Are you an entrepreneur looking to make a difference in people’s lives while building a profitable business? Starting a credit repair business might be the perfect opportunity for you. With millions of individuals struggling with credit issues, the demand for credit repair services is on the rise.

By focusing on credit repair business growth, you can not only help clients achieve financial freedom but also scale your business to new heights. In this article, we’ll guide you through the essential steps to successfully start a credit repair business and create a lasting impact.

Start Today and Explore the Features Firsthand!

Step #1: Educate Yourself and Gain Certification

Before diving into the world of credit repair, it’s crucial to educate yourself about the industry and gain the necessary certifications. Enroll in courses offered by reputable organizations such as the National Association of Credit Services Organizations (NACSO) or the Credit Consultants Association (CCA). These courses will provide you with a solid foundation in credit repair laws, strategies, and best practices, which are essential when starting a credit repair business.

Pursue Relevant Certifications to Start a Credit Repair Business

Additionally, consider pursuing certifications such as the Credit Repair Specialist Certification (CRSC) or the Certified Credit Consultant (CCC) designation. These certifications demonstrate your expertise and commitment to the industry, helping you stand out from competitors and build trust with potential clients when you start a credit repair business.

Step #2: Develop a Comprehensive Business Plan For Your Credit Repair Business Growth

A well-crafted business plan is essential for the success of any venture, including starting a credit repair company. Your plan should outline your target market, services offered, credit repair business marketing strategies, and financial projections. Consider the following questions when developing your plan for starting a credit repair business:

- Who is your ideal client?

- What unique value proposition will you offer?

- How will you differentiate yourself from competitors?

- What are your short-term and long-term goals?

Research Your Target Market When Starting a Credit Repair Company

Take the time to research your target market and identify their specific needs and pain points. This information will help you tailor your services and credit repair business marketing messages to effectively reach and resonate with your ideal clients when you start a credit repair business.

Step #3: Register Your Business and Obtain Necessary Licenses

To operate legally, you must register your credit repair business with the appropriate government agencies. Choose a business structure (e.g., sole proprietorship, LLC, or corporation) and register your company name with your state’s Secretary of State office.

Each business structure has its own advantages and disadvantages, so consult with a legal professional or accountant to determine the best option for your specific situation when starting a credit repair company.

Obtain Required Licenses and Permits to Start a Credit Repair Business

Additionally, obtain any required licenses and permits, such as a credit repair service provider license, which may vary by state. Familiarize yourself with the Credit Repair Organizations Act (CROA) and other relevant state and federal laws to ensure compliance and avoid legal issues down the road when you start a credit repair business online or offline.

Start Today and Explore the Features Firsthand!

Step #4: Establish Your Business Infrastructure

To run your credit repair business efficiently, you’ll need to set up the necessary infrastructure. This includes:

- Securing a physical office space or setting up a home office

- Investing in reliable computer systems and software

- Implementing a secure client relationship management (CRM) system

- Establishing a dedicated phone line and email address

Choose Your Office Space

When choosing a physical office space, consider factors such as location, accessibility, and affordability. If you opt to start a credit repair business online, ensure that you have a dedicated workspace that allows for privacy and professionalism when interacting with clients.

Invest in Technology

Invest in reliable computer systems and software that can handle the demands of your business, such as credit repair software, billing and invoicing tools, and secure communication platforms. A robust CRM system will help you manage client interactions, track progress, and streamline your workflow when starting a credit repair company.

Step #5: Build a Strong Online Presence

In today’s digital age, having a strong online presence is crucial for attracting clients and building credibility. Start a credit repair business online by creating a professional website that showcases your services, expertise, and success stories. Your website should be user-friendly, informative, and optimized for search engines using relevant keywords, such as “starting a credit repair company” or “credit repair business marketing.”

Engage with Potential Clients Online

Engage with potential clients through social media platforms and online forums. Share valuable content, such as credit repair tips, industry news, and client testimonials, to establish your authority and build trust with your audience. Consider starting a blog on your website to provide in-depth information and attract organic traffic as part of your credit repair business marketing strategy.

Step #6: Develop a Marketing Strategy for Your Credit Repair Business

To grow your credit repair business, you’ll need to implement a comprehensive credit repair business marketing strategy. Some effective marketing techniques include:

- Networking with financial professionals, such as mortgage brokers and real estate agents

- Participating in local community events and workshops

- Offering free educational resources, such as blog posts or webinars

- Leveraging online advertising platforms, such as Google Ads or Facebook Ads

- Encouraging client referrals through incentive programs

Network with Financial Professionals for Credit Repair Business Marketing

Networking with financial professionals can be a powerful way to generate referrals and build strategic partnerships. Attend industry events, join local business associations, and actively seek out opportunities to collaborate with complementary businesses as part of your credit repair business marketing efforts.

Building strong relationships with mortgage brokers, real estate agents, financial advisors, and other professionals in the financial industry can lead to a steady stream of referrals. These professionals often work with clients who are in need of credit repair services, and they can recommend your business as a trusted solution.

Participate in Community Events and Workshops

Participating in local community events and workshops allows you to connect with potential clients and showcase your expertise. Consider hosting your own workshops or seminars on credit repair topics to establish yourself as a thought leader in the industry and enhance your credit repair business marketing strategy.

Look for opportunities to sponsor or participate in community events, such as financial literacy workshops, homebuyer seminars, or small business expos. These events provide an excellent platform to educate the public about the importance of credit repair and how your services can help them achieve their financial goals.

Offer Free Educational Resources as Part of Your Credit Repair Business Marketing

Offering free educational resources, such as blog posts, e-books, or webinars, can help attract potential clients and demonstrate your value. These resources should provide actionable advice and insights that empower individuals to take control of their credit health, further supporting your credit repair business marketing efforts.

When creating educational content, focus on topics that address the most common questions, concerns, and challenges faced by your target audience. For example, you could create a series of blog posts that break down the components of a credit report, explain how credit scores are calculated, or provide tips for disputing errors on credit reports.

Leverage Online Advertising

Online advertising platforms, such as Google Ads or Facebook Ads, can be effective in reaching your target audience and driving traffic to your website. Develop targeted ad campaigns that speak directly to the needs and concerns of your ideal clients as part of your credit repair business marketing plan.

When creating online ads, use compelling headlines, clear calls-to-action, and eye-catching visuals to grab the attention of potential clients. Use targeted keywords that align with the search intent of individuals seeking credit repair services, such as “credit repair help,” “improve credit score,” or “fix bad credit.”

Encourage Client Referrals

Encouraging client referrals through incentive programs can be a cost-effective way to grow your business. Offer discounts, free services, or other rewards to clients who refer their friends and family to your credit repair business, further enhancing your credit repair business marketing strategy.

Word-of-mouth referrals are incredibly valuable for credit repair businesses, as they come with an inherent level of trust and credibility. To encourage referrals, start by providing exceptional service to your existing clients, ensuring that they have a positive experience and achieve the desired results.

Start Today and Explore the Features Firsthand!

Step #7: Provide Exceptional Service and Build Client Relationships

The key to long-term success in the credit repair industry is providing exceptional service and building strong client relationships. Be transparent about your process, set realistic expectations, and keep clients informed throughout their credit repair journey. Regularly communicate with clients, providing updates on their progress and addressing any concerns or questions they may have.

Educate Your Clients

Go above and beyond to educate your clients about credit management and financial literacy. Offer ongoing support and resources to help them maintain their improved credit standing long after your services have concluded.

By genuinely investing in your clients’ success, you’ll foster loyalty and encourage positive word-of-mouth referrals, which can be a powerful aspect of your credit repair business marketing strategy.

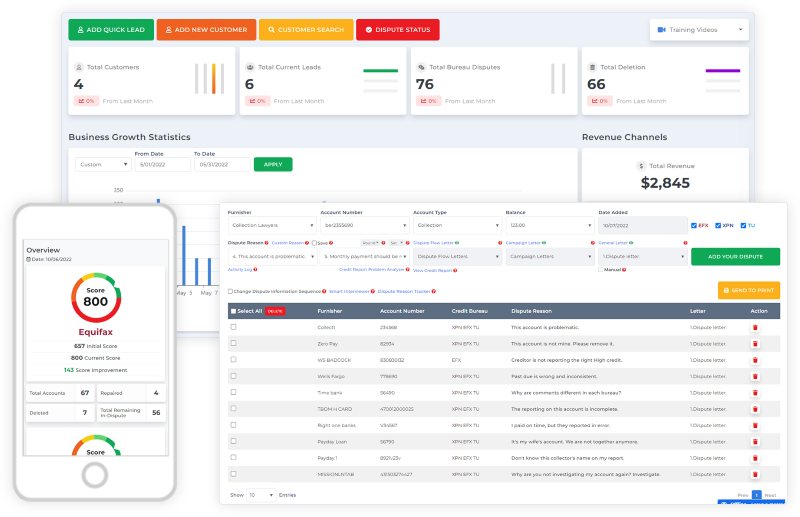

Client Dispute Manager Software to Streamline Your Credit Repair Business

As your credit repair business grows, managing client disputes and tracking progress can become increasingly complex and time-consuming. Investing in a reliable client dispute manager software can help streamline your operations and ensure that you provide the best possible service to your clients.

Look for software that offers features such as:

- Automated Dispute Tracking: Easily monitor the progress of each client’s case and stay on top of deadlines and follow-up tasks.

- Customizable Dispute Letters: Save time by using templates that you can quickly adapt to each client’s unique situation while maintaining compliance with relevant laws and regulations.

- Real-time Status Updates: Keep your clients informed about the progress of their case, reducing the need for frequent phone calls or emails.

- Integrated Billing and Invoicing: Streamline your financial processes and keep track of client payments.

- Client Portals For Secure Document Sharing: Provide a secure platform for clients to upload and access important documents.

- Reporting and Analytics Capabilities: Gain valuable insights into your business performance and identify areas for improvement.

Automating repetitive tasks and centralizing client information can significantly enhance your operations and help you provide the best possible service to your clients as you navigate the complexities of the credit repair process.

Start Today and Explore the Features Firsthand!

Frequently Asked Questions (FAQs)

Do I Need A Specific Degree Or Background To Start A Credit Repair Business?

While a background in finance or a related field can be helpful, it’s not a requirement. What matters most is your willingness to learn, your commitment to helping others, and your ability to navigate the complexities of the credit repair process when starting a credit repair company.

How Much Does It Cost To Start A Credit Repair Business?

The cost of starting a credit repair business can vary depending on factors such as location, business structure, and credit repair business marketing expenses. On average, you can expect to invest between $5,000 and $10,000 to get your business up and running, whether you choose to start a credit repair business online or offline.

How Long Does It Take To See Results In Credit Repair?

The timeline for credit repair varies from client to client, depending on the extent of their credit issues. On average, clients may start seeing positive results within 3-6 months, but some cases may take longer. It’s essential to set realistic expectations with your clients and keep them informed throughout the process when starting a credit repair company.

Is Credit Repair Legal?

Yes, credit repair is legal. However, credit repair companies must comply with the Credit Repair Organizations Act (CROA) and other relevant state and federal laws. It’s essential to operate your business ethically and transparently to avoid legal issues. Familiarize yourself with the legal requirements and best practices to ensure compliance and protect your business and clients when you start a credit repair business.

How Can I Differentiate My Credit Repair Business From Competitors?

To differentiate your credit repair business from competitors, focus on providing exceptional service, offering unique value propositions, and building a strong brand identity. Consider specializing in a specific niche, such as helping clients with bankruptcy or student loan credit issues.

Continuously educate yourself and your team to stay ahead of industry trends and provide the most effective solutions for your clients as you start a credit repair business online or offline.

Conclusion

Starting a credit repair company can be a fulfilling and lucrative venture, but it requires dedication, knowledge, and a genuine desire to help others. By following these essential steps and staying committed to your clients’ success, you can build a thriving business that makes a positive impact on people’s lives.

Remember, the key to success lies in continual learning, adaptability, and an unwavering focus on providing value to your clients. Stay informed about industry developments, invest in your education and training, and always prioritize your clients’ needs.

With hard work, perseverance, and a client-centric approach, you can establish a successful credit repair business that transforms lives and helps individuals achieve their financial goals, whether you start a credit repair business online or through traditional means.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: