Are you struggling with negative items on your credit report that seem impossible to remove? Many individuals face this challenge, but there’s a powerful solution that often goes overlooked: the pay for delete letter.

As a credit repair specialist with over a decade of experience, I’ve helped countless clients successfully negotiate with creditors using this effective strategy.

This comprehensive guide will walk you through the process of creating and using a pay for delete letter template that gets results.

Start Today and Explore the Features Firsthand!

Understanding the Pay for Delete Letter Template Process

The strategy of using a pay for delete letter has emerged as one of the most effective approaches to credit repair in recent years. A well-crafted pay for removal letter can often achieve what standard payments cannot – the complete removal of negative items from your credit report.

This approach combines negotiation skills with legal knowledge to create optimal results.

Key Elements of a Successful Template

The effectiveness of your pay for delete letter depends heavily on understanding its core principles and proper execution strategy. Every successful paid debt removal letter template builds upon proven negotiation techniques that collection agencies respond to positively.

A professional letter of deletion for credit report must balance assertiveness with cooperation to achieve desired outcomes. Your pay and delete letter sample approach should demonstrate both willingness to pay and knowledge of credit reporting practices. The timing of your submission can significantly impact success rates with creditors.

Benefits of Using a Template Approach

Using a pay for delete letter template offers several distinct advantages over standard debt payment approaches. A well-executed pay for removal letter can often result in complete removal rather than just showing as “paid.” Your paid debt removal letter template should emphasize mutual benefits for both parties involved.

The pay and delete letter sample approach typically leads to faster credit score improvement. Creating an effective letter of deletion for credit report requires understanding both creditor motivations and legal requirements.

Essential Components of a Pay and Delete Letter Sample

A successful pay for delete letter contains several essential elements that increase its effectiveness with creditors. Your letter must maintain a professional tone while clearly stating your proposal and expectations. Understanding these components helps create a compelling case for debt resolution.

Writing an Effective Letter of Deletion for Credit Report

Every pay for delete letter template must begin with complete and accurate contact information. Your letter should include your full name, current address, phone number, and account details.

A professional paid debt removal letter template includes creditor information copied exactly from your credit report.

Reference numbers and dates help locate your account quickly and process your request efficiently. Proper formatting demonstrates attention to detail and professionalism.

Sending Your Pay for Delete Letter Template

Professional delivery of your letter increases chances of success. Following proper procedures ensures your letter reaches the right person. Timing and method of delivery can significantly impact response rates.

Finding the Right Recipient for Your Pay for Removal Letter

Accurate identification of the current debt owner is crucial before sending your letter. Collection accounts often change hands multiple times, requiring thorough research. Your paid debt removal letter template must reach the person with authority to remove negative items.

Documentation from credit reports and collection notices helps verify proper recipients. Professional research prevents wasted time and improves success rates.

Start Today and Explore the Features Firsthand!

Formatting Your Paid Debt Removal Letter Template

Professional formatting enhances the impact of your pay for delete letter template significantly. Your letter of deletion for credit report must follow standard business letter conventions perfectly.

Include clear section headings and well-organized paragraphs throughout your pay for removal letter.

Apply consistent formatting to maintain a professional appearance throughout the document. Your pay and delete letter sample should look polished and businesslike.

Delivery of Your Pay and Delete Letter Sample

Always send your pay for delete letter template via certified mail with return receipt requested. Track delivery of your pay for removal letter to ensure proper receipt by the creditor.

Keep copies of your paid debt removal letter template and all supporting documentation. Follow up professionally if no response is received within 30 days. Document every communication attempt and response carefully.

Alternative Approaches to Pay for Delete Letters

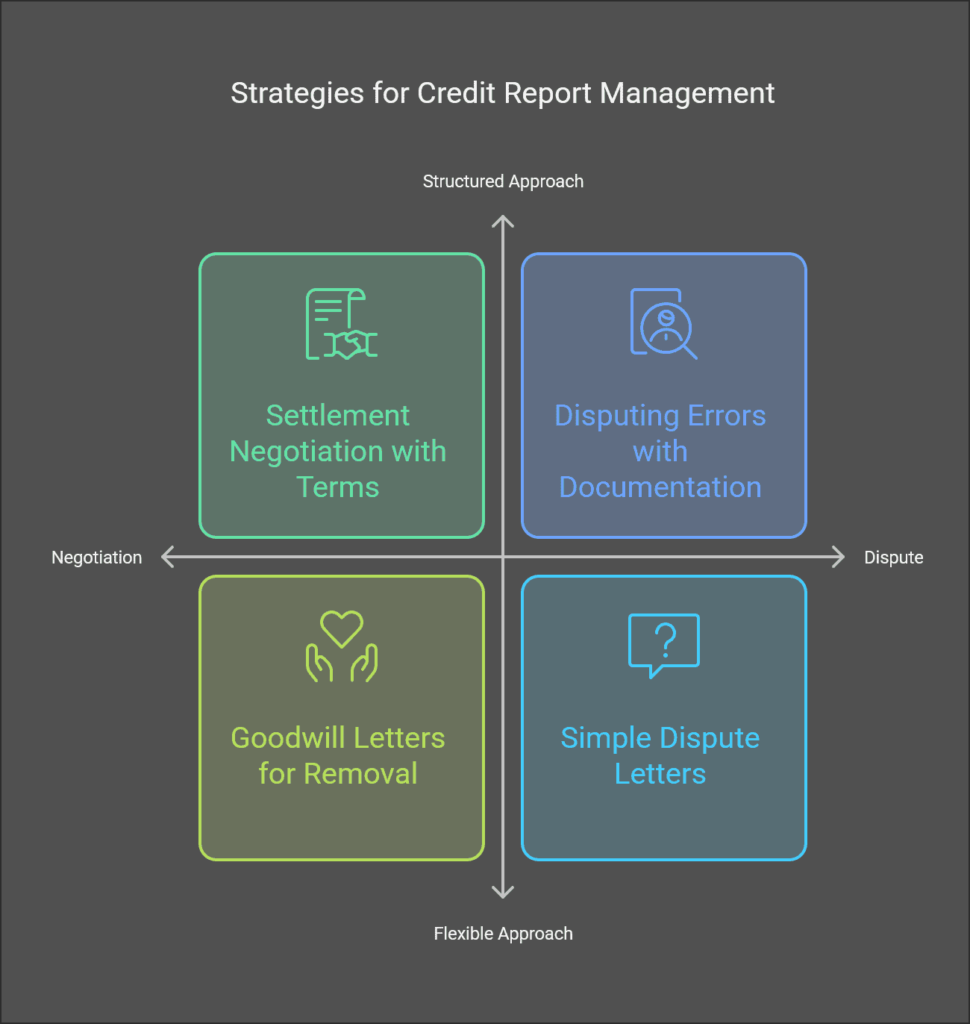

Sometimes alternative strategies must complement your pay for delete letter approach. Different situations may require varied techniques for optimal results. Understanding all available options strengthens your negotiating position.

Using a Goodwill Pay for Removal Letter

Goodwill letters offer an alternative when standard pay for delete letters prove unsuccessful with creditors. Focus on positive payment history and extenuating circumstances in your pay for removal letter approach.

Your paid debt removal letter template might work better as a goodwill request for long-term accounts. Include specific examples of good faith efforts in your letter of deletion for credit report. Maintain a professional yet personal tone while appealing to creditor mercy.

Start Today and Explore the Features Firsthand!

Disputing Credit Report Errors

Always verify accuracy before sending your pay for delete letter template to any creditor. Your pay for removal letter should address specific inaccuracies when they’re discovered.

Different approaches apply when disputing errors versus negotiating removal of accurate items. Include relevant supporting documentation with your letter of deletion for credit report. Follow specific legal requirements for dispute communications.

Settlement Negotiation Strategies

Consider combining settlement offers with your pay for delete letter approach for better results. Your pay for removal letter might include multiple payment options or terms.

Structure your paid debt removal letter template to allow room for negotiation. Professional pay and delete letter sample terms often include flexible settlement provisions. Using multiple strategies increases your chances of success significantly.

Expected Outcomes of Your Pay for Delete Letter Template

Success rates vary when using pay for delete letters for credit improvement purposes. The effectiveness of your pay for delete letter template depends largely on factors like debt age, amount, and creditor policies. Understanding typical outcomes helps set realistic expectations and develop effective follow-up strategies.

Common Response Patterns

Most creditors respond to a pay for delete letter within 30 days of receipt. Your pay for removal letter might receive immediate acceptance, particularly from smaller collection agencies.

The paid debt removal letter template often leads to negotiations rather than outright acceptance or rejection. Some creditors may counter-offer with alternative terms to your letter of deletion for credit report.

Professional follow-up increases success rates significantly when initial responses are neutral or negative.

Start Today and Explore the Features Firsthand!

Timeline for Results

The process of implementing a successful pay for delete letter strategy typically takes 45-60 days from start to finish. Your pay for removal letter may require multiple rounds of communication before reaching an agreement. Credit report updates usually appear within 30 days after a successful paid debt removal letter template agreement.

Following up on your letter of deletion for credit report ensures timely implementation of agreed terms. Consistent monitoring helps track progress and maintain documentation of changes.

Credit Score Impact of a Successful Pay for Removal Letter

A successful pay for delete letter can significantly improve your credit score within 60-90 days. The impact varies based on factors like the age of the debt, your current credit profile, and the number of negative items being removed. Professional timing of your paid debt removal letter template maximizes potential benefits.

Measuring Credit Score Changes

Credit score improvements from a successful pay for delete letter typically range from 20-150 points. Your pay for removal letter success might show results faster with newer collection accounts than older ones.

The paid debt removal letter template strategy works best when combined with other credit improvement efforts.

Regular monitoring helps track the impact of your letter of deletion for credit report. Professional credit monitoring services can help document score changes effectively.

Legal Guidelines for Pay and Delete Letter Sample Success

Following proper legal procedures ensures your pay for delete letter strategy remains compliant and effective. Understanding your rights under the Fair Credit Reporting Act strengthens your negotiation position.

Professional handling of legal requirements demonstrates credibility and increases success rates.

Legal Rights and Protections

The Fair Credit Reporting Act provides specific rights when dealing with creditors and credit bureaus. Your pay for delete letter template must align with legal requirements for debt validation and verification.

The paid debt removal letter template should reference relevant consumer protection laws when appropriate.

Understanding statute of limitations on debt collections impacts your letter of deletion for credit report strategy. Professional knowledge of legal rights strengthens your pay and delete letter sample approach.

Start Today and Explore the Features Firsthand!

Documentation Requirements

Maintain comprehensive records of every pay for delete letter and related communication sent. Your pay for removal letter copies should include certified mail receipts and delivery confirmations. Create organized files for each paid debt removal letter template and creditor response.

Track all phone conversations and follow-up communications regarding your letter of deletion for credit report. Professional documentation practices protect your interests throughout negotiations.

Final Steps and Follow-Up Procedures

Successful implementation of your pay for delete letter strategy requires consistent monitoring and follow-up. Professional handling of the post-agreement phase ensures creditors fulfill their obligations. Systematic tracking helps maintain momentum throughout the process.

Monitoring Credit Report Changes

Check your credit reports regularly after receiving agreement to your pay for delete letter. Your pay for removal letter success should reflect in credit reports within 30-45 days.

The paid debt removal letter template agreement terms should specify timeline expectations.

Document any delays in implementing your letter of deletion for credit report agreement. Professional follow-up ensures creditors honor their commitments promptly.

Long-term Success Strategies

Maintain copies of successful pay for delete letter agreements for future reference. Your pay for removal letter strategy may need adjustment based on results and creditor responses.

Implement systems to prevent future paid debt removal letter template needs through better financial management.

Build positive credit history while resolving negative items through letter of deletion for credit report efforts. Continue monitoring credit reports regularly after successful negotiations.

Expert Recommendations for Pay for Delete Letter Success

Success with pay for delete letters requires careful planning, professional execution, and persistent follow-up. Understanding creditor motivations and industry practices improves your negotiation position. These proven strategies help achieve optimal results when implemented correctly.

Key takeaways:

- Verify debt details before sending letters

- Maintain professional communication

- Document all correspondence

- Monitor credit reports regularly

- Follow up appropriately

- Stay persistent but professional

Conclusion

Success with your pay for delete letter strategy requires careful preparation, professional execution, and persistent follow-up with creditors. A well-crafted pay for removal letter, combined with proper documentation and monitoring, can significantly improve your credit profile when implemented correctly.

Understanding the legal framework and maintaining professional communication throughout the process strengthens your negotiating position with creditors. Your paid debt removal letter template serves as a powerful tool for credit improvement when customized appropriately for each situation.

Following the guidelines in this comprehensive guide while maintaining realistic expectations about timelines and outcomes will help optimize your letter of deletion for credit report strategy and achieve your credit improvement goals.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: