In the world of personal finance, the credit repair business offers hope to those burdened by poor credit scores. However, mistakes in the credit repair business can undermine your success. In this article, we’ll explore these common missteps and offer solutions. Whether you’re a seasoned pro or new to the field, learning to avoid these errors is key to your success.

From misleading advertising to compliance with regulations and the use of credit repair software, this guide equips you with the knowledge to navigate the credit repair landscape effectively.

Let’s begin our journey to understanding these mistakes in the credit repair business and how to sidestep them for a prosperous future.

Mistake #1: Lack of Proper Training and Education

One common error in the credit repair industry is the need for more training and education. Credit repair is a field that requires a grasp of credit laws, regulations, and the complexities of credit reporting. With a foundation of knowledge and expertise, credit repair professionals might intentionally damage their client’s credit by enhancing it.

Solution:

As a credit repair specialist, investing in your own education is paramount. Understanding the Fair Credit Reporting Act (FCRA), Fair Debt Collection Practices Act (FDCPA), and other relevant regulations is crucial. Enroll in reputable credit repair courses and certification programs to build your expertise.

Additionally, utilizing credit repair software is a game-changer. These software tools offer valuable resources for staying well-informed. They provide up-to-date information on credit laws and regulations, as well as templates for dispute letters and client management tools.

With the assistance of credit repair software, you can stay on top of the ever-changing credit landscape and ensure you’re providing your clients with the most accurate and effective credit repair services. It streamlines the learning process and helps you avoid errors that stem from a lack of knowledge.

Remember, in the credit repair business, knowledge is power. The better informed you are, the more effectively you can advocate for your clients’ credit health, ultimately leading to better results and satisfied customers.

Mistake #2: Misleading or False Advertising

Another prominent mistake in the credit repair business is engaging in misleading or false advertising practices. While the desire to attract clients is natural, making exaggerated promises or providing incomplete information can lead to dissatisfaction and potential legal issues. Misleading advertising not only erodes trust but can also result in damage to your reputation and business.

Solution:

As a credit repair specialist, your advertising practices should be grounded in honesty and transparency. It’s crucial to accurately convey the benefits of your services without resorting to deceptive tactics. Rather than making unverifiable guarantees, focus on educating potential clients about the credit repair process and its potential outcomes.

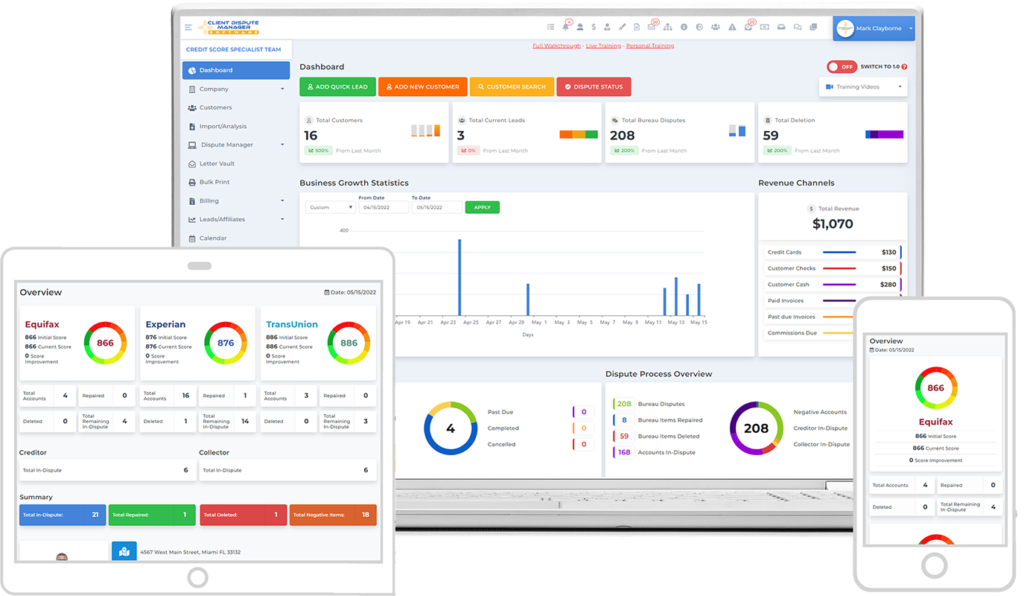

In addressing this common mistake, credit repair specialists can turn to Client Dispute Manager Software. This specialized software provides a wealth of resources for crafting compliant and informative advertising materials. With pre-designed templates and compliance checks, you can create marketing content that not only grabs attention but also adheres to industry regulations.

Moreover, Client Dispute Manager Software streamlines the process of tracking client disputes, ensuring transparency and accountability in your services. This enhanced level of transparency not only prevents false advertising but also fosters trust between you and your clients.

By leveraging such software, you can build a reputation for ethical and reliable credit repair services, setting yourself apart from those who engage in deceptive practices.

Mistake #3: Inadequate Compliance with Regulations

In the intricate world of credit repair, one of the most significant mistakes in the credit repair business revolves around insufficient compliance with the myriad of regulations governing the industry. Credit repair specialists operate within a complex legal framework, which is frequently subject to change.

Neglecting to understand and adhere to these regulations fully can lead to legal consequences and damage the credibility of your credit repair business.

Solution:

Compliance with credit repair regulations is a foundational aspect of this business. Familiarizing yourself with key laws such as the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA) is essential. Keeping up with any legislative changes is crucial to provide effective credit repair services.

Compliance also involves maintaining accurate records and transparent client interactions. Develop a well-documented dispute-handling process and communicate clearly with clients about their rights and the steps taken to enhance their credit. Regular self-audits ensure ongoing adherence to regulations.

Ultimately, compliance isn’t just about legal avoidance; it’s about earning client trust. Operating within the law instills confidence that you can guide them through the complexities of credit repair effectively. Building a reputation for ethical and responsible credit repair services sets you apart in the industry.

Mistake #4: Neglecting Customer Communication

In the intricate world of credit repair, overlooking the vital aspect of customer communication stands out as a common mistake in the credit repair business. Effective communication is the backbone of any successful credit repair endeavor. Failure to maintain clear and consistent interaction with clients can lead to frustration, dissatisfaction, and, ultimately, a negative impact on your reputation.

Solution:

Responsive and transparent communication is paramount in the credit repair business. Regularly connect with clients through their preferred channels, keeping them informed about their credit repair progress. Educate clients about their rights and the repair process, empowering them to make informed financial decisions.

By making communication a priority and creating a supportive environment, you avoid common mistakes and build a strong reputation. Satisfied and informed clients become loyal partners on their journey to better credit.

Mistake #5: Not Utilizing Credit Repair Software

Another common oversight among the mistakes in the credit repair business is the failure to embrace the benefits of credit repair software. In an industry where time and precision are of utmost importance, not using this powerful tool can hinder your progress and success.

Solution:

To overcome this hurdle, consider adopting Client Dispute Manager Software as an integral part of your operations. This specialized software is tailored to streamline and enhance your credit repair processes. It simplifies the management of client disputes, enabling you to track, organize, and respond to them more efficiently.

Client Dispute Manager Software also offers a wealth of resources, including templates for dispute letters that adhere to legal standards, ensuring that your communications with credit bureaus and clients are both professional and compliant.

By incorporating this credit repair software into your business, you can greatly enhance the quality of your service. Not only does it save you time, but it also reduces the risk of errors, ensuring that your clients receive efficient and effective credit repair assistance. In a competitive industry, having the right tools at your disposal can make all the difference.

Mistake #6: Overpromising Results

A significant mistake in the credit repair business is making lofty promises and overestimating what can be achieved in the credit repair process. While the desire to offer hope to clients is admirable, setting unrealistic expectations can lead to disappointment, damaged client relationships, and a tarnished reputation.

Solution:

The key to avoiding this mistake is managing your client’s expectations effectively. Be transparent about what credit repair can and cannot do. Explain that results may vary, and timelines for improvement can be different for each individual. Instead of making grandiose guarantees, focus on providing a realistic assessment of their credit situation and what you can reasonably achieve.

By taking this approach, you not only maintain the trust and satisfaction of your clients but also build a reputation for honesty and integrity in the credit repair business. Clients who understand the limitations of credit repair are more likely to be patient and appreciate the genuine efforts put into improving their credit health.

Mistake #7: Ignoring Credit Report Errors

Failing to address credit report errors promptly and effectively is a significant mistake in the credit repair business. Neglecting these inaccuracies can have long-lasting repercussions, as unresolved errors may continue to drag down a client’s credit score and financial prospects.

Solution:

The key to avoiding this mistake is vigilance and proactivity. Regularly review your client’s credit reports for inaccuracies and promptly dispute any errors you encounter. This may involve crafting dispute letters, gathering supporting documentation, and maintaining open communication with credit bureaus to ensure the errors are rectified.

Educate your clients about the importance of monitoring their credit reports and how to spot potential discrepancies. Encourage them to report any errors they discover and assist them in addressing these issues. By staying on top of credit report errors, you not only boost your clients’ credit scores but also establish yourself as a diligent and effective credit repair specialist who truly advocates for your client’s financial well-being.

Introducing Client Dispute Manager Software

In the credit repair business, having the right tools and resources at your disposal is essential for navigating the complex landscape of credit improvement. One such invaluable tool is Client Dispute Manager Software. This comprehensive software solution is designed to streamline and enhance your credit repair processes, making it easier to avoid common mistakes in the credit repair business.

Throughout this article, we’ll explore various challenges and missteps that credit repair specialists may encounter, and we’ll demonstrate how Client Dispute Manager Software can be a game-changer in addressing these issues effectively.

Whether it’s compliance with regulations, managing customer communication, or rectifying credit report errors, this software offers a set of features and resources that can help credit repair professionals provide efficient, compliant, and transparent services to their clients.

Let’s delve into the top mistakes in the credit repair business and how, with the assistance of Client Dispute Manager Software, you can navigate these challenges with confidence and expertise. Whether you’re a seasoned professional or new to the field, this software can be your secret weapon for success in the credit repair industry.

Conclusion

In the realm of credit repair, avoiding common mistakes is vital for success. The right knowledge, transparent communication, and tools like Client Dispute Manager Software can help you provide effective, ethical, and compliant services. By focusing on client empowerment and building trust, you can establish yourself as a reputable credit repair specialist in this competitive industry.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.