For a small business, a strong credit score is essential. It opens doors to growth opportunities and financial stability. But, mistakes happen, and sometimes credit reports aren’t perfect. That’s where credit repair software comes in.

A simple tool that’s making a big difference for businesses, it helps correct those errors and boost credit scores efficiently. Ready to learn why every small business should have this in their toolkit? Let’s get started.

Why Small Businesses Need a Solid Credit Score

Imagine this: you’re planning a road trip, and for that, you need a vehicle in top condition. Similarly, for a small business to journey toward success, it requires a solid credit score.

Growth Opportunities

Think of credit as a master key for a small business. A commendable score isn’t just a statistic; it’s a gateway to manifold opportunities. From gaining access to pivotal business loans to tapping into valuable funding channels, it’s the leverage a business needs.

Empowered with these financial tools, a business can confidently expand its horizons, onboard skilled professionals, and invest in promising ventures.

Building Trust

Suppliers and partners view a strong credit score as a beacon of trustworthiness in the business landscape. When they see a business with a commendable credit score, it’s akin to a seal of approval.

It signals not only that the business is adept at handling its finances but also that it values long-term stability and is likely to honor its commitments. This reliability creates a foundation for lasting and mutually beneficial relationships in the business world.

Better Loan Terms

With a robust credit score at the helm, banks and lenders view a business as a trustworthy borrower. This trust translates into tangible benefits: not only are they more inclined to sanction loans, but they often do so with attractive perks.

This can mean lower interest rates, which saves money in the long run, and flexible repayment schedules, allowing businesses to manage cash flow more effectively.

Leasing Advantages

Are you contemplating leasing a prime storefront or a modern office space? A shining credit record can be your best advocate. Landlords, when reviewing potential tenants, give special preference to businesses with commendable credit histories.

This solid financial standing acts as an assurance, signaling to property owners that their premises will be occupied by responsible tenants who prioritize timely rent payments.

Insurance Benefits

A robust credit score does more than just pave the way for loans; it plays a pivotal role in the eyes of insurance providers. When businesses demonstrate financial responsibility through impressive credit standings, insurance companies take note.

Such businesses are often perceived as more dependable and less of a risk, resulting in favorable insurance rates and the added benefit of substantial long-term savings.

Common Credit Challenges Faced by Small Businesses

Navigating the financial landscape is no easy task, especially for budding small businesses. While passion and hard work are at the core of every venture, sometimes credit-related challenges can

throw a wrench in the works.

Let’s delve into some common credit hurdles that small businesses often encounter:

Late Payments

Whether it’s a simple oversight, unexpected expenses, or periodic cash flow disruptions, late payments can leave a mark on a credit score. These seemingly minor lapses accumulate over time, painting a picture of inconsistency.

To lenders, regular delays signal potential unreliability, making them wary and prompting concerns about the business’s ability to handle its financial commitments in the long run.

High Credit Utilization

Consistently using a significant portion of available credit sends a signal. It suggests that the business may be leaning too heavily on external funds. Lenders, seeing this pattern, might worry about the business’s financial sustainability, making them hesitant to provide further credit.

Credit Report Errors

Mistakes, while a natural part of any process, can have lasting impacts when it comes to credit reports. Sometimes, due to errors or oversight, incorrect data finds its way into these reports.

Such discrepancies, even if unintentional, can unjustly tarnish a business’s credit reputation, leading to misconceptions about its financial health and creating hurdles in securing future credit or favorable terms.

Limited Credit History

New businesses, brimming with potential and ambition, often face a paradoxical challenge. While they may have promising prospects, their novelty means they haven’t had the chance to establish a lengthy credit track record.

This lack of a verifiable credit history can give lenders pause, making them more cautious in extending credit, even if the business shows great promise in its operations and vision.

Personal Credit Mix-up

Smaller businesses, often operating with closely knit teams and lean resources, face a unique challenge: the potential blending of personal and business finances. When these financial worlds collide, it creates a complex web that can be hard to untangle.

This fusion not only muddies the waters of clear financial management but can also lead to an unintended dip in the business credit score, affecting its credibility in the eyes of lenders.

Bankruptcy or Debt Issues

Past financial hiccups, whether they manifest as bankruptcy or as lingering unpaid debts, leave a lasting mark on a business’s financial narrative. These setbacks, even if overcome, serve as cautionary tales for potential lenders.

As a result, they can darken a business’s credit reputation, making it challenging to secure trust and favorable financial terms in future dealings.

Introduction to Credit Repair Software

Navigating the financial seas can be tricky for small businesses. With challenges like maintaining a solid credit score and ensuring all financial records are accurate, it’s a journey that demands precision and attention to detail. Enter credit repair software.

At its core, credit repair software is a tool designed to help businesses – especially the smaller ones – streamline their credit management processes. Think of it as a dedicated assistant that keeps tabs on your credit report, ensuring errors and discrepancies are caught early and corrected promptly.

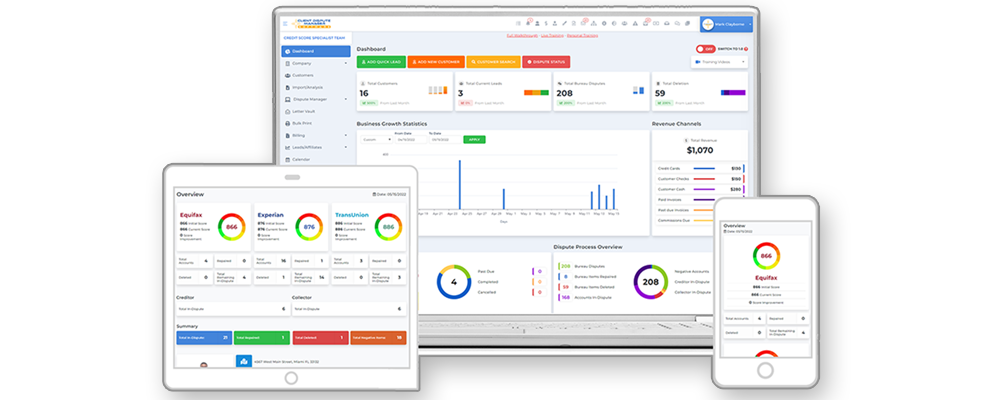

Examples of such software include Client Dispute Manager Software, which helps businesses effectively manage and address discrepancies in their credit reports. Beyond just spotting errors, these software solutions offer insights and recommendations on how to improve and maintain a healthy credit score.

In a world where creditworthiness can make or break opportunities, having such a tool in your business toolkit isn’t just smart – it’s essential. For small businesses aiming for growth and stability, credit repair software is more than just a luxury; it’s a path to ensuring financial health and building trust in the marketplace.

Why Every Small Business Should Consider Credit Repair Software

In the bustling world of small businesses, every detail counts, especially when it relates to finances. The integrity of your credit can be the bridge to growth opportunities or the barrier holding you back.

Here’s why credit repair software should be on every small business owner’s radar:

Error Detection

Even the tiniest inaccuracy on a credit report can snowball into major setbacks for a small business. Such errors, often overlooked in manual reviews, can deter potential funding or partnerships.

Credit repair software acts as a vigilant watchdog, promptly spotting these discrepancies and helping rectify them. This ensures your business remains in its rightful standing, free from the weight of unintentional credit blemishes.

Time-Saving

Manually reviewing credit reports is an uphill task that can divert attention from vital business functions. With credit repair software, this process is simplified and accelerated. Entrepreneurs can then reallocate their time to core operations, ensuring the business thrives without unnecessary distractions.

Financial Insights

Beyond the basic function of spotting inaccuracies, credit repair software offers a wealth of knowledge. Delving deeper into your financial patterns, these tools can pinpoint areas of improvement, offering actionable advice.

By understanding these insights, businesses gain a roadmap not just for rectifying mistakes but for proactively building and upholding a robust credit profile that opens doors to numerous opportunities.

Build Confidence

Having certainty about the accuracy of your credit report instills a sense of confidence when approaching financial ventures. Whether it’s seeking a loan or forging a new partnership, this assuredness resonates.

Potential lenders and partners can sense this confidence, and it strengthens their trust. In a world where credibility matters, an accurate credit standing becomes an invaluable asset, bolstering business relationships and opportunities.

Cost-Effective

Credit report inaccuracies can lead to missed opportunities and financial losses. Each overlooked detail can cost a business dearly in potential revenue. By investing in credit repair software, businesses proactively guard against these losses, ensuring that their financial trajectory remains on an upward climb.

Key Features to Look for in a Credit Repair Software for Small Business

For a small business, every tool in its arsenal should deliver value and efficiency. When it comes to credit repair software, certain features can make the difference between a good tool and a game-changer.

Here’s what to keep an eye out for:

User-Friendly Interface

Small businesses are well-acquainted with the art of multitasking, as they often must manage a myriad of operations simultaneously. Considering this, a solution like the Client Dispute Manager software offers an intuitive and easy-to-navigate platform.

Such interfaces eliminate unnecessary complexities, ensuring that users can swiftly grasp functionalities and maximize their valuable time.

Automated Dispute Management

Discrepancies in credit data are not a rarity. Features within credit repair tools that proactively identify and manage these inconsistencies become indispensable. This vigilant automation maintains credit report integrity and eliminates the drudgery of manual checks.

Detailed Reporting

Credit repair software must provide actionable insights. In-depth reports that pinpoint areas of concern in credit health, coupled with tangible solutions, make the software invaluable in steering businesses toward improved financial status.

Integration Capabilities

Integration is key in our digital age. The capability of credit repair tools to meld seamlessly with existing systems like accounting or CRM platforms is a priceless feature. Such integrations enhance efficiency and response time to business needs.

Data Security

The rising threat of cyber-attacks underscores the importance of robust data protection. When considering credit repair software, platforms like Client Dispute Manager Software stand out due to their emphasis on advanced encryption and strict security protocols.

Such rigorous measures not only safeguard business data but also fortify user trust in the system.

Customizable Alerts

Real-time updates can be a lifesaver. Software that provides custom alerts about credit changes ensures businesses remain proactive in their financial management. Alerts act as an early detection system, positioning businesses to address credit issues promptly.

Support and Training

The learning curve with new software can be steep. Hence, platforms that offer dedicated support become vital. With an accompanying array of training resources, businesses can fully leverage the software’s potential, ensuring optimal returns on their investment.

Conclusion

Small businesses often grapple with financial management, relying on a good credit score. In a world where credit determines opportunities, credit repair software is essential. It’s not just a tool but a guide for challenges like dispute resolution and data security.

Employing this software is like having a reliable anchor for businesses, allowing them to proactively navigate their financial path. While the financial road may have hurdles, the right software makes the journey manageable.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.