In the intricate dance of claim handling, today’s insurance agents are faced with a dual challenge: ensuring a swift resolution to claims while also nurturing their clients’ financial health. This is where the strategic application of credit repair software for insurance agents becomes not just a convenience, but a cornerstone of modern agency practice. It equips professionals with the capability to address credit issues with a finesse that traditional methods can’t match.

Ready to see your client relationships deepen and your operational efficiency soar? Let’s unpack the transformative effects of this innovative software on your agency’s day-to-day successes.

Understanding the Need for Credit Repair in Insurance

Navigating the insurance world can sometimes feel like a maze, especially when credit scores come into play. Understanding how credit health affects insurance rates is like learning a new language for many folks. But here’s the simple truth: good credit can mean better insurance deals. That’s where credit repair steps onto the stage, specifically credit repair software for insurance agents.

Why Good Credit Matters for Your Insurance?

Think of a credit score like a report card for your money habits. Insurance companies peek at this report card before deciding how much to charge for coverage. It’s straightforward that better credit scores often lead to friendlier insurance rates. But when credit scores have a few blemishes, rates can soar, making it more challenging for people to afford the necessary insurance.

The Magic Wand of Credit Repair Software

Here’s the good news: even when credit scores aren’t shining bright, there’s hope. This is where credit repair software for insurance agents’ shines. It’s like a magic wand that can help fix those credit score boo-boos, which might otherwise increase insurance costs.

For insurance agents, using credit repair software means they can help their clients clean up their credit scores. It’s like helping a friend polish their resume; it makes a good impression. In the insurance world, that good impression can translate into savings for the client and more trust in the agent.

The Simple Power of Credit Repair Tools

Credit repair software gives insurance agents a set of simple yet powerful tools. It’s like having a Swiss Army knife for credit problems. Agents can help spot mistakes on credit reports, find ways to make scores better and give advice on keeping credit in tip-top shape. All of this can lead to smoother sailing when it’s time for clients to choose insurance plans.

In short, when insurance agents pack credit repair software into their toolkits, they’re ready to tackle credit challenges head-on. This makes clients happy and keeps the agents looking like heroes. And in a world where happy clients are the key to success, that’s a pretty big deal.

The Role of Insurance Agents in Credit Management

When we think about insurance agents, we often picture them helping us pick the best insurance plans or guiding us when we’ve had a fender bender. But they do another super important job: helping folks manage their credit. Yep, it’s true. Insurance agents can be like coaches for your credit score.

Why Agents Care About Your Credit?

Insurance agents understand that your credit score is like a financial handshake. It tells the insurance company if you’re the kind of person who plays by the rules and pays bills on time. A good credit score might mean less money to pay for insurance, and who doesn’t love saving money?

Insurance Agents as Credit Coaches

So, where does credit repair software for insurance agents fit into all this? Think of it like a toolbelt that helps these agents fix your credit score. They use it to check your credit report, find any mistakes, and help you clean them up. It’s like having a credit cleanup crew, with your insurance agent leading the charge.

Agents have a secret weapon with this software. It has tips and tricks to turn a so-so credit score into a sparkling one. They’ll help you understand why paying your bills on time is a massive deal for your credit score or why you should think twice before opening a new credit card to score that sign-up bonus.

More Than Just Selling Policies

Insurance agents do more than sell policies. They’re in the ring with you, helping you fight for a credit score that gets you the thumbs up from insurance companies. With credit repair software for insurance agents, they can ensure your credit report is accurate, which can help you get better deals on insurance. It’s like having a financial buddy in your corner, ensuring you’re not paying more than you should.

By weaving credit management into their day-to-day work, insurance agents do much more than keep an eye on your policies. They’re also looking out for your wallet and making sure you’ve got the credit score to keep your insurance rates as friendly as possible.

What is Credit Repair Software?

Ever wonder what a computer program can do to help fix credit scores? That’s exactly what credit repair software is all about. It’s like having a smart robot that helps insurance agents help you with your credit.

The Digital Tool for Fixing Credit

Credit repair software is a digital tool that helps find mistakes on your credit report kind of like a detective looking for clues. These mistakes could be things like bills you already paid but still show up as unpaid. Or maybe there’s a bill on there that isn’t even yours. Oops!

How It Helps Insurance Agents Help You?

Now, for insurance agents, this software is super handy. With it, they can help you spot and fix these mistakes quickly. Why does this matter? Because when your credit report is spotless, you can get better deals on insurance. And who doesn’t want that?

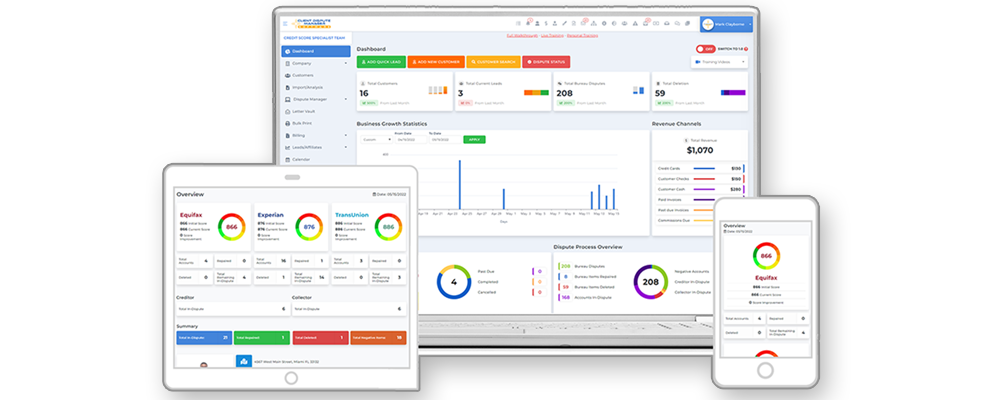

Say Hello to Client Dispute Manager Software

One special kind of credit repair software is Client Dispute Manager Software. It’s designed to make the whole “credit report cleaning” process as easy as pie for insurance agents. This software lets agents send out dispute letters for you, track the progress, and keep everything organized. It’s like giving your credit report a nice bubble bath so it’s clean and shiny for insurance companies to see.

So there you have it! Credit repair software, like Client Dispute Manager Software, is a game-changer for insurance agents and you. It makes the whole credit-fixing journey a whole lot smoother, and it’s a key part of what makes insurance agents today not just sellers of policies, but helpers in your financial world.

Benefits of Credit Repair Software for Insurance Agents

Let’s talk about something cool: credit repair software for insurance agents. It’s like a super-tool that helps these agents be even more awesome at their job.

Makes Their Job Easier

First up, this kind of software is like a magic wand for insurance agents. It helps them go through credit reports super fast to find any oopsies that might be messing with your credit score. With programs like Client Dispute Manager Software, they can spot errors without breaking a sweat. This means they can help fix your credit score quicker than a rabbit in a sprint!

Keeps Everything Neat and Tidy

Then, there’s the part where everything stays organized. Credit repair software lets insurance agents keep all your info in one spot. No more messy papers or lost emails. It’s all about being tidy, which means they can help you better and faster.

Helps Agents Be Superheroes to Clients

Insurance agents can turn into credit score superheroes when they use credit repair software. They’re not just selling insurance but also helping you save money by fixing your credit score. And when they use Client Dispute Manager Software, they’ve got all the gadgets they need to fight the bad credit monsters.

Gives You the Best Insurance Adventure

Lastly, this software is all about giving you a smooth ride on your insurance adventure. It helps agents give you tips on how to keep your credit in tip-top shape, which can lead to better insurance rates. And better rates mean more money in your pocket for the fun stuff.

So, there you go! Credit repair software, like Client Dispute Manager Software, is packed with benefits that help insurance agents help you. It’s a win-win for everyone!

Picking the Perfect Credit Repair Software For Insurance Agents

Choosing the right credit repair software can be as important as picking out the perfect pair of sneakers. You want them to fit just right and look good, too!

Find the Easy-to-Use Ones

First off, you want software that’s easy to use. Think of it as a video game; it’s not fun if it’s too hard. The best credit repair software for insurance agents is like playing on accessible mode; it’s got clear instructions and simple buttons, and you don’t need to be a computer whiz to figure it out.

Look for Top-Notch Tools

Next, you’ve got to check out the tools it offers. Just like a Swiss Army knife, you want your credit repair software to have all the cool gadgets. That means things like automatic dispute letters, a dashboard to see everything at a glance, and reminders so you don’t miss a beat.

Make Sure It's Got Support

Then, think about support. If you get stuck or something goes wonky, you need to have someone to call. Good credit repair software comes with a team ready to help you out, like having a lifeguard when you’re learning to swim.

Ask Around for the Best Picks

Don’t forget to ask other agents what they use. Word of mouth is a powerful thing. If everyone’s talking about a particular software, like Client Dispute Manager Software, it’s probably because it works well and makes life easier.

Check the Price Tag

Lastly, price is always something to consider. You don’t want to blow all your cash on software. Find one with a price that makes sense for what it does. It should be a good deal, kind of like finding that awesome sale at your favorite store.

So there you have it! Picking the right credit repair software is all about finding the best fit for you, just like those perfect sneakers. Make sure it’s easy, has all the right tools, comes with help when you need it, gets thumbs up from other agents, and doesn’t empty your wallet.

Conclusion

In a nutshell, credit repair software is a game-changer for insurance agents. It’s about working smarter, not harder, and delivering top-notch service to clients. By now, you’ve got the inside scoop on why these digital helpers are must-haves in the insurance world.

Remember, finding the right software is like choosing the best tool for a job it should make your life easier and get the job done well. So take the leap, grab that software, and start turning credit repair challenges into victories.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.