If you’re stuck with student loan debt and trying to clean up your credit, you’ve probably asked yourself: Can I remove student loans from my credit report? The short answer is—it depends. But under the right conditions, it’s possible.

Some people manage to remove student loans from their credit reports because of reporting mistakes. Others find out their loans should have been forgiven but weren’t.

In a few cases, the loan is too old to stay on the report. Whether you’re dealing with a mistake or working toward debt relief, there are ways to fix the issue.

One smart move is to use AI credit repair software. It helps you dispute errors, send letters, and track updates—all without handling paperwork on your own. Many people see this as the best method to get rid of student loan errors fast.

This guide covers everything you need to know about how to:

- Remove student loans from your credit report when legally allowed

- Use the best methods for paying off student loan debt

- Decide whether Student Loan Forgiveness is a better option

- Check your Student Loan Forgiveness eligibility

- Use smart tools to manage your credit repair process

Whether you’re starting a business, fixing past credit mistakes, or just trying to move forward, this article is here to help you make sense of your choices—without all the jargon.

Why It’s Important to Remove Student Loans from Your Credit Report?

Having student loans listed on your credit report is not always a problem. But when they are reported incorrectly or show missed payments, they can bring your credit score down.

If you are planning to apply for a mortgage, launch a business, or simply improve your financial standing, understanding how student loans affect your credit report can help you decide when it is time to act.

In many cases, taking action to remove student loans from your credit report that contain errors can make a noticeable difference. Knowing when and how to remove student loan information is key to protecting your financial profile.

How Student Loans Can Hurt Your Credit Score?

Student loans can help or hurt your score depending on how the information appears. Late payments, defaults, or incorrect balances create a negative impression. Even small mistakes like the wrong payment date can send a red flag to lenders.

Many people work to remove student loan entries that are either inaccurate or no longer valid. One update can raise your credit score and make a noticeable difference. If your credit report lists loans that were forgiven or settled, removing them may help you appear more creditworthy.

Errors in student loan reporting can also interfere with loan approvals or business funding. That is why more people are using AI tools to check eligibility and remove student loans from their credit report accurately.

Why People Try to Remove Student Loans from Their Credit Reports?

People try to remove student loans from their credit report for several reasons. In many situations, these loans contain reporting errors that hurt their credit score. Some borrowers discover that a loan that should have qualified for Student Loan Forgiveness still shows as unpaid.

Others find that removing outdated or duplicate entries is the only way to move forward with rebuilding their credit.

These issues can make it harder to access new credit or delay financial goals. By understanding your options and using smart tools, you can fix these problems and stay in control of your credit profile.

- The loan shows a balance even though it has been paid off

- The loan was forgiven through a program but still appears

- The loan is listed more than once

- The loan is over seven years old and should not be there

- The loan does not belong to them

These mistakes are more common than you might think. Fixing them can improve your credit report and increase your chances of being approved for credit cards, apartments, or job opportunities.

If you are dealing with any of these problems, AI credit repair software can help you challenge errors and track the results without needing to mail letters or fill out forms by hand.

How Loan Removal Supports Business and Financial Goals?

If you are running a small business or getting ready to launch one, your personal credit score still matters. Lenders often look at your personal credit before approving business credit. An old or wrong loan entry can stand in the way.

Many business owners now turn to software as the best method to get rid of student loan errors. It makes the process faster and cuts down on paperwork. For people juggling multiple accounts, this option can save time and reduce mistakes.

It also helps prevent delays that come from incorrect reporting. If you want to remove student loans from your credit report to improve funding options, using automated tools is a smart and reliable approach.

What Happens When You Remove Student Loan Information from Your Credit Report?

Removing a student loan from your credit report is not always easy, but when done correctly, it can help you reset your credit history. Depending on the situation, taking this step may lead to higher scores, better loan terms, or access to credit you could not get before.

It also allows you to clear outdated or inaccurate loan details that may be holding you back. For many borrowers, the decision to remove student loans from their credit report is part of a broader effort to regain financial control.

Does Removing a Student Loan Improve Your Credit Score?

In many cases, yes. If the student loan being removed had late payments, was in default, or was listed incorrectly, deleting it can raise your score. The change is often seen in the first update cycle, especially if the account was hurting your payment history or overall balance.

Some people also see score improvements when a duplicate entry is removed. These are common in older reports, especially for loans that were transferred between servicers.

Taking steps to remove student loan entries that do not belong on your file can lead to a cleaner report and better credit standing. In some cases, correcting a student loan error can shift a borderline score into an approval range for credit cards or home loans.

That is why many borrowers make it a priority to remove student loans from their credit report if they see incorrect or outdated information. Keeping your report clean can also help if you plan to apply for business funding or financial aid again in the future.

Can You Remove Student Loans from Your Credit Report Without Paying Them Off?

You do not always have to pay off a loan in full to get it removed. If the loan qualifies for Student Loan Forgiveness, or if it meets the criteria under the Fair Credit Reporting Act, it may be taken off the report.

This often happens when a loan is more than seven years old and has been inactive or when the loan data cannot be verified by the servicer.

Some borrowers also remove loans that were added in error or that show the wrong balance. Using software to detect these problems has become one of the best methods to get rid of student loan information that should not be listed.

These tools can flag outdated entries and track which accounts are eligible for removal. If you are trying to remove student loans from your credit report without long delays, using automation may offer a more accurate and time-saving process. It is especially helpful for people handling multiple disputes or checking for Student Loan Forgiveness eligibility.

Is It Legal to Use Software to Remove Student Loan Entries?

Yes, it is legal to use AI-based or automated credit repair software to manage disputes and account removals. The law allows you to challenge any item on your credit report that is inaccurate, outdated, or unverifiable.

These tools follow the rules and help you submit disputes without spending hours writing letters or reviewing reports manually.

Many people choose this option not just for speed but for accuracy. When done right, using smart tools to remove student loans from your credit report can be both efficient and completely legal. a small business or getting ready to launch one, your personal credit score still matters.

Lenders often look at your personal credit before approving business credit. An old or wrong loan entry can stand in the way.

Many business owners now turn to software as the best method to get rid of student loan errors. It makes the process faster and cuts down on paperwork. For people juggling multiple accounts, this option can save time and reduce mistakes.

It also helps prevent delays that come from incorrect reporting. If you want to remove student loans from your credit report to improve funding options, using automated tools is a smart and reliable approach.

How to Remove Student Loans from Your Credit Report Using AI Credit Repair Software?

Removing a student loan manually can take a lot of time. You may have to write dispute letters, contact servicers, and wait weeks for a response. AI credit repair software helps reduce the effort while increasing accuracy.

It can scan your report, detect possible errors, and even send the correct letters on your behalf. These systems often include features to help you identify loans eligible for removal or Student Loan Forgiveness.

If you want to remove student loans from your credit report with fewer delays and better tracking, software can make the process smoother and more effective.

Why Software Is the Best Method to Get Rid of Student Loan Errors?

Unlike doing everything by hand, software catches small mistakes you might miss. It also checks your full credit report against common problems, like duplicate accounts or loans that should have aged off.

Many users say this is the best method to get rid of student loan accounts that are harming their credit score.

The software can also alert you to loans that qualify for Student Loan Forgiveness or those that show up incorrectly after a consolidation. Instead of spending hours researching, you get guided help.

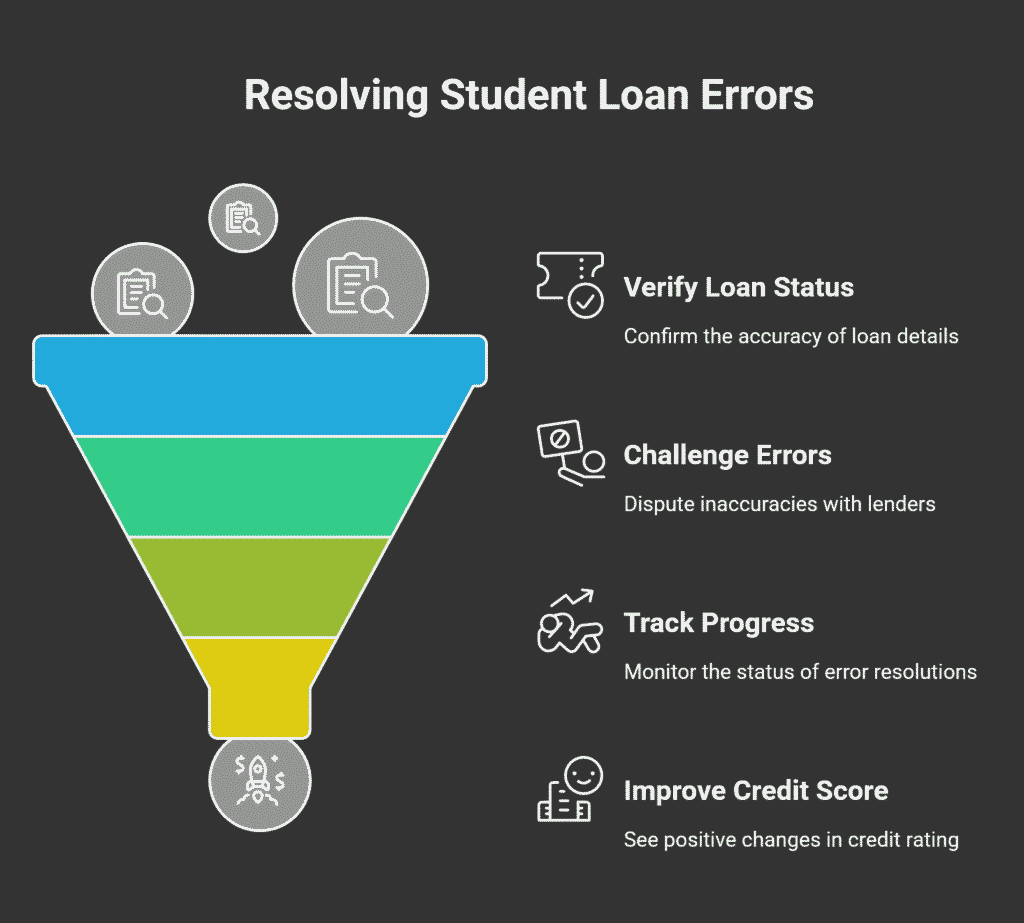

Steps to Remove Student Loan Accounts Using Automation

Using automation to remove student loans from your credit report can simplify the process and help you spot problems that are easy to miss. With the right software, you can track updates, find errors, and challenge items that should not be there.

This method is one of the most efficient ways to deal with incorrect student loan reporting and support faster improvements to your credit score.

- Upload your current credit reports

- Let the software scan for errors or outdated loan listings

- Confirm which loans should be challenged or removed

- Approve and send disputes automatically to the credit bureaus

- Track the responses and updates

This process takes less time than traditional methods and avoids the risk of paperwork errors. It also increases your chances of removing student loans from your credit report more efficiently by automating each step.

For many users, this approach proves to be the best method to get rid of student loan data that is either wrong or outdated.

How to Know if You Qualify for Student Loan Forgiveness?

Some loans can be forgiven if you meet the program’s requirements. Student Loan Forgiveness eligibility depends on the type of loan, your repayment plan, and sometimes your employer or income.

If your loan qualifies and is forgiven, you can then request that the entry be updated or removed. Tools that include forgiveness tracking can help you stay informed and avoid missing deadlines or filing mistakes.

Using technology to remove student loans from your credit report puts you in control. You save time, reduce stress, and make sure your report is as accurate as possible.

Removing a student loan from your credit report is not always easy, but when done correctly, it can help you reset your credit history. Depending on the situation, taking this step may lead to higher scores, better loan terms, or access to credit you could not get before.

It also allows you to clear outdated or inaccurate loan details that may be holding you back. For many borrowers, the decision to remove student loans from their credit report is part of a broader effort to regain financial control.

How Client Dispute Manager Software Helps Remove Student Loans from Your Credit Report

If you’re looking for an all-in-one solution to help remove student loans from your credit report, Client Dispute Manager Software can simplify the process. This software is designed for individuals and business owners who want to repair credit accurately and efficiently.

Whether you’re dealing with reporting errors, checking Student Loan Forgiveness eligibility, or looking for the best method to get rid of student loan records, the software provides tools to automate disputes, track results, and stay organized.

Client Dispute Manager Software gives you full control over your credit repair process. It allows you to upload reports, identify inaccurate or outdated loan entries, and generate customized dispute letters in just a few clicks. With built-in automation features, you can remove student loans from your credit report more quickly and with fewer errors compared to doing it manually.

This platform is especially useful for entrepreneurs and credit repair businesses looking to offer services to others. You can manage multiple client profiles, monitor dispute progress, and ensure all legal steps are followed properly.

For those who want a smarter, faster way to fix their credit or grow a business in the credit repair industry, Client Dispute Manager Software is a reliable choice.

Key Features of Client Dispute Manager Software

- Automated Dispute Generation: Create and send dispute letters based on pre-set templates customized to each credit report issue

- Credit Report Importing: Upload and analyze full credit reports to identify inaccurate student loan data fast

- Student Loan Forgiveness Tracking: Keep tabs on loan forgiveness progress and eligibility for easier dispute follow-up

- Client Management System: Organize and monitor multiple clients or personal disputes in one central dashboard

- Real-Time Dispute Progress Monitoring: Get updates on responses and outcomes without needing to call or email credit bureaus

- Compliance Tools: Built-in checks help you stay aligned with legal standards and avoid mistakes in the process

- Educational Training and Support: Includes learning materials for users new to credit repair or launching a credit repair business

While removing student loans from your credit report can help if they are inaccurate, some borrowers may need to focus on payoff strategies instead. Paying off your student loans on time improves your credit and removes the debt completely, which strengthens your financial standing over time.

Conclusion

Student loan debt can hold back your credit profile, especially if outdated or incorrect information is being reported. Thankfully, you have options. Whether you’re pursuing Student Loan Forgiveness, disputing errors, or exploring the best method to get rid of student loan accounts, the tools and strategies available today can make a real difference.

If you’re ready to take control, AI-driven tools like Client Dispute Manager Software can help you remove student loans from your credit report with more speed and accuracy. And if paying off the debt is your path, structured plans and consolidation can keep things manageable.

Whatever route you take, the most important thing is to act. Your credit impacts your future—and the sooner you address it, the sooner you move forward with confidence.. A thoughtful approach, backed by smart tools and accurate information, can help you move forward faster.. You save time, reduce stress, and make sure your report is as accurate as possible.

Removing a student loan from your credit report is not always easy, but when done correctly, it can help you reset your credit history. Depending on the situation, taking this step may lead to higher scores, better loan terms, or access to credit you could not get before.

It also allows you to clear outdated or inaccurate loan details that may be holding you back. For many borrowers, the decision to remove student loans from their credit report is part of a broader effort to regain financial control.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Below Is More Content For Your Review: