- A Goodwill Deletion Letter is a polite request asking creditors to remove a negative item—like a late payment—from your credit report as a courtesy.

- The Goodwill Saturation Technique involves sending multiple goodwill letters to different departments or contacts within the same company for better results.

- Use personal stories, strong payment history, and a professional tone to increase the chances of a goodwill deletion.

- Tools like Client Dispute Manager Software streamline the process with automated templates, tracking, and legal compliance.

- Be Consistent, Ethical, and Persistent—this method doesn’t guarantee success, but it significantly improves your odds.

A good credit score can open doors to better financial opportunities, but sometimes, past mistakes can leave negative marks on your credit report.

If you’ve ever wondered how to remove late payments or other negative items, the Goodwill Saturation Technique might be the solution you’re looking for.

This method involves sending multiple goodwill deletion letters to creditors in hopes of having negative marks removed as an act of goodwill.

In this article, we will explore how to write a goodwill letter, understand its impact, and provide practical goodwill letter templates to help you get started.

Whether you’re dealing with late payments or closed accounts, this strategy can improve your financial standing ethically.

The Goodwill Saturation Technique stands out because it applies persistence and ethical communication to achieve results.

What is a Goodwill Deletion Letter?

A goodwill deletion letter is a written request sent to a creditor, asking them to remove a negative item from your credit report as a courtesy.

Unlike dispute letters, which challenge inaccuracies, a goodwill letter for late payments acknowledges the mistake and appeals for leniency.

Lenders are not obligated to remove the negative item, but with the right approach, they may choose to do so.

How the Goodwill Saturation Technique Enhances Traditional Goodwill Letters?

The Goodwill Saturation Technique elevates the traditional goodwill letter process by applying consistent and polite pressure across multiple channels.

Unlike sending one letter and hoping for the best, the Goodwill Saturation Technique increases the chances of success by reaching out to different departments and representatives within the same organization.

Why Would a Creditor Agree to a Goodwill Request?

- You have a strong history of on-time payments before or after the late payment.

- The late payment was due to an unavoidable circumstance (e.g., medical emergency, job loss).

- You’ve taken steps to ensure on-time payments moving forward.

- The creditor values maintaining a positive customer relationship.

When to Use a Goodwill Letter for Late Payments?

A goodwill letter for late payments can be highly effective in certain circumstances. If the late payment was a one-time mistake rather than a recurring issue, a creditor may be more willing to remove the negative mark.

Having an otherwise positive credit history with on-time payments and responsible credit use can also improve your chances of success.

Additionally, providing a valid reason for the late payment, such as financial hardship, unexpected medical expenses, or a system error, can strengthen your request.

If you’re aiming to boost your credit score before applying for a mortgage, car loan, or other financial products, sending a goodwill deletion letter can be a valuable step toward improving your financial standing.

When timing and context are right, applying the Goodwill Saturation Technique can improve your odds significantly.

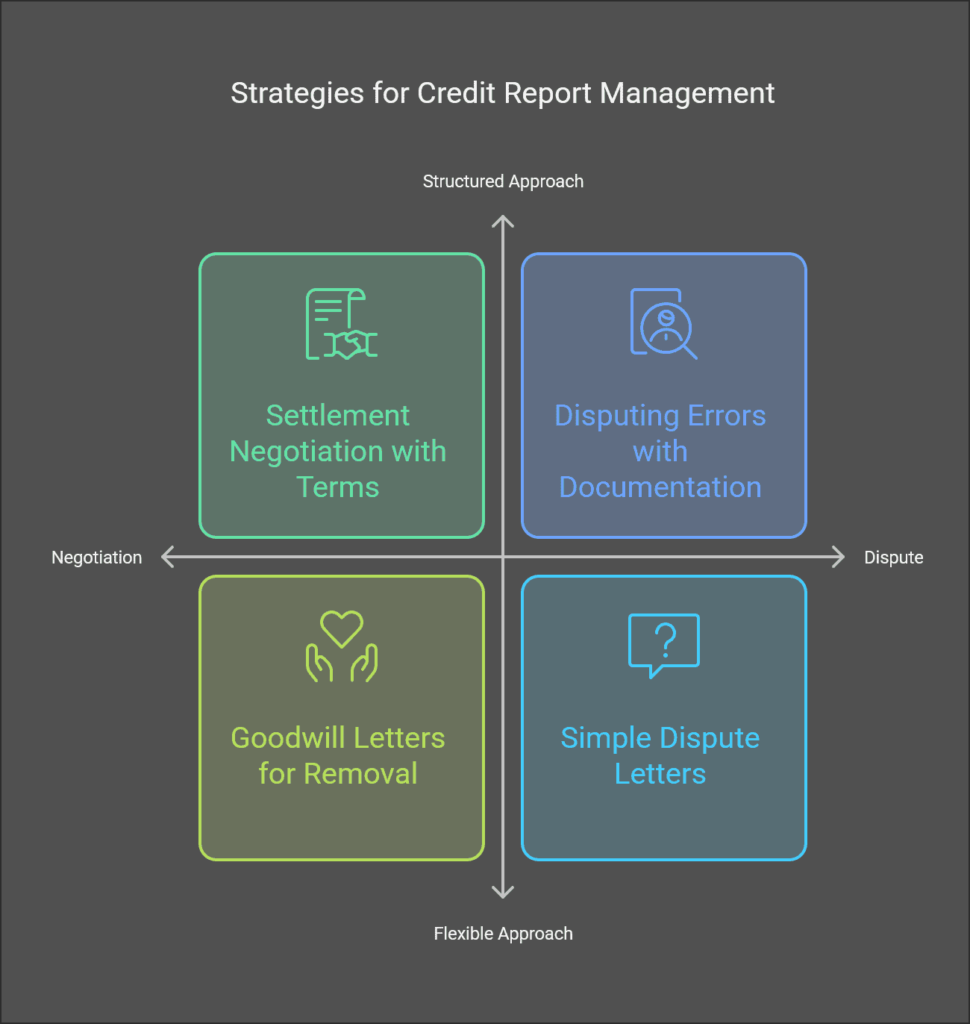

How Goodwill Letters Differ from Other Credit Correspondence?

Understanding the differences between a goodwill deletion letter and other types of credit correspondence is essential for successfully navigating credit repair.

While a goodwill letter for late payments appeals to the creditor’s leniency, other methods, such as pay-for-delete letters and dispute letters, serve different purposes.

Recognizing when to use a goodwill letter template versus another strategy can help you make informed decisions about improving your credit score and financial future.

Pay-for-Delete Letters vs. Goodwill Letters

A pay-for-delete letter is different from a goodwill deletion letter because it involves offering payment in exchange for removing a negative item from a credit report.

While this approach may seem appealing, it is not supported by major credit bureaus since they are required to report accurate credit information.

Unlike a goodwill letter for late payments, which appeals to a creditor’s goodwill and positive customer relationship, a pay-for-delete letter attempts to bypass the traditional reporting system.

Creditors are not obligated to accept such offers, and in many cases, they may refuse to engage in pay-for-delete agreements due to compliance requirements.

Instead, using a goodwill letter template to request a goodwill deletion in a professional and ethical manner may be a more effective approach to improving your credit score.

Dispute Letters vs. Goodwill Letters

A dispute letter is used to challenge inaccurate information on a credit report by requesting verification or correction of an error. If the disputed information cannot be proven accurate, credit bureaus are required to remove it.

A goodwill letter, on the other hand, does not dispute an error but instead requests a goodwill deletion from the creditor based on past reliability and special circumstances.

Unlike a dispute, a goodwill letter for late payments acknowledges the validity of the negative mark but seeks its removal as an act of goodwill.

While a dispute letter follows a legal process under the Fair Credit Reporting Act (FCRA), a goodwill deletion letter relies on the discretion and willingness of the creditor to make adjustments to a borrower’s credit history.

Components of an Effective Goodwill Letter

Writing an effective goodwill deletion letter requires a combination of professionalism, clarity, and a strong appeal to the creditor’s goodwill.

A well-structured goodwill letter for late payments should include a polite request, a brief explanation of the circumstances, and a clear statement of what you hope to achieve.

By using a goodwill letter template, you can ensure that your message is concise and impactful.

Below are the essential components to include in your letter to increase the chances of a successful goodwill deletion and improve your credit score.

Clear and Concise Language in Goodwill Saturation Technique

- Be polite and professional in your request.

- Keep your goodwill deletion letter under one page.

- Use a respectful and appreciative tone to increase your chances of a positive response.

- Address the creditor by name if possible to personalize your request.

- Avoid placing blame; instead, focus on your commitment to maintaining good financial habits.

Personal Anecdotes to Strengthen Your Case

Sharing a brief personal story that explains the reason for the late payment can make your goodwill deletion letter more persuasive. Creditors are more likely to respond positively if they understand the circumstances that led to the missed payment.

Emphasize that the issue has been resolved and will not happen again, reassuring them of your commitment to financial responsibility.

Highlight your efforts to improve your credit habits, such as setting up automatic payments, monitoring your credit report regularly, or improving your budgeting skills.

By demonstrating financial growth and reliability, your goodwill letter for late payments stands a better chance of success.

Goodwill Saturation Technique: Specific Requests That Work

When drafting a goodwill deletion letter, it is crucial to clearly state what you want removed from your credit report to avoid any misunderstandings.

Ensure that you provide your account details for easy reference, allowing the creditor to quickly locate your records. Additionally, offering to continue your business relationship with the creditor as a valued customer can demonstrate goodwill and encourage a positive response.

Expressing gratitude for their time and consideration in reviewing your request can leave a good impression and improve your chances of success.

If you have been a loyal customer, mentioning any long-standing relationship, such as years of service or multiple accounts, can further strengthen your case for a goodwill deletion of the negative item.

Step-by-Step Guide to Writing a Goodwill Letter

Writing a goodwill deletion letter is a structured process that requires careful attention to detail. The effectiveness of your request depends on how well you present your case to the creditor.

A properly formatted goodwill letter for late payments should include an explanation of your circumstances, a polite request, and assurance that you have improved your financial habits.

By following a step-by-step approach, you can maximize your chances of success and potentially have negative marks removed from your credit report.

Research Contact Information for Your Goodwill Deletion Letter

Finding the right recipient for your goodwill deletion letter is crucial. Contact the creditor’s customer service or look for a direct email or mailing address to ensure your letter reaches the correct department.

Some creditors may have a dedicated team for handling goodwill letter for late payments requests, so doing thorough research beforehand increases your chances of success.

Choose the Right Format for Your Goodwill Deletion Letter

A well-structured goodwill deletion letter should be professional yet personal. Use a goodwill letter template to organize your request clearly, keeping it concise and easy to read.

Make sure to use polite language and avoid unnecessary details that could dilute your message.

Drafting Your Letter

When writing your goodwill letter for late payments, start with a respectful introduction, acknowledging your past payment issue while emphasizing your overall positive payment history.

Clearly explain the reason for your request and how the removal of the negative mark can benefit both you and the creditor. Reaffirm your commitment to making timely payments moving forward.

Proofreading for Errors

Before sending your goodwill deletion letter, check for grammatical or factual errors to ensure professionalism and clarity. A well-written letter enhances credibility and increases the likelihood of a favorable response from the creditor.

Ensure that the letter is formatted correctly and all details, such as account numbers and dates, are accurate. A poorly written or disorganized goodwill letter for late payments may reduce your chances of approval.

Additionally, using a goodwill letter template can help structure your request effectively, ensuring that your message is both compelling and easy to read.

Taking the extra time to proofread and refine your goodwill deletion letter can make a significant difference in achieving a positive outcome.

Sending Your Letter

Once finalized, send your goodwill letter template via certified mail or email to track its delivery. This ensures you have proof that your request was received and can follow up if necessary.

If you don’t receive a response within 30 days, consider sending a polite follow-up letter or calling the creditor’s customer service to check the status of your request.

Some creditors may take longer to process goodwill requests, so remaining patient and persistent can be beneficial.

Additionally, if your goodwill deletion letter is denied, you may revise and resend it with additional details or a stronger explanation of your case.

Templates and Samples for Goodwill Letters

Using a goodwill letter template makes it easier to create a professional and effective request. Below is a simple template you can customize:

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Your Email Address]

[Your Phone Number]

[Date]

[Creditor’s Name]

[Creditor’s Address]

[City, State, ZIP Code]

Subject: Request for Goodwill Adjustment

Dear [Creditor’s Name],

I hope this letter finds you well. I am writing to formally request a goodwill adjustment for my account, [Account Number], with [Creditor’s Name]. I acknowledge that a late payment was reported on [Date of Late Payment], and I sincerely regret this oversight.

Due to [briefly explain the reason, such as a financial hardship, medical emergency, or other circumstances], I was unable to make the payment on time. Since then, I have taken significant steps to ensure that this does not happen again, including setting up automatic payments and closely monitoring my credit report.

I have been a loyal customer of [Creditor’s Name] for [X years] and have always maintained a responsible payment history. I am kindly requesting that you consider removing the late payment from my credit report as an act of goodwill. This adjustment would greatly help me in maintaining a strong credit profile, especially as I work towards [mention any financial goal, such as applying for a mortgage or loan].

I appreciate your time and consideration of this request. Please let me know if you need any additional information. I look forward to your positive response.

