Your credit score plays a crucial role in your financial health. Whether you’re looking to buy a home, secure a car loan, or obtain better interest rates, a good credit score can make all the difference.

However, many people struggle with credit issues, often feeling overwhelmed by the process of fixing their credit. Fortunately, DIY credit repair software can help you take control of your credit situation without relying on expensive credit repair agencies.

This guide will explore the best DIY credit repair software, how it works, its benefits, and how you can leverage white label DIY credit repair software and private label credit repair software DIY to build a business in the credit repair industry.

Additionally, if you’re looking for free DIY credit repair software, we’ll compare the best options available.

Start Today and Explore the Features Firsthand!

Understanding Common Credit Issues

Improving credit can be a daunting task, but with DIY credit repair software, individuals can take control of their financial health.

Whether you’re looking for the best DIY credit repair software or seeking free DIY credit repair software, these tools provide step-by-step guidance to dispute errors, track credit improvements, and develop positive financial habits.

For entrepreneurs, investing in white label DIY credit repair software or private label credit repair software DIY can offer a scalable business opportunity in the credit repair industry.

Common Credit Score Challenges

A low credit score can result from several common financial missteps, making it difficult to qualify for loans or better interest rates. DIY credit repair software helps users identify and fix these problems efficiently.

With options like free DIY credit repair software for beginners or the best DIY credit repair software for more advanced solutions, individuals can work toward better financial health.

- Late Payments and Missed Payments – These are among the biggest factors impacting credit scores. Using DIY credit repair software, you can set reminders and automate payments to avoid this issue.

- High Credit Utilization – If you’re using too much of your available credit, your score can drop. The right free DIY credit repair software can help you track and manage credit utilization.

- Errors on Credit Reports – Mistakes in your credit report can harm your score. The best DIY credit repair software provides automated dispute letters to correct inaccuracies.

- Collections, Charge-offs, and Bankruptcies – These can significantly lower your credit score. While they take time to recover from, white label DIY credit repair software can provide insights into improving your credit over time.

- Too Many Hard Inquiries – Applying for too much credit in a short period can hurt your score. Private label credit repair software DIY can help track and limit unnecessary applications.

How DIY Credit Repair Software Can Address Credit Challenges?

Many individuals struggle with credit issues that impact their financial well-being. DIY credit repair software provides an accessible and cost-effective way to tackle these problems head-on.

Whether you’re looking for free DIY credit repair software or investing in the best DIY credit repair software, these tools can help automate dispute processes, monitor credit changes, and offer actionable financial insights.

For business owners, white label DIY credit repair software and private label credit repair software DIY present opportunities to provide professional credit repair services under their own brand.

Misconceptions About Credit Scores

There are many myths about credit scores that can lead people to make poor financial decisions. Some of the most common misconceptions include:

- Checking your credit report lowers your score (it doesn’t—only hard inquiries do).

- Paying off old debts will instantly boost your credit score.

- You need to hire a credit repair company to fix your credit.

With free DIY credit repair software, you can address these issues and improve your credit legally and effectively.

Exploring the Best DIY Credit Repair Software Options

Finding the right DIY credit repair software can make a significant difference in how effectively you improve your credit. With so many options available, it’s essential to choose the best DIY credit repair software that aligns with your financial goals.

Whether you’re looking for free DIY credit repair software for personal use or exploring white label DIY credit repair software and private label credit repair software DIY to start a business, selecting a solution with the right features can help streamline the process.

Start Today and Explore the Features Firsthand!

What Makes a Credit Repair Software the Best?

When choosing the best DIY credit repair software, it’s important to assess your specific needs whether you’re improving your personal credit or launching a credit repair service.

Many users start with free DIY credit repair software to get familiar with the tools before upgrading to premium solutions.

For entrepreneurs, leveraging white label DIY credit repair software or private label credit repair software DIY ensures you can offer customizable, compliant services under your own brand., consider the following features:

- Credit monitoring tools for real-time score updates.

- Automated dispute letter generation for correcting errors.

- Personalized credit improvement plans based on your financial profile.

- Ease of use with a user-friendly interface.

How DIY Credit Repair Software Works?

DIY credit repair software works by helping individuals identify errors in their credit reports, draft dispute letters, and monitor their credit progress over time.

These platforms often come with built-in tools to automate common tasks and provide educational guidance, making credit repair accessible to anyone.

Whether you’re using free DIY credit repair software for personal improvement or implementing white label DIY credit repair software in a business model, these solutions are designed to streamline the entire process.

Features That Matter: What to Look for in Credit Repair Software

Private label credit repair software DIY is a great solution for entrepreneurs who want to offer personalized credit repair services under their own brand.

These platforms offer scalability, automation, and user-friendly interfaces that help both professionals and clients stay on top of credit disputes and improvement plans.

If you’re comparing options, be sure to evaluate the following essential features:

- AI-driven analysis of credit reports

- Automated dispute filing system

- Credit-building recommendations

- Legal compliance with credit laws

Client Dispute Manager Software: A Powerful DIY Solution

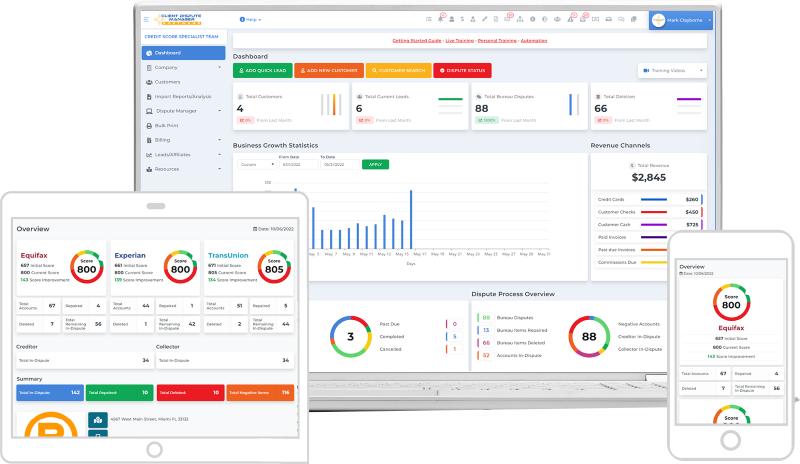

Client Dispute Manager Software is a standout choice for individuals and entrepreneurs looking for a robust and scalable DIY credit repair software solution.

This platform is packed with tools to help users manage the entire credit repair process, whether for personal use or as a full-fledged business using private label credit repair software DIY.

While it offers powerful customization and branding features, it’s important to note that Client Dispute Manager is a private label solution and does not offer white label DIY credit repair software functionality.

Key Features of Client Dispute Manager Software

- Automated Dispute Letter Generator – Create, customize, and send dispute letters to credit bureaus with just a few clicks.

- Credit Report Import Tools – Easily import and analyze credit reports to identify negative items that can be disputed.

- Client Management Dashboard – Track client activity, dispute history, progress, and communication all in one place.

- Built-In Compliance Tools – Ensure all actions align with CROA, FTC, and other regulatory standards.

- White Label & Private Label Options – Customize the platform with your branding to launch a compliant credit repair business.

- Educational Resources – Access training materials, tutorials, and webinars to stay informed and improve your credit knowledge.

- Email and SMS Integration – Automate client communication to streamline your workflow.

Whether you’re exploring free DIY credit repair software as a starting point or ready to invest in the best DIY credit repair software for professional growth, Client Dispute Manager Software delivers a flexible, powerful solution that meets a wide range of needs.

Start Today and Explore the Features Firsthand!

Legal & Compliance Considerations in DIY Credit Repair

When using or offering DIY credit repair software, it’s essential to understand the legal framework that governs credit repair practices.

Staying compliant with laws like the Credit Repair Organizations Act (CROA), the Fair Credit Reporting Act (FCRA), and the Federal Trade Commission (FTC) guidelines is key to protecting both yourself and your clients.

Whether you’re using free DIY credit repair software, operating a business with private label credit repair software DIY, or offering services through white label DIY credit repair software, compliance ensures long-term success and credibility.

Understanding Consumer Rights in Credit Repair

The Credit Repair Organizations Act (CROA) protects consumers from fraudulent credit repair companies. DIY credit repair software must comply with these regulations to ensure ethical business practices.

This includes being transparent about what the software can and cannot do, following clear disclosure rules, and avoiding misleading advertising.

Whether you’re just starting with free DIY credit repair software, upgrading to the best DIY credit repair software, or managing a service through private label credit repair software DIY, legal compliance is not optional—it’s essential for credibility and client protection.

Avoiding Scams & False Promises in the Industry

To stay compliant:

- Avoid making guarantees of instant credit score increases.

- Be transparent about the dispute process.

- Educate clients on their rights under the Fair Credit Reporting Act (FCRA).

Final Thoughts: Choosing the Best DIY Credit Repair Software for You

Whether you’re an individual looking to repair your credit or an entrepreneur aiming to start a credit repair business, DIY credit repair software provides a powerful, cost-effective solution.

By using the best DIY credit repair software, monitoring your credit responsibly, and ensuring legal compliance, you can take control of your financial future.

Start exploring free DIY credit repair software or consider white label DIY credit repair software to build a business in this growing industry. With the right tools and knowledge, you can achieve your credit goals and help others do the same.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!