Fixing your credit can feel confusing, but it doesn’t have to be. In 2025, more people than ever are taking control of their credit using easy to use tools called DIY credit repair software.

These programs help you find mistakes on your credit reports, send dispute letters to credit bureaus, and track your progress from your computer or phone.

If you’ve been wondering “What is the best DIY credit repair software?”, you’re not alone. With so many platforms offering different features, knowing where to start can be tricky.

That’s why this guide was created—to give you clear, simple answers and help you feel confident choosing the right tool for your needs.

Whether you want to fix errors on your credit report, learn how credit works, or take control of your financial future, DIY credit repair is a strong option. It’s not just for tech experts or professionals. Anyone can do it with the right guidance and software.

By the end, you’ll know what to look for and what to avoid when choosing the best DIY credit repair software for your needs.

Let’s get started!

Start Today and Explore the Features Firsthand!

What Is DIY Credit Repair Software and How Does It Work?

DIY credit repair software is a digital tool that helps you fix errors and improve your credit reports without hiring a credit repair company. It gives you everything you need to manage your credit repair process on your own—step by step.

These platforms guide you through reviewing your credit reports, identifying incorrect or outdated items, and creating letters to send to the credit bureaus. Many include built-in templates, tracking tools, and automation features to make things easier.

DIY credit repair software puts you in charge. It helps you take action with the right information and tools instead of feeling stuck or unsure.

Who Should Use DIY Credit Repair Software?

This type of software is a great choice if:

- You want to fix mistakes on your credit report

- You like being hands-on and learning as you go

- You want more control over your financial decisions

- You’re interested in understanding how credit works

Whether you’re just getting started or already understand the basics, DIY credit repair software can guide you through the process in a clear and organized way.

What Problems Does Credit Repair DIY Software Solve?

DIY credit repair tools are designed to solve common credit problems, like fixing inaccurate credit accounts, removing outdated negative items, and identifying reporting errors from credit bureaus.

These issues can hurt your credit score if left unaddressed, which is why taking control with DIY credit repair software is so valuable. By using organized templates and tracking tools, users can streamline the credit repair process and improve their reports without professional help.

- Inaccurate or outdated accounts on your credit report

- Negative items that should be removed

- Credit bureau errors

- Hard-to-understand credit report details

The software helps you organize your efforts and keeps track of your actions. Instead of wondering what to do next, you follow a clear plan that helps you fix issues and stay on track with your credit goals.

Why DIY Credit Repair Is a Growing Trend in 2025?

More people are turning to DIY credit repair solutions in 2025 because they want direct control over their credit journey. Instead of relying on third-party services, individuals are using smart digital tools to manage their credit reports, send dispute letters, and track their improvements.

The flexibility and convenience of using DIY credit repair software makes it a top choice for anyone who wants to take responsibility for their financial health.

The Rise of DIY Credit Repair Kits and Tools

As credit education becomes more accessible, so do the tools that help people take action. Many platforms now offer complete DIY credit repair kits that include pre-written dispute letters, tracking spreadsheets, and step-by-step guides.

These kits are often built into modern credit repair software, so users don’t have to gather materials on their own. Everything they need is in one place, saving time and confusion.

These ready-to-use kits are especially helpful for those new to credit repair DIY methods. They eliminate guesswork and provide a structured approach for sending dispute letters and monitoring updates.

With the right tools in hand, anyone can start improving their credit scores quickly and confidently.

Start Today and Explore the Features Firsthand!

Why People Prefer Credit Repair DIY Tools Over Services?

Users appreciate the transparency and control they get from credit repair DIY tools. You can see what’s happening at every step of the process, from identifying errors to submitting letters and tracking updates from the credit bureaus.

This self-directed method helps users feel more confident and empowered, which is why it continues to grow in popularity. Plus, many tools are designed to be beginner-friendly, so even those with no experience can get started quickly.

With credit repair software, users also gain access to detailed reporting and real-time updates, which helps them stay organized and focused.

These features make the best DIY credit repair software a preferred option for individuals who want to manage their credit on their own terms.

Key Features of the Best DIY Credit Repair Software Platforms

When comparing the best DIY credit repair software tools, it’s important to focus on features that help you work faster, stay organized, and handle disputes effectively.

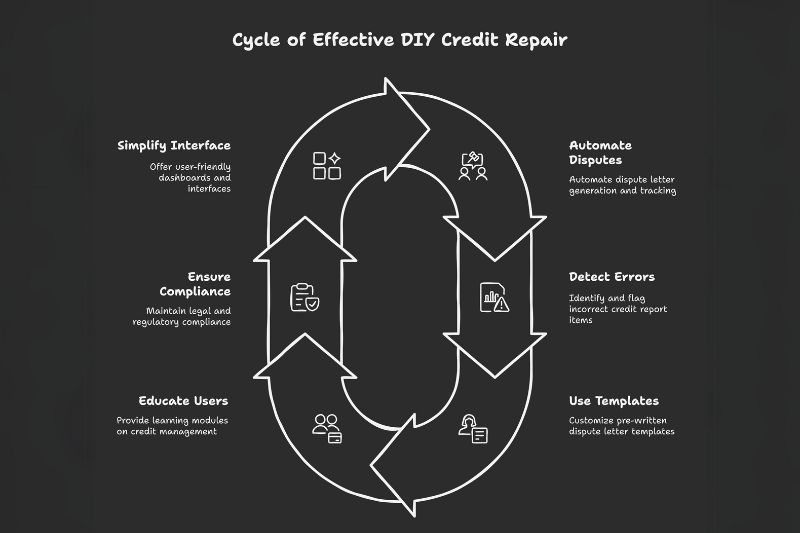

The best tools offer a mix of automation, error detection, templates, and educational support that make your credit repair process easier to manage.

These features are especially useful for individuals using DIY credit repair kits, as they simplify complex tasks. Choosing a platform with these built-in tools can improve your success with credit repair DIY methods and boost your confidence along the way.

Automated Tools for Credit Repair DIY

One of the biggest benefits of using DIY credit repair software is automation. Instead of manually writing and sending dispute letters, many platforms allow you to auto-generate and track them with just a few clicks.

These features save time, reduce errors, and give you a more efficient way to manage disputes with credit bureaus. With automated tools, users can complete tasks in minutes that might otherwise take days.

This is one of the reasons why the best DIY credit repair software continues to be a top choice for people seeking fast and accurate results.

Smart Error Detection for Faster Results

Modern credit repair DIY platforms often come with built-in tools that flag incorrect or suspicious items on your credit report. These smart error detection systems help you identify problems faster and act with confidence.

By catching mistakes early, you can fix your credit report more efficiently and improve your score over time.

This feature is especially helpful for users who are unfamiliar with credit report formatting or common reporting errors. Using error detection as part of your DIY credit repair kit saves valuable time and ensures no critical details are missed when disputing inaccurate items.

It’s a key reason why many consider smart detection an essential tool in the best DIY credit repair software.

Pre-Written DIY Credit Repair Letters That Save Time

Writing effective dispute letters can be stressful, especially if you’re not sure what to say. That’s why the best DIY credit repair software includes pre-written templates for a variety of situations.

These DIY credit repair letters can be customized to match your needs and ensure your communication with the credit bureaus is professional and compliant. These ready-to-use templates save time and reduce the stress of writing letters from scratch.

They also help you stay consistent and compliant with federal laws during the dispute process. With reliable templates built into your DIY credit repair kit, you can feel confident in every letter you send.

Start Today and Explore the Features Firsthand!

Credit Education and Learning Modules

The best software doesn’t just help you fix credit—it helps you understand it. Many DIY credit repair kits include helpful videos, articles, and step-by-step instructions so you can learn as you go.

These educational tools give you a deeper understanding of credit scores, reports, and how to avoid future issues. By improving your credit knowledge, you become better prepared to maintain healthy financial habits.

Understanding how to read your credit report and spot errors is a major benefit of using credit repair DIY software. This type of learning support makes the best DIY credit repair software a smart choice for long-term success.

Legal and Compliance Features for DIY Use

Using software that follows federal rules and stays compliant with the Fair Credit Reporting Act (FCRA) and Credit Repair Organizations Act (CROA) is essential. Top DIY credit repair software platforms include built-in legal safeguards to help you follow the right steps without crossing legal lines.

This is especially important for anyone new to the credit repair DIY process. These safeguards help protect your rights while guiding you through each stage of the dispute process.

Choosing compliant tools also ensures your actions are aligned with federal standards, which builds trust and keeps your efforts legally sound.

Beginner-Friendly Dashboards and Interfaces

A great credit repair tool should be easy to navigate. That’s why user-friendly design is one of the top features to look for in the best DIY credit repair software. Clean dashboards, step-by-step workflows, and visual progress tracking help you stay on top of your repair efforts from day one.

These features make it easier to follow your credit repair DIY plan without feeling overwhelmed. With intuitive tools built into the dashboard, even first-time users of DIY credit repair kits can confidently move through each stage of the process.

A well-designed interface also reduces the chance of making errors, which is crucial when managing sensitive financial information.

Choosing user-friendly software increases your success rate and makes the overall credit repair journey smoother and more efficient.

Client Dispute Manager Software: A Smart, User-Friendly Tool for DIY Credit Repair

If you’re searching for a platform that makes the DIY credit repair process easier, smarter, and more organized, Client Dispute Manager Software deserves your attention. It’s packed with tools that simplify each step of the credit repair journey, making it one of the best DIY credit repair software options in 2025.

Why Client Dispute Manager Software Stands Out?

Client Dispute Manager Software is built for people who want a practical and easy way to repair their credit on their own. It’s simple, guided, and packed with tools that help you take real action fast.

Here’s what makes it stand out as one of the best DIY credit repair software choices available today:

- Built for DIY Users: Whether you’re just starting out or already know the basics, this software gives you a simple and structured system to take control of your credit repair.

- Pre-Written DIY Credit Repair Letters: No need to write letters from scratch—choose from customizable templates that save time and follow industry best practices.

- Automated Dispute Tracking: Keep tabs on every dispute with real-time updates and a visual dashboard that shows your progress clearly.

- Educational Support: Access videos, tutorials, and credit education resources that explain each step, so you’re not left guessing.

- Compliance-Ready: Fully aligned with FCRA and CROA regulations, the platform helps you stay within legal limits while managing your disputes.

- Ideal for Self-Starters: If you like being hands-on and want to feel empowered through the process, this tool is designed with you in mind.

- Supports Deeper Understanding: Beyond fixing your credit, you’ll learn how the system works—knowledge that helps you long-term.

- Growth-Friendly: While we don’t cover business use or pricing, this platform also supports learning for those who may explore the credit repair industry further.

Client Dispute Manager Software combines automation, education, and user-friendliness to help you succeed with your DIY credit repair goals.

Start Today and Explore the Features Firsthand!

DIY Credit Repair Software vs Traditional Credit Repair Companies

Choosing between DIY credit repair software and traditional credit repair companies depends on your personal needs and goals. Each approach offers unique benefits, and understanding the differences can help you make the right decision for your situation.

DIY credit repair tools give you full control over how and when you take action, while also offering educational features to help you build credit knowledge.

Traditional companies may handle more of the work for you, but often limit your visibility into the process. The best choice depends on whether you want to learn by doing or prefer to delegate the task entirely.

Comparing Control, Speed, and Tools in Credit Repair DIY

With credit repair DIY software, you have complete control over your progress. You can view your credit reports, identify problems, and send dispute letters without waiting on someone else.

Many users find this faster and more empowering than using a traditional service, especially when the software includes tools like templates, automation, and tracking features.

These platforms make it easier to stay organized and act quickly, especially when you spot inaccurate items or outdated information.

The best DIY credit repair software also lets you keep everything in one place dispute letters, status updates, and timelines so you never lose track of what you’ve done and what’s next.

The Role of Transparency in DIY Credit Repair

One key advantage of DIY credit repair kits is transparency. You always know what’s happening and why. You’re the one sending the letters, reviewing the updates, and seeing the results firsthand.

This level of visibility can be reassuring and help you learn more about how credit really works.

It also encourages users to stay engaged in every step, rather than relying on outside companies. The best DIY credit repair software helps you build trust in your actions and offers clear, trackable progress to keep you informed and motivated.

Which Option Is Right for You?

If you prefer to learn and manage your finances independently, DIY credit repair software may be your best choice. It’s ideal for people who want a hands-on approach to fixing errors, improving credit scores, and building financial literacy.

This type of software is especially useful for those who enjoy following a clear, step-by-step process and want full visibility into their credit repair journey. It also empowers users to take ownership of their financial future without relying on third parties.

On the other hand, those with more complex credit issues or less time to manage disputes may still consider professional services. Either way, understanding your own goals is key to choosing the right path and using the best DIY credit repair software to meet your needs.

Start Today and Explore the Features Firsthand!

Frequently Asked Questions (FAQs)

What Is DIY Credit Repair Software?

DIY credit repair software is a tool that helps individuals correct errors on their credit reports without needing to hire a credit repair company. It provides pre-written DIY credit repair letters, dispute tracking, credit education, and guided steps to help users follow a structured plan.

This type of software empowers users to take charge of their credit with tools designed for simplicity and effectiveness.

Can I Really Fix My Credit on My Own?

Yes, many people successfully improve their credit using DIY credit repair tools. With the right software, you can manage disputes, monitor your credit, and build financial literacy all at your own pace. The best DIY credit repair software gives you confidence to act, saves you time, and keeps you organized throughout the process.

Are DIY Credit Repair Kits Effective?

When used correctly, DIY credit repair kits can be very effective. These kits typically include step-by-step instructions, customizable templates for dispute letters, and checklists to help users challenge errors and outdated items.

They are especially helpful for beginners and those who prefer a hands-on approach.

How Long Does Credit Repair Take?

Most users begin to see improvements within 30 to 90 days, though full results can take several months. Progress depends on the complexity of your credit issues and how consistent you are with follow-ups.

The best DIY credit repair software keeps you on track with reminders, automated timelines, and status updates.

Do I Need to Be Tech-Savvy to Use the Software?

No. Most DIY credit repair software is designed to be beginner-friendly. Tools like drag-and-drop navigation, visual dashboards, and simplified letter generators make it easy for anyone to use regardless of experience level.

For example, Client Dispute Manager Software offers a clean interface and intuitive setup, guiding users step-by-step through the credit repair process. It’s especially helpful for new users who want structure, confidence, and the right features to succeed with their credit repair DIY journey.

Is DIY Credit Repair Legal?

Absolutely. Under the Fair Credit Reporting Act (FCRA), you have the legal right to dispute inaccurate or outdated items on your credit report. DIY credit repair software helps you follow the correct process legally and confidently.

What Should I Look for in the Best DIY Credit Repair Software?

Look for software that offers a full set of features: automated dispute letter tools, compliance support, educational resources, progress tracking, and real-time updates. A complete platform helps you stay focused and increases your chances of success.

What Makes Client Dispute Manager Software a Top Choice?

Client Dispute Manager Software is one of the most comprehensive platforms for credit repair DIY users. It includes everything from pre-written DIY credit repair letters and educational resources to automation and legal compliance tools.

Its easy-to-use interface, real-time tracking, and built-in support make it ideal for individuals who want to take control of their credit repair process with confidence.

Whether you’re a beginner or experienced DIYer, this software provides the structure and flexibility to help you succeed.

Final Thoughts on Choosing the Best DIY Credit Repair Software

If you’re looking to take charge of your credit, using the best DIY credit repair software is a smart move. Tools like Client Dispute Manager Software give you step-by-step support, pre-written letters, and legal protection—all in one place.

You don’t need to be an expert. With an easy-to-use platform, helpful features, and consistent effort, you can confidently improve your credit on your own. Client Dispute Manager Software gives you everything you need to succeed with your credit repair DIY journey.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: