If you’re building a credit repair business, you probably didn’t start because you enjoy forms, documents, or compliance checklists. You started because you wanted to help people. You wanted the freedom to be your own boss, set your own schedule, and create something meaningful while guiding others toward better financial outcomes.

But here’s a truth many new business owners learn the hard way: it’s not the disputes that lose clients, it’s the onboarding.

You can understand credit reports, dispute processes, and consumer laws, yet still struggle to keep clients engaged if the first few days feel confusing or disorganized. Documents get requested through scattered emails. Clients aren’t sure what happens next. Agreements go unsigned. Momentum fades. And before the real work even begins, trust starts to slip.

That’s why credit repair client onboarding matters so much.

Your credit repair client intake process is the first real signal of professionalism. It tells clients whether they’re working with someone who has a clear system or someone still figuring things out. And in an industry built on trust, first impressions carry real weight.

Remember, most clients come to you feeling stressed, embarrassed, or unsure who to trust. Laws like the Credit Repair Organizations Act (CROA) and the Fair Credit Reporting Act (FCRA) exist to protect them for a reason. When onboarding feels rushed or unclear, doubt sets in quickly especially during the CROA three-day cancellation window.

But when onboarding is structured, supportive, and easy to follow, something powerful happens. Clients relax. They feel informed. They stay engaged long enough for credit restoration to actually take shape.

In this guide, you’ll learn a clear five-step onboarding framework designed to help you run your credit repair business with confidence, stay compliant, and show clients from day one that you have what it takes.

Start Today and Explore the Features Firsthand!

What Makes Credit Repair Client Onboarding Different?

Onboarding in a credit repair business isn’t the same as onboarding in most other service industries and that difference matters more than many people realize.

When clients come to you, they’re not just buying a service. They’re trusting you with deeply personal financial information. They’re often stressed, frustrated, or embarrassed about their credit situation. Some have already been misled by companies that promised fast fixes and delivered disappointment instead.

That emotional weight changes everything. Unlike other industries, you can’t collect fees upfront freely, rush clients through agreements, or “figure things out later.” Laws like the Credit Repair Organizations Act (CROA) and the Fair Credit Reporting Act (FCRA) exist to protect consumers and they shape how your onboarding must work from day one. Your intake process has to be clear, compliant, and transparent, or trust erodes quickly.

This is why credit repair client onboarding isn’t just an administrative step. It’s a trust-building system. Clients need to understand what’s happening, what’s required of them, and what realistic timelines look like without being overwhelmed by legal language or technical jargon.

When onboarding feels confusing, clients hesitate. When it feels structured and supportive, they stay engaged.

Another challenge unique to credit repair is timing. Because CROA includes a three-day right to cancel, the first few days matter more than you think. If onboarding feels slow or unclear during that window, clients may walk away before you’ve even had the chance to help them.

The good news is you don’t need to be perfect to do this well. Every expert was once a beginner, and every strong onboarding system starts with intention.

Once you understand why credit repair onboarding is different, you’re ready to build a process that protects your clients, supports compliance, and helps your business grow with confidence.

Why the Credit Repair Client Intake Process Carries Legal Weight?

Credit repair client onboarding isn’t just another setup task it’s the foundation of how your credit repair business builds trust, stays compliant, and keeps clients engaged. Because credit restoration involves sensitive financial data and strict consumer protection laws, the way you onboard new clients carries more weight than in most industries.

A clear, supportive onboarding process helps clients feel confident moving forward while setting the tone for a professional, well-structured relationship from day one.

Credit Repair Client Onboarding Starts With Emotional Trust, Not Just Paperwork

Unlike many service businesses, credit repair client onboarding begins with emotion before execution. Clients aren’t just hiring you to complete a task they’re trusting you with sensitive financial details and a situation that often carries stress, fear, or embarrassment.

For many, this is their first step toward credit restoration. They may already feel skeptical after hearing unrealistic promises elsewhere. If your onboarding experience feels rushed, unclear, or overly technical, that doubt grows fast.

That’s why Client Onboarding Processes for credit repair must be built around clarity and reassurance, not just document collection.

Why the Credit Repair Client Intake Process Carries Legal Weight?

The credit repair client intake process isn’t just about gathering information it’s a compliance checkpoint. Federal laws like the Credit Repair Organizations Act (CROA) and the Fair Credit Reporting Act (FCRA) shape how and when you can engage clients.

From required disclosures to the three-day right to cancel, onboarding sets the legal foundation for everything that follows.

When intake is poorly structured, clients may feel uncertain during that critical early window. When it’s clear and compliant, clients feel protected and that protection builds confidence in you and your process.

Start Today and Explore the Features Firsthand!

Step #1: Set Professional Expectations Before the Credit Repair Client Agreement

Setting expectations early is one of the most important steps in credit repair client onboarding. Before a client signs a credit repair client agreement or submits documents, they need clarity on what happens next, how the process works, and what role they play.

A structured welcome system helps your credit repair business build trust immediately while reducing confusion during the critical first few days.

Why the First 24 Hours of Credit Repair Client Onboarding Matter Most?

The first 24 hours after a client decides to work with you can either reinforce their confidence or quietly introduce doubt. This is the moment when credit repair client onboarding truly begins even before you collect a single document or send an agreement.

Setting clear expectations early shows clients that your credit repair business runs on structure, not guesswork.

An immediate welcome communication isn’t just good customer service; it’s strategic trust-building. As soon as someone becomes a client, they should receive a warm, reassuring message that confirms their decision, explains what will happen next, and outlines the first steps without overwhelming them.

When clients understand the roadmap from the start, they feel more confident and far less anxious moving forward.

What to Include in Your Welcome Communication and Welcome Packet?

Your welcome message should create clarity and anticipation, not stress. Use plain language to explain the credit restoration process, what documents will be needed, and what the next few days will look like. A simple checklist, a realistic 30–60 day timeline, and an explanation of how you’ll communicate going forward help turn an abstract service into a clear, manageable process.

This step is especially important during the CROA three-day cancellation window. When clients know exactly what to expect, they’re far less likely to experience buyer’s remorse. By answering common questions upfront, What happens now? How long will this take? you position yourself as organized, professional, and in control.

Using Automation Tools to Standardize This First Onboarding Step

Consistency matters. Whether a client signs up during business hours or late at night, they should receive the same professional experience. Most credit repair CRM software includes automated welcome sequences that send emails or texts immediately after signup. Simple automation tools can also work, as long as the system runs without manual effort.

The goal is straightforward: remove delays, reduce uncertainty, and ensure every client starts their journey with confidence.

Start Today and Explore the Features Firsthand!

Step #2: Master the Credit Repair Client Intake Process With Smart Documentation

A professional credit repair client intake process creates momentum instead of friction. Once expectations are set, clients should move smoothly into documentation without feeling overwhelmed or confused.

This step transforms onboarding from scattered back-and-forth into a structured system that protects compliance, saves time, and builds confidence in your credit repair business.

What the Credit Repair Client Intake Process Must Accomplish?

The goal of your intake process isn’t just to collect paperwork it’s to prepare your business to act accurately and legally. Before any credit restoration work begins, you need the right information, proper authorization, and a clear record of client consent.

A strong intake process should accomplish four things:

- Collect only the documents you legally need

- Verify the client’s identity and authorization

- Organize information so disputes are accurate

- Feel simple and manageable from the client’s perspective

Most intake issues happen when too much is requested at once or when clients don’t understand why documents are needed. Using a Credit Repair Onboarding Template helps standardize requests so every client follows the same clear path, reducing delays and frustration.

When clients feel guided instead of pressured, they complete intake faster and stay engaged longer.

How to Collect Documents Without Overwhelming Clients?

One of the biggest mistakes in credit repair client onboarding is treating intake like a data dump. Long emails, multiple attachments, and unclear instructions create confusion not efficiency.

A better approach is sequencing. Start with essential items like a government-issued ID, proof of address, and authorization to access credit reports. Then guide clients through the remaining steps once the basics are complete. Clear checklists and progress indicators make the process feel achievable instead of intimidating.

Using credit repair CRM software simplifies this even further. Secure client portals centralize document uploads, track completion automatically, and reduce the need for manual follow-ups. This protects sensitive information and helps ensure compliance with consumer protection laws like the FCRA, while also presenting a more professional experience.

When intake feels organized and intentional, clients don’t second-guess their decision they move forward with confidence.

Step #3: Handle the Credit Repair Client Agreement Template and Legal Requirements

Clear agreements protect both you and your clients. This step in credit repair client onboarding ensures expectations, rights, and responsibilities are documented properly before any dispute work begins.

When handled correctly, the credit repair client agreement builds trust instead of confusion and reinforces the professionalism of your credit repair business.

What a Credit Repair Client Agreement Template Must Include?

A credit repair client agreement template isn’t just a formality it’s a legal requirement under the Credit Repair Organizations Act (CROA). Clients must clearly understand what services you provide, what you do not promise, and what rights they have before moving forward.

At a minimum, your agreement should include:

- A clear description of services

- Required CROA disclosures

- The client’s three-day right to cancel

- No guarantees or promises of specific outcomes

- Signature and date acknowledgment

You may also reference relevant sections of the Fair Credit Reporting Act (FCRA), including Section 609 (consumer disclosures) and Section 611 (dispute rights), in plain language so clients understand how the law supports, but does not guarantee credit restoration efforts.

Start Today and Explore the Features Firsthand!

How to Explain Legal Requirements Without Scaring Clients Away?

Legal documents can feel intimidating, especially to clients already stressed about their credit. That’s why how you explain your credit repair client agreement matters just as much as what’s inside it.

Instead of using legal jargon, focus on reassurance. Let clients know the agreement exists to protect them, not to trap them. Briefly explain the three-day cancellation window, why disclosures are required, and how transparency benefits everyone involved.

Digital signatures make this process smoother and more accessible, especially for remote onboarding. Many credit repair CRM software platforms allow agreements to be reviewed, signed, and stored securely in one place reducing delays and keeping records organized.

When clients understand their rights and feel respected, they’re far more likely to move forward with confidence instead of hesitation.

Step #4: Build Trust Through Education and Early Results

Education is where credit repair client onboarding shifts from setup to confidence. Once documents and agreements are in place, clients need to understand what’s happening, what timelines look like, and how progress will be measured.

This step helps your credit repair business reduce anxiety, set realistic expectations, and keep clients engaged long enough for credit restoration efforts to take effect.

What Clients Must Understand Before Credit Restoration Begins?

Before any disputes are sent, clients need a clear, simple explanation of how credit repair actually works. This doesn’t mean overwhelming them with legal language it means helping them understand the basics so they don’t expect instant results.

Clients should know:

- Credit restoration is a process, not a one-time action

- Timelines vary depending on credit history and reporting accuracy

- Disputes are governed by the FCRA, including Section 611 (dispute handling)

- Updates will happen in stages, not overnight

When clients understand the “why” behind the process, they’re far less likely to panic or disengage during the early weeks. This education step turns uncertainty into patience and positions you as a guide, not just a service provider.

How Early Wins and Clear Progress Tracking Strengthen Onboarding?

Early momentum matters. While you should never promise specific outcomes, identifying potential opportunities early helps clients feel reassured that progress is possible. This might include spotting inaccurate information, outdated accounts, or items worth reviewing under FCRA Section 609 disclosure rights.

Equally important is showing clients how progress will be tracked. Weekly or bi-weekly updates, client portals, and clear status indicators help clients stay connected without constant check-ins.

Many credit repair CRM software platforms make this easier by organizing reports, updates, and communication in one place. When clients can see movement even small steps they’re far more likely to trust the process and remain engaged.

Education paired with early visibility transforms onboarding into a confidence-building experience instead of a waiting game.

Start Today and Explore the Features Firsthand!

Step #5: Scale Your Business With Credit Repair CRM Software Automation

As your credit repair business grows, consistency becomes just as important as expertise. This final step in credit repair client onboarding focuses on maintaining trust after setup by ensuring every client receives timely communication, updates, and support without overwhelming you.

Smart automation allows you to scale while still delivering a professional, reliable experience.

Why Automation Is Essential for Modern Credit Repair Client Onboarding?

One of the most common problems in growing credit repair businesses is the follow-up gap. When updates are delayed or inconsistent, clients may assume nothing is happening even when work is underway.

Automation helps close that gap by creating predictable touchpoints that reassure clients and keep them engaged.

Automated check-ins, status updates, and reminders ensure clients know where they are in the process without needing to chase answers. This doesn’t replace personal communication; it supports it.

When used correctly, automation reinforces transparency and helps clients feel supported throughout their credit restoration journey. When your onboarding system runs smoothly in the background, you’re free to focus on client strategy instead of constant manual follow-ups.

Balancing Automation and Personal Support With Credit Repair CRM Software

The key to effective automation is balance. Routine updates, document reminders, and progress notifications can be handled through credit repair CRM software, while important conversations remain personal. This approach ensures efficiency without making clients feel ignored or automated away.

Automation also helps you measure onboarding success. Completion checklists, response times, and engagement indicators show you where clients may be getting stuck allowing you to step in early and offer support.

When clients experience consistent communication and clear progress tracking, onboarding doesn’t feel like a phase it feels like a system they can trust. That trust is what allows your credit repair business to grow sustainably, without sacrificing quality or compliance.

Client Dispute Manager Software: A Complete System for Credit Repair Client Onboarding

By now, you’ve seen how each step in credit repair client onboarding builds on the last. Clear expectations lead to smoother intake. Proper documentation supports compliant agreements. Education and communication build trust. Automation keeps everything running consistently.

The challenge most growing credit repair businesses face isn’t knowing what to do it’s managing all of these steps without things slipping through the cracks. That’s where having a centralized system matters.

Client Dispute Manager Software was built to support the real-world workflow of a credit repair business, not just individual tasks. Instead of juggling emails, spreadsheets, document folders, and reminders, CDMS brings the entire onboarding process into one structured environment.

How Client Dispute Manager Software Supports All the Steps?

Client Dispute Manager Software is designed to align directly with the five onboarding steps you’ve just learned.

For Step #1, automated welcome sequences ensure new clients receive immediate confirmation, next steps, and reassurance even if they sign up outside business hours.

For Step #2, secure client portals allow documents to be uploaded, tracked, and stored safely. Intake checklists help ensure nothing is missed while keeping the credit repair client intake process simple for clients.

For Step #3, compliant credit repair client agreement templates can be reviewed and signed digitally, with records stored automatically for reference and protection.

For Step #4, client dashboards and progress tracking tools help educate clients and show movement over time, reinforcing trust without overpromising results.

For Step #5, built-in automation handles routine updates and reminders, allowing you to scale without losing consistency or personal connection.

Start Today and Explore the Features Firsthand!

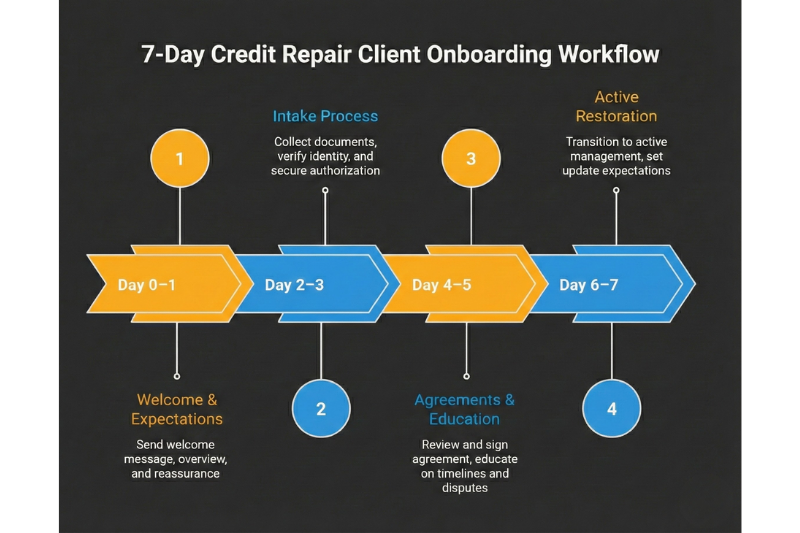

How to Onboard Credit Repair Clients From Lead to Active Client in 7 Days?

A clear timeline removes uncertainty for both you and your clients. When credit repair client onboarding follows a predictable schedule, clients know what to expect and you know exactly when to move forward.

This seven-day framework turns onboarding into a smooth transition instead of a drawn-out guessing game while keeping your credit repair business compliant and organized.

- Day 0–1:- Welcome, Expectations, and First Touchpoint: The process begins the moment a client says yes. Within the first 24 hours, your welcome message sets the tone. Clients should receive confirmation, a simple overview of what happens next, and reassurance that they’re moving in the right direction. This early clarity is especially important during the CROA three-day cancellation window, when confidence matters most.

- Day 2–3:- Complete the Credit Repair Client Intake Process: Once expectations are set, focus on completing the credit repair client intake process. This includes collecting essential documents, verifying identity, and ensuring authorization is in place. Clear checklists and secure portals help clients complete intake without feeling overwhelmed, while keeping your records compliant and accurate.

- Day 4–5:- Agreements, Education, and Initial Review: By mid-week, the credit repair client agreement template should be reviewed and signed. This is also the right time to educate clients on realistic timelines, how disputes work under the FCRA, and how progress will be tracked. When clients understand the process, they’re far less likely to second-guess it.

- Day 6–7:- Transition to Active Credit Restoration: The final step is transitioning clients from onboarding to active management. Intake is complete, agreements are in place, and expectations have been reinforced. Clients should know how updates will be delivered and what the next phase looks like. At this point, onboarding feels complete and trust is firmly established.

A structured seven-day onboarding workflow reduces delays, improves retention, and sets your credit repair business up for long-term success.

Credit Repair Client Onboarding: Your Questions Answered

How Long Should Credit Repair Client Onboarding Take?

For most credit repair businesses, client onboarding should take 5–7 days from the initial “yes” to becoming an active client. This allows enough time to set expectations, complete the credit repair client intake process, review agreements, and educate clients without rushing or creating confusion.

What Documents Are Required During the Credit Repair Client Intake Process?

Most onboarding processes require a government-issued ID, proof of address, signed authorization, and access to credit reports. These documents help verify identity and ensure disputes are accurate and compliant under the Fair Credit Reporting Act (FCRA). Collecting only what’s necessary keeps onboarding efficient and client-friendly.

Can I Use A Credit Repair Onboarding Template To Standardize My Process?

Yes. A Credit Repair Onboarding Template helps ensure every client follows the same clear steps. Templates reduce errors, speed up intake, and make your process feel more professional especially helpful for newer credit repair businesses building consistency.

How Does Client Dispute Manager Software Help With Credit Repair Client Onboarding?

Client Dispute Manager Software centralizes the entire onboarding process in one place. It helps automate welcome messages, collect documents securely, manage agreement templates, track progress, and maintain consistent communication making it easier to stay organized, compliant, and professional as your credit repair business grows.

Start Today and Explore the Features Firsthand!

Transform Your Credit Repair Business With Professional Onboarding

Building a successful credit repair business isn’t about doing everything perfectly from day one. It’s about putting the right systems in place and improving them step by step. As you’ve seen throughout this guide, strong credit repair client onboarding isn’t just an operational task. It’s the foundation that supports trust, compliance, and long-term growth.

When onboarding is clear and structured, clients feel confident moving forward. They understand what’s happening, why it matters, and what realistic progress looks like. That confidence reduces cancellations, improves engagement, and allows credit restoration efforts to unfold the way they’re supposed to without unnecessary friction or confusion.

The five-step framework you’ve learned isn’t about rushing clients or overpromising outcomes. It’s about guiding them with transparency, consistency, and care. From setting expectations to automating communication, each step reinforces the same message: you’re in good hands.

And remember every expert was once a beginner. You don’t need years of experience to run a professional operation. You need clarity, intention, and the willingness to build systems that support both you and your clients. When you do that, you give yourself the freedom to be your own boss, set your own schedule, and grow a business you can be proud of.

If you’re ready to simplify onboarding, stay compliant, and run your business with confidence, the right tools can make all the difference.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!