Have you ever wondered if taking a credit repair course or earning a credit repair business certification could help you grow your business? If you run a credit repair company or you’re thinking about starting one, you already know how competitive the industry is.

Clients want to trust you, regulators expect you to follow strict credit repair laws, and you need the right skills to keep up.

The problem? Many credit repair training programs and online credit repair classes are expensive, outdated, or don’t give you the practical tools you need to succeed. And if you’re asking yourself, “How do I become a credit repair specialist?” you’ve probably already seen dozens of courses that promise big results but leave you more confused than confident.

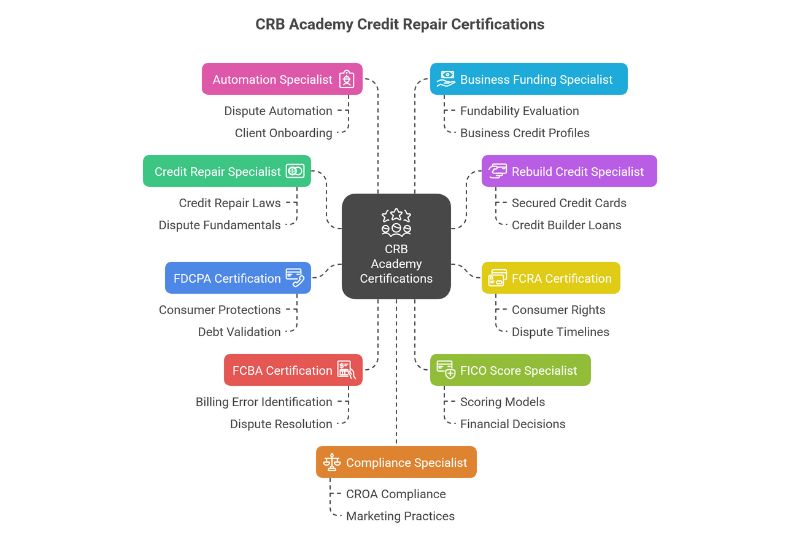

That’s where Client Dispute Manager Software steps in with something different. Inside its CRB Academy, paying members unlock exclusive free credit repair business certifications designed specifically for entrepreneurs, credit repair professionals, and anyone eager to understand consumer protection laws like the Fair Credit Reporting Act.

These certifications are not just about theory—they’re practical, step-by-step programs you can apply immediately in your business.

In this article, we’ll break down:

- Why a credit repair course is essential for your business growth?

- How free training inside CRB Academy works?

- A closer look at the 9 credit repair certifications you can earn

- How these certifications give you an edge in building credibility and client trust?

By the end, you’ll see how these free resources can help you stay compliant, build your reputation, and grow a stronger credit repair business.

Key Takeaways:

- CRB Academy in Client Dispute Manager Software offers 9 free credit repair business certifications designed for entrepreneurs and credit repair professionals.

- These certifications cover compliance, disputes, rebuilding credit, FICO scoring, automation, and business funding, giving you a complete roadmap for business success.

- Unlike other costly or outdated programs, the training is practical, step-by-step, and focused on credit repair laws such as FCRA, FDCPA, FCBA, CROA, TSR, and FTC guidelines.

- Certifications help you build credibility with clients, protect your business with compliance, and scale growth through automation and funding strategies.

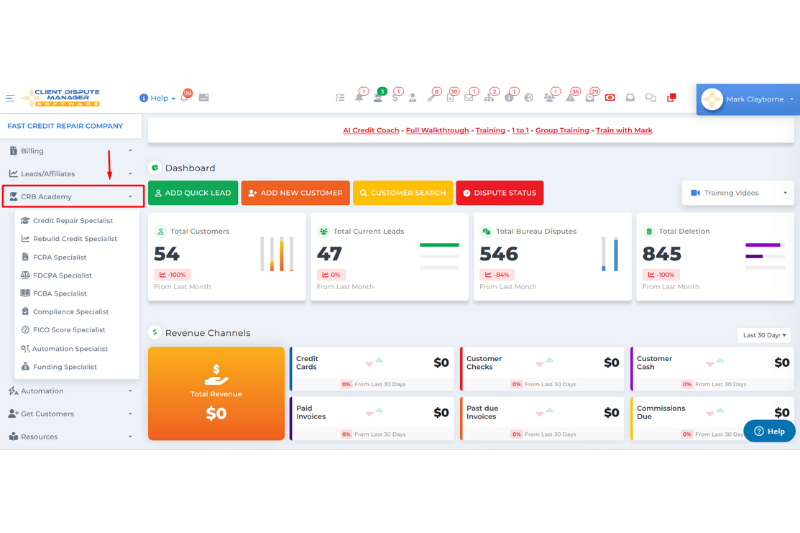

- Access is simple: current CDM members find courses under the CRB Academy menu, while new paying users unlock certifications month by month as part of their membership.

Start Today and Explore the Features Firsthand!

Why Credit Repair Business Certification Matters for Growth?

Running a credit repair business is more than just sending dispute letters. To stand out, you need knowledge, credibility, and a system that keeps you compliant with important credit repair laws. That’s where a credit repair business certification becomes a game-changer.

If you’ve ever searched online for a credit repair course or training, you’ve probably run into two big problems:

- Many programs cost hundreds or even thousands of dollars.

- A lot of training is outdated or doesn’t fully cover laws like the Fair Credit Reporting Act or consumer law credit repair guidelines.

This leaves business owners frustrated. You want to follow the rules, but it can feel impossible to find reliable and affordable education that teaches both the technical side of credit repair and the compliance standards needed to protect your company.

When clients come to you, they’re usually stressed, unsure, and looking for someone they can trust. Having structured certifications inside a platform like CRB Academy helps in three important ways:

- Proves Your Knowledge: A certification shows that you’ve completed organized training and understand the legal and practical side of credit repair.

- Builds Client Confidence: Clients feel reassured knowing you’re trained in key areas like dispute processes, compliance, and consumer protection laws.

- Sets You Apart: In a crowded industry, displaying a recognized certification gives you an edge over competitors who may not have formal training.

The truth is, certifications aren’t just pieces of paper. They’re milestones in your growth that show clients you’re serious about your profession, while also giving you the tools to run your business the right way.

With CRB Academy, you begin with the essentials and then expand into more advanced certifications — creating a step-by-step path to long-term success.

Credit Repair Training with CRB Academy in Client Dispute Manager Software

The CRB Academy is built directly into Client Dispute Manager Software, making it easy for users to access structured learning without leaving the platform. Inside the Academy, you’ll find step-by-step credit repair courses designed to guide you through both the fundamentals and advanced compliance training.

Each course ends with a certificate of completion, proving you’ve mastered essential skills that build credibility with clients. Unlike generic credit repair classes online, the CRB Academy was created specifically for credit repair business owners who need practical, compliant training.

The Academy focuses on the real-world challenges you face every day—such as following strict credit repair laws, educating clients, and running your operations efficiently. You’ll begin with the essentials and, as you progress, unlock advanced certifications that give you a complete roadmap to growth.

Why Its Different from Other Online Credit Repair Certification Programs?

Most online programs give you theory, but they often leave out the practical tools and compliance guidelines you need to run a real credit repair business. The CRB Academy solves this by:

- Focusing on Compliance: Courses cover essential laws like the Fair Credit Reporting Act and other consumer protection topics that every business owner must know.

- Designed for Entrepreneurs: Whether you’re just starting or already managing clients, the training is tailored to help you build credibility and grow your business step by step.

- Exclusive to Client Dispute Manager Software: Instead of paying hundreds or thousands for outside courses, these certifications are included at no extra cost as part of your membership, with access designed to guide your learning in the right sequence.

This structure makes the CRB Academy one of the most valuable credit repair business training resources available today. You’ll gain not only knowledge and credibility but also a clear roadmap for long-term success—while saving money along the way.

Start Today and Explore the Features Firsthand!

9 Credit Repair Certification Courses You Can Earn Today

The CRB Academy offers nine certifications that cover every critical area of the credit repair industry. From dispute fundamentals and compliance to automation and business funding, these programs are designed to give you practical skills you can apply step by step as you grow.

Each credit repair course is structured to help you stay compliant, build client trust, and create a sustainable business model. You’ll begin with the foundational certification and, as you continue your training, unlock advanced courses that give you a complete roadmap for long-term success.

#1: Credit Repair Specialist Certification Course

The Credit Repair Specialist Certification Course is the foundation of the CRB Academy. It focuses on the core skills every credit repair professional needs: understanding credit repair laws, learning dispute fundamentals, and staying compliant with the Fair Credit Reporting Act and other consumer protection regulations.

In this course, you’ll cover:

- The basics of the credit reporting system and how to read reports accurately.

- Step-by-step dispute processes, including letter writing and follow-up timelines.

- An overview of key credit repair laws such as FCRA, FDCPA, and CROA.

- Client onboarding best practices and setting proper expectations.

- Documentation and record-keeping for compliance.

- Strategies for communicating with credit bureaus, creditors, and clients.

- Common mistakes to avoid when disputing and how to resolve them.

- Practical examples and case studies to apply what you learn in real situations.

Completing this course gives you a solid foundation to operate as a professional in the credit repair industry. By mastering both the laws and the dispute process, you’ll be prepared to guide clients with confidence, avoid compliance issues, and build long-term trust in your business.

Start Today and Explore the Features Firsthand!

#2: Rebuild Credit Specialist Training Program

The Rebuild Credit Specialist Training Program goes beyond disputes and focuses on helping clients add positive credit to their reports. This course covers practical strategies like:

- Using secured credit cards to establish payment history.

- Leveraging credit builder loans to improve credit mix.

- Understanding and guiding clients on authorized user tradelines.

- Teaching clients how to manage new accounts responsibly.

- Setting realistic goals and timelines for rebuilding credit.

This program is designed to help your clients achieve long-term financial success. By showing them how to add positive accounts and maintain good habits, you’re not only repairing their credit—you’re empowering them to create a stronger financial future.

This certification strengthens your role as a trusted advisor who can provide solutions beyond just disputes.

#3: Fair Credit Reporting Act (FCRA) Certification

The Fair Credit Reporting Act (FCRA) Certification is one of the most important courses in the CRB Academy because it dives deep into the law that governs how credit information is collected, reported, and disputed.

In this course, you’ll explore:

- The history and purpose of the Fair Credit Reporting Act and why it matters for consumers.

- Consumer rights under the FCRA, including the right to accurate and verifiable information.

- Step-by-step dispute timelines and the obligations of credit bureaus and furnishers to investigate disputes.

- How to recognize violations of the FCRA and guide clients on the right course of action.

- Documentation best practices to ensure compliance with federal requirements.

- Real-world examples of how to apply FCRA knowledge ethically in your credit repair business.

By completing this certification, you’ll gain a solid understanding of one of the most critical credit repair laws. This not only protects your clients but also protects your business by ensuring you remain compliant.

With this knowledge, you can confidently educate clients, handle disputes within legal boundaries, and establish yourself as a true professional in the credit repair industry.

#4: Fair Debt Collection Practices Act (FDCPA) Certification

The Fair Debt Collection Practices Act (FDCPA) Certification focuses on teaching you how to guide clients through one of the most stressful parts of credit repair: dealing with debt collectors.

In this course, you’ll learn:

- The rights consumers have under the FDCPA and how to explain them clearly to clients.

- How to identify abusive or unfair collection practices and respond appropriately.

- Properly guiding clients through the debt validation process and responding to collection letters.

- Documentation and record-keeping methods that protect both you and your clients.

- Real-world scenarios showing how to apply FDCPA rules ethically while supporting your clients.

By completing this certification, you’ll be able to confidently educate clients on their protections against harassment, threats, and deceptive practices.

You’ll also strengthen your credibility as a credit repair specialist who understands consumer law credit repair and knows how to keep both clients and your business compliant.

Start Today and Explore the Features Firsthand!

#5: Fair Credit Billing Act (FCBA) Certification

The Fair Credit Billing Act (FCBA) Certification teaches you how to handle one of the most common client concerns: billing errors on credit accounts.

In this course, you’ll learn:

- What qualifies as a billing error and how to identify them on client accounts.

- The step-by-step process for disputing billing mistakes with creditors.

- Consumer rights under the FCBA, including timelines for dispute resolution.

- How to properly educate clients so they understand their protections and responsibilities.

- Real-world examples of how resolving billing errors can positively impact credit scores and client trust.

By completing this certification, you’ll be equipped to guide clients through billing disputes with confidence. This knowledge not only helps fix credit issues but also empowers clients by teaching them how to exercise their rights effectively.

It positions you as an expert who can simplify complex credit repair laws for clients and strengthen their financial confidence.

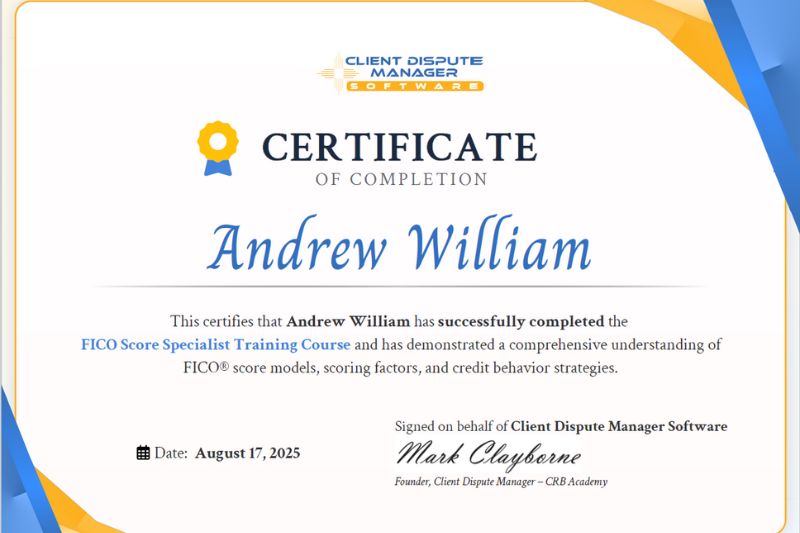

#6: FICO Score Specialist Certification Course

The FICO Score Specialist Certification Course helps you understand one of the most important aspects of credit repair: credit scoring.

In this course, you’ll learn:

- How FICO scoring models work and the key factors that influence scores.

- Common myths about credit scores and how to explain the truth to clients.

- Practical strategies for helping clients improve their scores responsibly.

- How to set realistic timelines and goals so clients don’t fall for quick-fix promises.

- Real examples showing how everyday financial decisions impact FICO scores.

By mastering this course, you’ll be able to train clients on how to manage their credit scores realistically. This certification positions you as an expert who can cut through confusion, provide clear education, and help clients see lasting improvements in their financial health.

#7: Automation Specialist Certification for Credit Repair Businesses

The Automation Specialist Certification teaches you how to streamline your operations so you can save time, reduce stress, and serve more clients effectively.

This program emphasizes using technology to replace repetitive manual tasks, giving you more freedom to focus on client relationships and business strategy.

In this course, you’ll learn:

- How to automate the dispute process, from generating letters to tracking responses.

- Setting up automated client onboarding to reduce manual work and errors.

- Using automation tools for billing, invoicing, and reminders.

- Leveraging technology to monitor progress and generate reports quickly.

- Best practices for staying compliant while using automation in your business.

By completing this certification, you’ll understand how to scale your credit repair business efficiently. Automating key tasks allows you to focus on serving clients, building relationships, and growing your company without being buried in repetitive work.

Start Today and Explore the Features Firsthand!

#8: Business Funding Specialist Certification Program

The Business Funding Specialist Certification Program is designed to expand your services beyond credit repair and into helping clients secure the funding they need for financial stability or business growth.

This credit repair course focuses on teaching you practical steps to guide clients toward business credit and lending opportunities, making it an essential part of your overall credit repair business training.

In this course, you’ll learn:

- How to evaluate a client’s fundability and prepare them for loan or credit applications.

- The difference between personal guarantee (PG) credit cards and EIN-only business credit options.

- How to guide clients in building business credit profiles that lenders trust.

- An overview of SBA loans, vendor credit, and other financing opportunities.

- Step-by-step strategies to help clients avoid common pitfalls when applying for funding.

By mastering this program, you’ll position yourself as more than just a credit repair specialist you’ll become a resource for long-term financial growth.

Offering funding guidance builds stronger client relationships, adds value to your services, and helps you stand out in the competitive credit repair industry.

#9: Compliance Specialist Certification in Credit Repair

The Compliance Specialist Certification in Credit Repair is one of the most critical programs in the CRB Academy. While many credit repair courses teach you how to dispute errors, this certification ensures you know how to run your business legally and avoid costly mistakes.

Compliance is not optional in the credit repair industry—it’s what keeps your business safe and builds lasting client trust.

In this course, you’ll learn:

- How to avoid violations of the Credit Repair Organizations Act (CROA) and why it’s the foundation of consumer protection in credit repair.

- Understanding the Telemarketing Sales Rule (TSR) and how it applies to your sales and marketing practices.

- Key guidelines from the Federal Trade Commission (FTC) to keep your business advertising truthful and fair.

- How to design compliant onboarding processes, including contracts and disclosure requirements.

- Best practices for creating compliant marketing campaigns that attract clients without risking penalties.

- Record-keeping and documentation standards that protect your company if you are ever challenged legally.

By completing this certification, you’ll gain the knowledge to operate within the law while still growing your business. This credit repair certification positions you as a trustworthy professional who respects consumer rights and avoids the pitfalls that can shut down a business.

Whether it’s writing a contract, launching a new campaign, or onboarding a client, you’ll know exactly how to stay compliant while delivering excellent results.

How to Access Free Credit Repair Certifications in Client Dispute Manager Software?

For paying members of Client Dispute Manager Software, accessing certifications inside the CRB Academy is simple. Just log in, navigate to the CRB Academy menu, and you’ll find your available courses.

Here’s how access works:

- Trial Members: No certifications are available during the free trial.

- First Paid Month: You’ll unlock the Credit Repair Specialist Certification to start building your foundation.

- Second Paid Month and Beyond: You’ll gain full access to all nine certifications, including advanced training in compliance, automation, rebuilding credit, and business funding.

Each course is designed to guide you step by step and provide a certificate upon completion, helping you build credibility and compliance at the same time.

That means you’re not just getting powerful dispute and compliance tools—you’re also unlocking structured credit repair training and official certifications that strengthen your business at no additional cost.

This makes joining Client Dispute Manager Software a smart move for anyone looking to grow their expertise, stay compliant with credit repair laws, and build long-term credibility in the credit repair industry.

Start Today and Explore the Features Firsthand!

Why These Certifications Give Credit Repair Businesses a Competitive Edge?

The nine certifications offered in CRB Academy go beyond theory—they give you real-world strategies that directly strengthen your business. Each credit repair course is designed to not only improve your knowledge but also give you tools that help you stand out in a competitive market.

- Building Credibility with Clients: Clients want to work with professionals they can trust. When you display multiple credit repair business certifications, it sends a clear message that you have invested in training and understand the laws that protect them. Certifications act as proof of your expertise and help you build stronger relationships with new and existing clients.

- Protecting Your Business with Compliance: Staying compliant with credit repair laws is crucial for long-term success. These certifications cover key regulations like CROA, TSR, and the Fair Credit Reporting Act, giving you the knowledge to avoid costly mistakes. By following the right compliance steps, you protect both your clients and your business reputation.

- Scaling Growth with Automation and Funding: Certifications in automation and funding help you move beyond just repairing credit. By learning how to streamline processes and guide clients in accessing credit or business funding, you position yourself as a full-service professional.

This not only saves you time but also opens new revenue streams, helping your credit repair business grow faster and more sustainably.

Conclusion

Earning one or more of these nine credit repair business certifications through the CRB Academy is more than just completing a course—it’s about building a strong, compliant, and credible business.

Each certification is designed to give you practical skills, from understanding credit repair laws to automating your workflow and helping clients secure funding. Together, they create a complete roadmap for success.

Whether you’re just starting out or already running a credit repair company, these free credit repair courses inside Client Dispute Manager Software give you the tools to stand out, serve clients better, and grow your business with confidence.

By taking advantage of this training, you’re not only investing in your knowledge but also securing a brighter future for both your clients and your business.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: