Have you ever found a mistake on your credit report and thought, “How am I supposed to fix this?” You’re not alone. Many people feel confused and overwhelmed when it comes to writing dispute letters.

It’s not just about putting words on paper—it’s about saying the right thing to get the mistake fixed. And let’s be honest: that’s not easy when you’re not a credit expert.

Now imagine having a smart helper who can write those letters for you in minutes. That’s exactly what a credit dispute letter generator can do. It uses AI to create custom letters based on your unique credit problems—without the headache, stress, or guesswork.

Whether you’re trying to remove an account that isn’t yours, fix a wrong balance, or clean up late payments, this tool can help. But here’s the big question: Can it really save you time—and does it actually work?

In this article, we’ll break it all down in plain language. You’ll learn what a credit dispute letter generator is, how it works, what it can do (and what it can’t), and whether it’s the right choice for you.

We’ll also show you how to write strong credit repair letters, give you access to helpful templates, and share real-life tips you can use right away.

Let’s get started—and take one big step toward fixing your credit the smart way.

Start Today and Explore the Features Firsthand!

What Is a Credit Dispute Letter Generator and How Does It Work?

Fixing errors on your credit report might sound like something only a financial expert could do. But thanks to modern tools, that’s no longer true. A credit dispute letter generator is a tool that makes this job easier—and faster—by helping you create the right kind of letter to send to the credit bureaus.

Instead of spending hours writing, researching, and guessing what to say, you can use AI to guide the process.

Let’s break it down into simple pieces.

A Simple Overview of AI-Generated Credit Dispute Letters

A credit dispute letter generator is a software tool that uses artificial intelligence (AI) to write letters that correct mistakes on your credit report. These mistakes could include accounts that don’t belong to you, wrong payment dates, duplicate accounts, or balances that are off.

Instead of starting with a blank page, the AI asks you questions about the problem. Then it uses that info to create a ready-to-send AI generated credit dispute letter. It’s fast, easy, and requires no writing skills.

Think of it like a smart assistant who knows the right tone and format for getting results.

What Makes These Tools Better Than Copy-Paste Templates?

You can find free credit dispute letter templates online, but they often feel generic and outdated. Most people don’t know how to tweak them to match their own credit issue. That’s where the generator stands out.

Here’s why it works better:

- It customizes your letter based on the exact problem you’re dealing with

- It chooses the right language to make your dispute clear and professional

- It includes important legal references, like the Fair Credit Reporting Act (FCRA), which boosts your letter’s credibility

Templates are like one-size-fits-all shirts—sometimes they fit, but not always. An AI-generated letter is more like getting a suit tailored to you.

Why DIY Users and Credit Pros Prefer AI Automation?

Whether you’re fixing your own credit or helping others as part of a business, time matters. Many entrepreneurs running credit repair software businesses now rely on AI tools to handle the first draft of dispute letters.

Here’s why:

- DIY users love that they don’t need writing or legal skills

- Credit repair pros use it to scale—writing dozens or even hundreds of letters in a fraction of the time

- It reduces errors, improves quality, and helps ensure credit repair letters are consistent and clear

AI doesn’t just speed things up. It also gives users more confidence—because the letter feels professional and persuasive.

Step-by-Step: How to Use a Credit Dispute Letter Generator

Using a credit dispute letter generator may sound fancy, but it’s actually super simple. You don’t need to be tech-savvy, and you definitely don’t need to be a credit expert.

Whether you’re fixing your own report or helping clients through your credit repair software, this tool walks you through everything—step by step.

Here’s exactly how it works:

Step #1: Input Your Credit Report Details

First, you tell the generator what’s wrong. Most AI tools will ask you:

- Which account or item you want to dispute

- What’s incorrect about it (wrong amount, not your account, etc.)

- Which credit bureau reported it (Experian, TransUnion, or Equifax)

This info is important because the letter needs to be specific. General complaints like “This looks wrong” don’t get results. But when you feed the tool the right details, it knows how to respond.

Many generators even allow you to import your credit report directly—saving you from copying and pasting information.

Start Today and Explore the Features Firsthand!

Step #2: Choose a Smart Credit Dispute Letter Template

Next, the generator selects a credit dispute letter template based on your situation. These templates are like building blocks—they have all the essential legal language, structure, and tone already in place.

For example:

- Disputing a duplicate account

- Correcting a late payment that was actually paid on time

- Removing an unauthorized hard inquiry

- Addressing identity theft-related errors

With one click, the right template is matched to your case. You can then review and tweak it before moving forward.

Step #3: Let AI Customize the Letter Based on Your Case

Here’s where the magic happens. The generator fills in the blanks with your personal data, tailoring the letter just for you. It uses the info you provided to:

- Insert the correct account and dispute reason

- Refer to the correct credit bureau

- Format the message in a professional, legally accurate tone

The result is an AI generated credit dispute letter that sounds like it was written by a pro—even though you did it in just a few clicks.

Step #4: Send It with Confidence (Mail, Upload, or Fax)

Once your letter is done, it’s time to send it. Depending on the platform you’re using, you may be able to:

- Download the letter and print it for certified mailing

- Upload it directly through a credit bureau’s dispute portal

- Fax it, if the bureau or creditor allows that

Some advanced credit repair software even includes built-in options for:

- Batch printing letters for multiple clients

- Tracking delivery status

- Setting reminders for follow-ups

This final step is where your effort turns into action—and it’s a whole lot faster than writing and mailing everything from scratch.

Client Dispute Manager Software: A Smart Credit Dispute Letter Generator for Businesses and DIY Users

When it comes to credit repair tools, not all software is created equal. If you’re serious about saving time and getting real results especially if you’re managing clients or planning to start a credit repair business Client Dispute Manager Software is one of the most powerful tools you can choose.

It combines the ease of an AI-generated credit dispute letter system with the advanced capabilities of full-scale credit repair software. Whether you’re a beginner or an entrepreneur, it gives you everything you need to take control of the dispute process.

Start Today and Explore the Features Firsthand!

Key Features That Make It Stand Out

Here’s what makes Client Dispute Manager Software a game-changer if you’re looking for a reliable credit dispute letter generator:

- AI-Powered Dispute Letter Generator: Create fully customized, legally formatted credit dispute letters in minutes. Just enter a few key details, and let the AI do the rest—no writing skills needed.

- Credit Dispute Letter Templates for Every Situation: Choose from a library of proven credit dispute letter templates designed for late payments, charge-offs, inquiries, collections, and more.

- Multi-Bureau Dispute Support: Easily generate and send letters to Experian, TransUnion, and Equifax, all from one dashboard.

- Client Management System: Keep track of every customer’s progress with secure, organized folders, timelines, and built-in notes.

- Batch Printing & Follow-Up Reminders: Handle bulk disputes quickly with one-click printing and schedule reminders to follow up with bureaus or clients.

- Built-In Education Center: Learn how to write credit dispute letters that work, understand credit laws, and improve your skills—right inside the software.

- Business Toolkit for Entrepreneurs: Includes billing, automation, email marketing, and workflow templates to help you grow your credit repair business.

Whether you’re helping yourself or dozens of clients, this software does more than just save time—it gives you the tools to succeed with confidence.

Start Today and Explore the Features Firsthand!

Benefits of Using an AI Credit Dispute Letter Generator

Fixing your credit doesn’t have to be frustrating or slow. With an AI credit dispute letter generator, you can take action faster, avoid common mistakes, and feel more confident that you’re saying the right things in your dispute.

Whether you’re working on your own credit or managing letters for clients through credit repair software, the benefits are real—and powerful.

Let’s explore the biggest advantages.

Save Hours on Research, Writing, and Editing

Writing a credit dispute letter from scratch takes time. First, you have to figure out what to say. Then you have to make sure it’s worded just right, sounds professional, and includes all the correct details. That can take hours.

But with a generator, you skip all of that. The tool:

- Uses smart templates built by credit experts

- Fills in the correct data for you

- Adjusts the tone and structure based on your input

That means you can go from confusion to completion in minutes—not hours. With an AI credit dispute letter generator, you also reduce the chances of common errors that slow down the credit repair process.

Plus, if you’re using a complete credit repair software platform, this tool fits right into your workflow—helping you manage multiple disputes efficiently and accurately.

Create Credit Dispute Letters That Actually Work

One of the biggest concerns people have is: “Will this letter even work?”

With a generator, you’re not guessing. These tools are designed to create credit dispute letters that work by using industry-approved strategies and consistent formatting techniques that increase credibility.

They also align with best practices found in leading credit repair software, helping to streamline your credit repair journey. Whether you’re fixing a late payment or disputing an incorrect account, an AI-powered tool ensures each letter is focused, effective, and easy to manage.

- Following proven formats

- Including the right language and legal references

- Making your case clear, firm, and professional

Instead of hoping your letter works, you can feel confident that it’s been written the way credit bureaus expect. AI-generated credit dispute letters help ensure consistency and reduce the risk of errors that could delay or derail your case.

By leveraging advanced credit repair software, users can build letters that not only meet bureau standards but also improve the chances of getting a fast and favorable response.

Start Today and Explore the Features Firsthand!

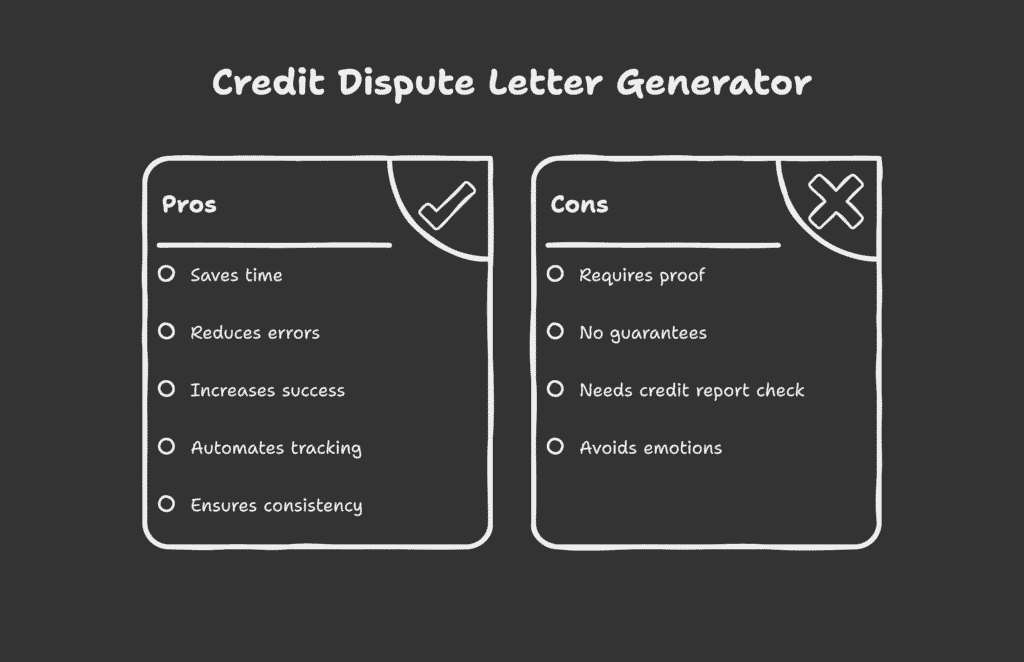

What a Credit Dispute Letter Generator Can’t Do for You?

While a credit dispute letter generator is powerful, it’s not magic. There are some important things it can’t do—and knowing these limitations can help you use the tool more effectively. By understanding where automation stops, you can use these tools wisely and avoid common pitfalls that lead to frustration or delays.

It Can’t Guarantee Credit Score Increases

Even the best AI credit dispute letter can’t promise your credit score will go up. That’s because credit repair depends on how the credit bureau and data furnisher respond to your dispute—and whether they agree the information is inaccurate.

The generator helps you say things clearly and correctly, but the final outcome depends on outside factors.

It’s important to remember that results can vary depending on the item being disputed and the strength of the supporting documentation. No software, no matter how advanced, can override the judgment of credit bureaus.

It Won’t Work Without Supporting Evidence

Credit bureaus need proof. If you’re disputing a collection or charge-off, just sending a letter isn’t enough. You often need to include documents like statements, receipts, or identification to back up your claim.

The generator helps you draft the letter, but you still need to provide evidence when it’s required.

Attaching solid proof increases your chances of a successful outcome and shows that your request is valid and verifiable. Think of the generator as your assistant not your entire strategy.

It Can’t Replace Strategic Human Judgment

Some credit repair cases need creative thinking and personal insight. AI can help you get started, but there are moments when only a human can make the best call especially when crafting goodwill letters, escalation letters, or legal notices beyond a basic credit repair letter.

For example, understanding the emotional tone or unique background behind a goodwill request often requires a personal touch. Combining your judgment with AI tools can lead to the best overall strategy.

Understanding these limits can help you get the most out of your software while knowing when to go beyond the automation. Used wisely, it’s a powerful tool—but not the whole solution.

As part of a smart credit repair approach, a credit dispute letter generator saves time, supports organization, and boosts confidence but your decisions still drive the results.

How to Write a Good Credit Dispute Letter (Even Without a Generator)

Even if you’re not using an AI credit dispute letter generator, it’s still possible to write an effective letter on your own. Knowing what to say and how to say it can be the difference between a rejected claim and a successful credit correction.

A well-crafted credit dispute letter can still hold power when it follows the same structure used in many automated tools.

Learning how to format and personalize your own credit repair letter can also give you a stronger understanding of your credit rights and responsibilities.

Start Today and Explore the Features Firsthand!

Key Elements of a Strong Credit Repair Letter

To make your credit dispute letter as strong as possible, include these key parts:

- Your full name, address, and date of birth

- The name of the credit bureau you’re writing to (Experian, Equifax, or TransUnion)

- A clear explanation of the item you’re disputing

- Supporting facts, such as payment history or proof of error

- A request to remove or correct the inaccurate information

This format helps ensure the bureau can verify your identity and understand exactly what you’re disputing. Including all of these elements also increases the chances of your credit dispute letter template being processed efficiently.

It shows professionalism and attention to detail, which are key when working with credit bureaus or using credit repair software.

Copy This Proven Credit Dispute Letter Template

Here’s a simplified credit dispute letter template you can use:

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Credit Bureau Name]

[Address]

Subject: Dispute of Inaccurate Credit Report Information

To Whom It May Concern,

I am writing to dispute the following item on my credit report. The item is inaccurate because [explain briefly why]. I am requesting that this item be investigated and removed or corrected.

Account Name: [Name]Account Number: [XXXX-XXXX]Reason for Dispute: [Reason]

I have attached a copy of my credit report and supporting documents. Please complete the investigation and notify me of the results.

This template is widely accepted and meets the formatting standards used in many credit repair letters.

What to Say When Disputing Collections or Charge-Offs?

When disputing collection accounts, be clear and confident. Avoid emotional language and focus on the facts. For example:

“The account listed was paid in full and should not be reported as outstanding.”

“I do not recognize this debt and request validation.”

If you’re using a credit dispute letter generator, these statements are built in—but you can still include them manually when writing on your own.

Being direct and factual improves your credibility and increases your chances of resolution.

Start Today and Explore the Features Firsthand!

Do 609 Credit Dispute Letters Actually Work?

You may have heard about the famous “609 letter”—a popular method in the credit repair world. But what is it really, and does it actually work?

Many people are drawn to 609 letters because they’ve seen videos or posts promising fast credit score improvements. However, it’s important to understand what a 609 credit dispute letter can and cannot do.

What Is a 609 Credit Dispute Letter?

A 609 credit dispute letter refers to Section 609 of the Fair Credit Reporting Act (FCRA). This section gives you the right to request a copy of your credit report and the sources of the information it contains. Some people use this law to challenge negative items on their credit report, asking for verification or removal.

But here’s the truth: Section 609 doesn’t actually require credit bureaus to delete accurate negative items just because you ask. The law allows you to request proof, but if the information is verified as accurate, it will stay on your report.

That’s why using a credit dispute letter generator for 609 letters can help you format your request properly, but it won’t force a deletion unless the item is genuinely unverifiable.

Can It Help Remove Late Payments or Charge-Offs?

Sometimes. If the creditor can’t provide documentation or if the account details are outdated or wrong, a 609 letter may lead to removal. But if they do have records proving the item is correct, it’s unlikely to be removed.

That’s why pairing a 609 letter with supporting documentation and smart follow-up letters like those created with credit repair software can improve your chances.

Using a reliable credit dispute letter generator can also help ensure your message is clear, accurate, and legally appropriate.

The more precise and professional your letter is, the better your chances of achieving a successful dispute outcome.

Remember, not every situation calls for a 609 letter. It’s just one tool in the credit repair toolbox.

Does a 609 Letter Have to Be Notarized?

This is a common myth. While some templates online suggest notarizing the letter to appear more formal, the law does not require it. Sending a notarized letter may seem more official, but it does not increase your chances of success. Most credit bureaus care more about clear facts and supporting documentation than notarization.

Understanding the role and limits of 609 letters helps you avoid false expectations and use them effectively especially when integrated into your overall strategy with a credit dispute letter generator or credit repair software.

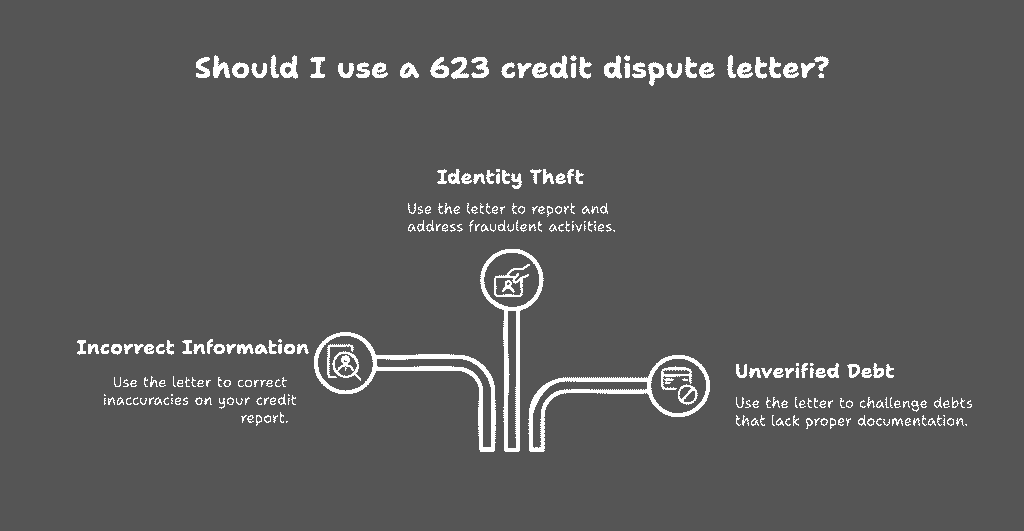

What Is a 623 Credit Dispute Letter and When Should You Use It?

Just like the 609 letter, the 623 credit dispute letter is another popular tool used in credit repair but it works a little differently. If you’re trying to correct inaccurate information directly with the original creditor (not just the credit bureau), this letter can be a powerful option.

Section 623 of the Fair Credit Reporting Act (FCRA) gives you the right to request that the original data furnisher like a bank or collection agency investigate and verify the accuracy of the reported information.

Understanding Section 623 of the FCRA

Section 623 outlines the responsibilities of data furnishers. That means any lender, creditor, or collector who reports to credit bureaus must make sure the information they share is accurate and up to date.

When you send a 623 letter, you’re not asking the credit bureau to fix an error you’re asking the source to investigate and respond.

This can be a smart move if the bureau has already verified the item, but you still believe it’s wrong. By reaching out to the creditor directly, you may get a faster resolution or uncover mistakes that the bureau missed.

Sample 623 Letter for Collection Removal

Here’s a simple example of a 623 letter request:

Subject: Request for Investigation Under Section 623 of the FCRA

To Whom It May Concern,

I am writing to dispute information your company has provided to the credit bureaus. I believe the following item is inaccurate and request an investigation under Section 623 of the Fair Credit Reporting Act:

Account Name: [Name]

Account Number: [XXXX-XXXX]

Nature of the Dispute: [Reason for dispute]

Please provide all documentation and records you used to verify the accuracy of this information. If you find that the information is inaccurate or incomplete, I request that you notify the credit bureaus to correct or remove it immediately.

Sincerely,

[Your Name]

Using a credit dispute letter generator or credit repair software can help format and deliver this type of letter effectively.

Start Today and Explore the Features Firsthand!

609 vs. 623 Credit Dispute Letters Compared

Both letters are useful, but they target different sources and serve distinct purposes in your credit repair strategy. Using the right letter at the right time especially when powered by a reliable credit dispute letter generator can lead to more effective results.

Incorporating both approaches into your workflow using credit repair software gives you the flexibility to handle disputes from every angle.

A 609 letter is typically sent to the credit bureau to request proof of reported items, while a 623 letter is directed to the original creditor or data furnisher to request an investigation into the accuracy of the information they reported.

If you’ve already disputed an item with a bureau and didn’t get results, a 623 letter is a strong follow-up. It’s especially helpful when you’re dealing with collections, charge-offs, or inaccurate account statuses.

By using tools like credit repair software or an AI credit dispute letter generator, you can generate both types of letters efficiently helping you stay organized and respond with confidence throughout the credit repair process.

Final Takeaways: Should You Use a Credit Dispute Letter Generator?

A credit dispute letter generator is a powerful time-saving tool for both individuals and professionals. It simplifies the credit repair process, helps reduce errors, and builds letters that are more likely to get results. Whether you’re disputing one item or managing dozens, having the right tools matters.

These generators are especially effective when paired with credit repair software that automates tracking and follow-ups. By combining automation with accuracy, users can maximize their chances of success with every dispute.

Do:

- Use clear, specific language

- Include supporting documentation

- Track your letters and follow up

- Use an AI credit dispute letter generator for consistency and speed

Don’t:

- Submit vague or emotional complaints

- Forget to check your credit report details

- Expect guaranteed results without proof

Conclusion

Navigating the credit repair process doesn’t have to be intimidating or time-consuming. With the help of a credit dispute letter generator, anyone from a first-time DIY user to a seasoned credit repair business owner can create powerful, professional dispute letters in just minutes.

These tools not only make your communication with credit bureaus more effective, but also ensure that you stay organized and consistent.

For those who want to take it a step further, combining this technology with full credit repair software offers even greater advantages, such as bulk dispute management, automation, and progress tracking.

Whether you’re correcting a few mistakes on your personal report or helping clients achieve financial recovery, the right tools can streamline your workflow and improve your success rate.

By using smart automation and proven templates, you’re not just writing letters—you’re taking real steps toward building better credit and greater financial freedom.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: