Getting a letter from a debt collector can feel frustrating. You might wonder if the debt is real or if the amount is correct. That is why a debt validation letter can help.

This type of letter gives you a way to ask a debt collector to prove that a debt is accurate. It gives you a chance to stop a mistake before it affects your credit.

Collectors do not always have the right information. Sometimes, they try to collect a debt that was already paid. Other times, they might contact the wrong person.

If you do not respond, that debt could show up on your credit report and lower your score. It might even lead to court.

A validation of debt letter is a clear and legal way to request proof. You do not need legal training to write one, but you do need to say the right things. That is where this guide helps.

By following the steps in this guide, you can respond with confidence. Whether you are fixing your own credit or helping others do the same, this guide is here to help you do it the right way.

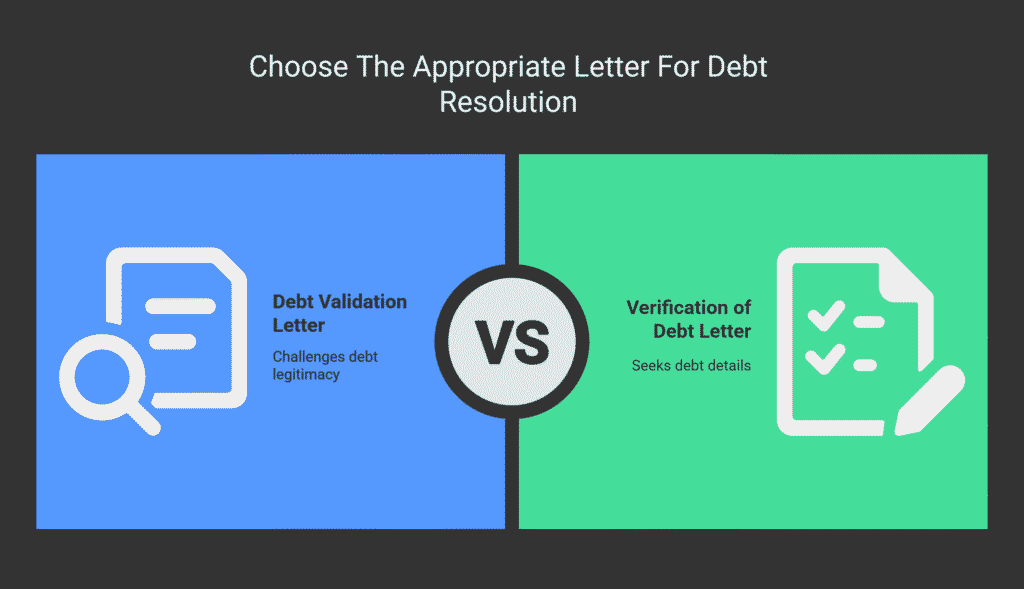

Debt Validation Letter vs. Verification of Debt Letter: What’s the Difference?

If you are dealing with a debt collector, you might see different terms. Two of the most common are debt validation letter and verification of debt letter. Though they sound alike, they are not the same.

When to Send a Debt Validation Letter vs. a Verification of Debt Letter?

A debt validation letter is something you send to the debt collector. It is your way of asking them to prove that the debt is real. This letter puts pressure on the collector to provide details, like who the original creditor is and how the total amount was calculated.

A verification of debt letter is usually what the collector sends back to you. It should include documents or statements that explain the debt. If they do not respond with clear proof, they may not be allowed to continue collecting it.

Why Choosing the Right Letter Matters Legally?

It is easy to mix these up. Just remember:

- You send the debt validation letter

- They send the verification of debt letter

Some people also use the term credit validation letter. It means the same thing as a debt validation letter. Different names, same goal—getting proof before you agree to anything.

If the collector does not send a proper verification of debt letter, they cannot list the debt on your credit report or try to collect. That is why sending your request early matters. You only have a short time—usually 30 days after the first contact—to make the request.

Knowing when and how to send the right letter can help protect your credit. In the next section, we will look at why this process matters.

The Importance of a Validation of Debt Letter in the Credit Dispute Process

Sending a validation of debt letter does more than request information—it sets the record straight. When used correctly, it gives you a simple way to ask for proof and avoid mistakes that might hurt your credit.

This short letter puts the burden on the collector to provide facts, not guesses. It is a smart way to stop wrong information before it becomes a problem.

How a Debt Validation Letter Verifies the Debt's Legitimacy?

When a debt collector contacts you, the law gives you the right to ask for proof. This is where the validation of debt letter becomes useful. It is a simple request that can stop errors before they affect your credit.

Debt collectors must follow rules. They cannot just claim that you owe money without backing it up. By sending a debt validation letter, you ask them to show that the debt is real, that they are allowed to collect it, and that the amount is correct.

A clear and direct credit validation letter helps you request details without saying anything that might hurt your case. Many people use a simple credit validation letter template to keep the message focused and avoid common mistakes.

This small step can lead to better control over your credit record.

How a Credit Validation Letter Protects Your Consumer Rights Under FDCPA?

If they cannot prove any of this, they may have to stop trying to collect. They also cannot report it to credit agencies or continue contacting you.

This is why a credit validation letter can protect you. It gives you control. You are not refusing to pay. You are asking for the truth before you take any action. That is your right under the law.

Without this letter, collectors can make mistakes. They might report the wrong balance. They might contact the wrong person. These mistakes can hurt your credit score and make future loans harder to get.

By using a debt validation letter early, you can stop those mistakes. It helps you fix problems before they grow.

Next, we will look at what to include in the letter to make sure your request is clear and correct.

What to Include in a Debt Validation Letter (and What to Avoid)?

When writing a debt validation letter, you want to include only the details that matter. This letter is not meant to explain your story or defend your side. It should ask for facts, nothing more.

A short and well-written request shows that you know your rights and expect proper proof before anything else happens.

Key Details for an Effective Validation of Debt Letter

A debt validation letter should focus on facts. Include your name and address, the name of the collection agency, and a clear request for proof of the debt. Ask for the full amount owed, how it was calculated, and the name of the original creditor.

Using a credit validation letter template helps you stay clear and avoid adding anything unnecessary. Keep your tone calm and neutral.

A simple and direct validation of debt letter helps avoid confusion and shows that you are serious about getting accurate records. Sticking to proven language and using a trusted format can help prevent delays.

If done the right way, your debt validation letter can stop errors before they start.

Common Mistakes Found in a Credit Validation Letter Template

Some letters include statements that can hurt your case. Do not admit the debt is yours. Avoid emotional language or threats. Do not include details that go beyond what is needed to identify the account.

A good validation of debt letter avoids promises to pay or requests that suggest you agree with the debt. Keep the message short, firm, and focused on asking for records.

What should you leave out? Do not agree to pay anything. Do not say the debt is yours. Avoid personal details unless needed to identify the account. A clean and focused validation of debt letter will speak for itself.

Using a well-written credit validation letter shows you know what to ask for and how to protect yourself. If you use a credit validation letter template, make sure it stays simple and does not include extra claims or emotional statements.

How to Write a Debt Validation Letter That’s Legally Compliant?

Writing this letter does not require legal knowledge, but it does require care. Each line should stay focused on asking for proof, not agreeing with the debt. This section will show you how to write a clear debt validation letter that protects your rights and avoids missteps.

Steps to Follow Using a Sample Debt Validation Request Letter

Writing a debt validation letter that follows legal rules helps protect your rights. If the letter includes the wrong language, it can be used against you. Keeping it short, factual, and polite is the safest approach.

Start with a clear subject line and your personal details. Then, include a simple request asking the collector to send proof of the debt. Using a credit validation letter template is helpful for staying on topic and avoiding risky wording.

Avoid saying anything that accepts the debt as yours. Do not offer to pay or suggest that you agree with the balance. A well-written validation of debt letter should focus only on asking for records and stopping contact until those records are sent.

Create Your Own Credit Validation Letter Template

You can write your own letter from scratch or use a sample debt validation request letter found online. A good credit validation letter template helps you stay focused and avoids wording that could create problems. Before you choose a format, make sure it is based on current law and includes only what is needed.

Look for a template that:

- Is short and to the point

- Does not include personal opinions

- Clearly asks for proof of the debt

- Avoids admitting anything about the debt

Once you complete the letter:

- Print and sign it

- Send it by certified mail with tracking

- Keep a copy for your records

Even though templates do not guarantee results, they make it easier to avoid common mistakes and stay organized.

What Happens After You Send Your Debt Validation Letter?

Sending a debt validation letter is the first step, but what happens after you mail it also matters. Knowing what to expect helps you stay prepared and respond correctly. Timing, tracking, and keeping detailed records all play a part in what comes next.

Following up on your validation of debt letter helps make sure your rights stay protected.

Timeline and Expectations After Sending a Validation of Debt Letter

Once the collector receives your validation of debt letter, they are required by law to stop collection activity until they provide proof. This includes phone calls, letters, and credit reporting.

Most collectors respond within 30 days, but some may take longer.

Here is what usually happens:

- They stop contacting you while reviewing your request

- They send a verification of debt letter with documents if they have proof

- If they cannot provide proof, they must stop trying to collect

Keep a copy of your letter and the receipt from certified mail. It shows that you met the deadline and made the request in writing.

What to Do if You Don’t Get a Response from the Debt Collector?

If 30 days pass and you do not hear back, the collector may be breaking the rules. You can:

- Send a follow-up letter asking again for proof

- Report the collector to the Consumer Financial Protection Bureau (CFPB)

- Contact the credit bureaus if the debt shows up on your report

You should also stop any communication with the collector until you receive a proper response. If they continue to contact you or list the debt without proof, you may have a legal case.

Keeping copies of your credit validation letter, delivery receipts, and any reply—or lack of reply—is useful if you need to take further steps.

Responding to a Debt Collector’s Reply to Your Debt Validation Letter

Once you send your debt validation letter, you may receive a reply. This response often comes in the form of a verification of debt letter. Knowing how to read it and what to do next can help you stay in control of your credit.

Do not assume the debt is confirmed just because a letter arrives. Take time to review the documents and make sure everything checks out. The details in the collector’s reply will guide your next steps.

If the Debt Is Confirmed with a Verification of Debt Letter

If the collector sends a verification of debt letter, read it closely. It should include documents that show the full amount owed, the name of the original creditor, and proof that the collector has the right to collect the debt. If the information checks out and you recognize the debt, you can decide what to do next.

You have a few options:

- Settle the debt for less than the full amount

- Pay it in full

- Contact the original creditor to confirm the details

Make sure any deal is in writing before you send money. You can also ask for the item to be removed from your credit report after payment. That request is known as a pay-for-delete, though collectors are not required to agree to it.

What If the Debt Cannot Be Validated?

If the collector cannot provide proof, they must stop collection efforts. This includes calls, letters, and reporting the debt to credit bureaus. You have the right to report them if they continue without proof.

Steps to take:

- Save their response, or lack of response

- File a complaint with the CFPB or your state attorney general

- Send a follow-up letter reminding them of their legal duty

A validation of debt letter gives you legal power to question the debt. If they do not prove it, they should not collect it. Keeping clear records makes it easier to protect your rights if you need to take further action.

Understanding Your Rights When Using a Credit Validation Letter

Sending a credit validation letter is backed by legal rules. These rules protect you from unfair collection practices and make sure debt collectors follow the law. Knowing these rights gives you more control in handling your credit issues.

A well-prepared debt validation letter stops unfair contact and forces collectors to follow legal steps. This makes the validation of debt letter a strong and simple tool for protecting your credit file.

Legal Protections Under the Fair Debt Collection Practices Act (FDCPA)

The Fair Debt Collection Practices Act (FDCPA) sets rules that debt collectors must follow. Once you send a debt validation letter, they cannot contact you until they provide proper proof. They also cannot harass you, call you at strange hours, or lie about what you owe.

The FDCPA protects you by:

- Requiring collectors to stop contact if proof is not provided

- Banning threats, false claims, and repeated calls

- Allowing you to sue if they break the rules

Understanding these points helps you use your validation of debt letter with confidence.

How to Report Violations After Sending a Debt Validation Letter?

If a collector keeps contacting you without proving the debt, you can report them. Save all letters, emails, and phone records. These can help your case, especially if the collector keeps violating the Fair Debt Collection Practices Act. Documentation helps show that you followed the proper steps.

You can file a complaint with:

- The Consumer Financial Protection Bureau (CFPB)

- Your state attorney general’s office

- The Federal Trade Commission (FTC)

Your debt validation letter is the first step. If the rules are broken after you send it, the law is on your side. Take action if you need to. Following through protects not just your credit, but your legal rights as well.

How Client Dispute Manager Software Helps You Send a Debt Validation Letter the Right Way

Client Dispute Manager Software gives you a simple and organized way to create and send a debt validation letter. It is designed to help you write letters that follow the law and avoid risky mistakes. You do not need to spend hours trying to format or research what to include.

The software provides a reliable framework that guides you through the process. This helps you stay focused on what matters—getting clear, legal responses from collectors without delays.

Here is how it helps:

- Built-in Credit Validation Letter Template: You can use pre-written formats that follow current laws. This reduces errors and keeps your letters focused.

- Quick Customization: Add your own details without changing the structure of the letter.

- Letter Tracking Tools: Keep track of what you send and when you sent it, so you never miss a deadline.

- Safe Record-Keeping: Store copies of every validation of debt letter and all related responses in one place.

Whether you are fixing your own credit or running a credit repair business, this software saves time and helps you stay within legal limits. Many users choose Client Dispute Manager Software because it makes the debt validation process easier to handle from start to finish.

Conclusion

Sending a debt validation letter is one of the most direct and effective ways to protect your credit. It gives you the legal right to question a debt and ask for clear proof before taking any next step.

With the help of tools like a credit validation letter template or automated software, you can stay organized and avoid common mistakes.

Every step, from writing the letter to tracking responses, matters. When done the right way, this process can stop inaccurate debt collection and keep your credit report clean.

If you want to handle disputes safely and confidently, use the tools and tips covered in this guide. They are simple, legal, and proven to work.

Take charge of your credit by using the validation of debt letter to request proof, stop harassment, and protect your future.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.