Sincerely,

[Your Name]

Sample Goodwill Letter for Late Payments

If you need a goodwill letter for late payments, this sample can guide you:

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Your Email Address]

[Your Phone Number]

[Date]

[Creditor’s Name]

[Creditor’s Address]

[City, State, ZIP Code]

Subject: Request for Goodwill Adjustment for Late Payment

Dear [Creditor’s Name],

I hope this letter finds you well. I am writing to formally request a goodwill adjustment for my account, [Account Number], with [Creditor’s Name]. I recently discovered that a late payment was reported on [Date of Late Payment], and I sincerely regret this oversight.

The late payment occurred due to [briefly explain the reason, such as financial hardship, a medical emergency, or an unexpected situation], which temporarily impacted my ability to make timely payments. Since that time, I have taken proactive measures to ensure this does not happen again, such as setting up automatic payments and closely monitoring my credit report.

I have been a responsible and loyal customer of [Creditor’s Name] for [X years] and have consistently maintained a positive payment history. Given my past reliability and commitment to financial responsibility, I kindly request that you consider removing the late payment from my credit report as an act of goodwill. This adjustment would greatly assist me in maintaining a strong credit profile, especially as I work toward [mention any financial goal, such as applying for a mortgage or loan].

I deeply appreciate your time and consideration of this request. Please let me know if any additional information is required. I look forward to your positive response and hope to continue my long-standing relationship with [Creditor’s Name].

Sincerely,

[Your Name]

Potential Impact of Goodwill Letters on Credit Scores

A successful goodwill deletion letter can help improve your credit score by removing negative marks, making it easier to qualify for loans and credit cards with better terms.

Even if a goodwill letter for late payments is not accepted, continuing to make on-time payments and maintaining good credit habits will still have a positive impact on your credit history.

Over time, consistent responsible credit behavior can help outweigh the effects of past negative marks.

Additionally, staying proactive by checking your credit report regularly and addressing any inaccuracies can further support your efforts to rebuild a strong financial profile.

Understanding Response Timelines

After sending your goodwill letter template, creditors typically take 30 to 60 days to respond. If you don’t receive a reply, consider sending a follow-up letter or reaching out through other communication channels.

Some creditors may require multiple attempts before considering a goodwill deletion letter, so persistence can be key.

Additionally, checking your credit report periodically for any updates can help you track whether the requested goodwill letter for late payments has been processed.

If your request is denied, you may consider refining your approach and resubmitting with additional supporting details.

Can Goodwill Letters Remove Closed Accounts or Bankruptcies?

While a goodwill deletion letter can sometimes remove closed accounts, it is unlikely to erase bankruptcies from a credit report.

Credit bureaus typically retain bankruptcy records for seven to ten years, depending on the type of bankruptcy filed.

In these cases, it’s best to explore alternative credit repair strategies such as debt repayment plans, credit-building programs, and regularly monitoring your credit report for any inaccuracies.

Additionally, maintaining responsible financial habits, such as making timely payments and reducing outstanding debt, can gradually improve your credit profile over time.

