Ever wonder why so many people try to start a credit repair business but give up within months? The truth is, credit repair looks simple from the outside. You learn how to send dispute letters, sign a few clients, and expect quick results. Then reality hits—deadlines pile up, clients stop responding, and legal rules get confusing fast.

Many beginners fail because they rely on manual work instead of credit repair automation and skip the systems that keep a business organized. Others never learn how to run a credit repair business the right way. They lose track of client progress, forget to stay compliant, or spend hours chasing paperwork instead of growing their company.

If you want to succeed, you need structure, consistency, and the right tools. That’s where credit repair business software changes everything. It helps you manage clients, automate disputes, and stay compliant without stress. You can track every letter, monitor results, and focus on what matters most helping people rebuild their credit and trusting you in the process.

In this guide, we’ll break down the seven biggest reasons new credit repair businesses fail and show you how to avoid each one using proven systems and smart automation. Whether you’re just learning how to start a credit repair business or you’ve been struggling to keep clients, these lessons will help you build a business that lasts.

Start Today and Explore the Features Firsthand!

Key Takeaways:

- Compliance comes first. Many new owners fail because they ignore CROA, TSR, and state laws. Use credit repair business software with built-in compliance tools to stay protected.

- Automation saves time. Manual work causes delays and errors. Credit repair automation helps you generate disputes, track results, and update clients faster.

- Client communication builds trust. Keep clients informed with portals, automated updates, and reports inside your credit repair software for business.

- Data drives success. Track dispute performance, client progress, and marketing results. Use analytics to refine how you run your credit repair business.

- The right system prevents failure. Tools like Client Dispute Manager Software combine automation, compliance, and reporting giving you everything you need to start a credit repair business that lasts.

#1: Ignoring Legal Compliance When You Start a Credit Repair Business

Many new owners start a credit repair business without learning the laws that govern it. The Credit Repair Organizations Act (CROA), the Telemarketing Sales Rule (TSR), and individual state regulations exist to protect consumers from unfair practices. Ignoring these rules can lead to penalties, lawsuits, or even the forced shutdown of your business.

When you handle sensitive credit data, every form, contract, and letter must follow specific legal standards. Failing to include required disclosures or charging clients before services are complete are common violations that put your business at risk.

The good news is that modern credit repair software for business helps you stay compliant from day one. The best platforms include built-in templates, disclosure forms, and digital contract tools that meet CROA and TSR guidelines. This ensures every client interaction follows the law while saving you hours of manual work.

Avoid this mistake by:

- Using credit repair business software that securely stores signed client contracts.

- Following prebuilt compliance workflows designed around CROA and state rules.

- Reviewing and customizing communication templates before sending them to clients.

Compliance isn’t optional, it’s the foundation of a legitimate and trustworthy credit repair business. By using software that integrates compliance tools directly into your workflow, you can focus on helping clients improve their credit without worrying about legal missteps.

#2: Relying on Manual Work Instead of Credit Repair Automation

One of the fastest ways to burn out when you start a credit repair business is by doing everything manually. Many new owners spend hours writing dispute letters, tracking responses, and updating client files by hand. This approach not only wastes valuable time but also increases the risk of missing dispute deadlines or sending inconsistent letters.

Credit repair automation eliminates these problems. Instead of typing each letter or manually tracking results, automation tools generate professional dispute letters, schedule reminders, and organize every case in seconds. Using credit repair business software with built-in automation means you can focus more on client service and less on repetitive admin work.

Automation also ensures consistency. Each letter follows FCRA and CROA standards, so you never have to worry about formatting errors or missing disclosures. When clients see quick updates and well-documented results, your reputation grows and so does your business.

Avoid this mistake by:

- Automating dispute creation and delivery through your credit repair business software.

- Using prebuilt templates that comply with FCRA and CROA regulations.

- Setting automatic reminders for dispute follow-ups and client updates.

When you switch from manual work to credit repair automation, you save hours every week, reduce errors, and give your clients the professional experience they expect.

Start Today and Explore the Features Firsthand!

#3: Poor Client Management and Missed Communication

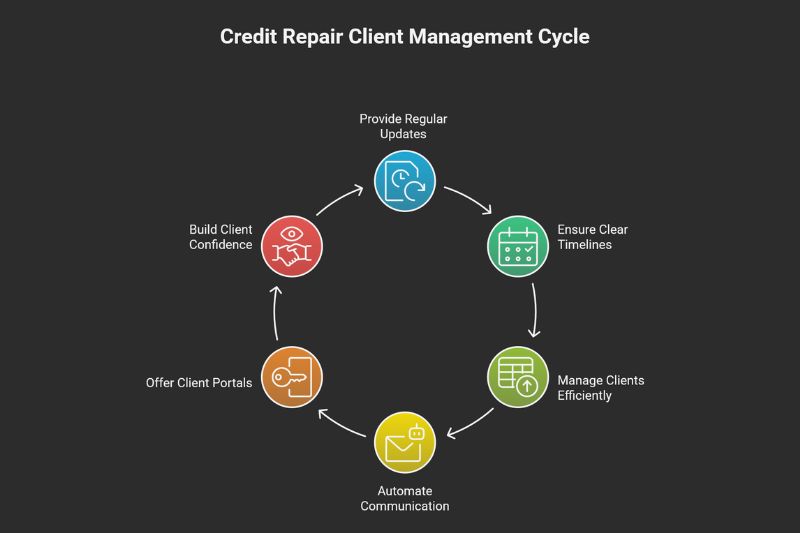

A strong credit repair business depends on trust, and trust comes from communication. Many owners who start a credit repair business lose clients because they don’t provide regular updates or clear timelines.

When clients feel ignored, they begin to doubt your credibility even if you’re doing the work behind the scenes.

That’s where credit repair business software makes all the difference. Instead of juggling phone calls, emails, and spreadsheets, you can manage every client in one organized dashboard.

The best platforms include credit repair automation features that send progress reports, reminders, and updates automatically, so your clients always know what’s happening with their disputes.

Even better, modern systems include client portals where customers can log in anytime to check their dispute status, uploaded letters, and recent results. This level of transparency builds confidence and reduces follow-up calls.

Avoid this mistake by:

- Using built-in portals that allow clients to view progress and dispute updates.

- Setting automated email or text notifications to keep clients informed.

- Tracking every note, document, and conversation in one place through your credit repair software for business.

Good communication keeps clients engaged and loyal. With the right credit repair business software, you can stay organized, maintain professionalism, and turn every client interaction into long-term trust.

#4: No Clear System to Measure Credit Repair Progress

One of the biggest reasons new owners struggle when they start a credit repair business is failing to track results. Many spend time sending dispute letters but never measure which ones actually work.

Without proof of success, it becomes difficult to show clients their progress or demonstrate the real value of your service.

Modern credit repair software for business solves this problem. It tracks every dispute from creation to resolution and organizes results into clear visual reports. Instead of guessing which accounts were removed or updated, you can see detailed progress charts for each client in seconds.

This level of transparency builds trust and credibility. Clients want to see improvement over time whether that’s deleted accounts, reduced balances, or updated credit statuses. When they can view reports inside your credit repair business software, they feel confident that their investment is paying off.

Avoid this mistake by:

- Generating progress reports automatically using your credit repair automation tools.

- Sharing improvement charts with clients each month to maintain accountability.

- Reviewing dispute success rates regularly to identify what’s working and where to adjust.

Tracking progress isn’t just about data it’s about showing clients the real impact of your work. With a consistent reporting system built into your credit repair software for business, you can turn every result into proof of success and build stronger, lasting relationships.

Start Today and Explore the Features Firsthand!

#5: Weak Lead Generation and No Marketing Automation

Many new entrepreneurs start a credit repair business focused only on disputes and client results. But without a steady stream of new leads, even the best service will stall. Growth depends on consistent marketing, and manual outreach or word of mouth isn’t enough to sustain a business long term.

That’s where credit repair automation becomes essential. The best credit repair business software now includes built-in marketing tools that capture, organize, and follow up with leads automatically.

Features like lead forms, referral tracking, and self-service signup links make it easier for potential clients to connect with you anytime without you lifting a finger.

With automation, your website becomes a 24/7 lead generator. You can collect signups directly from landing pages, nurture them through automated emails, and turn interested visitors into paying clients faster.

Avoid this mistake by:

- Embedding self-service signup links on your website or social media pages.

- Connecting your CRM or email list to your credit repair business software for seamless lead tracking.

- Automating follow-up messages so every new lead gets the right information at the right time.

When you combine smart marketing with credit repair automation, you never have to worry about running out of clients. Your system continues to attract, convert, and retain new leads while you focus on delivering results.

#6: Lack of Training and Process Consistency

When you start a credit repair business, it’s easy to focus on getting clients and overlook building solid internal processes. But without clear systems and training, every team member ends up doing things differently. That inconsistency leads to errors, missed deadlines, and frustrated clients.

Each client’s case must follow a structured, step-by-step workflow. From dispute preparation to follow-up communication, having a consistent process ensures accuracy and compliance. This is where credit repair software for business makes a major difference.

The best platforms come with preloaded dispute flows, client intake forms, and built-in tutorials that walk your team through every step. You don’t have to guess what comes next the system guides you. That means less confusion, faster onboarding for new staff, and smoother day-to-day operations.

Avoid this mistake by:

- Following standard dispute templates built into your credit repair business software.

- Training new staff using built-in video tutorials and process guides.

- Reviewing client workflows weekly to keep performance consistent and error-free.

Process consistency builds professionalism and trust. With the right credit repair automation tools, every task from onboarding clients to managing disputes follows the same reliable path, helping your business grow smoothly and confidently.

Client Dispute Manager Software: The All-in-One Credit Repair Business Solution

If you want to avoid the mistakes that cause most startups to fail, you need a system designed for growth, organization, and compliance. Client Dispute Manager Software is the leading credit repair business software built to help you run every part of your business in one place.

This platform is used by credit repair owners, coaches, and consultants who want to save time, reduce errors, and deliver measurable results for their clients. It combines credit repair automation, legal protection tools, and client management features that support both new and experienced business owners.

Key Features That Prevent Startup Failure:

- Compliance Ready Workflows: Built-in tools follow CROA, TSR, and FCRA guidelines to help you stay compliant from day one. Every letter, contract, and client file is securely stored for documentation.

- Dispute Automation: Generate, track, and send disputes automatically. You can create hundreds of personalized letters in minutes using credit repair automation tools that follow best practices.

- Client Management Dashboard: Keep all client data organized in one view. Monitor dispute status, notes, and progress without switching between tools.

- Progress Reports and Analytics: Show real results. Clients can log in to view reports, while you track success rates and team performance through your credit repair software for business dashboard.

- Self-Service Signup Links: Turn your website visitors into clients automatically. With built-in lead capture, onboarding forms, and referral tools, you can grow your business 24/7.

- Team Collaboration Tools: Assign tasks, monitor workloads, and manage client updates efficiently within one secure system.

Using Client Dispute Manager Software helps you avoid the top causes of credit repair business failure manual processes, poor tracking, and noncompliance. With automation, reporting, and compliance tools working together, you can focus on what matters most: helping clients improve their credit while growing your company the right way.

Start Today and Explore the Features Firsthand!

#7: Failing to Use Data for Long-Term Business Growth

A common mistake among new entrepreneurs who start a credit repair business is running their operations on gut feeling instead of data. Without accurate information, decisions about disputes, marketing, or client management turn into guesswork. This often leads to wasted time, poor performance, and missed opportunities for growth.

The most successful companies use credit repair business software that captures every detail—from dispute results to client progress and team productivity. Built-in analytics turn that information into clear insights, helping you identify what’s working and what needs improvement.

When you use credit repair automation, you can see which dispute types deliver the best results, how quickly clients move through the process, and where your team might be slowing down. That data helps you refine your strategy, streamline your workflow, and grow your business with confidence.

Avoid this mistake by:

- Using built-in analytics in your credit repair business software to monitor team performance and efficiency.

- Identifying your most effective dispute templates and adjusting weaker ones.

- Reviewing client conversion data to fine-tune your marketing and retention strategy.

Data-driven businesses last longer. With reliable analytics built into your credit repair software for business, you make smarter decisions, save resources, and build a credit repair company that keeps improving year after year.

Frequently Asked Questions (FAQs)

Why Do Most New Credit Repair Businesses Fail?

Most new owners fail because they start without structure, automation, or legal knowledge. They rely on manual work, skip compliance requirements like CROA and TSR, and lack systems to track client progress. Using reliable credit repair business software helps avoid these problems by managing clients, automating disputes, and staying compliant.

How Can Credit Repair Automation Improve My Business?

Credit repair automation saves time by generating dispute letters, tracking updates, and sending reminders automatically. It removes repetitive work and reduces human errors so you can focus on building client relationships and growing your business.

What Tools Do I Need to Start a Credit Repair Business the Right Way?

You need credit repair software for business, compliance documentation, and a structured workflow. The right platform handles client management, letter creation, progress tracking, and marketing automation all essential to running a legitimate and efficient business.

How Does Credit Repair Business Software Help With Compliance?

The best credit repair business software includes built-in CROA and TSR templates, digital contracts, and disclosure forms. These tools help ensure every client interaction and dispute follows federal and state laws, protecting your business from legal risks.

Conclusion

Starting a credit repair business is more than learning how to write dispute letters or send emails. It’s about running a structured, compliant, and organized company that earns client trust and produces measurable results. Many new owners fail because they try to handle everything manually or skip the systems that make professional credit repair sustainable.

Using credit repair business software helps you avoid those mistakes from the start. With automation, built-in compliance, and progress tracking, you gain the tools to manage clients efficiently and prove real results.

Modern platforms combine credit repair automation with workflows that handle everything client onboarding, dispute creation, follow-ups, and reporting all from one secure dashboard.

If you plan to start a credit repair business or already run one, the right technology will determine your long-term success. Instead of relying on guesswork, use a system that supports your daily operations, builds client trust, and helps you grow faster.

Client Dispute Manager Software gives you all these advantages. It’s a complete credit repair software for business designed to simplify your workflow, ensure compliance, and let you focus on what matters most helping your clients rebuild their credit and strengthening your reputation as a trusted professional.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: