In today’s digital age, safeguarding your financial identity is more critical than ever. A credit freeze, often referred to as a security freeze, is one of the most effective ways to protect your credit report from unauthorized access.

Whether you’re dealing with the aftermath of identity theft or proactively securing your credit, understanding how to freeze your credit can save you from future headaches.

This guide will walk you through the reasons, steps, and tools needed to successfully freeze your credit and protect your financial health.

Start Today and Explore the Features Firsthand!

What is a Credit Freeze?

A credit freeze, or security freeze, is a tool that restricts access to your credit report. It prevents creditors, lenders, and even identity thieves from opening new accounts in your name. This protective measure ensures your financial identity stays safe from unauthorized access.

Why Use a Credit Freeze to Protect Your Credit?

Freezing your credit is a proactive step to safeguard your identity. By limiting access to your credit file, you reduce the risk of identity theft, even in the event of a data breach. Learning how to freeze your credit report helps you control who can access your credit and offers peace of mind.

It also ensures that your financial information remains secure during vulnerable periods. Additionally, it provides a free and simple solution for anyone concerned about unauthorized access to their credit report.

When Should You Freeze Your Credit Report?

There are certain situations where freezing your credit is highly recommended. For example, if you have been a victim of identity theft or suspect fraudulent activity, initiating a freeze is a necessary step. Additionally, if you are not planning to apply for new credit anytime soon, freezing your credit can serve as a preventative measure.

Understanding how to freeze your credit for free during these times provides added security for your financial health. Taking action promptly can help mitigate risks and prevent potential financial losses.

Benefits of Freezing Your Credit Report

Freezing your credit has numerous advantages. It prevents unauthorized parties from accessing your credit report, significantly reducing the chances of fraud. Moreover, knowing how to freeze your credit can save you from the financial and emotional toll of identity theft.

It is a free and effective way to maintain control over your credit information. By taking this measure, you also protect your credit score from any fraudulent impacts.

How Does a Credit Freeze Protect Your Financial Identity?

A credit freeze serves as a robust barrier against unauthorized access to your credit report. It ensures that no one can open accounts or apply for loans under your name without your consent. Even if hackers gain access to sensitive data, a frozen credit report prevents misuse.

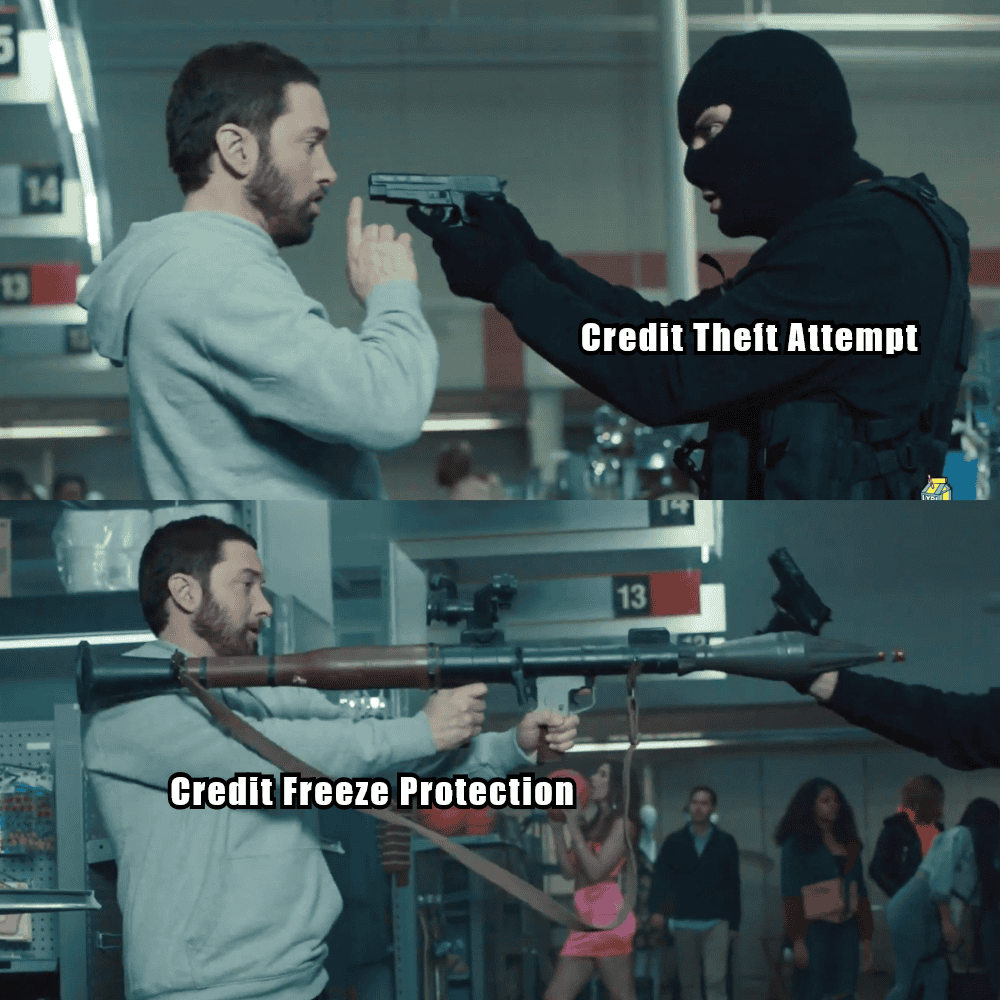

How Hackers Exploit Unprotected Credit Reports?

Hackers often target unprotected credit reports to open fraudulent accounts. They use stolen information, such as Social Security numbers, to apply for loans or credit cards.

Understanding how to freeze your credit report can stop these attempts, protecting your financial reputation. This step also acts as a deterrent for hackers seeking easy targets.

Why Consent is Essential for Credit Freezes?

A key benefit of freezing your credit is that no one, including potential creditors, can access your report without your explicit permission. This means you retain complete control over who views your financial data.

Knowing how to freeze your credit ensures you maintain this critical level of oversight. Without your consent, unauthorized applications or credit checks cannot proceed, securing your financial identity.

Start Today and Explore the Features Firsthand!

Common Misconceptions About Freezing Your Credit

Many people mistakenly believe that freezing their credit affects their credit score. However, this is not true. A credit freeze does not impact your existing accounts or your credit score.

Learning how to freeze your credit for free can dispel these myths and empower you to use this tool effectively. It’s also worth noting that a credit freeze does not limit your ability to use existing credit cards or lines of credit.

Steps to Freeze Your Credit with Equifax

Freezing your credit with Equifax is straightforward and free. Begin by visiting their official website and navigating to the credit freeze section. You will need to provide your personal details, including your full name, Social Security number, and current address.

Verifying Your Identity for Equifax Credit Freeze

Equifax requires identity verification to process your freeze request. You may need to upload documents such as a driver’s license or passport. This step ensures that only authorized individuals can initiate a credit freeze. Verifying your identity is a critical step in ensuring the security of your credit freeze.

Managing Your Equifax Freeze

Once your credit freeze is in place, Equifax will provide you with a unique PIN or password. This allows you to manage or lift the freeze as needed.

Knowing how to freeze your credit report with Equifax ensures you can take control of your credit protection. Retaining this PIN securely ensures you can access your freeze when required.

Start Today and Explore the Features Firsthand!

Benefits of Freezing Your Credit with Equifax

Equifax offers real-time updates and a user-friendly platform to manage your freeze. Their system is designed to make how to freeze your credit a seamless and stress-free experience.

By using their tools, you can maintain your financial security with confidence. Equifax also provides quick support to help users navigate any issues.

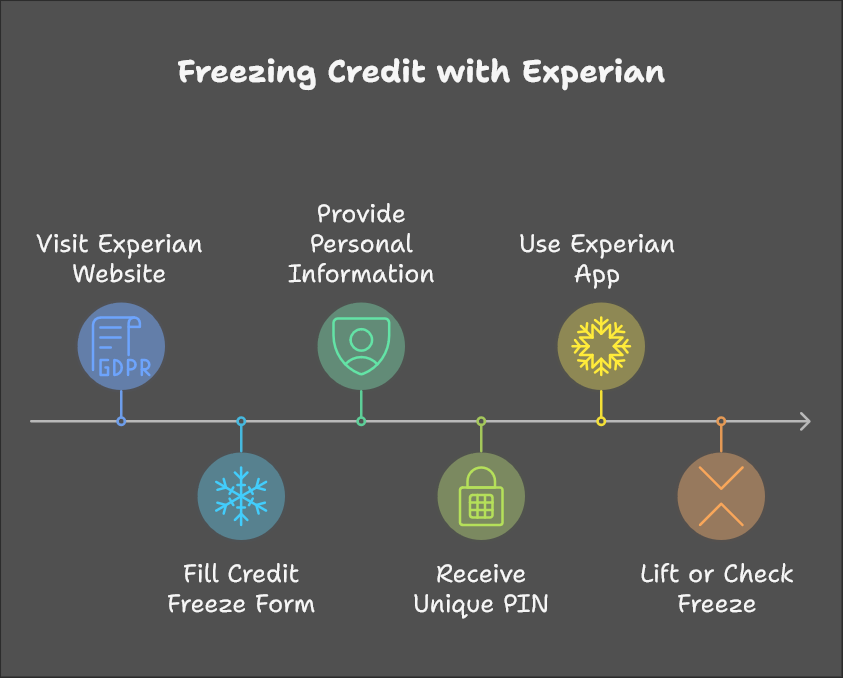

Steps to Freeze Your Credit with Experian

Freezing your credit with Experian involves a few simple steps. Start by visiting their website and filling out the online credit freeze request form. Provide the necessary information, such as your Social Security number and address, to initiate the process.

Secure Your PIN for Your Experian Credit Freeze

Once your freeze is approved, Experian will issue a unique PIN or password. This is required to lift or temporarily remove the freeze.

Understanding how to freeze your credit for free with Experian ensures that your financial data remains protected. Keeping your PIN secure is essential for managing your credit freeze effectively.

Experian’s App-Based Credit Freeze Management

Experian offers an app that allows users to manage their credit freezes easily. Through the app, you can lift a freeze temporarily or check its status.

Learning how to freeze your credit report with Experian’s app adds convenience to the process. This feature is especially useful for those who frequently need to adjust their freeze status.

Benefits of Using Experian’s Credit Freeze Tools

Experian provides additional features such as fraud alerts and credit monitoring. These tools complement a credit freeze, offering comprehensive protection.

Knowing how to freeze your credit with Experian can significantly enhance your financial security. By using their platform, you gain better insights into your credit health.

Steps to Freeze Your Credit with TransUnion

TransUnion makes it easy to freeze your credit through their online portal. Start by creating an account or logging in with existing credentials. Submit your personal information and any required documents to verify your identity.

TransUnion’s Freeze Management System

Once your freeze is active, TransUnion will provide you with a PIN. This PIN allows you to manage or lift the freeze when necessary.

Knowing how to freeze your credit report with TransUnion ensures that your credit remains secure at all times. Managing your freeze efficiently prevents any unwanted delays when applying for credit.

Start Today and Explore the Features Firsthand!

Customer Support for TransUnion Credit Freezes

TransUnion offers excellent customer support to guide you through the freezing process. If you encounter any issues, their team is available to help.

Learning how to freeze your credit with TransUnion ensures you have access to reliable support when needed. Their representatives can also help with troubleshooting account-related queries.

Advantages of Freezing Credit with TransUnion

TransUnion’s platform is intuitive and secure, making how to freeze your credit for free a straightforward process. Their focus on user experience ensures that freezing your credit is both quick and effective. Additionally, their system integrates well with other credit protection tools.

Information Required to Initiate a Credit Freeze

To initiate a credit freeze, you must provide accurate personal information. This includes your full legal name, Social Security number, date of birth, and address. You will also need to supply proof of identity, such as a government-issued ID.

Preparing Your Documents for a Credit Freeze

Ensure that all documents are clear and legible before submission. This minimizes delays in processing your freeze request.

Understanding how to freeze your credit report efficiently starts with thorough preparation. Submitting accurate documentation reduces the likelihood of errors.

Keeping Your Records Safe for Credit Freeze Management

Once your freeze is in place, keep your PIN or password in a secure location. This ensures that you can manage your freeze without difficulty. Knowing how to freeze your credit for free includes safeguarding your credentials. Secure record-keeping helps prevent unauthorized access.

Avoiding Common Mistakes in Credit Freezing

Errors in the submission process can delay your credit freeze. Double-check all information before submitting your request to avoid issues.

Learning how to freeze your credit accurately saves time and ensures prompt protection. Proper review ensures your freeze is implemented smoothly.

Conclusion

Freezing your credit is a powerful tool for protecting your financial identity. By understanding how to freeze your credit, you can prevent unauthorized access to your credit report, reduce the risk of identity theft, and maintain peace of mind.

Whether you use Equifax, Experian, or TransUnion, the process is straightforward and free. Take the necessary steps today to safeguard your financial future and ensure your credit remains in your control.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: