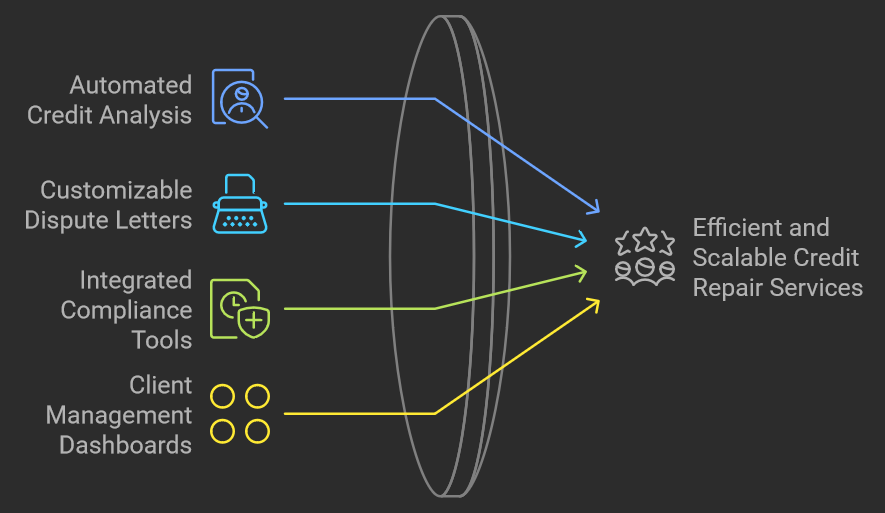

Running a credit repair business can be both rewarding and challenging. Managing client disputes, tracking credit reports, and ensuring compliance with industry regulations require organization, efficiency, and accuracy. Handling everything manually can slow down operations and limit your business growth.

This is where credit repair software comes in. With the right automation software for credit repair, you can streamline your workflow, save time, and provide better service to your clients. In this guide, we’ll explore how the best credit repair software for business can help you grow and automate your operations effectively.

If you’re looking for a solution to scale your credit repair business, improve dispute handling, and automate tedious tasks, keep reading to discover the essential features and benefits of using the right credit repair software.

Start Today and Explore the Features Firsthand!

The Importance of Credit Repair Software for Business Growth

Having the right credit repair software can make a significant difference in managing disputes, tracking credit reports, and maintaining compliance with industry regulations.

By automating essential tasks, businesses can save time, reduce errors, and improve client satisfaction.

Whether you are just starting or looking to scale your operations, investing in the best credit repair software for business will help streamline your workflow and boost efficiency.

How Credit Report Repair Software Automates the Dispute Process?

Manual dispute handling is time-consuming and prone to human errors. Without automation, businesses struggle with long processing times, lost documents, and inconsistent dispute follow-ups, which can delay results for clients.

Credit repair software automates the process by generating dispute letters instantly, ensuring proper formatting, and tracking responses from credit bureaus in real time.

With built-in templates and AI-driven recommendations, credit repair businesses can craft effective dispute strategies tailored to each client’s credit profile.

Faster dispute resolution leads to improved customer satisfaction, increased business revenue, and better retention rates. Clients are more likely to trust a service that delivers results quickly and efficiently.

Task automation reduces the workload for business owners, allowing them to focus on acquiring more clients and scaling their operations without compromising service quality.

Managing Clients More Effectively with the Best Credit Repair Software

Built-in CRM tools provide a centralized platform to store, organize, and track client data efficiently, ensuring smooth business operations.

With a secure client portal, clients can access their dispute progress in real time, fostering transparency and trust.

Automated notifications and reminders help businesses stay on top of important updates, minimizing delays and enhancing customer satisfaction.

By reducing administrative workload, these tools enable credit repair professionals to focus on improving client outcomes and scaling their business effectively.

Start Today and Explore the Features Firsthand!

Ensuring Compliance with the Right Software for Credit Repair Business

Staying compliant with Fair Credit Reporting Act (FCRA) and Credit Repair Organizations Act (CROA) is crucial for any credit repair business. Failure to adhere to these regulations can result in significant fines and legal repercussions.

Credit report repair software provides a structured approach to compliance by ensuring that all client data is securely handled and stored according to industry standards.

Automated compliance tools help businesses generate legally sound dispute letters, maintain proper documentation, and follow ethical credit repair practices.

The software also includes built-in audit logs that record all transactions and activities, offering a clear, trackable history of compliance efforts.

This not only minimizes legal risks but also provides transparency and accountability, helping businesses build credibility and trust with clients and regulatory bodies.

By leveraging compliance-focused automation, businesses can streamline operations while maintaining full adherence to federal and state credit repair laws.

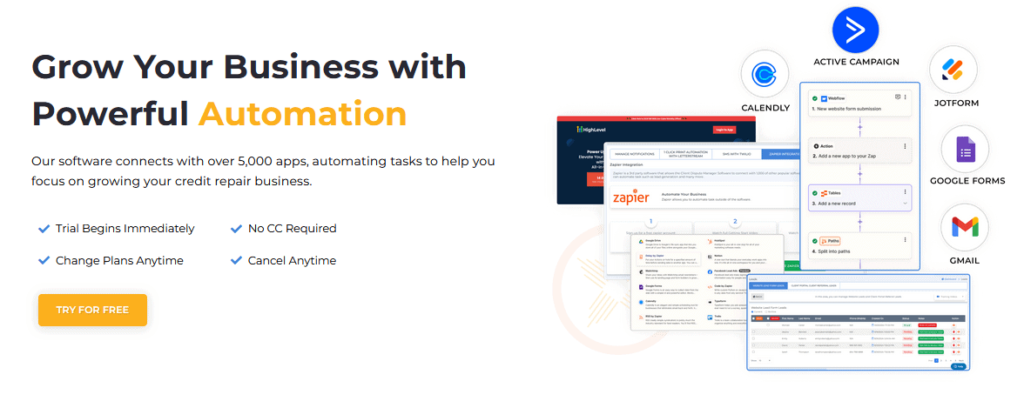

Scaling Your Business with Automation Software for Credit Repair

Automation enables you to efficiently manage a growing number of clients without adding excessive manual work.

By utilizing built-in marketing tools, you can create targeted campaigns that attract and nurture potential customers, increasing engagement and conversion rates.

Lead generation features streamline the process of capturing and managing prospects, helping you build a strong client base over time.

Additionally, affiliate and referral management functionalities allow you to establish strategic partnerships, expanding your network and increasing revenue through collaborative efforts.

As your business scales, automation ensures that operational efficiency remains high, enabling you to provide top-tier service without overwhelming your team.

Start Today and Explore the Features Firsthand!

Key Features of the Best Credit Repair Software for Business

Choosing the right credit repair software is crucial for streamlining your business operations, improving efficiency, and ensuring compliance with industry regulations.

The best credit repair software should offer automation tools, CRM integration, lead generation capabilities, and secure data management to help you handle disputes effectively.

Whether you are a startup or an established credit repair firm, having a feature-rich platform will allow you to manage clients seamlessly, optimize workflows, and scale your operations effortlessly.

Easy-to-Use Interface & Training for Credit Repair Businesses

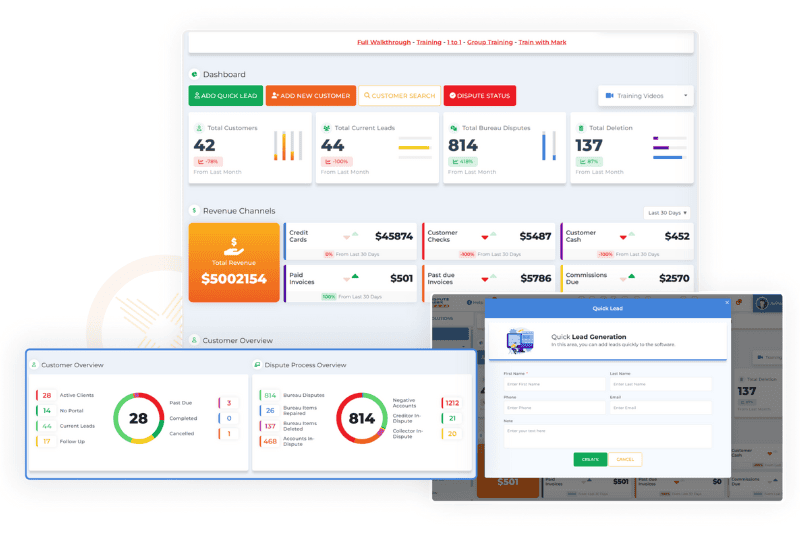

A beginner-friendly dashboard ensures easy navigation, allowing users to access essential tools and features without a steep learning curve. The intuitive design helps streamline workflows, making it easier for credit repair professionals to manage client disputes and track progress efficiently.

Step-by-step training modules provide comprehensive guidance for new users, ensuring they understand the system’s full capabilities.

These educational resources cover everything from importing credit reports to automating dispute processes, helping businesses maximize productivity from day one.

With built-in tutorials and ongoing support, users can quickly adapt to the software and implement best practices, improving both efficiency and client outcomes.

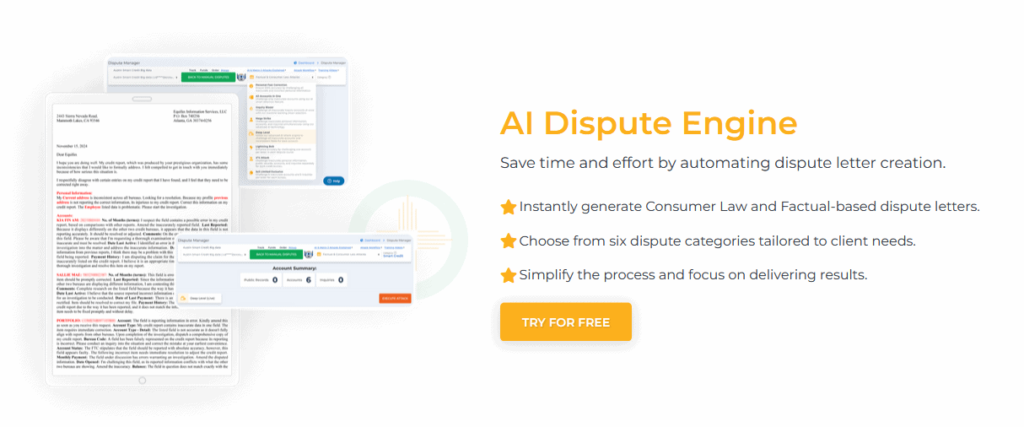

Advanced Dispute Letter Automation in Credit Report Repair Software

Generating custom dispute letters has never been easier with advanced automation tools that allow businesses to create personalized and legally compliant documents in just seconds.

By integrating real-time tracking capabilities, credit repair software ensures that each dispute’s progress can be monitored closely, reducing delays and increasing the likelihood of a favorable outcome.

Automated notifications help users stay updated on responses from credit bureaus, enabling timely follow-ups and strategic adjustments.

This level of efficiency not only enhances operational productivity but also improves client satisfaction by delivering faster results and maintaining transparent communication throughout the dispute resolution process.

Start Today and Explore the Features Firsthand!

Credit Report Importing & Analysis for Faster Disputes

Importing credit reports directly into the software eliminates the hassle of manual data entry, saving time and reducing the risk of errors. The software automatically scans reports for negative items, identifying potential disputes and categorizing them based on severity.

By leveraging built-in analytical tools, businesses can generate personalized dispute strategies tailored to each client’s unique credit profile.

This streamlined process ensures faster dispute resolution, improving client satisfaction and enhancing the overall efficiency of credit repair operations.

Additionally, automated tracking features keep users informed of updates and responses, allowing businesses to take timely action and maximize results.

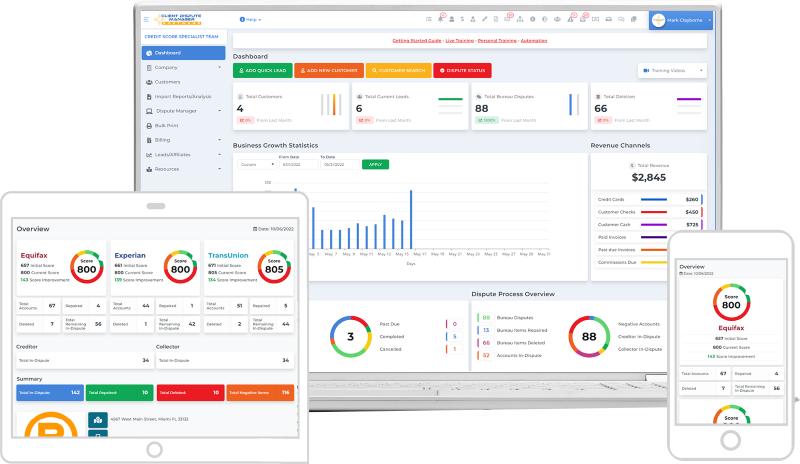

Business Management & CRM Tools in Credit Repair Software

Managing client records, dispute history, and billing in one centralized platform simplifies operations and enhances organization.

With credit repair software, businesses can securely store and access client data, track dispute progress, and maintain accurate financial records, ensuring seamless workflow management.

Automated reminders and scheduling tools help businesses stay proactive in their client communications, reducing missed follow-ups and improving overall customer experience.

By keeping track of dispute timelines and client interactions, businesses can enhance client retention rates and build stronger relationships.

A well-structured system not only streamlines administrative tasks but also allows credit repair professionals to focus on delivering results and growing their business efficiently.

Lead Generation & Marketing Features in Credit Repair Software for Business

Automated email campaigns play a vital role in nurturing leads and converting prospects into loyal customers. By using targeted messaging, businesses can send personalized emails based on client behavior, improving engagement and response rates.

These campaigns help credit repair professionals stay connected with potential clients, providing them with timely updates, promotions, and valuable insights.

Additionally, social media integration enhances brand visibility and credibility, allowing businesses to reach a broader audience.

By leveraging platforms like Facebook, Instagram, and LinkedIn, credit repair companies can build a strong online presence, attract new leads, and establish trust through consistent and informative content.

With a combination of automated emails and social media marketing, businesses can create a seamless lead generation strategy that maximizes conversions and supports long-term growth.

Start Today and Explore the Features Firsthand!

Multi-User Support & Cloud-Based Access in Credit Repair Automation Software

Multiple team members can collaborate seamlessly, ensuring that credit repair operations run smoothly even with a growing client base.

A cloud-based system enables users to access essential tools, client records, and dispute tracking features from any location, enhancing productivity and convenience.

With secure, remote access, teams can efficiently manage their workflow, stay updated on dispute progress, and provide real-time support to clients.

Whether working from the office or remotely, a cloud-powered platform ensures that credit repair professionals maintain efficiency and organization while expanding their business reach.

24/7 Support & Community Access for Credit Repair Business Owners

Having access to dedicated customer support is essential for running a successful credit repair business. With multiple support channels, including chat, phone, and email, users can quickly get assistance whenever they encounter technical issues or need guidance.

Fast and responsive support ensures that businesses can continue their operations without unnecessary delays. In addition to direct support, online community forums provide a valuable space for business owners to share experiences, ask questions, and learn from others in the industry.

Training resources, such as tutorials and webinars, offer continuous learning opportunities, helping users stay updated with the latest credit repair strategies, compliance requirements, and software enhancements.

By leveraging both live support and self-help resources, businesses can maximize their software usage and improve overall efficiency.

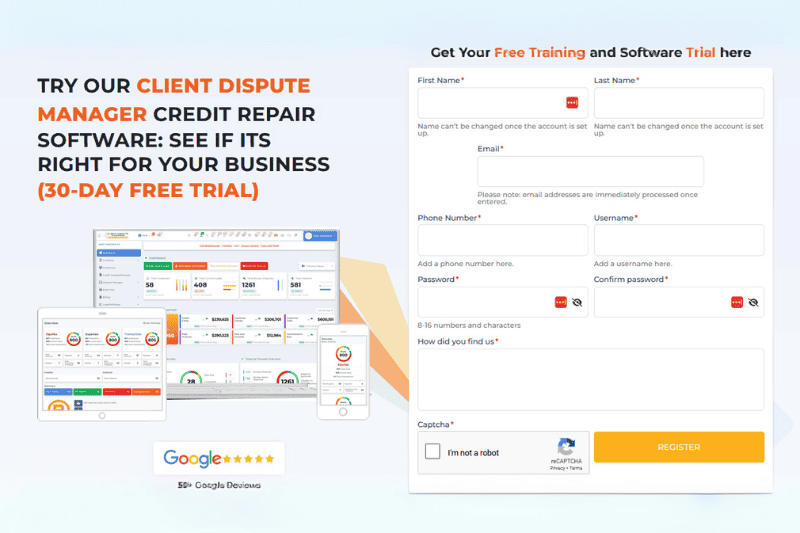

Pricing & Free Trials: Choosing the Best Credit Repair Software

Affordable pricing plans make credit repair software accessible to businesses of all sizes, whether you are a startup or an established company. Flexible subscription options ensure that businesses can choose a plan that fits their needs without unnecessary expenses.

A 30-day free trial provides the opportunity to explore all features, allowing users to test automation tools, dispute tracking capabilities, and CRM functions before making a commitment.

By experiencing the software risk-free, businesses can assess its effectiveness in streamlining operations and improving client management, ensuring they invest in a solution that aligns with their long-term goals.

Why Client Dispute Manager Software is the Best Credit Repair Software for Business?

Choosing the right credit repair software is essential for maximizing efficiency and ensuring smooth business operations. Client Dispute Manager Software stands out as an industry-leading solution that automates dispute management, simplifies client tracking, and helps businesses stay compliant with credit repair laws.

With its robust features, user-friendly interface, and advanced automation, this software is designed to streamline processes and scale your credit repair business seamlessly.

Whether you are looking to improve workflow efficiency or grow your client base, this all-in-one platform offers the necessary tools to help your business succeed.

Start Today and Explore the Features Firsthand!

Fully Automated Credit Repair Software for Faster Disputes

Automating the dispute process from start to finish eliminates the need for manual intervention, significantly reducing errors and enhancing efficiency.

By leveraging automated workflows, businesses can generate dispute letters, track responses from credit bureaus, and follow up on cases without the delays associated with manual processes.

This not only speeds up resolution times but also allows businesses to handle more clients without sacrificing quality.

With real-time tracking and updates, users can monitor the progress of disputes, ensuring that each case is handled promptly and effectively.

As a result, businesses can improve client satisfaction and streamline operations, making automation an essential feature for scaling a successful credit repair service.

All-in-One Credit Repair Software with CRM & Business Tools

An integrated credit repair software solution combines dispute handling, customer relationship management (CRM), and marketing tools into one seamless platform.

Businesses can store and organize client information, track dispute progress, and manage customer interactions with ease. Having all essential tools in a single interface reduces the need for multiple software programs, saving both time and operational costs.

By streamlining workflows, businesses can focus on growth strategies, nurturing client relationships, and delivering effective dispute resolutions without switching between different systems.

The built-in CRM capabilities also ensure that businesses can maintain a detailed history of client interactions, allowing for personalized service and improved client retention.

Start Today and Explore the Features Firsthand!

Compliance & Security Features in the Best Software for Credit Repair Business

Ensuring compliance with industry regulations is a top priority for any credit repair business. The best credit repair software includes built-in tools to help businesses adhere to the Fair Credit Reporting Act (FCRA) and the Credit Repair Organizations Act (CROA), reducing legal risks and maintaining ethical standards.

Automated compliance tracking ensures that all dispute letters follow regulatory guidelines, helping businesses avoid penalties and disputes.

Additionally, encrypted data storage protects sensitive client information, preventing unauthorized access and maintaining data integrity.

With security measures such as access controls, secure backups, and audit logs, businesses can confidently manage client data while staying compliant with federal and state regulations.

Business Growth & Marketing Features in Credit Repair Software

Expanding a credit repair business requires effective marketing strategies and lead generation tools.

The best software solutions include automated marketing features that help businesses attract and convert leads through email campaigns, landing pages, and follow-up reminders.

Social media integration allows businesses to reach potential clients on various platforms, increasing brand visibility and engagement. Referral program tracking enables businesses to establish partnerships with affiliates, rewarding those who bring in new clients.

By automating these processes, businesses can maintain a steady flow of new customers while focusing on delivering high-quality credit repair services. These growth-oriented features help businesses scale efficiently without adding unnecessary workload.

Start Today and Explore the Features Firsthand!

Dedicated Support & Training for Credit Repair Business Owners

Reliable customer support is essential for businesses that rely on credit repair software to manage their operations efficiently. 24/7 support ensures that users can access assistance whenever needed, whether for troubleshooting technical issues or getting guidance on software features.

A comprehensive knowledge base, including training videos, webinars, and step-by-step tutorials, empowers users to maximize the software’s capabilities.

Ongoing support and community forums provide opportunities to connect with industry experts and fellow credit repair professionals, allowing businesses to stay informed about best practices and industry updates.

With dedicated support and training, users can continuously improve their workflow, ensuring long-term success in the credit repair industry.

Affordable Credit Repair Software with a 30-Day Free Trial

Investing in credit repair software should be cost-effective and scalable to meet the needs of both startups and established businesses.

Flexible pricing plans allow businesses to choose a solution that fits their budget without compromising on essential features. A 30-day free trial provides an opportunity to explore the software’s capabilities, test automation tools, and assess its effectiveness before making a long-term commitment.

This risk-free trial ensures that businesses can make an informed decision, evaluating how the software streamlines their workflow and enhances client management.

By offering affordable plans and trial periods, credit repair software providers help businesses maximize efficiency without unnecessary financial strain.

Start Today and Explore the Features Firsthand!

How to Get Started with Client Dispute Manager Credit Repair Software

Getting started with credit repair software is simple and efficient, allowing you to automate disputes, manage clients, and grow your business with ease. With an intuitive setup process and user-friendly tools, businesses can quickly integrate software into their workflow.

By leveraging automation, tracking features, and built-in compliance tools, you can streamline operations while ensuring accuracy and efficiency.

Whether you are new to credit repair or looking to optimize your existing business, the right software can provide the structure and automation needed to scale successfully.

Step #1: Sign Up for the Free Trial of Client Dispute Manager Software

Sign up on the official website to get immediate access to all features and tools. The quick registration process ensures you can start automating disputes and managing clients right away, without requiring a credit card. Experience the platform firsthand and explore its powerful automation capabilities risk-free.

Start Today and Explore the Features Firsthand!

Step #2: Set Up Your Business with the Best Credit Repair Software

Setting up your credit repair software is quick and efficient, allowing you to begin managing disputes and clients seamlessly. Configure your dashboard settings to suit your workflow, ensuring easy navigation and access to essential tools.

Importing credit reports directly into the system simplifies data management, reducing manual entry errors and speeding up dispute analysis.

Customizing dispute letter templates ensures accuracy and efficiency, enabling you to send professional, legally compliant letters with minimal effort.

With these foundational steps completed, you can start automating your credit repair process and improving client outcomes immediately.

Step #3: Start Automating Your Credit Disputes

The one-click dispute system simplifies case management by allowing users to generate and send dispute letters quickly, reducing processing time.

With automated tracking, businesses can monitor client progress and receive real-time updates, ensuring timely follow-ups.

This feature enhances efficiency, minimizes errors, and improves client satisfaction by streamlining the dispute resolution process.

Start Today and Explore the Features Firsthand!

Step #4: Scale Your Business with Automation & Growth Tools

Growing your credit repair business requires the right tools to manage an expanding client base efficiently. The multi-user feature allows team members to collaborate seamlessly, ensuring smooth operations even as demand increases.

Built-in marketing tools help attract new clients by automating email campaigns, managing social media outreach, and optimizing lead generation efforts.

By combining team scalability with strategic marketing automation, businesses can boost revenue while maintaining high-quality service. These features provide a strong foundation for sustainable business growth in the competitive credit repair industry.

Start Today and Explore the Features Firsthand!

Frequently Asked Questions (FAQs)

What Makes Client Dispute Manager the Best Credit Repair Software?

Client Dispute Manager stands out as one of the best credit repair software solutions due to its powerful automation, user-friendly CRM integration, and built-in compliance tools.

It streamlines the dispute resolution process by automating tasks, reducing manual effort, and ensuring accuracy in handling client credit issues.

The software provides an all-in-one platform for managing clients, generating dispute letters, and tracking progress in real time. Additionally, it helps businesses maintain compliance with credit repair laws, offering security and transparency throughout the dispute resolution process.

Whether you’re a startup or an established business, this software offers the efficiency and scalability needed to grow and optimize operations.

Is Credit Repair Software Easy to Learn for Beginners?

Yes, credit repair software is designed with beginners in mind, offering step-by-step training guides, video tutorials, and an intuitive interface that simplifies the learning process.

Users can quickly navigate the system, automate dispute workflows, and manage client data without prior technical experience.

With dedicated customer support and extensive learning resources, even those new to the credit repair industry can efficiently utilize the software to improve their business operations.

Can I Use This Credit Report Repair Software for Personal Credit Repair?

While this software is primarily designed for businesses, individuals can also use it to manage their personal credit disputes.

The automation features simplify the dispute process, allowing users to generate letters, track responses, and monitor progress efficiently.

Personal users benefit from the same compliance and tracking tools as business users, helping them maintain accuracy and effectiveness in improving their credit reports.

Does Client Dispute Manager Offer a Free Trial?

Yes, Client Dispute Manager provides a 30-day free trial, allowing users to explore all its features before making a commitment. During the trial period, users can test automation tools, client management systems, and compliance tracking to determine how well the software fits their business needs.

This risk-free option ensures businesses can confidently invest in the software, knowing it meets their requirements.

How Does This Credit Repair Software Help with Legal Compliance?

Start Today and Explore the Features Firsthand!

Credit repair businesses must adhere to strict industry regulations, including the Fair Credit Reporting Act (FCRA) and the Credit Repair Organizations Act (CROA).

This software includes built-in compliance tracking to help businesses operate within legal guidelines. Automated features ensure that dispute letters follow regulatory standards, while secure data storage protects client information.

By integrating compliance tools, the software helps businesses avoid legal risks, maintain transparency, and build credibility with clients and regulatory authorities.

Conclusion

Finding the best credit repair software for business is essential for streamlining operations, ensuring compliance, and maximizing growth potential.

The right software provides automation tools that eliminate manual processes, making it easier to manage disputes and track client progress.

Compliance-focused features help businesses adhere to credit repair laws while maintaining data security and accuracy. Scalable solutions enable companies to grow their client base without compromising efficiency.

Whether you are a startup or an established credit repair business, investing in a robust software platform can optimize workflows, enhance client satisfaction, and drive long-term success.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: