You might not know this, but credit repair for immigrants is my arena. Over the years, I’ve cracked the code on the U.S. credit system and I’m here to guide you through it. Whether you’re just starting out or looking to polish your financial standing, I’ve got the playbook. With tools like Client Dispute Manager Software at your disposal, I’ll show you how to turn those credit score woes into wins. Ready to take control of your credit journey in a new land?

Let’s dive in.

Understanding the U.S. Credit System

Let’s take a little adventure into what I like to call ‘Credit Land.’ It’s a place you’ll need to get familiar with living in the U.S., especially if you’re starting a new chapter here. Understanding this can be a game-changer, and it’s super important for anyone diving into credit repair for immigrants.

The Lowdown on Credit Scores

So, credit scores. Imagine you’re back in school, and this number is like the grade you get after a big test. It shows banks just how awesome you are at handling your cash. Keep that score high, and you’ll find doors opening all over the place, like getting loans without a fuss and maybe even better deals on stuff you want to buy.

Your Credit Report Card

Think of your credit report as your financial yearbook. It’s got all the deets on the money you’ve borrowed, credit cards you’ve used, and even those times you paid late (oops!). Companies peek at this before they give you more credit. It’s their way of saying, “Can we trust this person with our money?”

Why This Stuff Matters?

Now, you’re probably wondering, “Why should I sweat over this?” Well, let me tell you, a shiny credit score can be your best buddy. It helps you snag good deals on a car, get a cozy spot to live, and maybe even start your own business. Plus, in the credit repair journey, especially for you newcomers, knowing this stuff is like having a secret map to treasure.

Fixing Up Your Credit Score

Alright, let’s chat about fixing that credit score. It’s not rocket science, promise. It’s about taking the right steps, like making sure you pay bills when they’re due and not letting them pile up. And for my immigrant pals out there, fixing up your credit is like tuning up your car – do it right, and you’ll be cruising smooth in no time.

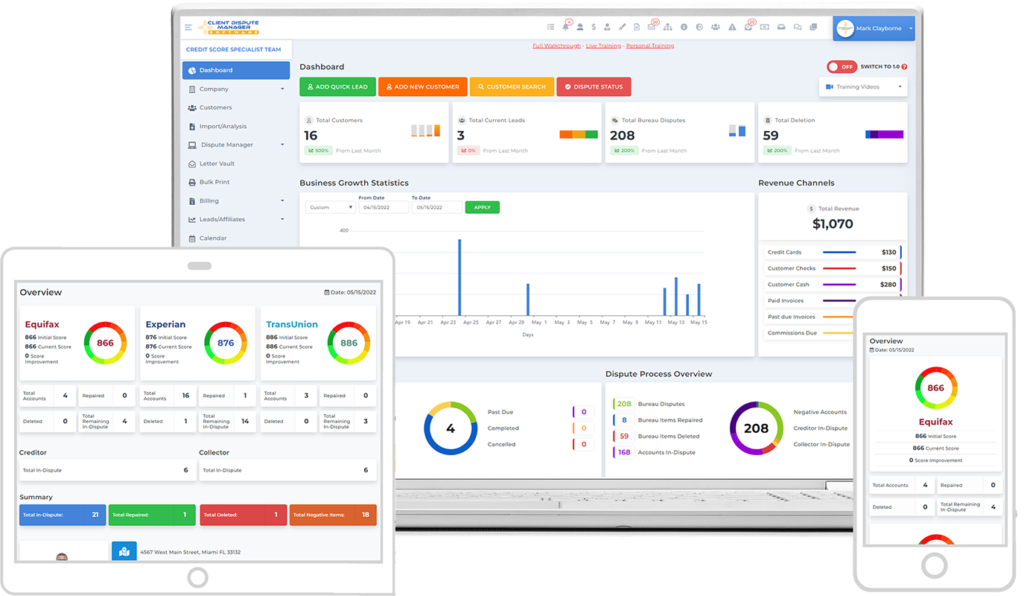

Keeping track of your money moves with tools like Client Dispute Manager Software can also help. It’s like having a personal credit coach right in your computer. Remember, every little fix you make is like planting a seed for your future money tree here in the U.S. So let’s roll up our sleeves and get to planting!

Common Credit Challenges for Immigrants

As you’re setting up shop in your new American home, you might hit some bumps on the road to a great credit score. Let’s talk turkey about these common credit hiccups that immigrants often face. Don’t worry, though I’m here to guide you through, just like a trusty GPS for credit repair for immigrants.

Starting from Scratch

Picture this: You’re new in town, and no one knows you yet. That’s kind of like your credit history here it’s a blank slate. In the credit world, having no history can be as tricky as having a bad one. It’s like the credit folks are saying, “How can we trust you with money if we don’t know you?” But hey, everyone starts somewhere, right?

Dodging the ID Puzzle

Getting credit without a social security number can be a real head-scratcher. It’s like trying to play a game where you don’t know all the rules. Most banks want this number to look you up and see your credit history. If you don’t have one, there are other ways around it, like getting an Individual Taxpayer Identification Number (ITIN). It’s like having a backstage pass to the credit show.

The Long Wait for Credit History

Building a credit history is like growing a tree it takes time. You can’t just snap your fingers and have a credit report full of good stuff. This can be tough when you need a loan for a car or a crib for your family. But like planting seeds for your garden, every little credit move you make now will grow over time.

Staying Away from Scams

And let’s not forget about those sneaky scams. Sadly, some folks out there might try to take advantage of your new status. They dress up like real deals, but they’re just wolves in sheep’s clothing. Always keep your eyes peeled and work with legit credit repair services. Think of it like sticking to the main roads instead of wandering down the sketchy alleys.

Keeping Up with Payments

Lastly, keeping up with bills can be a juggling act when you’re juggling a whole new life. Maybe the bill comes in English, and you’re still rocking Español or Tagalog. Missing payments because of a language barrier can affect your credit score. It’s key to get help or use tools that speak your language so you don’t miss a beat.

Credit Repair Strategies Tailored for Immigrants

Let’s dig into some advanced credit repair techniques that’ll help you hustle your score up the ranks. These tips are convenient for my immigrant friends out there who are working hard on their American dream.

Dive Into Debt Validation Like a Boss

First up debt validation. This is like asking for a receipt when something seems fishy. If a debt collector hollers at you, claiming you owe money, hit ’em with a debt validation letter. It’s their job to prove you owe the dough. If they can’t, that debt could vanish like ice cream on a hot day.

Negotiate Like You’re Buying a Used Car

Got a legit debt? Try to settle for less than what you owe, like you’re haggling at a flea market. Offer to pay a part of the debt right away if they agree to report it as “paid in full” on your credit report. It’s a compromise that can work out well for both of you.

Goodwill Letters – Your Secret Weapon

Did you make a late payment in the past? It happens to the best of us. Write a goodwill letter to your lender explaining your hiccup and ask nicely to remove the negative mark. Sometimes, a little kindness and a good story can work wonders.

Dispute, Dispute, Dispute

Last but not least, dispute any inaccuracies like a knight battles dragons. It’s all about accuracy, my friends. If something on your credit report doesn’t look right, challenge it. Every little victory helps your score.

Using these advanced techniques, you’re not just repairing credit; you’re taking charge like a pro. So, my immigrant allies, arm yourselves with these tactics and march toward that top-notch credit score. Ready, set, repair!

Leveraging Client Dispute Manager Software

Let’s talk tech. There’s this super cool tool called Client Dispute Manager Software. Think of it as the Swiss Army knife for slicing through credit repair problems. It’s a big deal for folks fixing their credit, especially for the newcomers that’s you, my immigrant pals!

Say Hello to Your New Best Friend

This nifty program is like having a credit repair buddy who works 24/7. It keeps track of your disputes, like little arguments you have with credit reporting agencies when they goof up your report. This software ensures you don’t miss a beat and keeps those disputes organized.

No More Head-Scratching Over Letters

Writing dispute letters can be as tricky as tongue twisters. But guess what? The Client Dispute Manager Software has templates. It’s like having cheat sheets for your credit homework. Just fill in the blanks, and you’re good to go. No sweat, no tears.

Keeping an Eye on the Prize

Want to see how your credit repair journey is going? This software has dashboards that show your progress. It’s like a video game where you level up, but instead of beating dragons, you’re boosting your credit score. And who doesn’t want to win that game?

Perfect for the Pros and the Rookies

Whether you’re a credit repair rookie or a pro, this software fits like a glove. It simplifies the complex stuff so everyone can use it. And for my immigrant crew, it’s a lifesaver, guiding you through the credit repair seas without getting lost in translation.

By leveraging Client Dispute Manager Software, you’re not just repairing credit; you’re joining the league of smart, tech-savvy folks who use the right tools for the job. So, let’s gear up and get your credit score climbing up that ladder with some tech help!

Conclusion

In conclusion, credit repair for immigrants is a crucial step towards financial stability in your new home. Keep a close eye on your credit report, pay your bills on time, and manage your credit wisely. Old accounts matter, so cherish them. Balance paying off debt with saving money for a rainy-day fund is key.

This journey might be long, but it paves the way for a secure financial future. Stay patient, stay informed, and your credit will grow alongside your dreams. Here’s to building a strong credit foundation in your new chapter!

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.