In today’s fast-paced world, the credit repair industry is evolving rapidly, demanding efficient and effective solutions to stay competitive. If you’re an entrepreneur, an individual with credit issues, or someone keen on the credit repair industry, you might be wondering how to optimize your credit repair process with credit repair software automation.

This is where credit repair software automation comes into play, and tools like GoHighLevel can make a significant difference.

Start Today and Explore the Features Firsthand!

Understanding Credit Repair Software Automation

Credit repair software automation involves using technology to streamline and automate various tasks involved in credit repair. This includes tracking credit disputes, managing client information, and automating follow-ups. By leveraging automated credit repair tools, you can save time, reduce errors, and improve overall efficiency. As a result, you can focus more on helping your clients and growing your business.

Why Automate Your Credit Repair Process?

Before diving into how to use GoHighLevel for credit repair automation, let’s explore why you should consider automating your credit repair process. Automation eliminates repetitive tasks, allowing you to focus on more strategic activities. Automated systems ensure that every step of the credit repair process is followed accurately and consistently.

As your business grows, automation helps you manage an increasing number of clients without compromising on service quality. Moreover, reducing manual labor lowers operational costs, ultimately saving you money.

Integrating GoHighLevel with Credit Repair Software

GoHighLevel is a powerful tool designed to automate marketing and client management processes. Integrating it with your credit repair software can enhance your business operations significantly. Here’s how to get started.

Step #1: Set Up GoHighLevel

First, create an account on GoHighLevel if you haven’t already. Familiarize yourself with its dashboard and features. GoHighLevel offers various tools for marketing automation, CRM, and more. Take some time to explore these features to understand how they can benefit your business. Setting up GoHighLevel involves several key steps:

- Sign Up and Log In: Visit the GoHighLevel website and sign up for an account. After completing the sign-up process, log in to your new account.

- Dashboard Overview: Once logged in, spend some time navigating the dashboard. Familiarize yourself with the different sections, including Contacts, Pipelines, Marketing, and Automation.

- Customize Your Profile: Update your profile with relevant business information. This includes your business name, contact details, and any other pertinent information.

- Explore Features: GoHighLevel offers a range of features such as email marketing, SMS campaigns, funnel builders, and appointment scheduling. Take some time to explore these features to see how they can enhance your credit repair business.

- Integrate Other Tools: If you use other tools like Google Calendar or Stripe, integrate them with GoHighLevel to streamline your operations.

Start Today and Explore the Features Firsthand!

Step #2: Use Zapier for Integration

To connect GoHighLevel with your credit repair automation software, you’ll use Zapier, a platform that allows you to automate workflows by connecting different apps. Here’s a step-by-step guide:

- Create a Zapier Account: Sign up for Zapier if you don’t have an account yet. Visit the Zapier website and complete the registration process. Once registered, log in to your Zapier account.

- Find Your Apps: On Zapier’s dashboard, search for your credit repair software automation and GoHighLevel. Type the names of your apps in the search bar to find them easily.

- Create a Zap: A Zap is an automated workflow that connects two or more apps. Start by creating a new Zap. Click on “Make a Zap” to begin the setup process.

- Set the Trigger: Select your credit repair software automation as the trigger app. Choose an event that will start the automation, such as a new lead. This means when a new lead is added to your credit repair software, the automation will be triggered.

- Connect Your Accounts: Zapier will prompt you to connect your credit repair software automation account. You may need to provide API keys or login credentials. Follow the on-screen instructions to complete the connection.

- Set the Action: Choose GoHighLevel as the action app. Select an action, such as adding a new contact or sending an automated email. This action will be executed once the trigger event occurs.

Maximizing the Benefits of Credit Repair Software Automation

Now that your credit repair software automation is integrated with GoHighLevel, let’s explore how to maximize the benefits of this setup. By following these tips, you can make the most of your credit repair business automation tools.

Automating Lead Management

Managing leads is crucial for any credit repair business. With GoHighLevel, you can automate lead capturing, follow-ups, and nurturing. Use GoHighLevel to create landing pages and forms that capture leads automatically.

Set up automated email or SMS follow-ups to engage with leads instantly. Additionally, use GoHighLevel’s CRM to track lead interactions and automate nurturing campaigns. This approach ensures efficient and effective credit repair process automation.

Streamlining Client Onboarding

Client onboarding can be time-consuming, but automation can streamline the process. Send new clients a welcome email with information about the next steps. Automate the collection and management of necessary documents.

Furthermore, use GoHighLevel’s scheduling tools to automate appointment bookings, making it easier for clients to get started. By using automated credit repair tools, you can enhance the onboarding experience.

Enhancing Communication

Effective communication is vital in credit repair. Automation ensures timely and consistent communication. Keep clients informed about the progress of their credit repair through automated updates. Send automated reminders for upcoming appointments or deadlines.

Moreover, use GoHighLevel’s personalization features to send tailored messages based on client data. This enhances the effectiveness of your credit repair automation software.

Tracking and Reporting

Tracking and reporting are essential for measuring the success of your credit repair efforts. Generate automated reports to track key metrics such as dispute resolution rates and client satisfaction.

Use GoHighLevel’s analytics to gain insights into your business performance. Identify areas for improvement and make data-driven decisions to enhance your services. Effective credit repair process automation relies on accurate tracking and reporting.

Start Today and Explore the Features Firsthand!

Overcoming Challenges in Credit Repair Automation

While automation offers numerous benefits, it’s important to be aware of potential challenges and how to overcome them. By preparing for these challenges, you can ensure a smooth transition to an automated system.

Challenge #1: Initial Setup Complexity

Solution: Start small. Focus on automating one process at a time. Use available tutorials and support from platforms like GoHighLevel and Zapier. This gradual approach will help you understand the system better and avoid overwhelm.

Challenge #2: Integration Issues

Solution: Ensure that your credit repair software automation and GoHighLevel are compatible with Zapier. If you encounter issues, seek support from the respective platforms or hire an expert. Investing in professional help can save you time and prevent potential problems.

Challenge #3: Data Security

Solution: Ensure that all data transferred between platforms is encrypted. Use strong passwords and enable two-factor authentication. These security measures will protect your clients’ sensitive information and maintain trust.

Start Today and Explore the Features Firsthand!

Integrating Client Dispute Manager Software with Credit Repair Automation

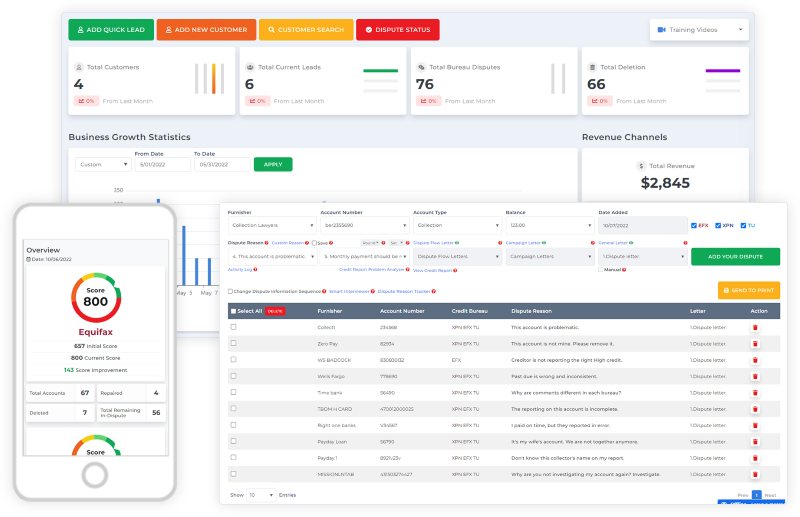

Client Dispute Manager Software is an essential tool for any credit repair business. It provides comprehensive features to manage client disputes, track progress, and streamline communication.

Integrating Client Dispute Manager Software with your credit repair automation setup, including GoHighLevel, can significantly enhance your business efficiency and client satisfaction.

Maximizing the Benefits of Client Dispute Manager Software Integration

By integrating Client Dispute Manager Software with GoHighLevel and other credit repair business automation tools, you can maximize the benefits of automation. Here are some tips:

- Automate Client Updates: Use automation to keep clients informed about the progress of their disputes. Send automated updates through GoHighLevel’s communication tools.

- Enhance Client Communication: Leverage Client Dispute Manager Software’s client portal and GoHighLevel’s personalized messaging features to maintain consistent and effective communication with clients.

- Streamline Dispute Resolution: Automate the generation and sending of dispute letters to credit bureaus. This will save time and reduce manual errors.

- Improve Reporting and Analytics: Use detailed reports from Client Dispute Manager Software to track dispute resolution rates, client satisfaction, and overall business performance.

Start Today and Explore the Features Firsthand!

Frequently Asked Questions (FAQs)

How Does Credit Repair Software Automation Benefit My Business?

Credit repair software automation streamlines various tasks involved in credit repair, such as tracking disputes, managing client information, and automating follow-ups.

By leveraging automated credit repair tools, you can save time, reduce errors, and improve overall efficiency, allowing you to focus more on helping your clients and growing your business.

What Is The Role Of Gohighlevel In Credit Repair Automation?

GoHighLevel is a powerful tool designed to automate marketing and client management processes. By integrating GoHighLevel with your credit repair software automation, you can automate lead management, client onboarding, communication, and tracking.

This integration enhances your business operations, improves client satisfaction, and boosts efficiency.

How Can I Integrate Client Dispute Manager Software With Gohighlevel?

To integrate Client Dispute Manager Software with GoHighLevel, you can use Zapier to connect both platforms. Create a Zapier account, find both apps, and create a Zap.

Set the trigger in Client Dispute Manager Software, map the data fields to GoHighLevel, and test the Zap to ensure it works correctly. This integration will enhance your credit repair process automation.

What Are The Common Challenges In Credit Repair Automation And How Can I Overcome Them?

Common challenges include initial setup complexity, integration issues, and data security concerns. To overcome these challenges:

- Start small and focus on automating one process at a time.

- Ensure compatibility between your credit repair software automation and GoHighLevel.

- Use strong passwords, enable two-factor authentication, and ensure data encryption to protect sensitive information.

How Can I Maximize The Benefits Of Credit Repair Software Automation?

To maximize the benefits of credit repair automation software, follow these tips:

- Automate lead capturing, follow-ups, and nurturing with GoHighLevel.

- Streamline client onboarding with automated welcome emails and document management.

- Enhance communication with automated updates and personalized messages.

- Use detailed reports and analytics to track performance and make data-driven decisions.

By implementing these strategies, you can effectively use credit repair business automation tools to improve your efficiency and provide better service to your clients.

Conclusion

Credit repair software automation, when integrated with powerful tools like GoHighLevel, can revolutionize your business operations. By automating lead management, client onboarding, communication, and tracking, you can enhance efficiency, reduce errors, and provide better service to your clients.

Whether you’re an entrepreneur looking to scale your business or an individual seeking to improve your credit, embracing automation is a step in the right direction. Start optimizing your credit repair process today with GoHighLevel and see the transformative impact of automation on your business.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- Great Ways to Educate Your Clients Through Manage Portal Content

- Fixing Credit: A Guide For New and Aspiring Credit Repair Consultants