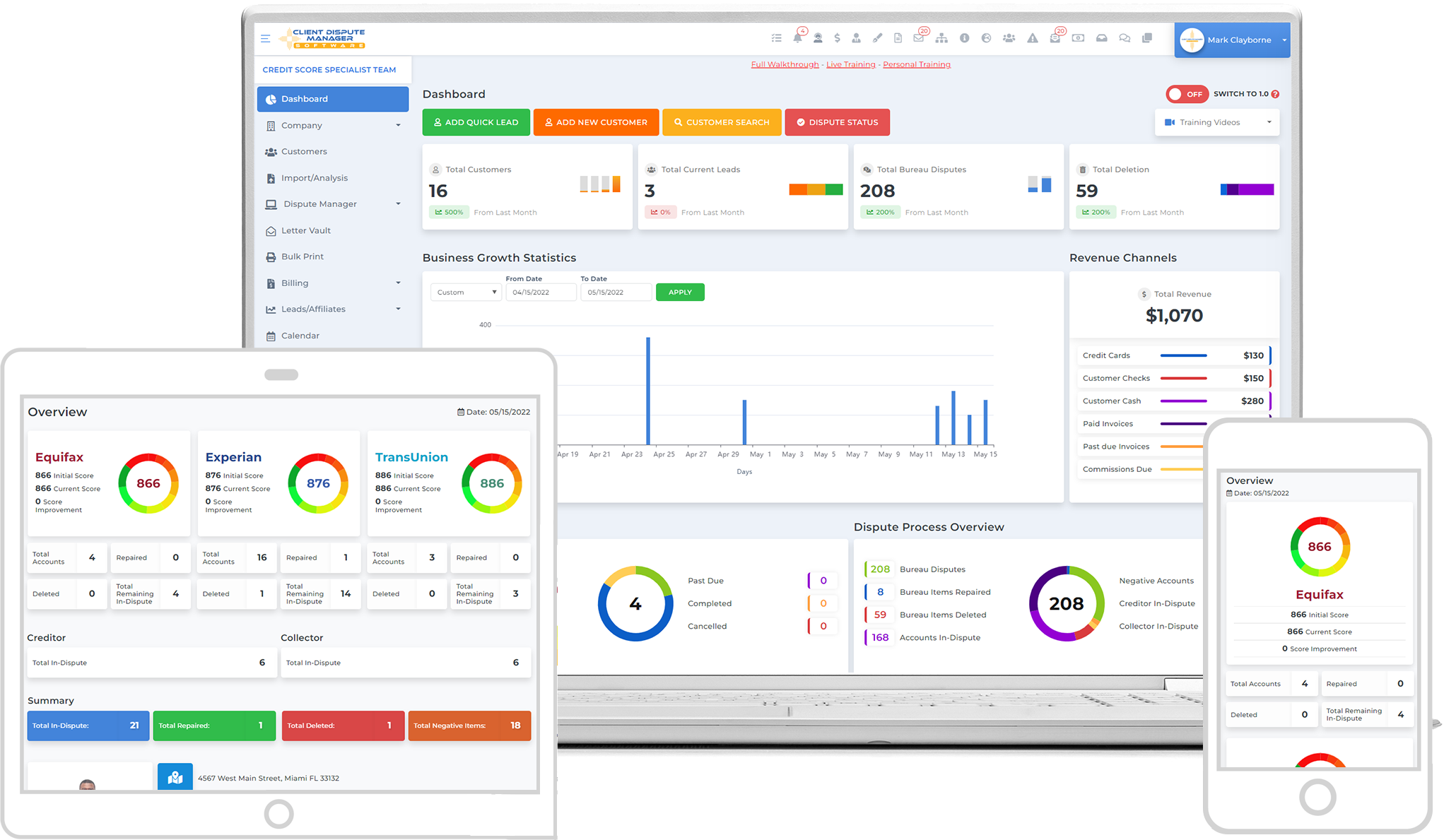

In today’s video, we’re going to talk about how the Client Dispute Manager Credit Repair software can help you when it comes to preparing disputes for your customer. So what is my theory on disputes?

It’s not so much about the dispute letter, but it’s more of what you say inside of the dispute letter and how you follow up with the credit bureaus, creditors and collectors because they have a duty to us to remove inaccurate information on our credit report or your customer’s credit report.

So in the Client Dispute Manager Credit Repair software, what I’m going to show you, the various dispute letters, we have over 250 dispute letters inside the software that you can use. Now, these dispute letters have been proven, we’ve used these dispute letters in our own credit repair company a long time ago.

And again, like I said, it’s not so much about the letter itself, but about what you say in the letter and how you use it and how it progresses and what you say to the credit bureaus, the creditors and the collectors and how you get them to follow the law when it comes to the Fair Credit Reporting Act.

Inside Of Client Dispute Manager Software

Now let me show you right now inside of the Client Dispute Manager Credit Repair software what we have and how these letters can help you improve your business when it comes to you helping improve your customer’s credit score.

So what we’re going to do right now, we’re in the software, I’m going to go over to customers, and then from there I’m going to go ahead and go to dispute. And the first thing we’re going to talk about is the Credit Bureau letters.

Credit Bureau Letters

So what we’ve done is we’ve broken down all of our letters into categories and the way it works, the first thing we’re going to talk about is the dispute flow letters. Now, there’s six dispute flow letters here and basically what it is, it’s a series of letters in a certain order.

So if you want to dispute fast, if your customers giving you all the right information and you don’t want to pick a whole lot of different letters, then you can just follow the dispute flow system right here.

This is a six month course. Over six months these letters will go out and they will talk to the Credit Bureau, the creditors, and the collectors. Now, right now we’re focusing only on the Credit Bureau so these letters that you see right now is strictly for the Credit Bureau and it’s targeted. It’s worded in a way that the Credit Bureaus must do their job helping consumers remove inaccurate information off of their credit report.

What To Do If Your Customer Has More Account?

For example, your customer has more than Say they have a lot of collection accounts or a lot of charge off accounts or a lot of judgments or whatever on their credit report and you want to use a campaign. So these are the campaign letters and we have campaigns, each letter is directed towards that particular inaccurate account.

As you can see, we have a council and transfer, authorized users, bankruptcies, charge offs, collection accounts, duplicate accounts, foreclosure and short cell, hybrid, identity theft, inquiries, judgements, mortgage lates, multiple lates, negative items reappearing on the credit report, that that one happens a lot. If the customer was late one time, paid collections, that’s a big one, paid collections. Re-age account, tax liens, and vehicle repos.

Again, these are campaign letters and again, what that means is that campaign letters basically mean is that if you have 50 collection accounts on a credit report or if you have 30 collection accounts on the credit report and you want to focus on those collections.

Now, remember, those collections, you have to find something that’s inaccurate with the collection account, right? There has to be a problem with the account itself. You can’t just be blindly disputing accounts when you know it’s pretty accurate.

But we don’t know that the collection account is accurate because the customer’s telling you that there’s a problem with these accounts, so it’s our job as credit restoration companies to help the customer fix this inaccurate information on the credit report and it’s in the form of a letter.

Using Of General Letter

So that’s where you would use the campaigns. Now, say for example, you don’t want to use any of the dispute flow letters or the campaign letters and you want to use a general letter. So right here we have a lot of general letters you can use as well that can help your customer when it comes to their credit report. Now these are very specific, general letters, proven letters to assist with removing inaccurate information off of the credit report for your customer.

Again, this is no secret. There’s letters all over the internet, right? So there’s no secret about sending dispute letters. Even the Federal Trade Commission says that, “Hey, here’s a dispute letter that you can use to send to the credit bureaus.”

We have a right, every consumer has outright to dispute inaccurate information on their credit report or how will they get a better credit score to get in their home? How will they get a better credit score to buy a car with a low interest rate? We have that right. That’s where the Fair Credit Reporting Act comes in.

Creditor Section

See they’re a little bit harder, they play games, especially Capitol One and we have to be educated. We have to know what we’re doing when it comes to sending out these dispute letters. The Client Dispute Manager Credit Repair software is making it really, really easy for you, especially you’re brand new in disputing.

So we have the deflow letters, round one, round two, round three, procedural request, show me proof that you’re reporting 100% accurately who is responsible for this reporting. And again, if you don’t want to use any of the campaign letters or the general letters, you would just use the flow letters. The flow letters are pretty quick, they’re straight to the point and a lot of people use the flow letters.

When I was running my credit repair company, I use a lot of flow letters because they’re straight to the point, right? It’s kind of like one, two, three, four, five, six. All right? And they’re geared directly for the creditor, not the Credit Bureau, the creditor.

This is why the Client Dispute Manager Software is so easy to use because we’ve taken all of the hard work out of it especially if you’re struggling with disputing and trying to figure out which letter to send.

What To Do If The Bureau Didn’t Respond?

We have rights. We need to protect ourselves, right? We need to protect our consumers. Our consumers don’t know. They’re not studying this stuff, right? So whenever a negative piece of information appears on a credit report and it’s truly inaccurate, it can kill the consumer’s credit score and you know that already.

It’s our job to help the consumers improve their credit score, period. It’s our job to do that. That’s why we have the Fair Credit Reporting Act. It’s our job to assist. Lawyers assist people when they get in trouble, doctors assist people when they get in trouble. It’s our job to assist consumers who don’t understand this entire process.

