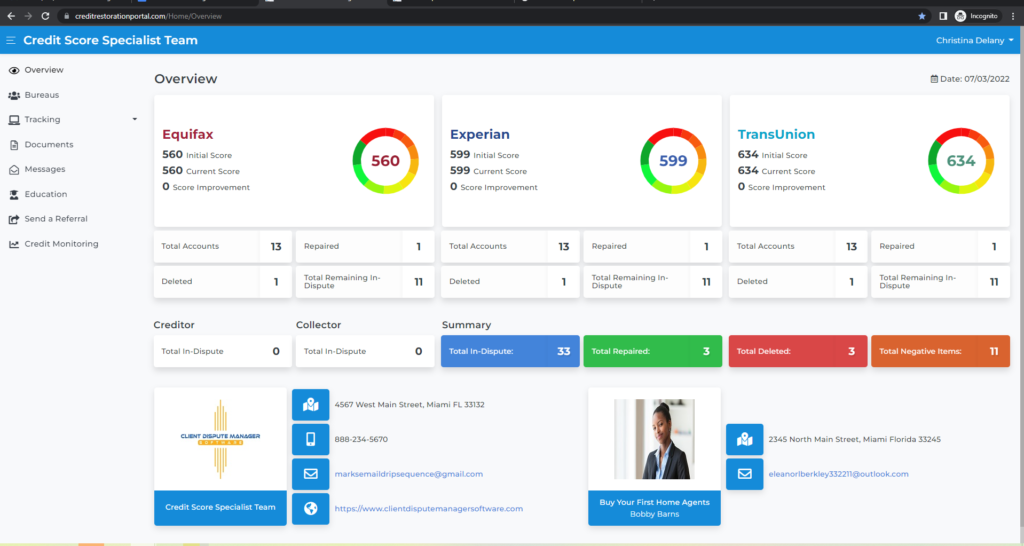

Step 8: Client Tracking Portal

And now what we’re going to do is we’re going to move on to step eight, give your client access to the client tracking portal. And this is step eight. That’s right. Well, what is the client tracking portal?

Well, this is the portal that your client will log into so they can keep track of exactly what you’re doing for them. See, they need to know on a regular basis, the progress, and what’s going on?

Are you sending out letters from me? Is my score improving? Have you gotten any deletions from me? Can I send you a message? How can I send you a message? How can I get educated by you? How can I send you a referral? Do you have a mobile app? And this is the client tracking portal.

So once you’ve sent out your dispute rounds for the customer, then you give them access to the client tracking portal, but don’t give them access before that. Because if you give them access to the client tracking portal before you do any work before you send out any letters, there will be no data inside of the client tracking portal.

So it’s very important that you give them access to this. So they can see exactly what you are doing for them. They can see the scores, they can see what’s in dispute, they can see what’s deleted, what’s repaired. They have all your information here. If they are referred by an agent, a real estate agent, or a loan officer, you can see the real estate agent or loan officer’s picture here. They can track everything here on the left.

They can send you messages. They can upload documents. You can educate them right here in the education section. They can send you a referral. They can update the credit monitoring information right here. So they can pretty much do a lot of things. This is like their home. The client tracking portal is like their home. This is where they live.

And it’s very important that you give them access to this after you send down the first dispute rounds. Also, we have a mobile app, and they can download the mobile app as well. They can download it right from the document section inside here of the client tracking portal, where they upload their documents.

They can send you documents every time they get updated. Every time they get updates, every 30 days they can log into the portal and upload their documents from their phone, or they can upload them from the desktop and they can send it right to you. Yes. So give them access to the client tracking portal, after you send out your first dispute rounds for them.

Step 9: Nurture Your Customers

You know that you need to nurture your customer. Now, what do I mean by that? This is step number nine, and this step is critical. This step is so critical. Nurturing your customers, so they do not cancel your service.

Step number nine, after you give them access to the client tracking portal, you come back into the software, the Client Dispute Manager, and you turn on one of our most powerful features in the software, which is called the auto nurturing email system. Now, what is that?

Now, this system will automatically send emails out to your customer and nurture them. That’s right. You don’t need third-party software. You don’t need to pay for other software. This will automatically nurture your customers step by step.

And not only that, these emails are properly crafted to say the right words, and it has the right wording for you to nurture your customer. It teaches your customer. It educates your customer. It reminds your customer to send updates to you. And on top of that, we have what we call something new, the happy birthday emails.

That’s right. Automatically the software will send out happy birthday emails to your customer based on their date of birth.

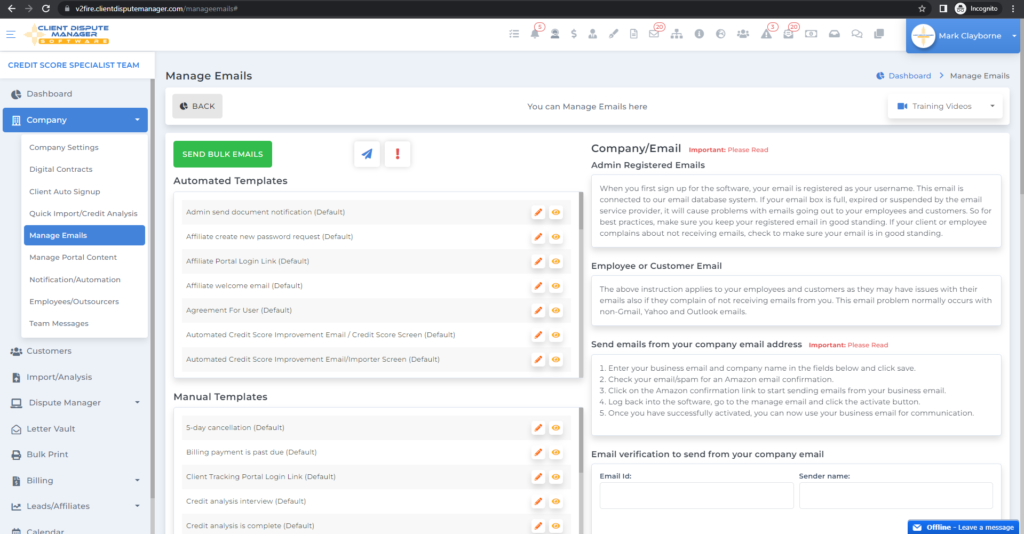

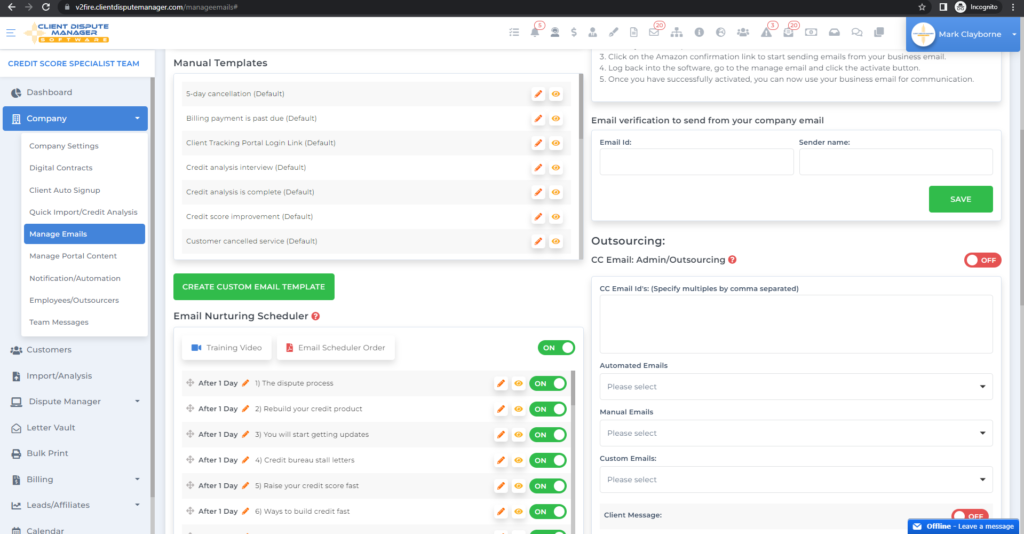

Now, let me show you what I’m talking about. So as you can see, I’m in the manage email screen right here. And we have a lot of automated emails that go out to the customer. And if you scroll down right here, we have the email nurturing sequence right here.

These are automatic emails that go out to your customer based on how you schedule them. Very, very powerful. And you can create your own, if you want, you can create your own nurturing emails and you can plug them right in here, plug and play, and you can control who gets the emails.

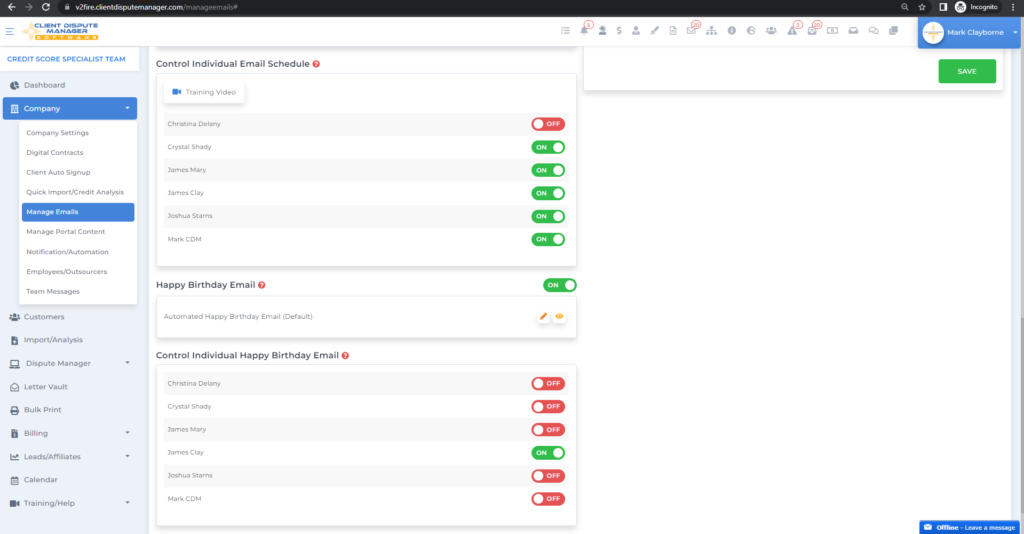

Now here’s the happy birthday email right here. As you can see, you can turn it on. Well, mine is on automatically, and my customers will automatically get happy birthday emails on their birthday. It’s a very powerful tool. It helps retain the customer. If the customer’s thinking about canceling, these nurturing emails are very powerful.

It saves you so much time, especially if you’re brand new. So you only need to turn it on one time. You don’t need to do this every single time. And it’s very powerful that you do this when you are running your credit repair business.

A lot of people miss this part, and this is why a lot of customers cancel, because they don’t understand how to nurture their customers. So you want to make sure you turn that on, after you give your customer access to the client tracking portal.

Step 10: Tracking And Follow-up

Now, what does that mean? So we mailed the letters out. We mailed the letters out. We turned on the nurturing emails, but we have to wait 30 days before the credit bureaus have a result for our customers. Now that’s what the Fair Credit Reporting Act states, that they have 30 days to investigate the results. 30 days to investigate the disputes.

But we got to remember, we need to give them five days for the mail to get to them and five days for the mail to get back to us. So I always say 40 days. In the software, we have tagged to 40 days.

After 40 days, the software is going to send you a notification by email and ask you to check your results. Now here’s the great thing, you don’t have to wait for the results for your customer to send to you.

And you don’t have to log in to the credit monitoring site to check for the results, because you can simply use a new feature, well, not a new feature, but you can simply use a feature we have called the Fast Checker. And the Fast Checker will log into the credit monitoring site for you and check for deletions for your customer.

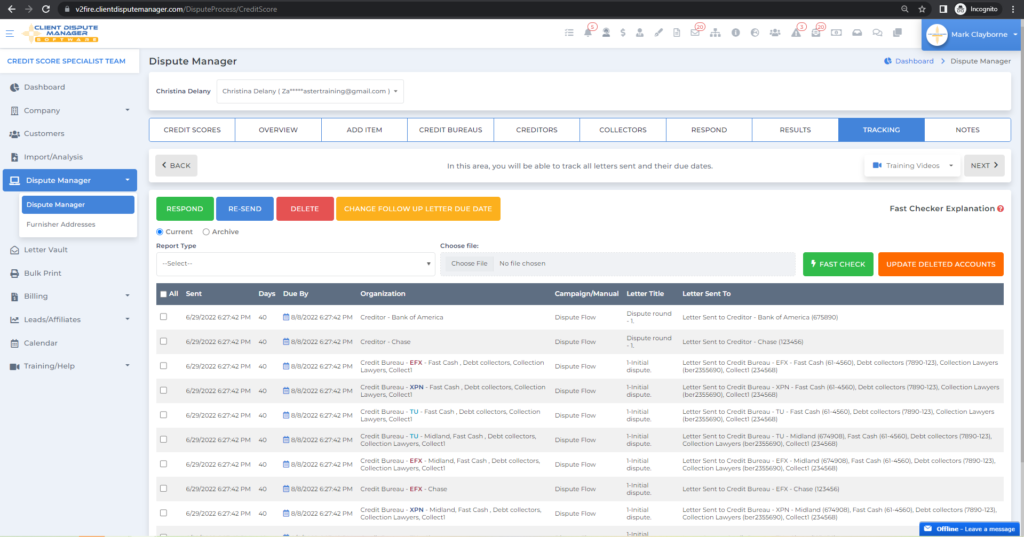

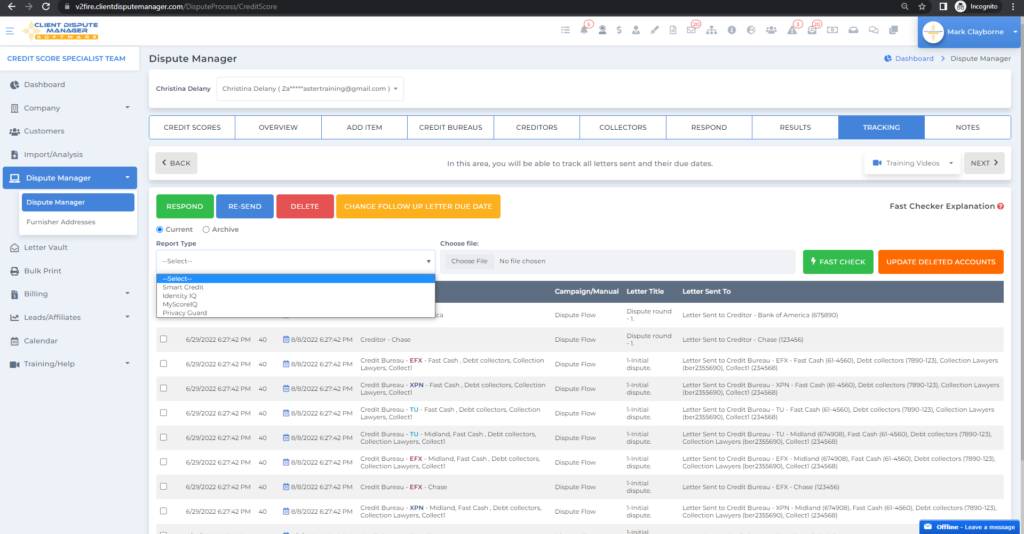

Now, let me show you exactly what I’m talking about. So we’re going to go over here to the tracking screen. And we’re already at the tracking screen here. Now, these are all of the letters that you sent out on behalf of your customer.

These are all the letters you sent out. And when you’re ready to check to see if there has been any deletions or any repairs or whatever. If you want to see the updates for this particular customer, you would simply select, Smart Credit, Identity IQ, My Score or Privacy Guard. You’ll choose the credit report here and you’ll click on Fast Check.

Now, when you click on Fast Check, what will happen is the Fast Checker will check to see if there’s been any deletions. If there have been any deletions, then the fast checker will show you that there’s been deletions and you will have the option to send your customer an updated report. A report telling your customer that these accounts have been deleted and their credit score has increased. It’s very powerful.

You don’t have to manually log into the credit monitoring, and you don’t have to wait for the customer to send you an update. So every 40 days you can use the Fast Checker to do all the work for you. It’s a very powerful thing. So all you have to do from here is rinse and repeat, that’s it. So I went through 10 steps, 10 steps on how to run a credit repair business.

This is how you do it, if you are running it on your own. Say, it’s just you and you don’t have any staff or anything, this is what you would do. You would repeat this process over and over and over until you start to scale, you start to grow and then you can hire other people to do this process for you.

Conclusion

So, as I said before, it was very simple. It’s not complicated. The software does a lot of the work for you. So look, check this out, if you’re just starting to run a credit repair business, I have a couple of things for you. I have a free trial for you of a Client Dispute Manager, a free 30-day trial, and no credit card is required. And I also want to give you a book it’s called 101 Credit Secrets Gurus Don’t Want You To Know.

So you’ll get that book when you sign up for the free trial. And I also want to give you free training, a free 15-day email training, email master course on how to start and run a successful credit repair business. So all of this works together.

The software trial, the book, the free book on the 101 Credit Secrets Gurus Don’t Want You To Know, and the 15 email sequence teach you to step by step on how to run a successful credit repair business. And I want to give that to you for absolutely free. I hope that these 10 steps really helped you. I hope that now you have some clarity that is not as difficult as you think it is.