Are you new to Credit Repair Business and you are struggling to try to determine which dispute letter to use? What about the experience? Do you have a lot of experience at disputing and, again, when you get to rounds two and three, you still struggle with what letter to use?

Well, I have the perfect solution for you, and that solution is called the dispute guide. We have integrated the dispute guide directly into the Client Dispute Manager that will assist you with every single one of your disputes. Let me show you what I’m talking about.

The first thing I’m going to do, right now, is I’m going to go in. I’m already in the Client Dispute Manager. Let me go to the customer screen. I’m going to take you over to the dispute manager screen. We’re going to click on dispute. Let’s click on overview, just to see our credit scores here.

Now, what we’re going to do, we’re going to click on the credit bureau screen. Now, this is the credit Bureau screen. This is where it all starts.

What I’m going to do, right now, say for example, you want to dispute your first round, your second round, or your third, fourth, fifth, and you’re not sure of what letter to use. That’s where the dispute guide comes in.

Now, let me show you what I mean. All you have to do is click this green text right here, and popped up right here is our dispute guide. Now this dispute guide is focused strictly for the credit bureau letters right here, and if you scroll down, which I’m not going to do that, you’ll see all of the powerful information that’s built into this dispute guide.

Now, this is step-by-step. It teaches you how to dispute and why to dispute and which letter to use for the credit bureaus. Do you understand what I’m saying? This is pure gold if you’re trying to get better at disputing for your customer, removing inaccurate information. This dispute guide is pure gold.

If I scroll down, it’ll pretty much tell you. As you can see, all of these letters right here, all these letters here, and all of the general letters, it’ll pretty much give you a reason on why you want to send out each letter. It’s kind of like the theory behind each letter.

Now, when you really think about it, whenever you send letters out to the credit bureaus, there has to be a reason behind each letter. You can’t just send the letter randomly. It has to be a reason. If the account is inaccurate, you got to send the right letter for that particular account. You understand what I mean? And that is where the dispute guide comes in.

Credit Bureau

Now, let me show you something else. That is just for the credit bureau, because we always start with the credit bureau. Let’s go to the creditor screen. Not only do we have the dispute guide on the credit bureau screen, we also have the dispute guide on the creditor screen, as well.

Now, let me click this here. As you can see, the Fair Credit Billing Act, the creditor dispute instructions. Now, this takes you step by step on why you should send this letter. Now I’m kind of giving you some information for free right here. Dispute round one, dispute round two, dispute round three, and disputing with a 1099, I’m kind of giving that information for free right now. Okay?

So you probably saw some of the information. That is fine. That goes to show you the power of the dispute guide. It’s very powerful. All right.

Now, just think about it for a second. I wrote that book in the back right there. As you can see in the back, Hidden Credit Repair Secrets. It’s been number one on Amazon for seven years in a row. All the power, all of the studying that I did on how to repair someone’s credit, how to improve someone’s credit score,

I put my step-by-step moves in this dispute guide. We’re talking about years of experience. I told you I was obsessed when it came to disputing. That’s why I got so good at it.

Client Dispute Manager Software

So what I wanted to do to give back to you guys, everyone who’s using the Client Dispute Manager software, I wanted to give back this dispute guide. If you’re in a trial, you won’t be able to access this dispute guide inside of the trial. It’s only for active Client Dispute Manager members. Okay?

So the dispute guide alone is extremely important to your success in a credit restoration business because you have to know exactly what letter you’re sending and why. You can’t just send random letters, so this is why I included the dispute guide. All right.

So we talked about the credit bureaus. We talked about the creditors. Now, we’re going to move over to the collectors.

Creditors

This is when you send letters directly to the collection agency. I have the dispute guide, as well, right here. And I know you’re probably wondering what’s under the hood. All of my strategies, all of the reasonings in my entire credit repair life, when I was running my credit repair business, I have it built right into the dispute guide.

Literally, everything I know about the dispute letter and why you should send the letter is built right into the dispute guide for the collection agency. Every single letter that I have in the software, I break it down for you and I explain why you would send that letter, and it’s all in the dispute guide.

Response Strategy

In that 30 days, when you get that response back, the creditor, the collector, or the credit bureau is going to give you an update. “Is it verified? It’s suspicious letter, we think you working with a credit repair company, we need more information,” whatever the case may be.

So what I’ve come up with, over the last four or five years when I was running a credit repair business, I gathered a lot of data on how credit bureaus, how creditors, and how collection agencies will typically respond to you.

Now, this is very important because what happens is if you don’t know how to respond back to the collector, to the credit bureau, or the creditor, you won’t be able to really help your customer. Right?

And even if it’s truly inaccurate on the account, you won’t be able to help your customer because you just don’t know how to respond back. So what you’re going to do is you’re going to go on the internet, you’re going to waste a lot of time trying to read all of these letters, trying to determine what letter to send to these agencies to respond back.

Now, you know I’m not lying. You know I’m telling the truth here because it’s absolutely true. This is exactly what I did when I was running a credit restoration business. Okay? Now, what I did was I took all of my successful letters that I use to respond back to the creditors, to the collectors, to the credit bureaus, and I put them all inside of the Client Dispute Manager credit repair software.

I put them all inside of the Client Dispute Manager credit repair software for you, that’s right, to make your life so much easier when it comes to disputing.

Now, why would you try to reinvent the wheel? Why would you try to use all these special letters when the letters that I used four or five years ago worked, were successful, and helped my clients?

I’m not saying don’t use your letters, which you should, but what I’m saying is use what’s proven, that’s worked already, right? Use things that’s worked to cut the learning curve.

Now, let me show you something. I’m not going to click on the respond, the dispute guide here, because I want to leave it as a mystery for you. If you are a Client Dispute Manager software member, hello.

Thank you for being an active member. I appreciate it. You guys already have access to the dispute guide. But if you’re not, I’m not going to click on this dispute guide and I’m not going to show these dispute reasons because it’s kind of like a secret and it’s kind of like a mystery because you have to learn how to properly respond to credit bureaus, creditors, and collectors with the right wording inside of a letter.

Years and years of studying credit repair, years and years of studying the laws, years and years of trial and error, years and years of battle testing the letters out there in the field, real time testing, sending these letters out on behalf of my customers, I poured them right here and I’m not going to give them away for free.

You understand what I mean? Because it took too much time for me to put them together, but you can get access to them. You can get access to these battle-tested letters and, also, you can get access to my dispute guide right here in the Client Dispute Manager. Again, if you are watching this video and you are a Client Dispute Manager software member, thank you for being a family member.

Again, I wanted to say this to you because again, like I said, that is new. We just added the dispute guide inside of the Client Dispute Manager. Again, until next time, this is Mark Clayborne, the founder of the Client Dispute Manager software. We’ve got a lot of stuff coming in 2020 and I hope to see you next time in my next video. Take care.

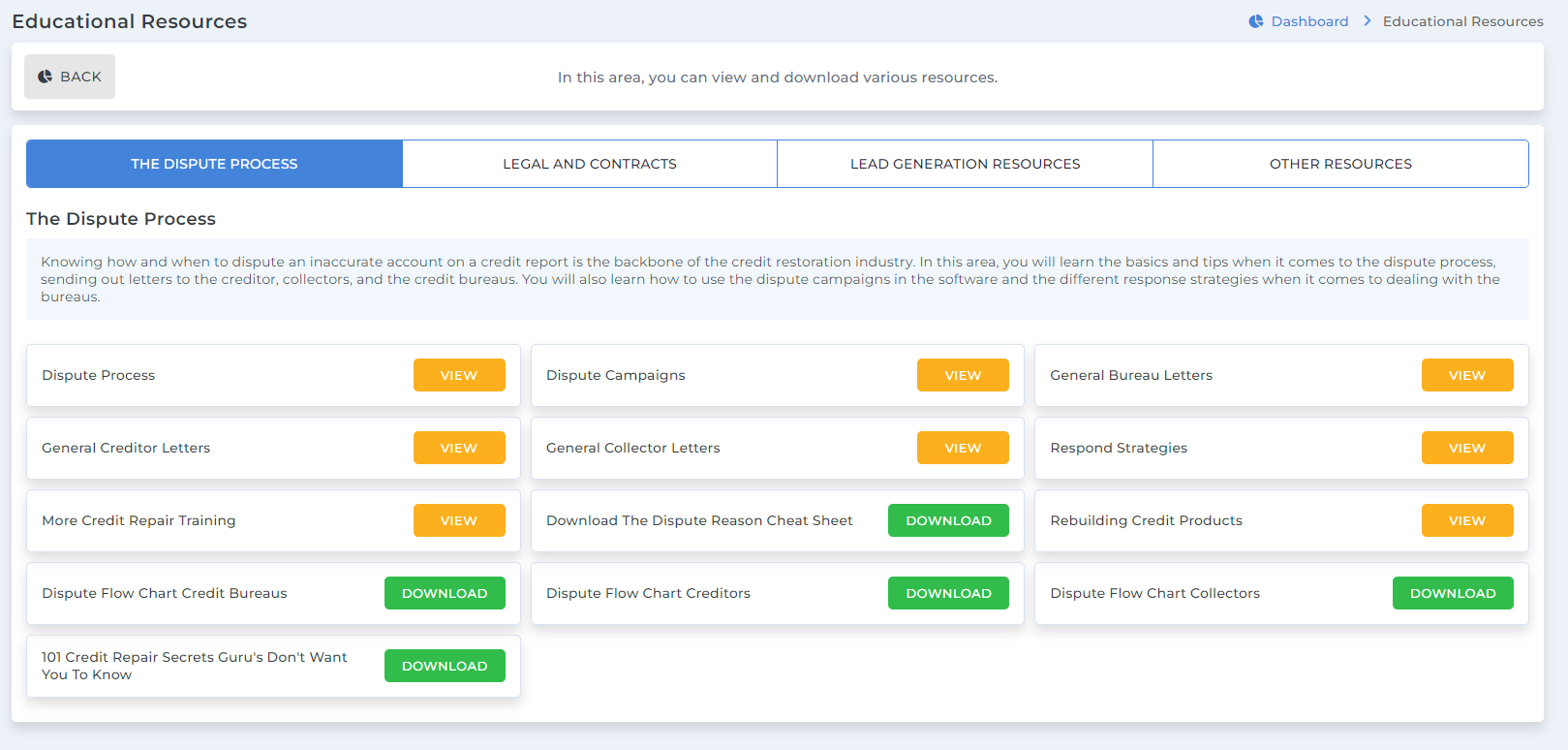

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.