Campaign Letters

The same thing for campaign letters for creditors. We have campaign letters for creditors. The same concept here and over here is the general letters.

Now, these general letters are strictly for the creditors. Again, an array of letters. You don’t have to worry about adding all these letters. These letters already here for you. “Oh, yeah Mark, but I have my own letters.” That’s fine. You can use the manual letters right here. You can upload your old letters right here using the manual feature. As you can see, I have some right here. I have one already in here.

So you can bring all of your old letters over to the Client Dispute Manager that have worked for you, and you can add all of your old letters and put them in categories just like you see right here. All right. But I’m telling you the letters that we have already in the Client Dispute Manager are pretty effective.

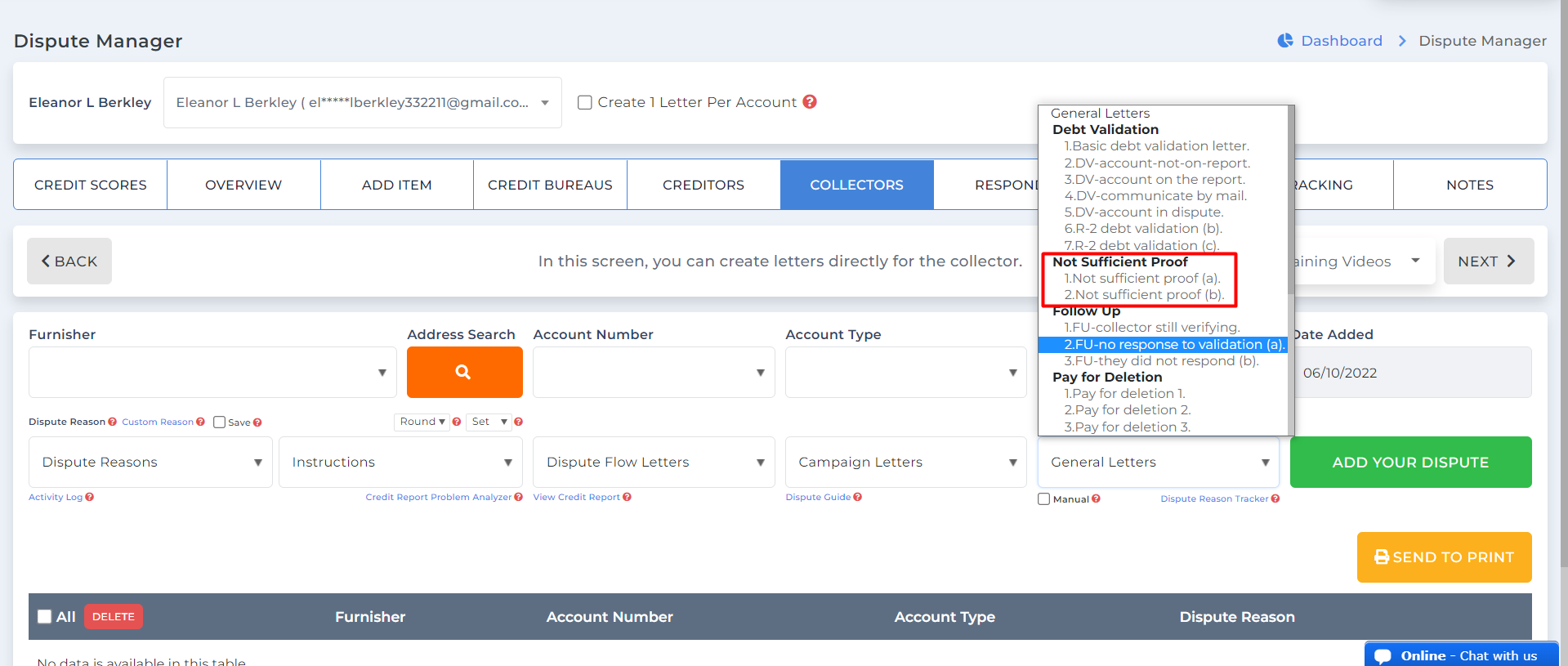

Now let’s go to the collector section here. Again, the collector section is strictly for collectors. Now collectors, you know what I think about collectors, right? They don’t care, they lie, they do all kinds of things.

So over the years we put together a lot of letters that we’ve used to fight against collectors. The collectors, you’re just a social security number to them. They don’t care. They don’t hold up to their side, so we have to fight back. We have to fight back. We have laws in place in the US for our consumers. So we have a variety of letters for the collection agencies as well.

Right here is the dispute flow letters for collection agencies. Now this is a four step system for collectors. Very easy to use. I don’t care if you’re new in the game or I don’t care if you’re very experienced. These things work here.

And also we have campaign letters for the collectors. Now each one of these letters are geared directly for the collection agency. You can pick this debt settlement right here, there’s medical bills, there are paid collections, re-age accounts right here. If we go over to general letters, again, basic debt validation letters, communication by mail, debt validation, account in dispute, R-2 debt validation, R-2 debt validation, and non-sufficient proof.

That means the collection agency sent you some proof and it wasn’t sufficient. So you want to hit him with this letter. Follow up letters, pay for deletion letters, settlement offers. Okay, so there’s a lot of stuff built into the Client Dispute Manager already.

Now, some of you guys may be saying, “Well Mark, that’s good and all, but I’ve been in the credit repair industry for a long time.” That is great. I am not saying that the letters that’s built into the Client Dispute Manager is a magic wand.

What I’m saying to you is that we have used every single one of these letters in our credit repair company a long time ago and all we’re doing is giving it to you. Why would you want to reinvent the wheel? I don’t want to reinvent the wheel.

If someone has something that’s proven to work, I want to try what it is that they have. Why would you reinvent the wheel? Share with me. Let me use what you have and see if it works. Just modify the letters to fit your customer’s own particular situation. Modify the letters to fit your customer’s own particular situation.

Manual Letters

Now if you want a whammy, bring in all of your letters, upload your letters in the manual letter section and now you will have over 500 letters to choose from whenever you are sending letters out to the creditor, collector or Credit Bureau. Make sure the letter is based on the situation for your particular customer.

And make sure you get all of the information from your customer in the interview so you can properly add the proper dispute reason inside of the letter and work hard for your customer or for yourself if you are challenging inaccurate information on the credit report.

And lastly, let’s go and take a look at the respond letters. Now I love the respond letters because the respond letters, there’s a letter to respond when the Credit Bureaus send you updates. So when they send you updates, we have respond that is right here.

So whenever a Credit Bureau sends you an update, you can respond using these letters here. We need more information, your disputes are suspicious, your account has been updated, your disputes are frivolous, we think you’re working with a credit repair company, your account is accurate, a Credit Bureau failed to respond within 30 days, Credit Bureau did not provide procedures, we will not investigate this same dispute again. Experian is known for that.

They’ll send you letters back, update saying, “We will not investigate this dispute again.”

All right, so again, respond letters. Let’s keep going. Collections, cease and desist, contact me by letter only, collector sold my settle account, collectors selling your settlement account, the remaining balance, the collector sold it. Okay.

A second collector trying to collect on the balance, they’re not licensed to collect in my state. And then we go on and on, let’s move that over here. And then we got, scroll down, we’ve got creditor response letters as well.

All right, so like I said before, the respond letters are incredibly powerful. We have dealt with almost every respond response that the Credit Bureaus have sent to us and we know the type of letters that they send and a lot of them are stall letters. So we got a counter letter that you can use to send out to the Credit Bureaus pretty much.

I mean, because look, like I said, there’s no law saying that you cannot represent a consumer, right? Maybe Georgia says that. But every state has their own ball when it comes to credit repair, when it comes to credit score improvement.

It is best that you make sure that you look at your state laws and the federal law, study the Fair Credit Reporting Act. Study the Fair Debt Collection Practices Act. Learn what the collectors can and cannot do. Study the laws that’s related to this stuff. Understand the regulatory bodies that fight for us as consumers.

Use all the resources that you have, all the tools that you have to help yourself improve your credit and to help your customer improve their credit. Because let me tell you something, any of us can be a victim of inaccurate reporting by a creditor and when a creditor does not report the correct information on your credit report, it can damage your score instantly and it’s very difficult to get the creditor on the phone to try to dispute your particular situation on the phone.

It’s a lot of red tape, so it’s very important that you keep up to date on all the laws in your state and also the federal laws when it comes to disputing sending out dispute letters.

Again, this is Mark Clayborne, the founder of the Client Dispute Manager. I hope that this video helped you. I hope that it gave you some more insight on how to properly use dispute letters.

And lastly, what ever you’re disputing on or for a customer or for yourself, always go after inaccurate information. Always look for the problems on credit report before you start disputing. Never dispute accurate information if you know that the information is accurate because your customer told you is accurate. They said, “Yeah, all of that is accurate.” I don’t know if the customer really knows if it’s accurate, but if they tell you line by line that that is their balance, that is their account, then you don’t want to dispute that.

It’s just when they tell you that it’s inaccurate, that they don’t believe that that balance is right. They never heard of that account, they never heard of this customer. So that’s how you want to dispute. You want to do factual disputing and very ethical. This is Mark Clayborne. I’ll see you in the next video.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.