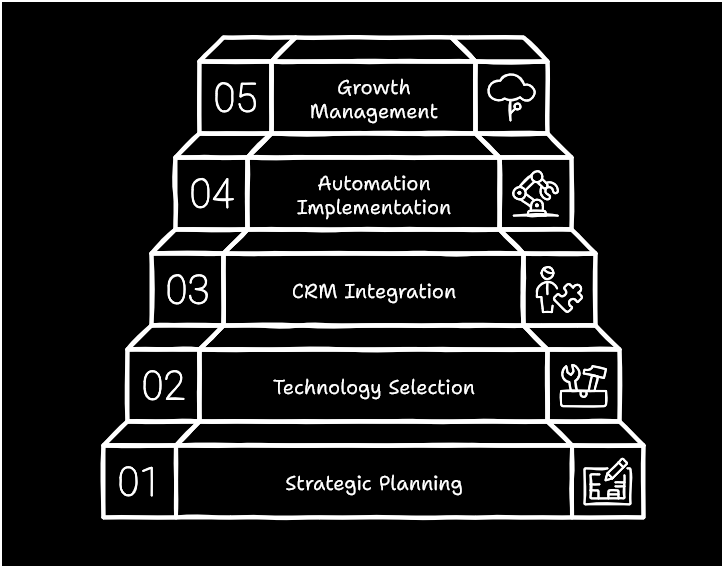

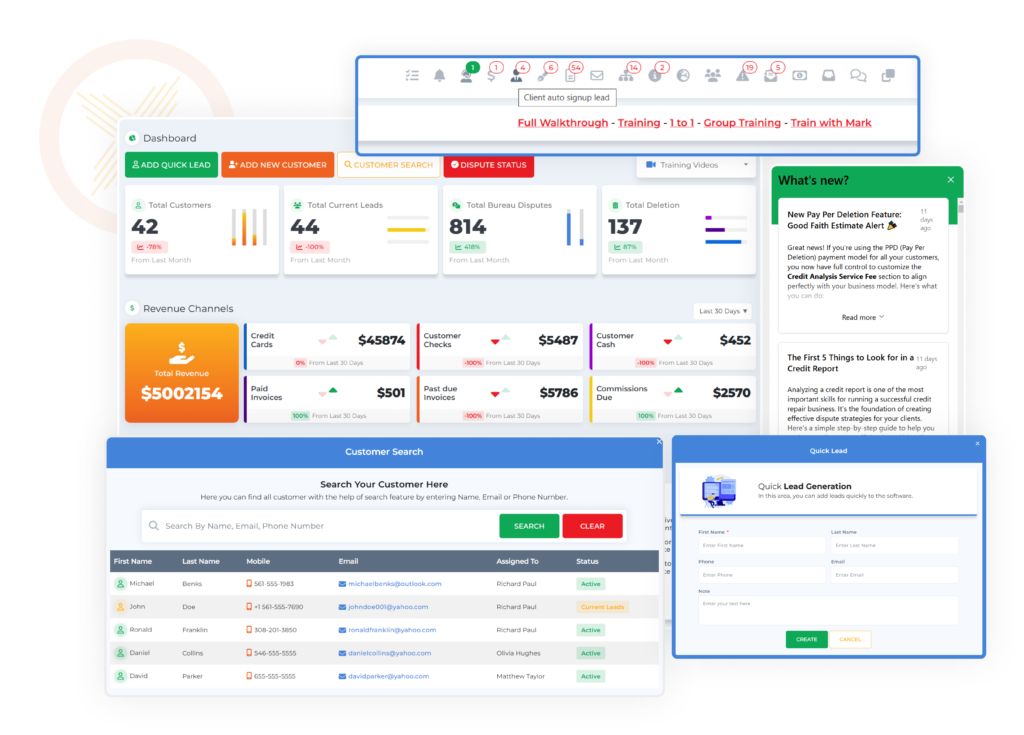

Client Dispute Manager Software: Streamlining Your Credit Repair Process

Managing and sending multiple goodwill deletion letters can be a time-consuming process, but using an efficient tool like Client Dispute Manager Software can simplify the credit repair journey.

This all-in-one credit repair software is designed to help individuals and credit repair businesses organize their goodwill letter for late payments, track responses from creditors, and automate follow-ups.

By leveraging this software, you can streamline the process of sending goodwill deletion letters, ensuring each request is documented and managed effectively.

Key Features of Client Dispute Manager Software

- Automated Letter Creation: Generate and customize goodwill letter templates with ease.

- Tracking & Follow-Ups: Monitor the status of your goodwill deletion letter requests.

- Client Management System: Keep track of all credit-related disputes in one centralized location.

- Compliance Assurance: Ensure that your goodwill letter for late payments and other correspondence meet legal and industry standards.

- Success Rate Optimization: Improve the likelihood of successful goodwill deletions by utilizing a structured and organized approach.

Using Client Dispute Manager Software, you can enhance efficiency and maximize the effectiveness of your goodwill deletion letters, ultimately improving your chances of securing a cleaner credit report.

Tips for Increasing the Effectiveness of Your Goodwill Letter

- Personalize your goodwill letter for late payments with a clear explanation of the situation.

- Keep your letter concise and professional to maintain credibility.

- Follow up if you don’t receive a response within a reasonable timeframe.

- Use a goodwill letter template to ensure clarity and effectiveness.

- Be patient, as different creditors have varying policies on goodwill deletion requests.

Conclusion: Navigating Your Credit Situation with Goodwill Letters

The Goodwill Saturation Technique is a strategic and ethical way to request the removal of negative marks from your credit report.

While results vary, writing a compelling goodwill deletion letter can increase your chances of success.

If you’re struggling with late payments or closed accounts, using the goodwill letter templates and step-by-step guide in this article will help you take control of your credit future.

Start drafting your goodwill letter for late payments today and take a step toward improving your financial health!

In summary, the Goodwill Saturation Technique is a powerful, ethical approach to credit repair. By strategically applying this method, you give yourself multiple chances to engage with a creditor in hopes of a favorable outcome.

If you’re serious about rebuilding your credit, mastering the Goodwill Saturation Technique should be part of your strategy.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.