Launching a credit repair business is a unique challenge, but the opportunities for success are vast if you employ smart, cost-effective credit repair marketing strategies. This article focuses on actionable steps for attracting clients and generating credit repair leads without overspending on marketing.

Whether you’re starting from scratch or looking to scale your efforts, these strategies centered on credit repair marketing, credit repair branding, credit repair advertising, and more will provide the foundation for long-term growth and client trust.

Start Today and Explore the Features Firsthand!

Why Effective Credit Repair Marketing Matters?

The success of your credit repair business depends on how effectively you market your services. Credit repair marketing involves promoting your services in a way that educates potential clients, builds trust, and converts them into loyal customers.

Since this industry is filled with complex regulations and inherent skepticism from consumers, credit repair branding and credit repair business marketing need to focus heavily on transparency, trust, and credibility.

In today’s competitive market, simply advertising your services isn’t enough. You need to create a comprehensive credit repair marketing strategy that not only draws attention but also positions your business as an expert and a partner in your clients’ financial recovery journey.

Building Trust with Credit Repair Branding

Credit repair branding is more than just your logo or website design; it’s the trust and credibility your business conveys. In an industry like credit repair, where clients entrust you with sensitive financial information, branding that builds confidence is crucial.

Key Elements of Successful Credit Repair Branding

- Consistency: Keep your messaging consistent across all platforms—your website, social media, emails, and ads. Inconsistent branding can confuse potential clients and make your business seem less trustworthy.

- Transparency: Honesty in your communication is paramount. Many credit repair businesses fall into the trap of overpromising, which can erode trust. Instead, focus on setting realistic expectations and explaining your services clearly.

- Client-Centric Messaging: Use your brand to position yourself as a solution provider. Your marketing messages should convey empathy for your client’s financial struggles and how you can partner with them to improve their credit.

Implementing Effective Credit Repair Marketing Strategies

Now that you’ve established strong credit repair branding, it’s time to focus on credit repair marketing strategies that will drive traffic, generate credit repair leads, and convert prospects into paying customers.

Start Today and Explore the Features Firsthand!

Social Media Marketing for Credit Repair Business Marketing

Social media is one of the most powerful and cost-effective tools for credit repair business marketing. Platforms like Facebook, Instagram, and LinkedIn allow you to reach a wide audience while controlling your costs.

How to Use Social Media Effectively for Credit Repair Marketing?

- Educational Content: Post regular updates with credit repair tips, financial literacy posts, and client success stories. Educational content builds trust and positions you as an expert in the industry.

- Client Testimonials: Share real client testimonials to humanize your brand and show how you’ve helped others. This helps convert skeptical prospects into credit repair leads.

- Engagement: Actively engage with followers by answering their questions or responding to comments. Engagement encourages loyalty and strengthens relationships with your audience.

Email Marketing for Credit Repair Leads

Email marketing is one of the most cost-effective credit repair marketing strategies. It allows for direct, personalized communication, which is critical for nurturing credit repair leads.

Steps to Create a Successful Email Campaign for Credit Repair Marketing

- Build Your List: Offer free educational information, guide, or report in exchange for email addresses. This approach helps you attract people genuinely interested in credit repair.

- Nurture with Value: Don’t bombard subscribers with promotions. Send them valuable content, such as tips on improving credit scores or insights into the credit repair process. You’re building trust and positioning yourself as a long-term partner.

- Automated Follow-Ups: Set up automated follow-up emails for new subscribers. For example, you could create a welcome series that gradually introduces them to your services.

Leveraging Search Engine Optimization (SEO) for Credit Repair Marketing

Search engine optimization (SEO) is crucial for driving organic traffic and generating credit repair leads without spending on ads. If done correctly, SEO can become one of the most profitable credit repair marketing strategies for your business.

Key SEO Strategies for Credit Repair Business Marketing

- Keyword Optimization: Research and target high-intent keywords such as “fix my credit score” or “best credit repair company.” Ensure these keywords are used naturally throughout your website’s content and blog posts.

- Local SEO: Many credit repair businesses serve specific geographic areas, making local SEO essential. Optimize your site for location-based keywords like “credit repair services in [City]” and claim your Google Business Profile to improve local visibility.

- High-Quality Content: Regularly publish blog posts that answer frequently asked questions about credit repair or provide credit improvement tips. Creating useful, engaging content improves your chances of ranking higher in search results.

Pay-Per-Click (PPC) Advertising for Immediate Results in Credit Repair Marketing

When you’re ready to invest in credit repair advertising, PPC ads are a powerful tool for gaining visibility. With platforms like Google Ads or Facebook Ads, you can target specific audiences based on their demographics, interests, and search behavior.

Best Practices for PPC Advertising in Credit Repair Marketing

- Set Clear Goals: Define what you want from your PPC campaign whether it’s to generate credit repair leads or increase brand awareness.

- Target the Right Keywords: Focus on high-intent search terms, such as “how to fix my credit fast” or “credit repair help.” These keywords attract prospects who are ready to take action.

- Track Performance: Use analytics to monitor the performance of your ads. Identify which keywords or audiences are performing well and optimize your campaigns accordingly.

Start Today and Explore the Features Firsthand!

Referral Programs: The Power of Word-of-Mouth Credit Repair Marketing

Word-of-mouth remains one of the most powerful marketing tools. By creating a referral program, you can leverage your existing clients to bring in new business without additional credit repair advertising costs.

How to Create an Effective Referral Program for Credit Repair Business Marketing?

- Offer Rewards: Provide clients with a financial incentive, such as a discount or bonus, for every successful referral they make.

- Promote Your Program: Use social media, email marketing, and your website to promote your referral program. Make sure clients are aware of the opportunity.

- Track Referrals: Implement tools like Client Dispute Manager Software to keep track of referrals and reward your clients efficiently.

Using Client Dispute Manager Software to Enhance Your Credit Repair Marketing

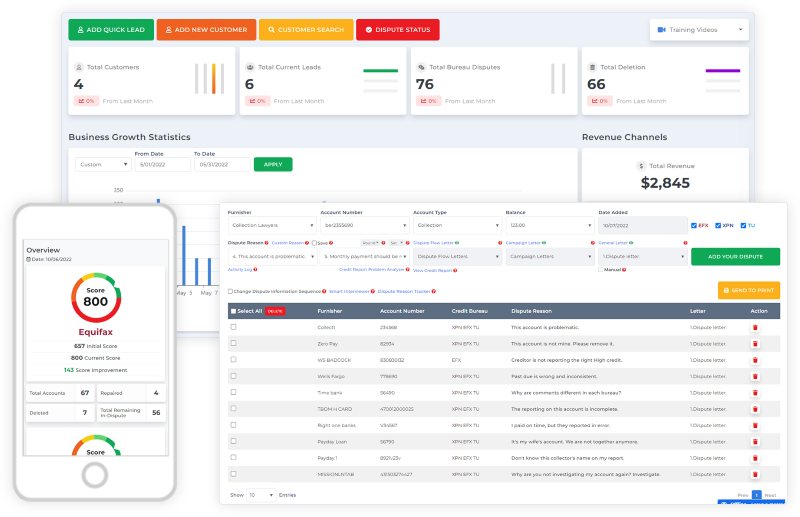

One of the most powerful tools you can incorporate into your credit repair marketing strategies is Client Dispute Manager Software. This software offers a comprehensive solution for managing disputes, streamlining your workflow, and enhancing the overall client experience.

Beyond improving operational efficiency, it plays a crucial role in optimizing your credit repair business marketing by offering tools that can help attract more clients and retain them through seamless service delivery.

Key Benefits of Client Dispute Manager Software for Credit Repair Businesses

- Streamlined Credit Repair Processes: The software automates many aspects of the credit repair process, saving you time and reducing manual errors. This allows you to focus more on your credit repair business marketing efforts and client acquisition.

- Effective Lead Management: With built-in tools for tracking and managing credit repair leads, the software helps you nurture prospects through every stage of the sales funnel. Efficient lead management increases conversion rates and maximizes the ROI of your credit repair advertising campaigns.

- Enhanced Client Communication: Automated email updates and a client portal improve transparency, keeping clients informed about their progress. This boosts client satisfaction and strengthens your credit repair branding by building trust and credibility.

- Compliance and Security: Staying compliant with industry regulations is crucial in the credit repair industry. Client Dispute Manager Software offers features that help you adhere to legal requirements, protecting your business and reinforcing your reputation as a trustworthy service provider.

- Data-Driven Insights: Access to comprehensive reports and analytics allows you to monitor the effectiveness of your credit repair marketing strategies. By understanding what works, you can make informed decisions to optimize your marketing efforts.

By leveraging Client Dispute Manager Software, you not only improve operational efficiency but also enhance your credit repair marketing, leading to increased client acquisition and retention. This powerful tool can give your business a competitive edge in the crowded credit repair market.

Start Today and Explore the Features Firsthand!

Tracking and Measuring the Success of Your Credit Repair Marketing Strategies

To know whether your credit repair marketing strategies are working, it’s crucial to track key performance metrics.

Key Metrics to Monitor in Credit Repair Business Marketing

- Conversion Rate: The percentage of credit repair leads that convert into paying clients. A higher conversion rate indicates that your marketing strategies are effective.

- Cost Per Acquisition (CPA): How much you spend on credit repair advertising to acquire one new client. Keeping this number low ensures your marketing is cost-effective.

- Website Traffic: Use Google Analytics to see how much traffic your site receives from SEO, social media, and email marketing efforts.

- Engagement: Track how many people are engaging with your content on social media, opening your emails, or clicking on your ads.

Frequently Asked Questions (FAQs)

What Are the Best Credit Repair Marketing Strategies?

The best credit repair marketing strategies include leveraging social media, email marketing, SEO, PPC ads, and referral programs. A well-rounded approach using these strategies will help you attract credit repair leads and grow your business.

How Can I Make My Credit Repair Business Stand Out?

You can make your business stand out through strong credit repair branding. Focus on building trust with your clients by being transparent, consistent, and client-focused in all your interactions.

What’s The Most Cost-Effective Way To Generate Credit Repair Leads?

The most cost-effective way to generate credit repair leads is through organic SEO, email marketing, and social media engagement. These methods require time but are highly effective for building long-term growth.

How Can Credit Repair Advertising Help My Business?

Credit repair advertising can increase your visibility online and reach people who are actively searching for credit repair services. PPC ads, in particular, offer immediate results and can drive traffic to your website.

Why Is Credit Repair Branding Important?

Credit repair branding is important because it establishes the identity and reputation of your business. Strong branding builds trust with potential clients and helps differentiate your business from competitors.

Conclusion

By implementing these cost-effective credit repair marketing strategies, you can grow your business while minimizing your marketing expenses. From building trust through strong credit repair branding to generating credit repair leads through social media, email marketing, SEO, and referrals, there are numerous ways to effectively market your business.

Most importantly, tracking and measuring the success of your efforts will ensure that you stay on the right path, continuously improving and optimizing your credit repair business marketing strategies.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- Unlock the Power of DIY Credit Repair Software: A Comprehensive Guide

- Credit Repair Software: Why It’s Important?