Are you dealing with a repossession on your credit report? If so, you’re likely asking, “How do I get a repo off my credit?” A repossession, commonly referred to as a “repo,” can create significant challenges when it comes to maintaining or improving your credit score. The good news is that with the right strategies and perseverance, you can address this issue.

This comprehensive guide will take you step by step through the process of learning how to get a repo off your credit and improve your financial health.

Start Today and Explore the Features Firsthand!

Understanding Repossessions and Their Impact on Credit

Before we delve into the solutions, it’s crucial to understand exactly what a repossession is and how it impacts your credit score. Knowing how repossession works will give you the knowledge to deal with it effectively and learn how to get a repossession off your credit.

What is a Repossession?

A repossession occurs when a lender takes back an asset, typically a vehicle, because of missed payments. This situation is common when someone has financed a car, boat, or other expensive item and fails to meet the agreed payment schedule. Once a lender repossesses the asset, they typically sell it to recover the outstanding debt.

Repossession can have a devastating effect on your credit score. If you’re in this situation, you’re likely seeking ways to get a repossession off your credit. This is where learning how to get a repo off your credit becomes essential, as it is a critical step toward financial recovery.

How Long Does a Repo Stay on Your Credit?

A repossession can remain on your credit report for up to seven years, starting from the date of your first missed payment. During these seven years, the repossession will weigh heavily on your credit score, making it difficult to qualify for new credit or loans.

This extended period of negative impact is why so many people are eager to find out how to get a repo off their credit as quickly as possible.

The negative effects of a repossession are most profound in the first few years, but the damage can last for the full seven years. Reducing this timeframe by learning how to get a repossession off your credit sooner is a powerful way to start improving your financial standing.

The Impact of a Repossession on Your Credit Score

A repossession can cause your credit score to drop significantly by 100 points or more in many cases. This decline can affect several critical factors that contribute to your overall credit score, including your payment history, amounts owed, and the length of your credit history.

Given these significant consequences, understanding how to get a repo off your credit is essential for anyone seeking to restore their financial health. Repossessions are a red flag to potential lenders and can make it challenging to secure loans, credit cards, or even a mortgage.

Learning how to remove repo from credit and implementing a strategy will help you recover from this situation faster.

The DIY Guide: How to Get a Repo Off Your Credit

Now that we’ve covered the basics, it’s time to dive into actionable steps. Below is a detailed, do-it-yourself guide on how to get a repo off your credit.

#1: Review Your Credit Reports to Get a Repossession Off Your Credit

The first step in learning how to get a repossession off your credit is to carefully review your credit reports. You can obtain copies of your credit reports from all three major credit bureaus—Experian, Equifax, and TransUnion—through AnnualCreditReport.com. Reviewing these reports will give you a comprehensive view of what is being reported.

Look for the repossession entry in your credit report. Check details like the date of the first missed payment, the repossession date, and any remaining account balances. This information is essential when learning how to get a repo off your credit since any inaccuracies can provide grounds for removal.

#2: Look for Inaccuracies to Help Get a Repo Off Your Credit

The next step in how to get a repossession off your credit is to search for errors in the repossession entry. It’s not uncommon to find inaccuracies in credit reports, such as incorrect dates, wrong account numbers, or even double listings of the same repossession.

Inaccuracies can make a huge difference when it comes to how to get a repo off your credit. Even minor errors, like misspelled names or incorrect balances, could be enough to dispute the entry with the credit bureaus and have the repossession removed.

Start Today and Explore the Features Firsthand!

#3: Dispute Inaccurate Information to Get a Repossession Off Your Credit

If you find any mistakes, the next step in how to get a repo off your credit is to dispute the inaccuracies with the credit bureaus. To do this, you’ll need to write a formal dispute letter explaining the errors you’ve found. Include any supporting documentation that verifies your claim, such as loan statements or copies of correspondence with the lender.

Send your dispute via certified mail with return receipt requested, so you have proof that the credit bureau received it. The credit bureaus have 30 days to investigate and respond to your dispute.

If they find that the information is indeed inaccurate, they will correct or remove the repossession entry from your report. This process is a key element in how to get a repossession off your credit.

#4: Negotiate with the Lender to Remove a Repo from Credit

If the repossession information is accurate and you cannot dispute it, the next step in how to get a repo off your credit is to negotiate with the lender. This strategy can be particularly effective if the lender still holds some outstanding balance on the repossession.

One of the most popular methods is a “pay for delete” agreement. In this situation, you offer to pay off the remaining balance (or a portion of it) in exchange for the lender agreeing to remove the repossession from your credit report. Make sure to get any agreements in writing before making any payments.

Another option is to write a goodwill letter to the lender. In this letter, you explain your situation and request that the repossession be removed as a gesture of goodwill. Some lenders are willing to accommodate such requests, especially if you’ve since made consistent, on-time payments. This can be a highly effective way to learn how to get a repossession off your credit.

#5: Consider Professional Help to Remove a Repo from Credit

If you’re finding it difficult to navigate the process of how to get a repo off your credit on your own, you may want to consider seeking professional assistance. Credit repair companies specialize in helping people remove negative items, such as repossessions, from their credit reports.

These companies understand credit laws and know how to communicate with credit bureaus and lenders on your behalf. They can often expedite the process and improve your chances of success in getting a repossession removed.

However, it’s important to choose a reputable credit repair company with a proven track record. Doing so will make how to get repo off credit much more manageable.

Prevention: Avoiding Future Repossessions

Once you’ve successfully learned how to get a repossession off your credit, it’s crucial to take steps to prevent future repossessions. Maintaining a healthy credit profile will ensure that you never have to figure out how to get a repo off your credit again. Here are some essential tips for avoiding repossessions in the future.

Communicate with Your Lender to Avoid Learning How to Get a Repo Off Your Credit

If you find yourself struggling to make payments, it’s essential to communicate with your lender as soon as possible. Many lenders offer alternative payment arrangements, such as deferred payments or loan modifications, to help borrowers who are facing financial hardship.

Being proactive about your financial situation can prevent repossession and eliminate the need to learn how to remove repo from credit again. Lenders are more likely to work with you if you’re transparent about your struggles.

Create a Budget to Prevent the Need to Get a Repossession Off Your Credit

One of the most effective ways to avoid future repossessions and ensure you never have to worry about how to get a repo off your credit again is to create and stick to a budget. A well-planned budget allows you to track your income and expenses, ensuring that you allocate enough funds to cover your debt payments.

Start Today and Explore the Features Firsthand!

Build an Emergency Fund to Avoid Learning How to Remove a Repo from Credit

Unexpected expenses can lead to missed payments and repossessions. To avoid this, start building an emergency fund that can cover 3-6 months of living expenses. This cushion can prevent financial strain and reduce the chances of needing to figure out how to get a repossession off your credit.

Set Up Automatic Payments to Avoid Learning How to Get a Repo Off Your Credit

Setting up automatic payments for your loans and credit cards is another great way to avoid missed payments and repossessions. Many lenders even offer small discounts for using auto-pay, and it can prevent late payments that might lead to repossession.

Leveraging Client Dispute Manager Software to Remove a Repo from Credit

Start Today and Explore the Features Firsthand!

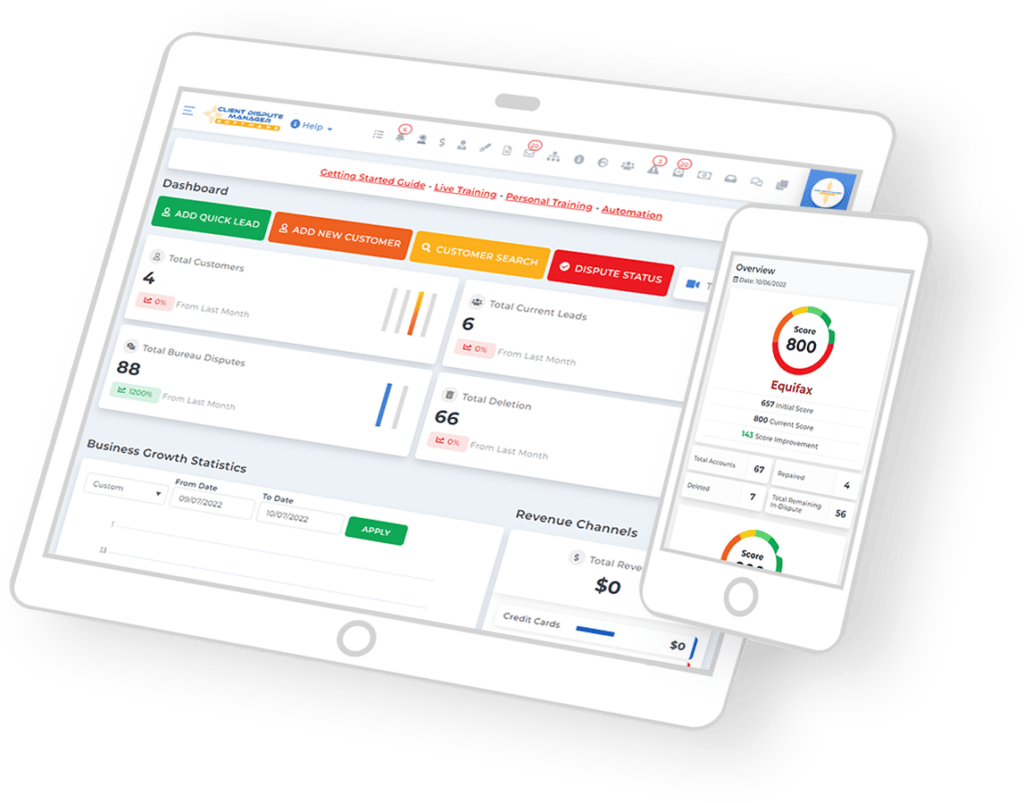

If you’re looking for an efficient way to manage your credit repair process, including how to get a repo off your credit, Client Dispute Manager Software can be a valuable tool. This software is designed to help individuals and credit repair businesses manage the entire credit dispute process more effectively and efficiently.

Here’s how Client Dispute Manager Software can assist in getting a repossession off your credit report:

Streamlined Credit Disputes

Client Dispute Manager Software offers a streamlined process for disputing inaccuracies on your credit report. Whether you’re dealing with incorrect repossession entries or other negative marks, the software guides you through creating and sending dispute letters to credit bureaus. It simplifies the often-complicated dispute process, saving you time and ensuring that your disputes are handled correctly.

Customizable Dispute Letters

The software provides customizable templates for dispute letters, which can be tailored to your specific needs. This feature is particularly useful when disputing a repo on your credit report. The software allows you to draft detailed, professional letters to dispute inaccurate repossession information, making it easier to communicate with credit bureaus and lenders effectively.

Tracking Progress

One of the challenges in credit repair is keeping track of disputes, responses, and deadlines. Client Dispute Manager Software enables you to monitor the progress of your credit disputes in real-time. You’ll be able to track which disputes are pending, resolved, or require follow-up actions, giving you better control over the process of how to get a repossession off your credit.

Automated Workflows

The software includes automated workflows that can help keep your credit repair journey on track. These automated processes help ensure that you are following the appropriate steps, whether you are working on how to get a repo off your credit or managing multiple disputes at once. It’s a powerful tool for individuals who may not have time to manually manage every aspect of credit repair.

Educational Resources

Client Dispute Manager Software also provides users with access to educational resources that explain the credit repair process in detail. If you’re still learning how to get a repossession off your credit, the platform offers insights and tips on how to handle various credit issues, including repossessions, to improve your chances of success.

Boosting Efficiency for Faster Results

One of the biggest benefits of using this software is that it can significantly reduce the time it takes to process disputes and get a repo off your credit. By automating tasks and organizing your dispute letters and follow-ups, Client Dispute Manager Software can help you see results faster, whether you’re working to remove a repossession or other derogatory marks from your credit report.

Start Today and Explore the Features Firsthand!

The Road to Credit Recovery After Removing a Repossession

After you’ve successfully removed a repossession from your credit report, the journey doesn’t end there. Learning how to get a repo off your credit is just the first step toward full credit recovery. Here are additional strategies you can use to continue improving your credit score and maintain a strong financial standing.

Pay Bills on Time After Removing a Repo from Your Credit

Once you’ve dealt with a repossession, it’s crucial to make sure you pay all your bills on time. Payment history is one of the most significant factors in determining your credit score, so this step is essential for long-term improvement. Setting up reminders or automatic payments can help you avoid late fees and protect your credit score.

Reduce Your Credit Utilization After Removing a Repo from Your Credit

Keeping your credit card balances low relative to your credit limits is another essential step. Aim for a credit utilization rate below 30% on all your credit cards. This will not only improve your credit score but also offset the damage caused by a repossession.

Diversify Your Credit Mix to Help After Removing a Repo from Your Credit

A diverse mix of credit types, such as credit cards, installment loans, and mortgages, can improve your credit score. However, only open new accounts when necessary, and focus on managing existing credit responsibly before adding new lines of credit.

Be Patient When Learning How to Remove a Repo from Credit

Credit recovery takes time sometimes months or even years. Stay committed to your credit recovery plan, and celebrate small victories along the way. Patience is crucial when it comes to fully recovering from a repossession and improving your financial situation.

Conclusion

Dealing with a repossession can feel overwhelming, but learning how to get a repo off your credit is the first step toward financial recovery. With the right strategies, persistence, and patience, you can successfully remove a repossession from your credit report and improve your financial standing.

By following this DIY guide and making smart financial choices moving forward, you can not only remove a repo from credit but also prevent future repossessions. Take action today, and you’ll be well on your way to a stronger financial future.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- 4 Things You Can Do in Removing An Inaccurate Repossession

- Unlock the Power of DIY Credit Repair Software: A Comprehensive Guide