In this article, I’m going to talk to you about how you can use credit repair software to create your dispute reasons for your dispute letters. Now before we talk about credit repair software, the first thing we want to talk about is what is a dispute reason and how do we properly use a dispute reason?

I’m going to show you four core sections in this credit repair software to client dispute manager and how you can use our default dispute reasons or custom reasons. Now every single time you send out a dispute letter, you have to have a dispute reason. Because without a dispute reason, how is the Credit Bureau going to know what to do with your letter?

Steps To Dispute:

One of the things you have to understand is that we don’t really want to get in the habit of making up our own dispute reasons when it comes to working for our clients. Now, if you are fixing your credit on your own or if you’re using credit repair software to fix your own credit, of course, you can use your own dispute reasons.

But one of the key things that you want to remember as a credit restoration business is that you always want to use the dispute reasons based on your customer’s interview. Not based on what you think, but based on what the customer tells you.

Now I know you’re saying to yourself, “Mark, yeah that’s good and all, but my customers, they don’t really know. They don’t really know what to say. They don’t really know what to say in the letter.” That’s not what I’m saying.

What I’m saying to you is that what you want to do is you want to take the wording that your customers is saying and then you want to kind of blend that wording with your wording to come up with the dispute reason.

How To Measure Dispute Reason?

As long as the underlining dispute reason is based on what your customer is saying. It’s based on your customer’s argument on why they feel that the account is inaccurate, but not why or not because of what you feel that the account is inaccurate. It’s always the customer’s word.

Interviewing

Whenever you’re interviewing a customer, you have to go deep and you have to ask them their reasoning on why they feel that this account is inaccurate. Now, the one bad thing that I see a lot of people do is that they don’t really interview their customers, and they just go start disputing based on what they think. See, that’s wrong because you didn’t get any feedback from your customer.

Starting today, what I want you to do is never send out dispute rounds without first going and taking a deep dive and interviewing your customer line by line asking them why do they feel that this account is inaccurate? Then based on their dispute reason, you take their dispute reason and you cultivate the appropriate dispute reason in your letter.

Now let me show you in the client dispute manager credit repair software how you can use four different modules to use default dispute reasons or even custom reasons.

Now let me show you how that works. Now the first thing we want to do is we want to go here. I’m already here inside of… This is our homepage. Let me go back to the homepage. Let’s go back to the customer screen. I’m already here in the customer screen and I want to go ahead and go to dispute. What I want to do is I want to click on credit bureaus.

Now from here I want to create my first dispute for Chase. Now just think for a second whether you are working for yourself or you are working for a customer. We’re talking about the credit bureaus here.

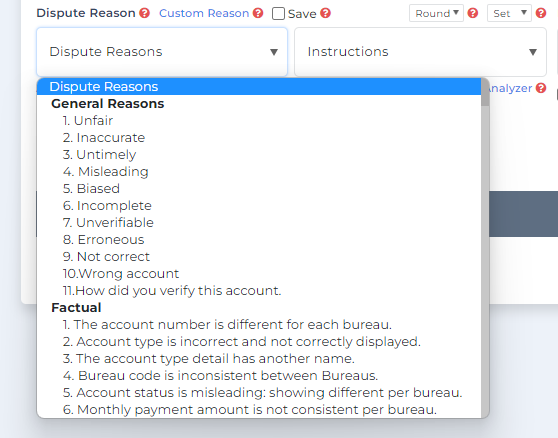

Now say for example, the customer tells you straight up that this account is not yours. Now that’s easy, right? You want to pick a dispute letter right here. We’ll say initial dispute. We have custom and we have drop down. So these are general reasons that a customer can tell you.

We have 11 general reasons, and then we have more specified dispute reasons on why an account can be inaccurate. These reasons right here are specifically for certain inaccurate items like bankruptcies, charge offs, collection accounts, duplicate accounts, foreclosures, short sales, hybrid, identity theft, inquiries, judgements, mortgage lates, like late payments for the mortgage, multiple late payments.

That means multiple, 30 days after 30 days. Negative items reappearing on the credit report after they were deleted. These are various dispute reasons that you can use, but make sure that you’re matching these default dispute reasons with your customer’s explanation.

What If The Customer Was Late One Time?

There are various dispute reasons you can use based on what the customer is telling you on why they were late. These are different things you can do. Remember what I’m telling you, you can use the default dispute reasons inside of the client dispute manager or credit repair software to match what your customer is saying.

Let’s take a look again.

Now say, for example, you don’t want to use the default dispute reasons, which we have a lot of them. As you can see, it goes on and on and on and on and on. These are very specific. Outdated accounts, paid collection, look at that. Paid collections. Re aged accounts, tax liens, a repost.

Now say, for example, you don’t want to use the default dispute reasons. You can have your custom reason. Now, when do custom dispute reasons come in? Custom dispute reasons come in when you feel that our default dispute reasons do not match what your customer is saying.

Your customer may say that “I never was late on the Chase account because I always paid that account on time. I have proof that I paid that account on time. See, all the documents are attached.” You see, that is a real genuine dispute reason. Now, all we have to do is hit enter. As you can see, it’s that fast. It goes into the dispute grid quick with a very detailed dispute reason.

That is what the bulk of a dispute letter is really built on is customized reasons, not simple reasons like this. “This account is not mine.” You see, that doesn’t tell the credit bureau anything. You have to go deep and you have to explain why you feel an account is inaccurate.

Let me give you an example. “This account does not belong to me. Does not belong to me. I never had this type of account before. Take a look at some of my other credit reports and you will see. You will see.” Right? Enter.

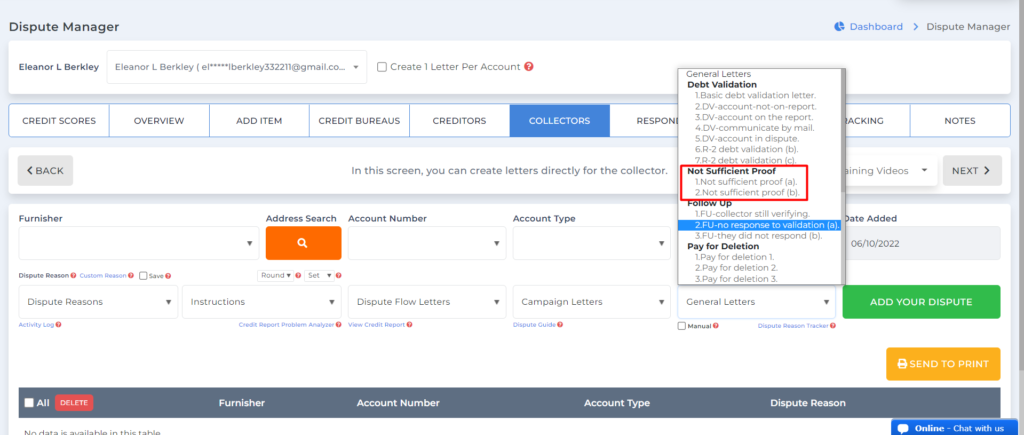

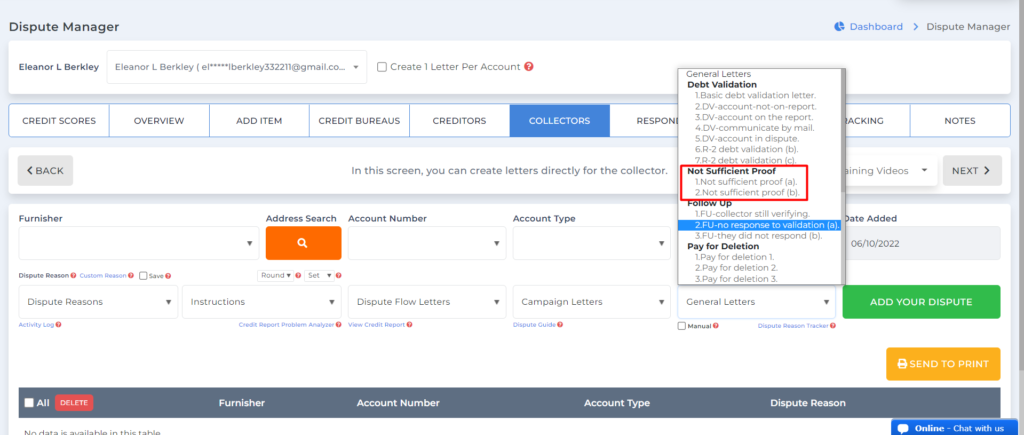

All right. Now what we’re going to do now is I’m going to now take you over and show you the creditor section, the collector section, and the response section on why the dispute manager engine is so powerful when it comes to disputing with the creditors and using the right dispute reasons based off of your customer’s interview. Very important. So let me show that to you really quick.

Now we’re in a creditor screen and we pretty much can do the same exact thing is that we want to base our dispute reasons off of your customer’s reason when you went through your interview with them. So the creditor’s screen is pretty much the same thing. You can type in a custom reason here or you can use our default reasons right here.

When you go over to the collector screen, it’s pretty much the same thing. You can type in a custom reason or you can use our default reasons as you can see here, but you want to make sure that it always matches what your customer is saying in their interview.

Lastly is our respond letters. Again, your dispute reasons, custom dispute reasons, or you cancel that, or you can use our default dispute reasons. Okay.

Now the bottom line is whenever you are creating a dispute reason for your customer, you always want to give the credit bureaus enough information for them to do a really good investigation. You never want to be really vague with your letters because again, like I said, the credit bureaus have the power. You don’t have the power.

Trust me. They do. When you send your letters off to them, you are waiting patiently for 30 days for them to get back with you with an update. Whenever you’re using your dispute reasons, always give the credit bureaus enough information to do their investigation.

Provide any supporting documents to support your argument for a better outcome for yourself or for your customer. This is Mark Clayborne from the Client Dispute Manager Software, Credit Repair Software. I hope you enjoyed this video, and I’ll see you in the next video.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.