As a provider of credit repair services, your main goal is to help your customers improve their credit scores by creating dispute letters. At the same time, you want to have or use credit repair software that will make all the tasks as automated as possible.

Once those dispute letters have been submitted to the credit bureaus, creditors, and collectors, it is now time for you to wait for their response. These responses from the credit bureaus, creditors, and collectors might take up to 30 days and sometimes even longer.

Be your own boss. Set your own schedule and travel when you want.

Start a credit business today. Click to learn more.

Start a credit business today. Click to learn more.

So how can you change the follow-up letter due date for the dispute letters you created in the credit repair software for business so you can keep track of when to follow up with each dispute?

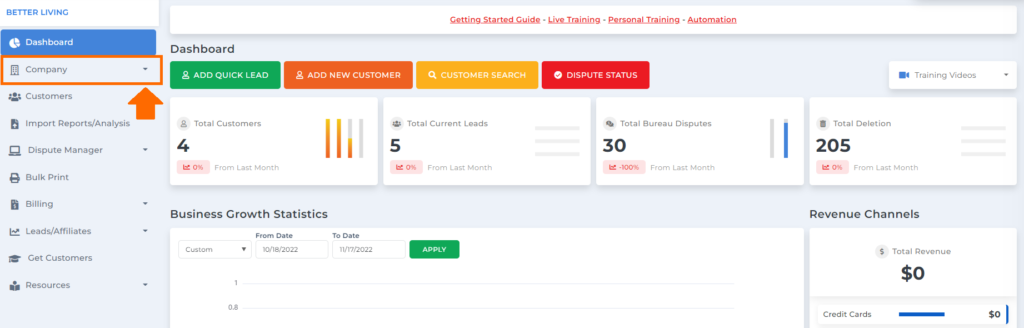

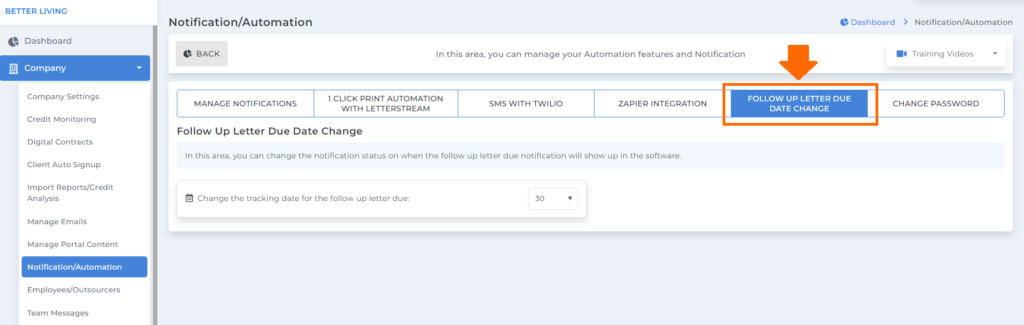

To change the follow-up letter due date inside the credit repair software for business, select the company menu option.

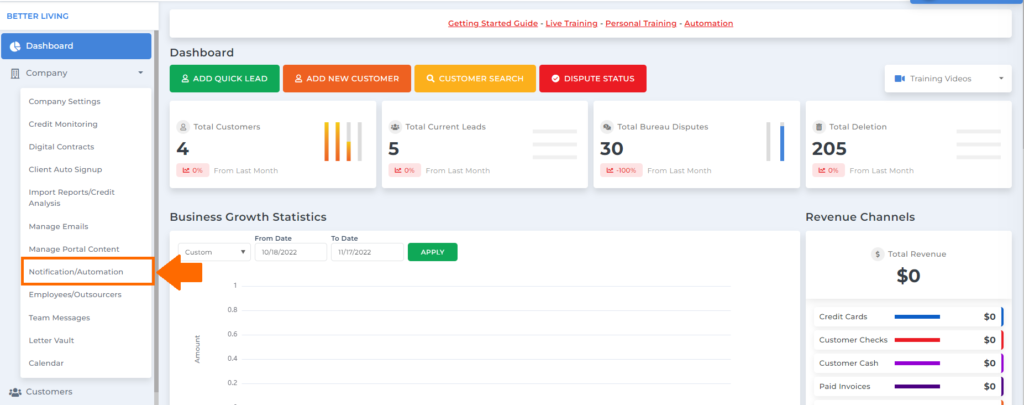

Then under the company menu option, click notification/automation.

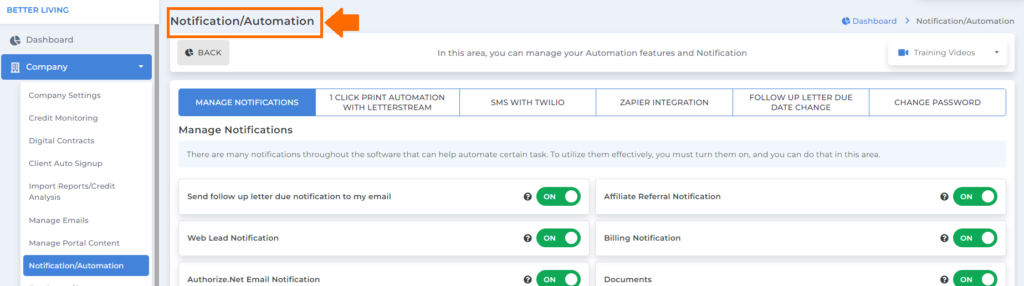

You will be routed to the notification and automation screen, where you can manage your automation features and notification.

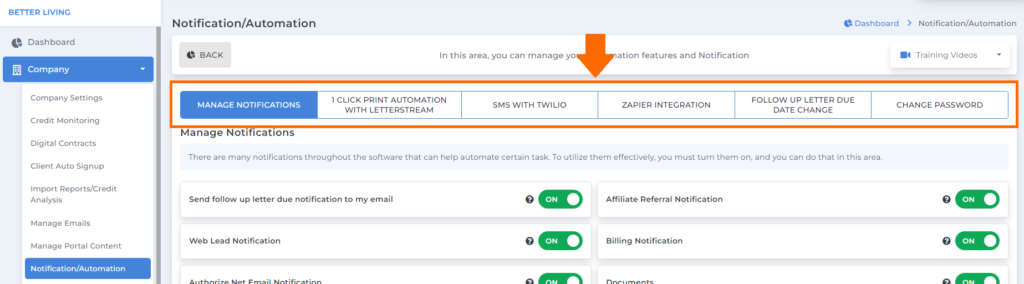

Under the notification/automation screen, you will see the following: manager notifications, 1-click print automation with Letterstream, SMS with Twilio, Zapier integration, follow-up letter due date change, and change password.

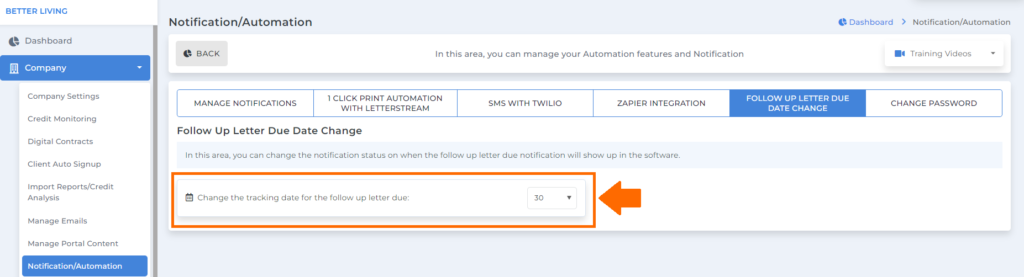

Go to the follow-up letter due date change tab to pick the number of days you prefer for your follow-up.

In this section, you can change the notification status for the number of days the follow-up letter due notification will show up inside the software.

Be your own boss. Set your own schedule and travel when you want.

Start a credit business today. Click to learn more.

Start a credit business today. Click to learn more.

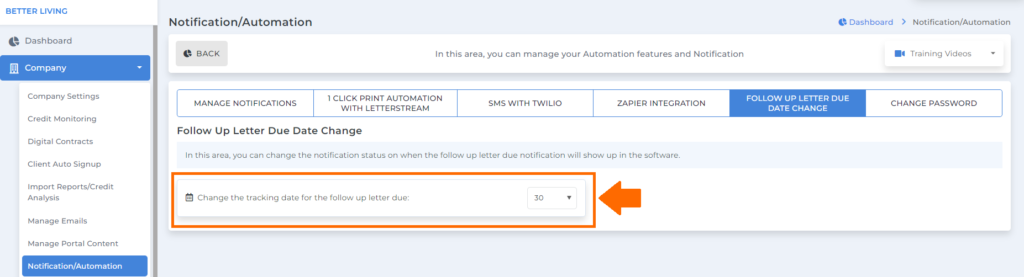

Then click the dropdown to change the number of days; it could be 30, 35, or 40 days.

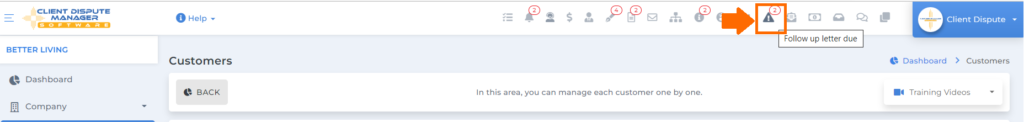

Let’s say you picked 30 days for the follow-up letter due date and sent your dispute letters today. After 30 days, a notification will show up in the software to remind you about your dispute letters due for follow-up.

This is the notification icon for the follow-up letter due in the software.

For the follow-up letter due date, it will apply to all the dispute letters you will be sending. That’s why it is important to pick your desired number of days for follow-up so you won’t miss any dispute letters due for follow-up.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.