- Check Your Credit Report for Medical Collections – Look for errors, duplicates, or accounts your insurance should’ve covered. Verifying accuracy is step one.

- Send a Medical Debt Validation Letter – Request proof from the collection agency. If they can’t verify the debt, it must be removed.

- Dispute Inaccuracies with the Credit Bureaus – Use supporting documents to challenge incorrect entries under the Fair Credit Reporting Act (FCRA).

- Negotiate Removal with Pay-For-Delete or Goodwill Letters – If the debt is valid, some agencies may agree to remove the account if you settle or explain financial hardship.

- Use tools like Client Dispute Manager Software – Automate the dispute process, track updates, and stay compliant while removing medical collections faster and more efficiently.

Medical debt can negatively impact your credit score, making it harder to secure loans, mortgages, or even credit cards. If you’re dealing with how to remove medical collection account, you may be wondering about the best way to go about it.

The good news is that there are several strategies you can use to remove medical collections from credit report effectively. Whether it’s through disputes, negotiations, or legal strategies, this guide will help you understand how to get a medical collection removed from credit report.

In this comprehensive guide, we will walk you through the entire process, ensuring you understand your rights, the best dispute methods, and ways to prevent removing medical collections from credit report from affecting your financial future.

Understanding Medical Collections and Their Impact on Credit Scores

A medical collection account appears on your credit report when a medical bill goes unpaid for an extended period and is sent to a collection agency.

Unlike other types of debt, how to get medical collections removed from credit report has unique regulations, and recent changes in credit reporting make it easier to remove medical collections from credit report if you follow the right steps.

What is a Medical Collection Account?

A past-due medical bill that has been sent to a collection agency can significantly impact your credit score. Typically, medical collections are reported to credit bureaus after 60 to 180 days of non-payment, depending on the provider’s policies.

Once a medical collection account appears on your credit report, it can lower your score, making it difficult to secure loans, mortgages, or other lines of credit.

Understanding how to remove medical collections from credit report is crucial for improving your financial standing.

How Medical Collections Affect Your Credit Score?

Medical collections can significantly impact your credit score, often reducing it by 50-100 points. Even after paying off a medical collection account, it can remain on your credit report for up to 7 years, making it difficult to qualify for loans, mortgages, or even credit cards.

Understanding how to remove medical collections from credit report is crucial for improving your financial stability.

By following the correct steps, such as disputing errors, negotiating settlements, or leveraging recent credit reporting changes, you can effectively work towards removing medical collections from credit report and improving your creditworthiness.

Can Removing a Medical Collection Improve Your Credit Score?

Yes! Successfully removing medical collections from credit report can lead to a noticeable improvement in your credit score, increasing your chances of qualifying for loans, credit cards, and better financial opportunities.

Since lenders heavily consider credit scores when making lending decisions, eliminating a medical collection account can make a substantial difference in your financial profile.

By following the right steps, such as disputing inaccurate debts and negotiating with collection agencies, you can improve your creditworthiness and take control of your financial future.

How to Identify and Verify a Medical Collection on Your Credit Report?

Before attempting how to remove medical collection account, it is essential to verify its accuracy and legitimacy.

Begin by reviewing your credit report from the three major credit bureaus—Experian, Equifax, and TransUnion—to locate any reported medical collections. Look for discrepancies such as incorrect balances, duplicate entries, or accounts that should have been paid by insurance.

Understanding how to get a medical collection removed from credit report starts with ensuring that the debt is valid. If you find errors, disputing the inaccuracies is a critical step in removing medical collections from credit report.

If the debt is valid, you can explore negotiation strategies to settle or remove it. By taking the necessary steps, you can work towards a cleaner credit history and improve your financial standing.

How to Check Your Credit Report for Medical Collections?

Requesting a free credit report from Experian, Equifax, and TransUnion is the first step in assessing your financial standing. Carefully examine the report to identify any how to get a medical collection removed from credit report, ensuring that all information is accurate.

Pay close attention to details such as errors, duplicates, or outdated information that could be negatively affecting your credit score.

If you find discrepancies, disputing them promptly can help you take control of your credit and work toward removing medical collections from credit report effectively.

Understanding Medical Debt Reporting Errors

Medical bills that were paid by insurance but still reported as unpaid can cause unnecessary damage to your credit score.

Errors such as incorrect account details or mistaken identity issues can result in wrongful reporting of medical debt, making it crucial to carefully examine your credit report for accuracy.

Additionally, expired collections that should no longer be reported can still appear on your credit file, negatively impacting your creditworthiness.

Identifying and disputing these inaccuracies is a key step in how to remove medical collection account effectively and improving your financial standing.

Ensuring your credit report reflects only accurate information is essential when working toward removing medical collections from credit report and restoring your financial health.

How to Validate a Medical Collection Before Disputing?

Contacting the collection agency to request debt validation is a crucial step in the process of removing medical collections from credit report. You should formally ask for proof that the medical collection account truly belongs to you and that the details are accurate.

If the collection agency cannot verify the debt with proper documentation, they are legally required to remove it from your credit report.

Understanding how to get a medical collection removed from credit report by leveraging this process can significantly improve your credit score and financial standing.

How to Get a Medical Collection Removed from Your Credit Report?

If the medical collection on your credit report is inaccurate, unverifiable, or unfair, you have legal grounds to dispute it under the Fair Credit Reporting Act (FCRA).

Understanding how to remove medical collections from credit report requires taking immediate action to challenge errors or inconsistencies.

Start by obtaining a copy of your credit report and thoroughly reviewing any medical collection account listed. If the details are incorrect, you can dispute the entry with the credit bureaus, providing supporting documentation to back your claim.

In cases where the collection agency cannot verify the debt, they must remove it, making removing medical collections from credit report a realistic possibility.

By actively disputing and following up on the status of your case, you can improve your credit score and protect your financial future.

Step #1: Request a Debt Validation Letter

Before taking further action, it is crucial to request a debt validation letter from the collection agency. This letter serves as proof that the medical collection account is legitimate and accurately reflects the amount owed. Under the Fair Debt Collection Practices Act (FDCPA), you have the right to ask the agency for a breakdown of the debt details.

If they fail to provide verification, they must legally remove the debt from your credit report. To start this process, send a written request to the collection agency asking for a detailed breakdown of the how to remove medical collection account they claim you owe.

Ensure you include all necessary account information and request documented proof of the original debt.

If they cannot provide sufficient evidence, you have the right to demand its removal from your credit report, making removing medical collections from credit report a feasible option for improving your financial standing.

Step #2: File a Dispute with Credit Bureaus

Filing a dispute with credit bureaus is a key step in how to remove medical collections from credit report. If you discover an error in a medical collection account, submitting a formal dispute can force the credit bureaus to investigate and potentially remove the incorrect information.

Start by submitting disputes to Experian, Equifax, and TransUnion, ensuring that you include supporting documentation that proves any errors or inaccuracies in the reported debt.

The credit bureaus have 30 days to investigate and respond, making it essential to follow up and ensure that any incorrect medical collections are properly addressed.

By successfully disputing erroneous debts, you can improve your credit score and take control of your financial future.

Step #3: Negotiate with Collection Agencies for Removal

Negotiating with collection agencies can be a highly effective way to remove medical collections from credit report and improve your credit score.

If the debt is legitimate and has been reported correctly, you may still have options to work out a resolution that benefits both you and the creditor. Many consumers explore the Pay-for-Delete strategy, which involves offering to settle the debt in exchange for its removal from the credit report.

While not all collection agencies agree to this method, some may be willing to remove the account if the debt is paid in full or settled for a lesser amount.

Another approach is to send a Goodwill Letter requesting a removal after payment, particularly if you have a strong history of on-time payments and can demonstrate financial hardship.

Regardless of the negotiation method you choose, always ensure that you get all agreements in writing before making payments.

Documenting the terms protects you from potential disputes and ensures that the collection agency follows through with the agreement, increasing your chances of successfully removing medical collections from credit report.

Removing Medical Collections from Credit Report: Strategies That Work

Some tactics work better than others when removing medical collections from credit report, and choosing the right approach can make a significant difference in your credit score recovery.

Understanding how to remove medical collection account requires a strategic approach, including disputing inaccurate information, negotiating with collection agencies, and leveraging credit reporting laws to your advantage.

By implementing proven methods such as pay-for-delete agreements, goodwill letters, and formal disputes with credit bureaus, you can increase your chances of successfully removing medical collections from credit report.

Each case is unique, so taking a personalized approach and understanding your rights under the Fair Credit Reporting Act (FCRA) can provide the best results.

The following are some of the most effective techniques for resolving and eliminating medical collection accounts from your credit report.

How to Dispute Inaccurate or Unverified Medical Collections?

Under the Fair Credit Reporting Act (FCRA), consumers have the right to dispute inaccurate or unverified medical collection accounts that appear on their credit reports.

If you find an error in your medical collections, you can formally challenge it by submitting a dispute to the credit bureaus.

To strengthen your case, it is important to provide supporting documents, such as insurance payments, billing statements, or any other records proving the inaccuracy of the reported debt.

Once a dispute is filed, the credit bureaus are required to investigate and verify the information within 30 days. If they fail to do so, the unverified medical collection account must be removed.

Understanding how to remove medical collections from credit report through legal provisions like the FCRA can significantly improve your financial standing and help you maintain a healthier credit profile.

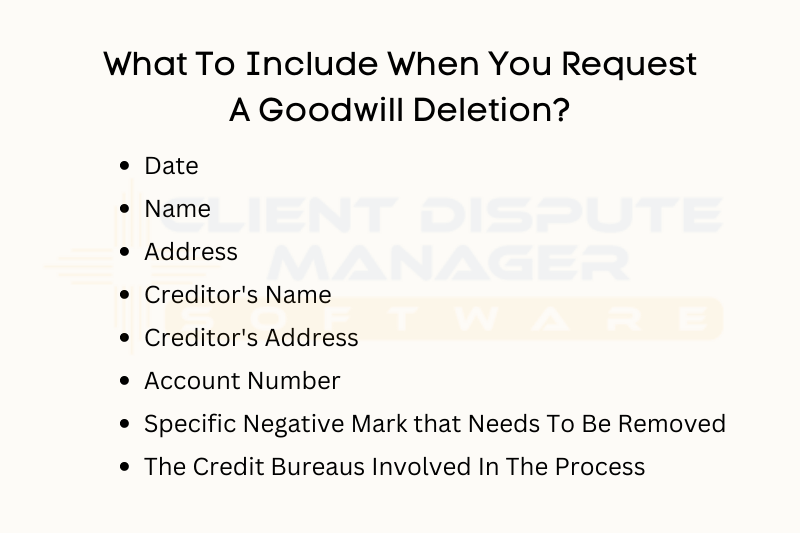

Using a Goodwill Letter to Request Removal

If the debt is legitimate and paid, you can request a goodwill deletion from the collection agency or creditor.

A goodwill deletion is a formal request asking the agency to remove the medical collection account from your credit report as a gesture of goodwill. If you have a strong history of making on-time payments and can demonstrate financial hardship, you may have a higher chance of success.

In your request, it is essential to explain financial hardship and ask for leniency, detailing why the debt occurred and how you have since worked toward financial responsibility.

Many agencies will agree to a goodwill deletion if the request is well-written, professional, and sincerely explains your situation.

This method can be an effective way of removing medical collections from credit report, ultimately improving your credit score and financial standing.

Pay-for-Delete Agreements: Are They Effective?

Some agencies will remove medical collections from credit report in exchange for full or partial payment, a process known as a pay-for-delete agreement. This strategy involves negotiating with the collection agency and offering a settlement in return for the removal of the medical collection account from your credit report.

However, not all collection agencies are willing to honor such agreements, and it is essential to approach this method with caution. Before making any payments, always get written confirmation from the collection agency that they will remove the debt from your credit report once payment is received.

Without this in writing, the agency may accept your payment but still keep the collection account on your credit history.

While pay-for-delete is not a guaranteed solution, it can be a valuable strategy when working toward removing medical collections from credit report and improving your credit score.

If this option is unavailable, consider other methods such as disputing inaccuracies or requesting a goodwill deletion.

Understanding Recent Changes in Medical Debt Reporting

Due to new regulations, it is now easier to remove medical collections from credit report than ever before, providing consumers with better opportunities to repair their credit.

Recent changes in credit reporting rules, such as the removal of paid medical collections from credit reports and the exclusion of unpaid medical debts under $500, have made a significant impact on how medical debt is treated.

Additionally, credit bureaus now require collection accounts to be at least one year old before they can be reported, giving individuals more time to resolve their medical bills before they negatively affect their credit score.

Understanding these changes is essential for those looking to improve their credit health and successfully remove medical collections from credit report through disputes, negotiations, or legal protections.

How the No Surprises Act Affects Medical Debt?

The No Surprises Act is a crucial regulation designed to protect consumers from unexpected medical bills and unfair debt collection practices. Many individuals find themselves dealing with medical collections due to surprise billing from out-of-network providers or emergency medical services.

This law helps by preventing these unforeseen expenses from impacting patients financially. Additionally, it increases transparency in billing and insurance coverage, ensuring that patients are aware of their financial responsibilities upfront.

By reducing surprise medical debt, this regulation plays a vital role in helping individuals avoid collections and work toward removing medical collections from credit report before they negatively impact credit scores.

Why Paid Medical Collections No Longer Hurt Your Credit Score

Recent changes in credit reporting policies have made it easier for consumers to manage their credit scores by removing certain types of medical debt.

Credit bureaus no longer report paid medical collections, which means that once you settle or pay off a medical collection account, it will no longer negatively impact your credit score.

Additionally, unpaid medical debt under $500 is no longer included in credit reports, providing relief to those struggling with smaller medical expenses. These updates are part of broader reforms aimed at reducing the long-term impact of medical debt on consumers’ financial health.

Understanding these changes can help you take the necessary steps to remove medical collections from credit report and maintain a healthier credit profile.

How Credit Bureaus Are Updating Medical Debt Reporting Rules?

Recent updates in credit reporting policies have introduced new guidelines that make it easier for consumers to manage their medical debt.

Collections must be at least 1 year old before they can be reported to credit bureaus, providing individuals with additional time to resolve outstanding medical bills before they negatively impact their credit score.

Additionally, more medical bills are being excluded from credit scoring calculations, especially those that fall under certain thresholds or have been settled through insurance disputes.

These changes offer a significant opportunity for individuals seeking to remove medical collections from credit report and improve their financial standing.

Client Dispute Manager Software: A Powerful Tool for Medical Collection Removal

Handling credit disputes manually can be time-consuming and complex, especially when dealing with medical collection accounts. That’s where Client Dispute Manager Software comes in as a powerful tool to streamline the dispute process and help you effectively remove medical collections from credit report.

How Client Dispute Manager Software Can Help?

Client Dispute Manager Software provides an all-in-one platform that allows individuals and credit repair professionals to automate and manage credit disputes efficiently. If you’re looking to get a medical collection removed from credit report, this software simplifies the process by offering features such as:

- Automated Dispute Processing: Generate dispute letters for how to remove medical collection account with ease and submit them to the credit bureaus.

- Credit Report Analysis: Identify inaccuracies and errors in medical collections that could be affecting your credit score.

- Customizable Letter Templates: Create and send effective medical collection removal letters tailored to different scenarios, such as goodwill requests and debt validation.

- Tracking and Follow-Up: Monitor the progress of your disputes and follow up with credit bureaus and collection agencies to ensure timely removal of medical collection accounts.

- Compliance and Legal Support: Stay updated with Fair Credit Reporting Act (FCRA) and Fair Debt Collection Practices Act (FDCPA) guidelines to strengthen your dispute cases.

Why Use Client Dispute Manager Software for Medical Debt Removal?

Manually disputing medical collections can take weeks or even months, requiring back-and-forth communication with credit bureaus and collection agencies.

By leveraging Client Dispute Manager Software, you can save time and ensure accuracy when submitting disputes.

Whether you are an individual looking to improve your credit score or a credit repair professional assisting clients, this tool provides a systematic approach to removing medical collections from credit report efficiently.

Final Thoughts on Removing Medical Collections from Your Credit Report

How to remove medical collection account is a common concern for many people. Successfully removing medical collections from credit report can significantly boost your credit score and financial health.

Whether disputing errors, negotiating settlements, or leveraging new credit reporting rules, taking proactive steps can lead to success.

If you’re struggling with persistent how to get a medical collection removed from credit report, seek professional help or explore legal options to protect your rights.

With persistence and knowledge, you can regain control of your financial future.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.