Have you ever opened a medical bill and felt confused? Many people deal with charges that look wrong or do not make sense. These mistakes create stress, and they can even turn into wrong medical debt on your credit report. When this happens, you need to dispute medical bills fast so you can protect your credit and your peace of mind.

Medical billing errors are common. A coding mistake or a slow insurance update can place a balance on your report that should not be there. If you ignore it, the problem can grow. Debt collectors may start calling you. Your credit score can drop. You may feel stuck.

You are not alone, and you have options. You can fix these mistakes and remove medical debt that is not yours. The process is easier when you follow clear steps. This guide shows you how to find errors, challenge them, and clean your credit report.

You will learn how to protect your rights, how to speak with providers, and how to use a Medical Debt Validation Letter when a collector contacts you.

You will also learn why this matters for your future. If you run a business, want to start one, or plan to grow in the credit repair industry, you need clean credit. Wrong medical debt can slow you down. When you know how to handle these problems, you stay in control.

Let’s walk through each step so you can fix the issue, remove wrong medical debt, and move forward with confidence.

Start Today and Explore the Features Firsthand!

Key Takeaways:

- Review itemized bills early so you can dispute medical bills before they move to collections.

- Gather your records, contact the provider and insurance, and push for corrections when you see errors.

- Use a Medical Debt Validation Letter when a collector contacts you with a balance you do not trust.

- File disputes with all three bureaus to remove medical debt that is wrong or cannot be verified.

- Keep strong records and follow up often so wrong medical debt does not harm your credit score or business goals.

Why Wrong Medical Bills Lead To Medical Debt You Must Remove?

Wrong medical bills often turn into medical debt when small errors go unnoticed. A billing code, a duplicate charge, or a slow insurance update can create a balance you do not owe. If you wait too long, that balance may move to collections and show up as medical debt on your credit report.

Once a collector reports the account, the damage grows. Even if the bill is wrong, the negative mark stays until you dispute medical bills and prove the mistake. This is why you must act fast to remove medical debt that does not belong to you.

You have strong rights that help you fix these issues, including FCRA medical debt rules, FDCPA medical debt rights, and the option to use a HIPAA medical records request. These tools let you correct errors early so they do not hurt your score or your future plans.

Signs You Need To Dispute Medical Bills Fast

You should dispute medical bills right away when the charges do not match the care you received. If the dates look wrong, the treatments seem unfamiliar, or the total does not match your records, the bill needs a closer look. Small errors can turn into bigger problems when left alone.

You also need to act fast when your insurance shows a denial you did not expect. A claim may be processed wrong, which creates a balance you do not owe. If you already paid but still see a charge, this is another clear sign to dispute medical bills.

Calls or letters from collectors for a bill you do not recognize are a serious warning. This often means the provider sent the balance out without fixing the error. When that happens, you must dispute medical bills before the wrong information reaches your credit report.

What You Need Before You Dispute Medical Bills?

You need a few key documents before you dispute medical bills. Start with an itemized bill from the provider that lists every charge. This helps you see the exact codes, dates, and services tied to the balance. Without this, you cannot compare the bill to your records.

You also need your Explanation of Benefits from your insurance. This shows what your plan covered and what the provider billed. When the numbers do not match, you have proof to support your dispute. Keep payment receipts or bank statements if you already paid part of the bill.

It also helps to keep notes from any calls with the provider or insurance. Write down the name of each person you spoke with and the date of the call. These details make your case stronger when you dispute medical bills and need to show a clear timeline.

Start Today and Explore the Features Firsthand!

Step #1: Review Your Itemized Bill To Learn How To Remove Medical Debt

Your first step is to look closely at the itemized bill. This document breaks every charge into simple lines so you can spot mistakes fast. When you understand each line, you learn how to remove medical debt that does not belong to you.

Compare the dates, treatment codes, and service descriptions with your own records. If you see a charge for a test you never took or a visit you never had, write it down. These errors are strong reasons to challenge the balance. Small mistakes grow quickly, so catching them early helps you remove medical debt before it reaches your credit report.

Check insurance adjustments as well. If the provider did not apply the correct coverage, the bill may show a higher amount than you owe. This is one of the most common issues people find when they review their itemized bill. A careful review helps you understand the problem and gives you a clear path to remove medical debt step by step.

Step #2: Contact the Provider To Dispute Medical Bills

Your next step is to call the provider’s billing department and explain the errors you found. This is the fastest way to clear up simple mistakes and dispute medical bills before they move to collections. Keep your itemized bill in front of you so you can point out each issue with confidence.

Ask the provider to review the charges and check their records. If the billing code, date, or service is wrong, they can correct it on the spot. You should also request written confirmation once they fix the error. This helps you later if the problem appears again.

If the provider needs more time, ask for a new itemized bill that reflects the changes. This updated document is important when you continue to dispute medical bills with insurance or the credit bureaus.

Step #3: Contact Your Insurance To Fix Errors That Create Medical Debt

After you speak with the provider, call your insurance company to check how the claim was processed. Many people end up with medical debt because a claim was delayed, denied by mistake, or coded wrong. A quick call can clear this up and help you remove medical debt before it spreads to collections.

Ask the insurance representative to review the claim line by line. Confirm what your plan should cover and what your responsibility should be. If the provider sent the wrong code or missed information, request a reprocessing. This simple step often fixes the balance right away.

Keep notes during the call. Write down the representative’s name, the date, and what they told you. These details help you later if you must continue to dispute medical bills or correct new errors that show up.

Step #4: Send a Written Dispute To Remove Medical Debt

A written dispute gives you clear proof that you challenged the charge. This step is important when you want to remove medical debt that was created by a billing error. A written letter also helps you if the provider or insurance does not respond to earlier calls.

Keep your letter short and direct. List the mistakes you found and attach copies of your itemized bill, your Explanation of Benefits, and any notes from past calls. Ask the provider to correct the errors and send you a written reply. This makes the dispute official and strengthens your case.

Make a copy of everything you send and keep it in your records. If the provider continues to report the wrong balance or sends it to a collector, your written dispute protects you and helps you dispute medical bills with proof. This gives you a stronger chance to remove medical debt from your report.

Start Today and Explore the Features Firsthand!

Step #5: Use a Medical Debt Validation Letter When a Collector Contacts You

When a collector reaches out about a balance you do not trust, you should use a Medical Debt Validation Letter right away. This letter forces the collector to prove the debt is real and accurate before they can continue reporting it. Many people find mistakes at this stage, which gives you a strong chance to fix the issue and protect your credit.

When To Use a Medical Debt Validation Letter?

Send this letter as soon as a collector contacts you about a bill you do not recognize or a balance that looks wrong. Use it when you believe the provider billed you by mistake or when the amount does not match your records.

This is also the right step when the provider moved the account to collections before responding to your dispute. A fast response protects you before the collector reports the account. It also stops them from pressuring you while you review the information.

What To Include In a Medical Debt Validation Letter?

Keep the letter clear and simple. Include your name, the account number, and the reason you are requesting proof. Ask the collector to show a full breakdown of charges, the name of the original provider, and any records that support the balance.

State that you want all collection activity paused until they send this information. You can also request copies of any payment history they claim you owe. This extra detail helps you catch errors the collector may have missed.

What Collectors Must Send Back After Your Medical Debt Validation Letter?

Collectors must send proof that the debt belongs to you. They must show the complete list of charges, the dates of service, and the name and contact information of the provider. They must also confirm the correct balance after insurance adjustments.

If they cannot verify the debt, they must stop collection efforts and remove the account from your file. This rule protects you from paying for medical debt that is not accurate. It also gives you strong evidence when you challenge the account with the credit bureaus.

How To Remove Medical Debt From Your Credit Report?

You can clean your report when you know how to remove medical debt that was added by mistake. This process works when you have the right documents and follow each step in order. The credit bureaus must review your dispute and correct entries they cannot verify. A careful approach helps you fix the problem fast and protect your score.

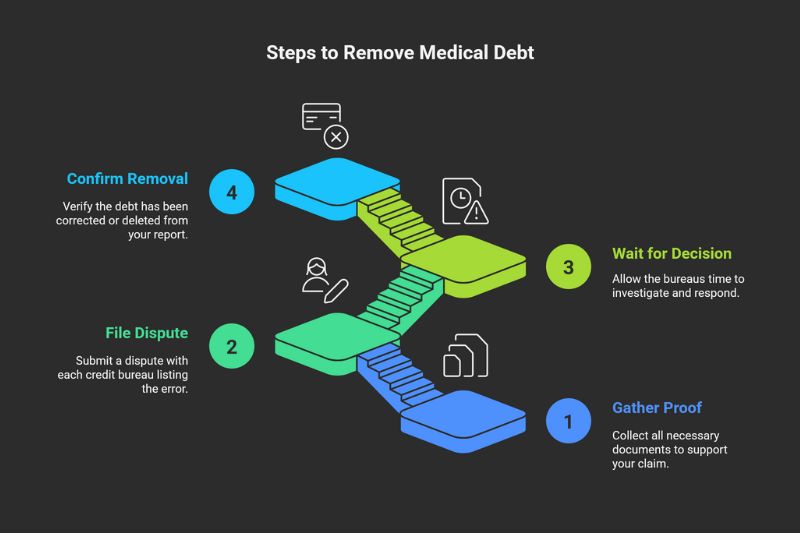

Step #1: Gather Proof To Remove Medical Debt

Start by collecting every document that supports your claim. This includes your itemized bill, your Explanation of Benefits, any corrected statements from the provider, and notes from past calls. These papers show the full story behind the error and help you explain how to remove medical debt the right way.

The more proof you have, the stronger your dispute will be when the bureaus review the account. Strong documentation also prevents the provider or collector from changing the story later. It keeps the process clear and protects you from further mistakes.

Step #2: File a Bureau Dispute To Remove Medical Debt

Submit a dispute with each credit bureau that lists the wrong entry. Upload your documents and write a short message that explains why the balance is not correct. Make the explanation simple so the reviewer can understand the mistake fast.

This clear approach makes it easier for the bureaus to confirm how to remove medical debt linked to billing errors. Save a copy of every document you submit for your records. It also helps to take screenshots of the submission page so you can show the date and time you filed the dispute.

Start Today and Explore the Features Firsthand!

Step #3: Wait for the Bureau Decision

The credit bureaus follow a set timeline to review your dispute. They contact the provider or collector to confirm the information you sent. If the company cannot verify the balance, the bureau must delete it.

During this period, check your email for updates or requests for more details. This step is part of how to remove medical debt through the official dispute process. Stay patient, because your dispute will move through several departments before you receive a final answer.

Step #4: Confirm the Medical Debt Is Removed

Once the investigation is complete, download a fresh copy of your credit report. Look for the account you disputed and confirm that it is corrected or deleted. Save this updated report in your records in case the error appears again in the future.

If the item still shows up or returns later, you can reopen the dispute with the proof you already gathered. This final check ensures you fully remove medical debt from your credit file. It also helps you track your progress and see how the change affects your score.

Your Rights When You Dispute Medical Bills

You have clear rights that protect you when you dispute medical bills. These rights help you challenge errors, request proof, and correct wrong medical debt before it damages your credit. Knowing these rules gives you more control and makes the dispute process easier to manage.

You have the right to see accurate information under the FCRA medical debt rules. This means credit bureaus must fix or delete any medical debt they cannot verify. You also have protection under FDCPA medical debt rights, which stop collectors from reporting false balances or pressuring you to pay bills you do not owe.

You can also request your records through a HIPAA medical records request. This lets you review treatment details and compare them to the charges on your bill. If the provider billed you for services you never received, these records help you prove it. These rights work together to support you each time you dispute medical bills and push for accurate reporting.

When Medical Debt Should Not Appear on Your Credit Report?

Some medical bills should never show up on your credit report. If the balance is under a set threshold or was recently created, the bureaus may not be allowed to list it. These rules help protect you from short-term billing delays and slow insurance updates. When you know the rules, you can spot wrong entries fast and remove medical debt before it harms your score.

Paid medical collections also should not appear on your report. Once the balance is paid, the bureaus must take it off. This applies even if the bill moved to collections earlier. If you see a paid balance still listed, you can dispute it with proof and have it removed.

Medical debt that has not been verified should not appear either. If the provider or collector cannot confirm the charges, the bureaus must delete the entry. This protects you when billing mistakes create balances you do not owe. If any of these situations apply to you, take action and remove medical debt that should not be reported.

How Client Dispute Manager Software Helps You Handle Wrong Medical Debt?

Client Dispute Manager Software gives you tools that make it easier to dispute medical bills and manage every step of the process. Many people struggle because medical disputes involve documents, timelines, and follow-ups. The software keeps everything organized so you do not miss important details.

You can store your itemized bills, Explanation of Benefits, and call notes in one place. This helps you track what you sent, what you received, and what still needs attention. When you work on how to remove medical debt, this level of organization keeps your workflow clear.

The software also lets you create letters, track disputes with each bureau, and document responses from providers or collectors. This is helpful when you handle wrong medical debt that needs strong proof and quick follow-up. Automated reminders keep you on schedule so each dispute moves forward.

If you run a credit repair business, these tools help you support your clients with consistent processes. You can manage multiple cases, save time, and keep every step documented. This helps entrepreneurs stay organized while helping clients fix medical debt on credit reports with confidence and accuracy.

Client Dispute Manager Software is designed for people who want to stay in control during disputes. When you use the tools correctly, you protect your records, follow proper steps, and handle every part of the process with clarity.

Start Today and Explore the Features Firsthand!

What To Do If the Medical Debt Is Correct but You Cannot Pay?

If the balance is correct and you cannot pay it right now, you still have options. Many hospitals and clinics offer financial help for patients who meet certain conditions. These programs exist to support people facing high medical costs. Asking for help early protects you from collection activity and new negative entries on your report.

Start by calling the provider’s billing department and asking about financial assistance or charity care. Many providers can lower the balance or place you on a payment plan that fits your situation. Keep notes from each call so you can track your progress. Clear records help you stay organized and prevent misunderstandings.

You can also review your insurance plan to check for appeal options. Some claims are denied by mistake, and an appeal can reduce what you owe. If the bill remains correct after the appeal, focus on staying in contact with the provider so the account does not move to collections. Staying active and communicating often keeps you in control and helps you avoid new medical debt problems on your credit report.

How Do You Dispute Medical Bills When the Charges Look Wrong?

You start by requesting an itemized bill from the provider. Review every line carefully and compare it to your Explanation of Benefits and treatment records. When you find errors, send a written dispute that explains the issue and includes proof.

This creates a clear record and forces the provider to review and correct the bill. Many errors get fixed at this stage when you provide clear documentation. The key is to act quickly so the mistake does not reach collections.

How Can You Remove Medical Debt From Your Credit Report?

You remove the debt by proving it is wrong. Collect your documents, submit disputes to all three credit bureaus, and explain the error in simple terms. If the provider or collector cannot verify the information, the bureaus must delete the account.

Proper documentation is the key to fast results. Always save updated reports so you have proof if the error returns. This protects your credit profile from repeat mistakes.

Start Today and Explore the Features Firsthand!

What Is a Medical Debt Validation Letter and When Should You Use It?

A Medical Debt Validation Letter is a request for proof sent to a collector. You use it when you do not recognize the bill, when the balance looks wrong, or when the provider sent the account to collections before answering your dispute.

The collector must pause activity until they verify the debt with real documents. This step prevents collectors from pressuring you while they search for proof. It also exposes inaccurate or incomplete records that you can challenge later.

Can a Credit Repair Software Help You Manage Medical Debt Disputes More Easily?

Yes. Tools like Client Dispute Manager Software help you organize records, track dispute deadlines, and prepare letters that support your case. This improves your workflow and reduces mistakes.

If you run a credit repair business, software also helps you manage multiple clients while keeping every case documented and consistent. It gives you a clear system for handling medical debt disputes from start to finish. This saves time and keeps each dispute moving forward without confusion.

Conclusion

Handling wrong medical bills can feel stressful, but you have a clear path forward when you stay organized and take action early. When you dispute medical bills with proof, follow up with providers, and track your steps with the credit bureaus, you protect your score and prevent small errors from turning into long-term problems. Each step you take helps you understand how to remove medical debt and keep your report accurate.

If you run a business or plan to grow in the credit repair industry, these skills matter even more. Clean credit opens doors for better opportunities, and the ability to manage disputes is a valuable skill for your clients and your own financial goals. With the right knowledge, the right documents, and the right tools, you can correct mistakes, stay in control, and move forward with confidence.

You now have a full guide that shows you what to check, who to contact, and how to challenge wrong entries. Use these steps whenever you see charges that do not make sense. Stay active, keep good records, and review your reports often. This simple routine protects you from wrong medical debt and keeps your financial future moving in the right direction.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: