A creditor letter is a dispute letter intended for a creditor. This could be an individual, a bank, or a supplier to whom money is owed. Your credit repair business plan should includes some default creditor’s letters that you can use anytime.

Creditors may often send your customers a variety of notices and letters in relation to their debt. If they fail to make a payment as agreed with their creditor, it may affect your customer’s creditworthiness and credit scores.

That is why writing letters to creditors is a great and powerful tool when communicating with your creditors. And when writing letters to creditors, you need to ensure that you have all the required information from your customer.

If you are just getting started with your credit repair service, you may find it difficult to create your own creditor’s letter.

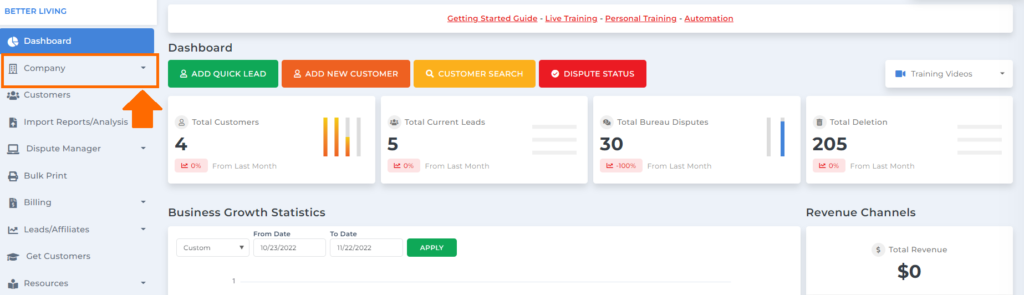

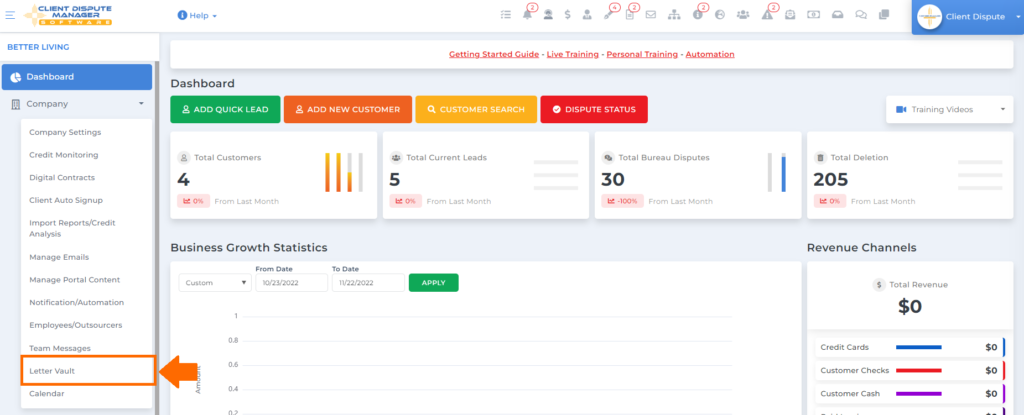

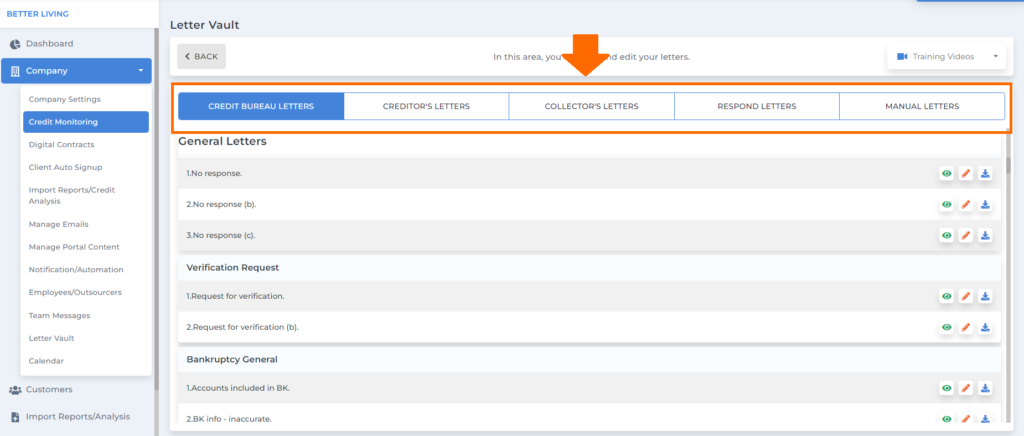

To check the creditor letters in the credit repair business plan, go to the company tab.

Then under the company menu options, click letter vault.

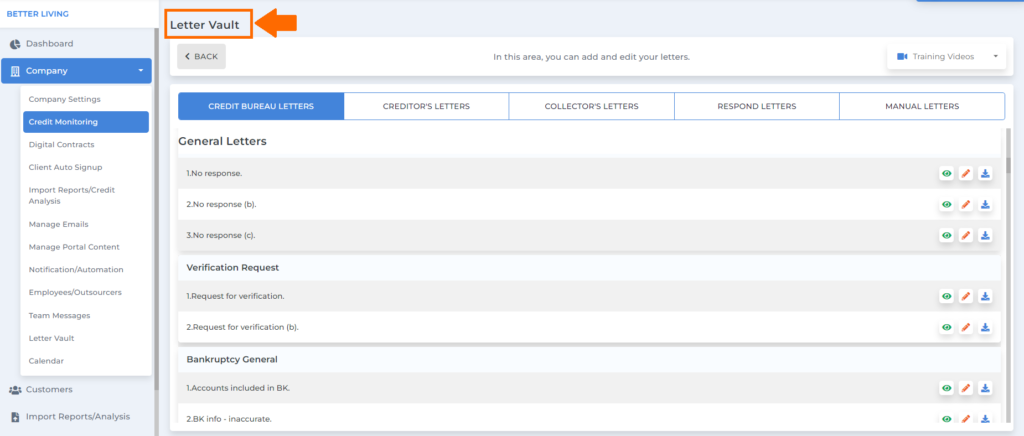

You will be routed to the letter vault screen, where you can see all the letters available to use. In this area, you can also add and edit your letters.

In the letter vault, we have letters for credit bureaus, creditors, collectors, respond, and manual letters.

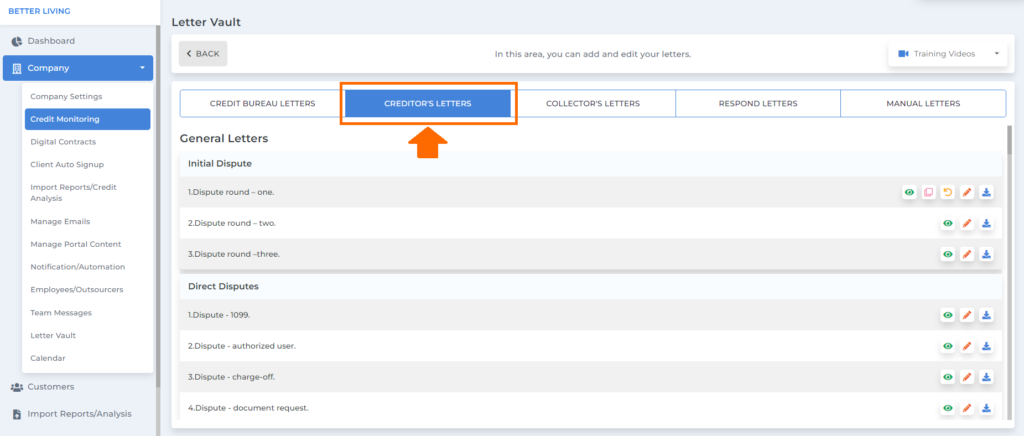

Over here are the creditor’s letters available for you to use.

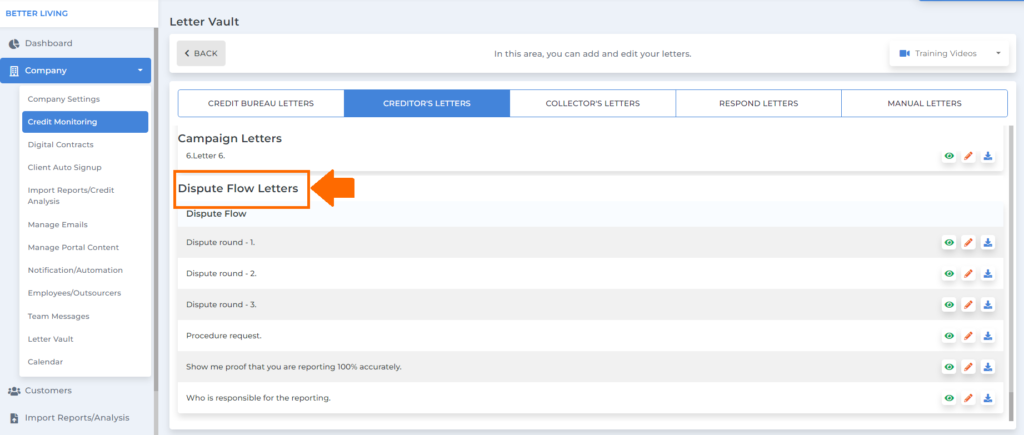

Under creditors’ letters, we have general, campaign, and dispute flow letters.

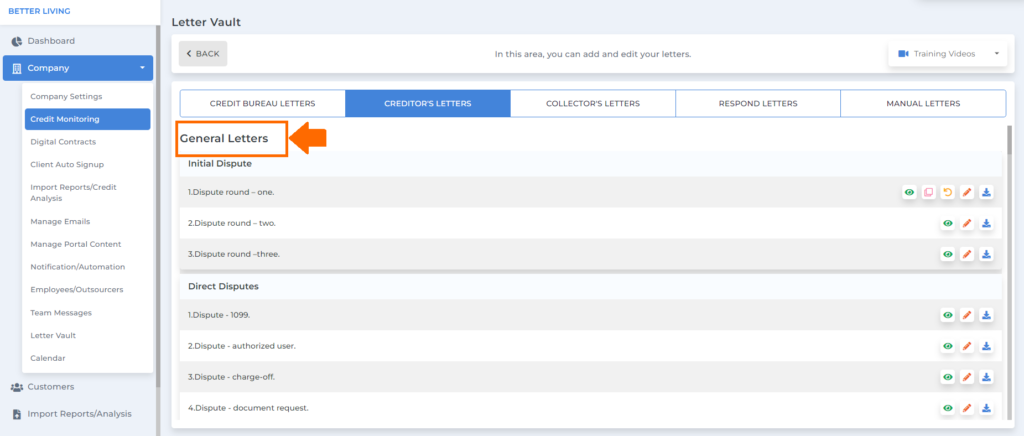

General Letters

– These letters are used to dispute or disagree with the errors in your credit report, like personal information fix, validation, and bankruptcy, to name a few.

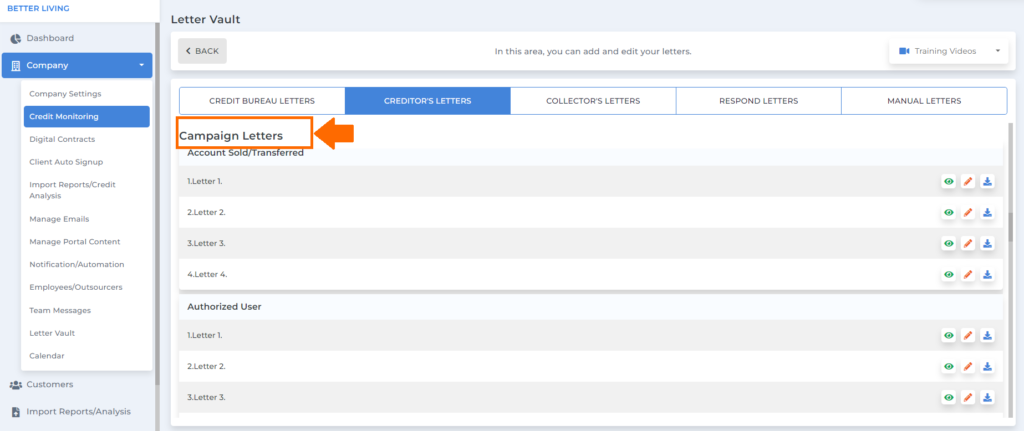

Campaign Letters

– These letters are more aggressive compared to other letters because they target derogatory accounts. And these letters do not follow a certain flow.

Dispute Flow Letters

– These letters are in general, and they follow a certain flow. It’s a series of dispute letters in a certain order.

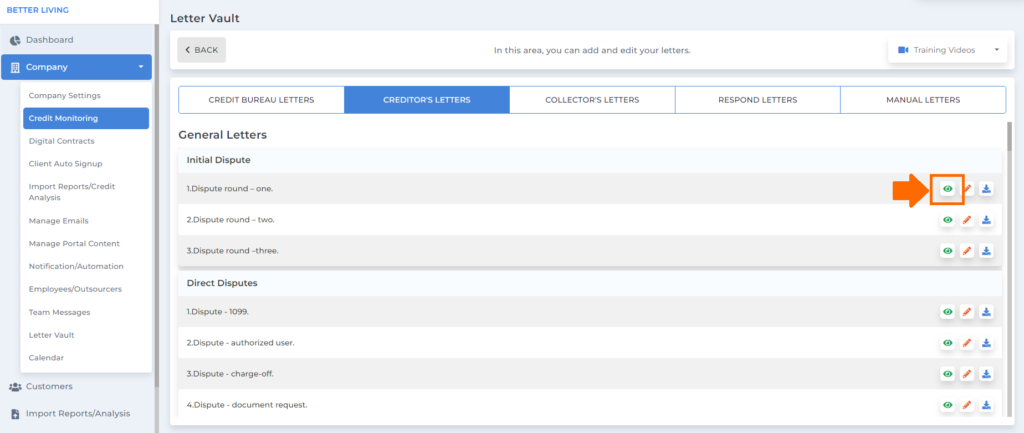

Then you can click this icon if you want to preview the letter before you use it.

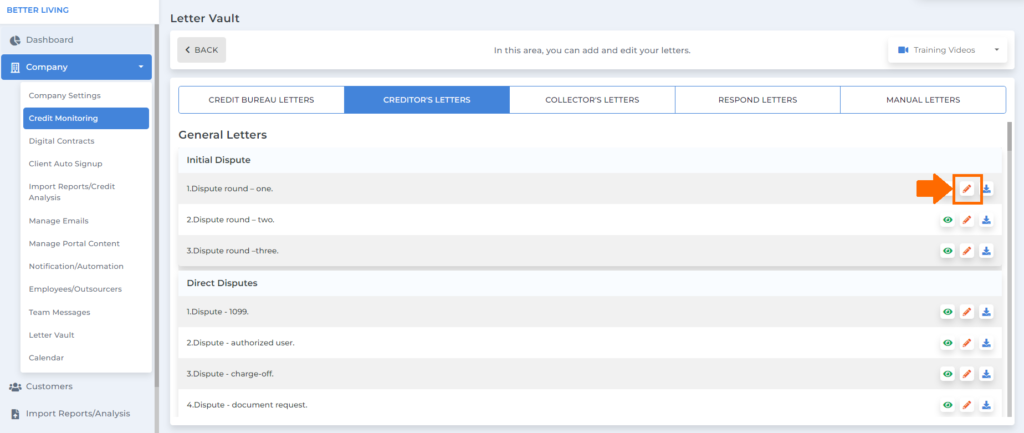

You can also edit the default letters by clicking this icon.

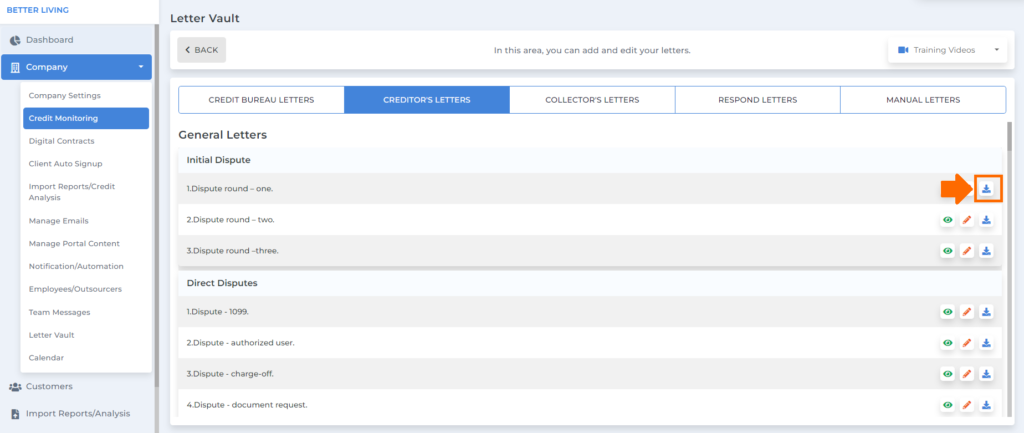

You can also download the letter by clicking this icon.

Writing a dispute letter to a creditor is not complicated, but it does require some attention to detail. Attaching some proof or supporting documents to your dispute letters to prove the credit errors would help you a lot to get the inaccurate information removed faster from your customer’s credit report.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.