Credit Repair books are undoubtedly becoming more in demand nowadays as individuals perpetually seek ways to repair their credit scores. If you are looking into repairing your financial status or planning to start a credit restoration business, you should add these reliable books to your list.

Table of Contents

CAN A BOOK ON CREDIT REPAIR HELP WITH YOUR CREDIT SCORE?

Credit repair has always been vital in one’s financial journey. Personal, auto and mortgage lenders often assess your credit scores to determine whether you have enough creditworthiness to qualify for a loan application.

Moreover, they are also highly based on your three-digit credit scores to know the interest rate you’re bound to pay on your loans. However, lenders today aren’t solely the ones that are looking into credit scores when it comes to making critical financial decisions.

Employers have also been part of the equation, looking into job applicants’ credit information when necessary to gain insight into the best step to take when hiring new employees or team members.

Most often, candidates who possess low credit scores miss out on securing the job of their dreams simply because one’s credit can already be very telling of how disciplined or trustworthy they can be.

Even auto insurance firms also use credit scores as an essential viable basis whenever they lay out policy premiums. From these instances alone, it’s quite clear that a strong credit score is essential if you want to ensure a better and stress-free financial future for yourself.

This is where credit repair books can educate you and provide you with the necessary information.

WHY REPAIR YOUR CREDIT?

If you know how important credit is, then you also probably value the significance of credit repair and regular monitoring once in a while.

For this reason, you might have already tried and tested various ways to fix your credit through several financial services. The unfortunate truth is that credit repair, as a service in itself, doesn’t exactly present the most credible reputation.

Credit repair services are often swamped with deceitful scammers who enjoy playing with people’s need for a quick credit score repair. This, in turn, has consequently led to plenty of fraudulent matters within the industry.

But while this is true, credit repair still remains to be a legit service that operates under federal law jurisdiction. It’s your right to fix your credit, and you also have several important reasons to pursue it.

Nonetheless, you might also find the idea of consulting credit repair books to be of great usefulness. Credit repair books, unlike financial services, offer an easy way of looking into the proper methods of handling your credit – all of which are proven and tested by individuals who have already gone through the same dilemma.

But before we dive deeper into the best credit repair books, here are some practical reasons why repairing your credit is a must.

BENEFITS OF FIXING YOUR CREDIT

1. You Can Quickly Identify Errors in Your Credit Report

Statistics show that there’s usually a one out of four chance that a significant error is present in credit reports. This study by the Federal Trade Commission also reports that at least one in five credit reports tend to contain mistakes that would typically affect one’s credit score, consequently decreasing their chances of getting loan approval.

What’s worse is that one in twenty of these contains specific errors that are projected to pull your credit score down by roughly 25 points or even greater. It’s worth noting that this isn’t just a minor problem that affects a particular demographic since it can happen to everyone.

If you look closely, the statistics show that you’re likely to become a victim of an erroneous credit report or fraud. That said, make sure to consider all the steps necessary so you can avoid them as much as possible.

Without active effort, you’ll only be setting yourself up for financial failure and will be left with little to no money at all.

2. Credit Repair Help Improve Your Credit Score

Remember that credit repair doesn’t necessarily translate to an improved credit score – that’s not the primary goal of fixing your credit. Credit repair is essential because they help eliminate the potential mistakes or errors that may have been overlooked in your credit scores.

When you do so, it also somehow boosts your credit score in the same way since you get to be free of the report errors that would have dragged down your original score otherwise. This basically means that a single credit dispute or complaint can already lead to a significant credit score increase.

You might also want to repair your credit if you’re looking for a quicker way to grow it and gain an excellent score in no time. Though a better credit score is just one of the positive side effects of repairing your credit, it’s also the most convenient way to boost your score.

3. You Get The Opportunity To Negotiate Lower Rates For Your Credit Card

Almost all credit cards have specific interest rates, most of which fluctuate on several factors. For example, an increase in credit card prime rates can also translate into an increased credit card APR.

However, the good news about this is that you can always reach out to your creditors or lenders for lower interest rates. This is only possible if you maintain an error-free credit report and a good credit score.

4. You Can Apply For Lower Interest Rates When Refinancing Your Loans

When applying for loans, you’ll usually need to pay respective interest rates. Your credit score is usually the main determining factor in the possible interest rates you’re eligible for.

In a nutshell, a good credit score usually means lower interest rates. It’s also a good indicator that you can easily seize currently available interest rates as soon as possible.

5. You'll Have A Less Stressful Approval Process When Refinancing

Waiting for pending loan approval is nerve-racking and stressful, to say the least. It can be anxiety-inducing to think about whether your credit score is good enough to secure your loan application, especially if you need one for emergency purposes.

And, of course, getting rejected is a kind of heartbreak in itself. But this doesn’t have to be the case since repairing your credit is an easy ticket to leveraging your approval chances. The two primary determining factors when getting your loan approved is your debt-to-income ratio and, of course, your credit score.

Opting for credit repair helps simultaneously fix your score, leaving you without too much to worry about throughout the process. You’ll only have to look out for the debt-to-income ratio, though you can always look at it online and free of charge.

If you’re already confident with your DTI and have repaired your credit score, you’ll find it easier to apply for more loans confidently and without stressing over minuscule worries. Similarly, you’ll also find property rental applications to be easier and hassle-free.

6. You Can Easily Become Ready For A Mortgage

Most people apply for a loan for varying reasons, but perhaps the most common is purchasing a property. Unfortunately, rising prices in rent have significantly hindered many people’s capability to purchase one.

But the good thing is that you can always qualify for affordable homeownership once your application gets approved. That said, having good credit is an essential part of becoming prepared for a mortgage. When lowering your loan interest rates, you’d find that nothing is more essential than a mortgage.

Not only that, mortgage interest charges pile up to whopping tens of thousand dollars over an average loan’s lifetime – quite a significant sum of money if you consider paying it out of pocket. You want a high credit score before applying for your mortgage to cut down on costs and avoid breaking the bank.

CREDIT REPAIR BOOKS

Now that you know the benefits of credit repair, you’re probably now considering fixing your own. But even so, you may still be quite unsure about how to go about it, how to start, and where to find such services.

Fortunately, credit repair books are an excellent option for you to know some of the tried-and-tested secrets and tips regarding credit repair. Besides, what’s better than reading a book about how someone has successfully overcome all the hurdles brought by having poor credit

Credit repair books have become hugely popular now since it details real-life experiences of individuals who have been in the same boat before and now want to share their experiences with other people struggling with the same dilemma.

Unlike online credit repair financial services, it’s also safe to say that reading credit repair books give some form of assurance and comfort to those who want to take the right action in their lives but are still quite hesitant to do so.

If you currently have poor credit, you might initially have reservations about consulting for credit repair services – the difference with credit repair books is that you can facilitate your own journey at your personal discretion, time, and pace.

Simply put, credit repair services only offer some sort of clear-cut path you need to pursue along the way. But with credit repair books, you equally get an overwhelming amount of knowledge, input, and valuable techniques that you can treasure for life.

They offer a sense of guidance when it comes to letting you take that decisive step to live the life you want and avoid moments that can potentially lead you into a financial rut. Now, there are so many best credit repair books out there you can purchase and learn from. However, here is a noteworthy book recommendation.

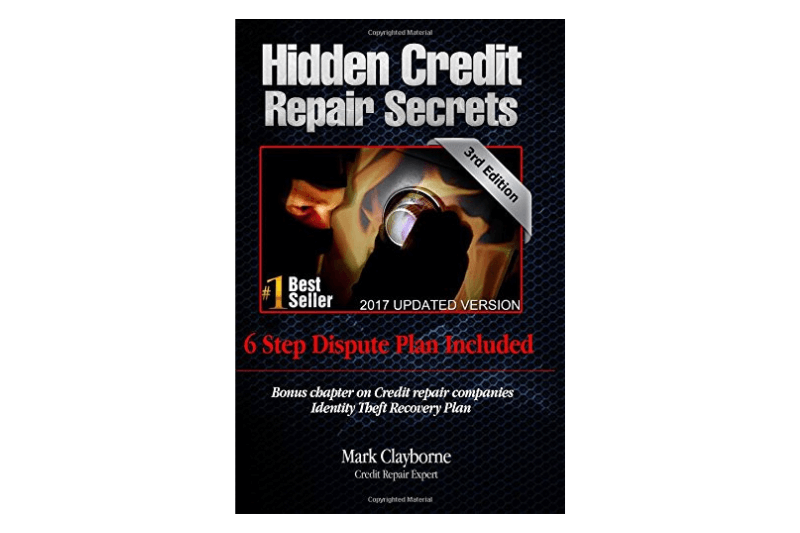

HIDDEN CREDIT REPAIR SECRETS BY MARK CLAYBORNE

The Hidden Credit Repair Secrets is one of the best credit repair books out there, and it’s written by Mark Clayborne. From the title alone, it packs all the necessary information you need to know about credit repair and even details a step-by-step process for handling credit disputes.

The book is a comprehensive and informative account of how you can restore your credit scores in easy, clear-cut steps. It’s essential to recognize that most of the common causes of failures are ignorance and a lack of knowledge about particular things.

However, this book offers you the requisite knowledge you need to start steering your life in the right direction. This provides an introspective yet objective view of knowing how to make decisions for yourself simply by having the necessary information you need in your hands.

It’s true that most individuals are holding back and are fearful of checking their credit due to certain worries that it will only go wrong. While understandable, fearing what you don’t know only results in missed opportunities and poor decisions.

Mark Clayborne presses readers into asking themselves what they would do with their lives if they had the knowledge, they need to pursue their dreams. Hidden Credit Repair Secrets lets you avoid common unfortunate incidents with credit applications.

With this, you can rest easy at night, knowing you steered clear of scams and collection calls. You’ll now know how to stick to a budget and spend without worrying about pending settlements or even avoid unwarranted family fights over money. You get to live daily, not being anxious about opening your email or looking at your bills.

Many readers of this book on credit repair have offered their personal testimonies about how it has helped them get through their respective situations.

With over 140 positive reviews, readers are satisfied with the effective step-by-step game plan and the valuable strategies recommended when you’re on the path of growing or building your credit. Reviews have particularly detailed the pay-offs, especially regarding handling questionable decisions, inaccurate errors, collections, and credit disputes.

The strategies listed in the book have served as a comprehensive guide that essentially helps raise one’s credit score and how you can settle your debts even in tricky situations.

HOW AND WHERE TO FIND A BOOK ON CREDIT REPAIR

If you’re looking for a credit repair book right now, you can consider looking for them online. Some of the best books on credit repair are conveniently up for sale on various selling platforms.

Thanks to the Internet, searching for what you want and need has become extremely convenient since you already get various search results in just a few clicks. When you search “best credit repair books” on the Internet, there usually are ready-made articles or recommendation lists about the popular books that center on the topic.

If you don’t want to stress yourself out further, you can just click on one of these articles and see if there’s a book you like on credit repair. Most of these already have an affiliate link to the book where you can buy directly.

Nonetheless, here are some notable platforms where you can find the best credit repair books free of charge and those that are paid. Some of these books can be available in e-book formats, or you can buy them in physical copy as well.

Ensure to read each credit repair book’s product description thoroughly before purchasing them so that you’re guaranteed to get what you’re looking for.

1. Amazon

One of the most obvious platforms for finding credit repair books is Amazon. As a popular eCommerce selling platform, Amazon houses many kinds of credit repair books for your daily dose of knowledge on credit repair. The price also varies depending on the content and the author.

Most credit repair books on Amazon are a quick starter guide on handling personal finance and handling credit. Others also touch on a few critical topics regarding handling credit disputes and efficient techniques when handling the entire process.

2. Audible

Apart from Amazon, Audible is also a great place where you can find books on credit repair. However, this is different in such a way that most books sold here are meant for auditory listening.

If you mainly prefer podcast types or have an auditory way of accumulating information, this may be the ideal platform to scour the best credit repair books for your needs.

It also sells many books on credit repair, including ones that focus on how you can boost your credit scores quickly or how you can take advantage of federal laws to help your case.

Either way, Audible provides quality credit repair books designed to help you through your financial situation, with varying topics for you to choose from.

3. eBay

eBay is also a popular online platform that sells millions of books. You can practically find every book genre on this platform, from fiction, non-fiction, and self-improvement. You’ll mainly find a wide range of credit repair books here at an affordable price.

It’s worth noting that some books sold on eBay can be pre-owned or secondhand, so it’s best to decide whether you’d prefer a new book to learn from or if you’re just there for the content.

Either way, it’s recommended that you first verify the quality and reputation of the store or seller so you can still be guaranteed the best value for your money upon purchase.

The great thing about the eBay platform, though, is it’s one of the most affordable places for online shopping. Not only are you presented with millions of options, but you also don’t have to worry about overpriced commodities or items.

4. Credit Repair Books Free Resource.

Of course, if you are looking for credit repair books free of charge, you can try looking for them online. Another option is to go to your local library or other book platforms where you can find best credit repair books free or paid.

WHO ARE THESE BOOKS ON CREDIT REPAIR FOR?

Books on credit repair are mainly for individuals who currently have poor or bad credit and are struggling with their loan applications. Everyone in this situation is familiar with the anxiety and frustration of having rejected loan applications repeatedly, which amplifies the need for proper guidance about how to handle this dilemma better.

But beyond having poor credit, a credit repair book is also designated for people who want to take the risk of making the decisive step to secure their financial future.

Books on credit repair are for individuals willing to take the chance to improve their current situations by actively seeking the knowledge that will help them do it.

If you’re often quite uncertain about what to do when handling credit debt or fixing your credit scores, then opting for a credit repair book is a good idea. These books are for people with big dreams and aspirations who are only held back by fear.

The content and ideas these books provide can significantly help you know the right strategies needed for making decisions. Most importantly, they also help you avoid questionable items and misleading items present in your credit report, which could consequently affect your loans.

You’re a target audience for credit repair books if you’re planning to take action to improve your current financial situation. These easy-to-read materials will offer valuable advice about handling your personal finance and help you live the life of your dreams without spending a good chunk of your energy constantly worrying about bills and pending fees.

BENEFITS OF LEARNING FROM THE BEST CREDIT REPAIR BOOKS

As with reading any kind of book, you get endless benefits from choosing credit repair books as a source of information. First, you obtain valuable knowledge which you wouldn’t find anywhere otherwise.

Wisdom almost often comes from basic knowledge, and having essential input from other people allows you to equally formulate smart decisions on your own.

The knowledge you gain from reading a book on credit repair is always open to interpretation, though what matters is how you apply it to your life and present situation.

Gaining information from books on credit repair is a way to humble yourself and recognize that there’s still a lot to learn. If anything, it only entices your curiosity about many things simultaneously. Reading credit repair books is also a form of exercise for your brain.

We understand that the digital era has made everything convenient these days, but reading physical credit repair books is still the best way to tune out of the digital world and concentrate.

With books, you are sucked into an entirely different realm where you only have your thoughts to entertain. In turn, credit repair books give you access to in-depth knowledge, which can translate into improved productivity and better habits.

Who knows, you will end up not just fixing your credit but also starting your very own business to help others repair their credit.