If you’re considering starting a credit repair business in South Dakota, it’s essential to familiarise yourself with the laws and regulations that govern this industry. In this article, we will explore the key legal requirements and guidelines you need to know to establish a compliant and successful credit repair business in South Dakota.

Choose a Business Structure

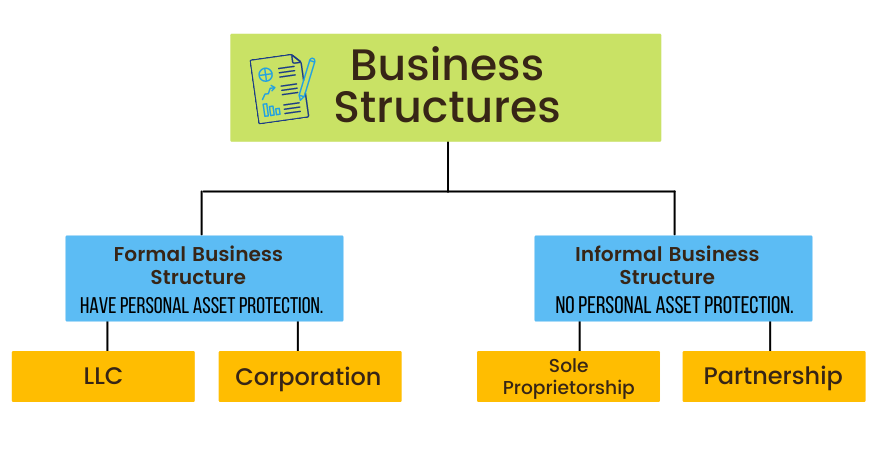

You will need to decide on the structure of your business, such as a sole proprietorship, partnership, limited liability company (LLC), or corporation. Consult a legal professional to understand the implications of each structure and choose the best one for your business.

Credit repair companies can operate under different business structures, but the most common ones are sole proprietorships and limited liability companies (LLCs).

A sole proprietorship is the simplest and most common business structure for credit repair companies. It is a business owned and operated by a single individual, who is personally responsible for all the debts and obligations of the business. This means that the owner’s personal assets are not protected from any liabilities of the business.

An LLC is a more complex business structure that provides limited liability protection to its owners, who are referred to as members. This means that the personal assets of the members are generally protected from any liabilities of the business. LLCs are often preferred by credit repair companies due to the protection it provides to their members.

There are also other business structures that credit repair companies may consider, such as partnerships, corporations, or cooperatives. The choice of a business structure depends on various factors such as the number of owners, tax implications, liability protection, and management flexibility.

Register Your Business

Register your business with the South Dakota Secretary of State. This will include filing the necessary paperwork and paying the appropriate fees. The requirements and fees may vary depending on your business structure.

To register your credit repair business with the South Dakota Secretary of State, you can follow these steps:

Visit the South Dakota Secretary of State's Website:

Go to the official website.

Click on the "Business Services" Tab:

On the top menu of the website, you will find the “Business Services” tab. Click on it to access business registration services and resources.

Choose Your Business Structure:

The registration process will vary depending on your chosen business structure (such as an LLC, corporation, or partnership). Click on the appropriate business structure to access relevant information and forms.

File Necessary Documents:

Once you’ve chosen your business structure, download the appropriate forms and follow the instructions provided. You’ll need to complete and submit these forms along with the required fees. For example, if you choose to form an LLC, you will need to file Articles of Organization.

Register Online (optional):

South Dakota offers online filing for some business structures, such as LLCs and corporations. If you prefer, you can use the online filing system by clicking on the “Online Filing” link on the “Business Services” page.

Check Name Availability:

Before you file your paperwork, you may want to check if your desired business name is available. Use the “Business Name Availability” search tool on the “Business Services” page to see if the name you want is already in use.

South Dakota does not currently require a surety bond. However, you should consult with the South Dakota Attorney General’s Office and the South Dakota Secretary of State to obtain the most recent information.

Obtain an Employer Identification Number (EIN)

Apply for an EIN from the Internal Revenue Service (IRS). This number is required for tax purposes and may be needed when opening a business bank account.

You can apply for an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) in several ways. Here are the steps to apply for an EIN:

Determine Your Eligibility:

You can apply for an EIN if you have a valid Taxpayer Identification Number (TIN) such as a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN), and you have a business or entity that requires an EIN.

Choose Your Preferred Method of Application:

You can apply for an EIN online, by fax, mail, or by phone.

Complete the Application Form:

You will need to complete the appropriate application form depending on the method of application you choose. The online application is the most popular method and can be completed on the IRS website.

Submit the Application Form:

Once you have completed the application form, you will need to submit it to the IRS. The submission process varies depending on the method of application you choose.

- If you apply online, you will receive your EIN immediately after completing the application.

- If you apply by fax or mail, you will need to wait for 4-7 business days to receive your EIN.

- If you apply by phone, you will receive your EIN immediately after completing the application.

Use Your EIN:

Once you receive your EIN, you can start using it for tax and other purposes, such as opening a business bank account, filing tax returns, and hiring employees.

It is important to note that applying for an EIN is free of charge, and you should only apply directly with the IRS to avoid scams or unnecessary fees charged by third-party providers.

Open a Business Bank Account

Open a dedicated business bank account to keep your personal and business finances separate.

To open a business bank account in South Dakota for credit repair, you will need to follow these general steps:

Choose a Bank:

Research and compare different banks in South Dakota to find the one that best meets your business needs. Consider factors such as fees, minimum balance requirements, location, and services offered.

Gather Required Documents:

You will need to provide certain documents to the bank to open a business account, including your business registration documents, tax identification number (EIN), and any other legal documents required by the bank.

Complete the Application:

Once you have gathered all the necessary documents, you can complete the application for the business account. The application may be completed online or in person, depending on the bank.

Provide Additional Information:

The bank may ask for additional information about your business, such as your business plan, financial statements, and credit history.

Deposit Funds:

To open the account, you will need to deposit funds into the account, as required by the bank.

Set up Online Banking:

You may want to set up online banking to manage your account and access online services offered by the bank.

Receive Your Debit Card and Checks:

Once your account is approved, you will receive your debit card and checks, which you can use to make transactions and manage your finances.

Obtain Any Necessary Permits and Licenses

Depending on your business activities, you may need to obtain local or state licenses and permits. Check with the South Dakota Department of Revenue for more information.

In South Dakota, credit repair companies are not required to obtain any specific licenses or permits to operate. However, credit repair companies must comply with all federal and state laws and regulations governing credit repair services, including the Credit Repair Organizations Act (CROA).

Here are the general steps you can follow to ensure compliance with regulations:

Research Federal and State Laws:

Familiarize yourself with the Credit Repair Organizations Act (CROA) and any other federal and state laws and regulations that may apply to your credit repair business.

Contact the South Dakota Secretary of State:

Contact the Secretary of State to register your business as either a sole proprietorship, partnership, corporation, or limited liability company (LLC).

Obtain an EIN:

You will need to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) to identify your business for tax purposes.

Register for State Taxes:

Contact the South Dakota Department of Revenue to register for state taxes, such as sales and use tax.

Check for Any Local Requirements:

Check with your local government to determine if there are any local permits or licenses required for your credit repair business.

Comply with CROA Requirements:

Ensure that your credit repair company complies with all requirements of the Credit Repair Organizations Act (CROA), such as providing consumers with a written contract, prohibiting upfront fees, and providing a three-day right to cancel.

Keep Accurate Records:

Maintain accurate records of all financial transactions and interactions with consumers to comply with regulations and to protect your business from legal issues.

Comply with the Credit Repair Organizations Act (CROA)

The CROA is a federal law that governs credit repair businesses. Be sure to understand the requirements of this law, which include providing clients with a written contract, not charging fees before services are rendered, and disclosing certain information to clients.

The Credit Repair Organizations Act (CROA) is a federal law that regulates credit repair services and sets rules for credit repair companies. The law was enacted in 1996 to protect consumers from fraudulent and deceptive practices in the credit repair industry. Here are some key provisions of CROA:

Written Contract:

Credit repair companies must provide consumers with a written contract that includes specific information about the services being offered, including the duration of the contract, the fees charged, and any guarantees or warranties.

Prohibition on Upfront Fees:

Credit repair companies are prohibited from collecting any fees before completing the promised services. This means that credit repair companies cannot charge upfront fees for credit repair services.

Three-Day Right to Cancel:

Consumers have the right to cancel the contract within three business days after signing the contract.

Prohibition on False or Misleading Statements:

Credit repair companies are prohibited from making any false or misleading statements to consumers about their services, including guarantees of improving credit scores.

Other federal laws and regulations that govern credit repair companies include:

Fair Credit Reporting Act (FCRA):

This law regulates how consumer credit information can be collected, used, and shared by credit reporting agencies and businesses that use credit information.

Truth in Lending Act (TILA):

This law requires lenders to disclose certain information about the cost of credit to consumers.

Fair Debt Collection Practices Act (FDCPA):

This law regulates the practices of debt collectors and sets rules for how they can contact and communicate with consumers.

Credit repair companies must comply with these laws and regulations to operate legally and protect consumers. It is important for credit repair companies to keep accurate records, provide clear information to consumers, and avoid any fraudulent or deceptive practices to ensure compliance with federal laws and regulations.

Be Aware of State Laws and Regulations

South Dakota may have specific laws and regulations governing credit repair businesses. You should consult with an attorney or the appropriate state agency to ensure compliance with any relevant state laws.

South Dakota does not have specific state laws governing credit repair businesses. However, credit repair businesses operating in South Dakota must comply with the federal Credit Repair Organizations Act (CROA) and other applicable federal and state laws.

The CROA has several requirements and prohibitions for credit repair businesses:

Do Not Make False or Misleading Statements:

Credit repair organizations cannot make false or misleading statements about their services, including claims about their ability to improve a client’s credit score.

Provide a Written Contract:

A written contract must be provided to the client before any services are rendered. The contract should include details about the services to be provided, the total cost of the services, a clear explanation of the client’s right to cancel, and the duration of the contract.

Allow a Three-Day Cancellation Period:

Clients must be given three days to cancel the contract without incurring any charges.

Do Not Charge Fees Upfront:

Credit repair organizations cannot charge clients for services before the services have been completed.

Provide a Disclosure Statement:

Clients must be given a disclosure statement that outlines their rights under the CROA and the specific services the credit repair organization will provide.

Retain Records:

Credit repair organizations are required to retain records of contracts and other relevant documents for a period of two years.

In addition to the CROA, credit repair businesses should be aware of and comply with any other federal and state laws that may apply, such as consumer protection laws, data privacy laws, and business registration requirements.

Obtain Liability Insurance

Consider obtaining liability insurance to protect your business from potential lawsuits.

Liability insurance is a type of insurance that provides protection to individuals and businesses against claims of negligence or wrongdoing that result in injury, property damage, or financial loss to another party. It is designed to cover the costs of legal defense and any damages awarded in a lawsuit.

There are several types of liability insurance, including:

General Liability Insurance:

This type of insurance covers claims of bodily injury or property damage caused by your business operations, products, or services. It can also cover claims of personal injury, such as slander or libel.

Professional Liability Insurance:

Also known as errors and omissions (E&O) insurance, this type of insurance covers claims of negligence, errors, or omissions in professional services provided by individuals, such as doctors, lawyers, and accountants.

Product Liability Insurance:

This type of insurance covers claims of injury or property damage caused by a product that your business manufactures or distributes.

Cyber Liability Insurance:

This type of insurance covers claims of data breaches, cyber-attacks, or other cyber incidents that result in financial loss or damage to others.

Having liability insurance can help protect your business from financial loss and legal expenses in the event of a lawsuit. It is important to review the coverage options and limits of liability insurance policies carefully and choose the right coverage for your specific business needs.

Create a Website and Marketing Materials

Develop a professional website and marketing materials to promote your services to potential clients.

Creating a good website and marketing materials for your credit repair business in South Dakota can help you reach potential clients and build your business. Here are some steps to consider:

Define Your Brand:

Determine your business values, mission, and unique selling points to create a brand that resonates with your target audience.

Create a Professional Website:

Your website should be easy to navigate, visually appealing, and provide relevant information about your credit repair services. It should also include a clear call to action, such as a contact form or a phone number, to encourage potential clients to reach out to you.

Optimize Your Website for Search Engines:

Use relevant keywords and meta descriptions to improve your website’s visibility in search engine results pages. This can help potential clients find your website when searching for credit repair services in South Dakota.

Use Social Media:

Create social media accounts for your business and use them to engage with potential clients, share relevant content, and promote your services.

Provide Valuable Content:

Create blog posts, videos, or other content that provides valuable information about credit repair services and educates potential clients on how you can help them.

Highlight Your Credentials:

Showcase your credentials, certifications, and experience to build credibility and trust with potential clients.

Use Testimonials:

Include testimonials from satisfied clients on your website and marketing materials to demonstrate the effectiveness of your services.

Stay Compliant with Regulations:

Ensure that your website and marketing materials comply with all federal and state laws and regulations governing credit repair services, including the Credit Repair Organizations Act (CROA).

Develop a Business Plan

Outline your business goals, target market, and strategies for achieving success.

Here are some key components to include in a business plan for credit repair:

Executive Summary:

This section should provide an overview of your business, including your mission, vision, and values. It should also include a summary of your business model, services offered, target market, and financial goals.

Market Analysis:

Conduct a thorough analysis of the credit repair industry in South Dakota, including the size of the market, the competition, and the regulatory environment. Identify your target market and their credit repair needs, and describe how you plan to differentiate your business from competitors.

Services Offered:

Describe the credit repair services you plan to offer, including credit report analysis, dispute resolution, and credit counseling. Explain how your services will benefit your clients and help them achieve their financial goals.

Marketing Strategy:

Develop a marketing plan that outlines how you plan to reach your target market and promote your services. Identify the marketing channels you plan to use, such as social media, search engine optimization, and advertising.

Management Team:

Describe the experience and qualifications of your management team and staff, including their backgrounds in credit repair, finance, or other relevant fields.

Financial Plan:

Create a financial plan that outlines your revenue and expense projections, startup costs, cash flow projections, and break-even analysis. Explain how you plan to fund your business and identify potential sources of financing.

Legal and Regulatory Compliance:

Describe how you plan to comply with all federal and state laws and regulations governing credit repair services, including the Credit Repair Organizations Act (CROA).

Educate Yourself

Stay informed about the credit repair industry, as well as federal and state laws and regulations that affect your business.

Staying informed about the credit repair industry and federal and state laws and regulations that affect your business in South Dakota is crucial to ensuring compliance and success. Here are some ways to stay informed:

Subscribe to Industry Publications:

Subscribe to industry publications, such as Credit Repair Cloud, Credit Repair Magazine, and The Credit Repair Summit, to stay up to date on the latest news, trends, and developments in the credit repair industry.

Join Industry Associations:

Join industry associations, such as the National Association of Credit Services Organizations (NACSO) and the National Association of Credit Repair Professionals (NACRP), to access resources, networking opportunities, and training programs.

Attend Industry Events:

Attend industry events, such as conferences, webinars, and seminars, to learn about new techniques, technologies, and best practices in credit repair.

Consult with Legal Professionals:

Consult with legal professionals, such as attorneys and certified public accountants, who specialize in credit repair and can advise you on compliance with federal and state laws and regulations.

Monitor Federal and State Regulatory Agencies:

Monitor regulatory agencies, such as the Consumer Financial Protection Bureau (CFPB) and the South Dakota Division of Banking, to stay up to date on any changes or updates to regulations that affect your credit repair business.

Join Local Business Organizations:

Join local business organizations, such as the South Dakota Chamber of Commerce and Industry and the South Dakota Small Business Development Center, to access resources, networking opportunities, and training programs specific to South Dakota.

Participate in Online Forums and Social Media Groups:

Participate in online forums and social media groups, such as Reddit, Facebook, and LinkedIn, to connect with other credit repair professionals, share ideas, and ask questions.

Now that you’re familiar with the laws for starting a credit repair business in South Dakota, you’re ready to embark on your entrepreneurial journey and make a positive impact on people’s financial lives.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.