- A repossession can seriously hurt your credit, but it’s not permanent. Learn how to fix credit after repo with smart, legal strategies.

- Start by pulling your credit reports and identifying any errors—especially incorrect repo entries.

- Use AI credit repair software like Client Dispute Manager Software to automate disputes and track progress.

- Rebuild credit after repossession by opening secured credit cards, making on-time payments, and maintaining low balances.

- Avoid common mistakes like disputing without proof, ignoring the repo, or opening too many new accounts too fast.

- Consistency, patience, and the right tools are key to restoring your credit and financial confidence.

Having your vehicle repossessed is more than just losing a car it can feel like losing your sense of stability. But here’s the good news: you can recover. Whether you voluntarily surrendered your car or it was taken without warning, this guide will show you how to fix credit after repo using smart, legal, and effective strategies.

With the right steps and some help from AI credit repair software you can bounce back stronger and more financially aware.

By learning the right techniques to dispute repossession on credit report entries and rebuilding credit after repossession, you’re taking a powerful step toward financial freedom.

Fixing your credit after a repo is not only possibleit’s a journey you can master with the right tools and persistence.

What Happens to Your Credit After a Repo?

Repossession doesn’t just affect your transportation it hits your credit score hard. Let’s break down what actually happens when a repo shows up on your credit report.

Not only does it signal missed payments and default to lenders, but it also significantly drops your credit score, making it harder to get approved for loans or credit cards.

If you’re working to fix credit after repossession, it’s essential to understand the damage and take steps toward rebuilding credit after repossession.

Knowing how long a repo stays on your credit and how to dispute repossession on credit report entries can give you a head start on recovery.

How Long Does a Repo Stay on Your Credit?

A repossession can remain on your credit report for up to seven years from the date of the first missed payment that led to the repo. This negative mark can lower your credit score by 100 points or more.

During this time, lenders may view you as high risk, making it harder to get approved for credit cards, loans, or even rental agreements.

That’s why it’s important to take action early, especially if you’re aiming to fix credit after repossession. Understanding how long a repo stays on your credit can help you develop a strategy for rebuilding credit after repossession and reducing its long-term effects.

The Impact of Voluntary vs. Involuntary Repossession

When it comes to repossession, the way it happened can shape your credit repair journey. Whether you voluntarily gave the car back or had it repossessed involuntarily, both actions are serious—but they aren’t viewed exactly the same by lenders.

Knowing the type of repossession you experienced can help you better plan how to fix credit after repossession and take the right steps toward financial recovery.

These details can also make a difference when you dispute repossession on credit report records using tools like AI credit repair software.

- Voluntary Repossession: You return the vehicle willingly. This can look slightly better to future lenders.

- Involuntary Repossession: The lender takes the vehicle without your agreement. It often reflects more poorly on your credit.

Regardless of the type, both will show up on your credit report and can damage your score. However, understanding the difference can guide you in rebuilding credit after repossession and identifying dispute opportunities that align with your specific case.

With smart planning and the right software, recovering your credit becomes much more manageable.

Dispute Repossession on Credit Report: What You Need to Know?

Did you know repossession entries can sometimes be challenged? If the lender reported incorrect information or didn’t follow proper procedure, you have the right to dispute it.

Many consumers aren’t aware that credit bureaus are required to investigate disputes within 30 days, which opens the door to resolving issues faster.

When you’re trying to fix credit after repossession, understanding your rights under the FCRA is key. This is also a great opportunity to use AI credit repair software to guide you through the dispute process with greater speed and accuracy.

Legal Ways to Remove Inaccurate Repo Records

Under the Fair Credit Reporting Act (FCRA), you can dispute any item on your credit report that is inaccurate, incomplete, or unverifiable.

This law gives you the legal right to challenge any misinformation that may be hurting your credit score. If you’re looking to fix credit after repossession, using this provision can be one of your most powerful tools.

Many people have successfully removed repossession accounts by filing accurate disputes and using AI credit repair software to streamline the process.

Steps to take:

- Request your full credit report from all three bureaus

- Identify any inaccuracies (dates, balances, or duplicate accounts)

- Write a detailed dispute letter

- Provide supporting documents (if available)

Using AI Credit Repair Software to File Disputes Faster

This is where tech can help. With AI credit repair software, you can simplify the process of managing multiple disputes and stay organized throughout your credit recovery journey.

These tools are especially helpful if you’re trying to fix credit after repossession and want to take action quickly and efficiently. With AI credit repair software, you can:

- Automatically scan your credit reports for repo errors

- Generate professional dispute letters in minutes

- Track responses from the credit bureaus

- Save time and reduce stress by automating repetitive tasks

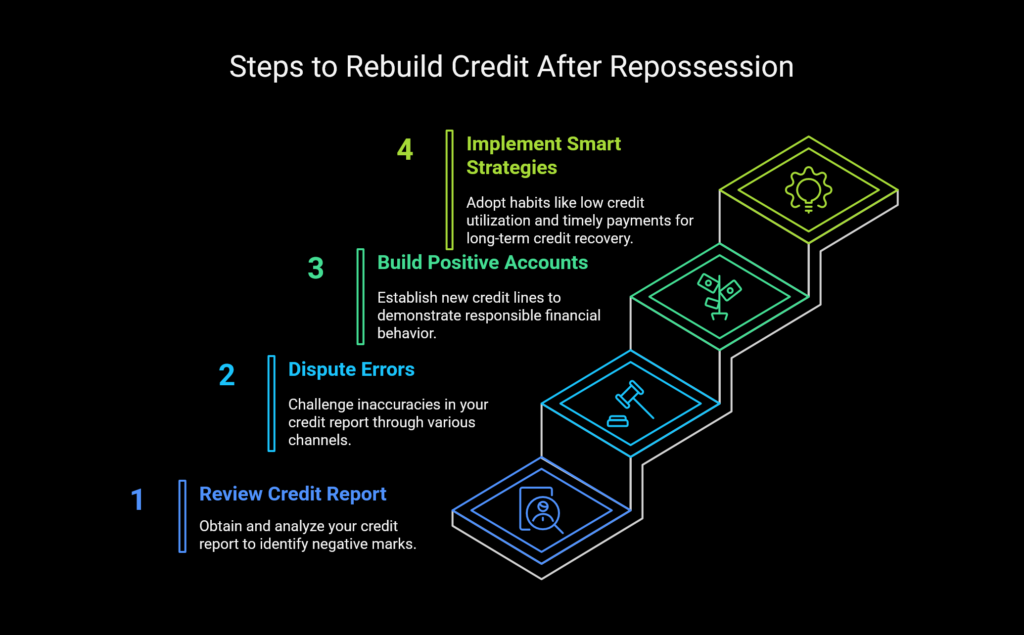

Rebuilding Credit After Repossession: Step-by-Step Recovery Plan

Recovery takes time, but every small win builds toward a healthier credit score. Fixing your credit after repossession means being consistent, focused, and strategic in every step you take.

Each on-time payment and corrected error brings you closer to rebuilding credit after repossession and improving your financial standing.

Step #1: Get Your Credit Report and Review It

Start by visiting Annual Credit Report to pull your free credit reports from all three bureaus. Reviewing your reports is a crucial first step to fix credit after repossession because you need a clear picture of what creditors see.

Carefully go through each section to identify the negative marks that are dragging your score down. This groundwork not only prepares you for future disputes but also helps establish a solid path for rebuilding credit after repossession. Look for:

- The repo account

- Associated late payments

- Any duplicate or inconsistent data

After reviewing your report, take notes on anything that stands out or seems incorrect. These details are essential when you’re preparing to dispute repossession on credit report entries and make progress toward rebuilding your credit profile.

Step #2: Dispute Any Errors (Especially the Repo)

Use your findings to launch disputes through various channels that are recognized and documented. This step is vital when you’re trying to fix credit after repossession because timely and well-documented disputes can lead to the removal or correction of inaccurate entries.

Leveraging AI credit repair software can help you manage this process efficiently and ensure all disputes are tracked. Use your findings to launch disputes through:

- Each credit bureau’s website

- Certified mail

- AI software for automated handling

After submitting your disputes, it’s essential to stay organized and follow up with each credit bureau if needed. Keep copies of all communication and track response deadlines, especially when you’re committed to rebuilding credit after repossession.

This persistence can be the difference between unresolved errors and real progress in fixing your credit.

Step #3: Rebuild Credit with Positive Accounts

While you work on removing the repo, add new positive data to help strengthen your credit profile. These new accounts show lenders that you’re serious about turning things around and rebuilding credit after repossession.

Responsible use of credit can also offset the negative impact of the repossession as you work to fix credit after repossession:

- Get a secured credit card

- Use credit-builder loans

- Pay all bills on time

Establishing new credit lines responsibly helps demonstrate improved financial behavior. This not only aids in fixing your credit after repossession but also builds a strong foundation for future financial opportunities.

Step #4: Fix Credit After Repossession Using Smart Strategies

Developing smart habits is a key part of long-term credit recovery. If you’re working to fix credit after repossession, focusing on these small but powerful behaviors can steadily rebuild trust with lenders and improve your score over time.

These strategies are simple to implement and play a vital role in rebuilding credit after repossession:

- Keep credit utilization low (below 30%)

- Diversify your credit mix responsibly

- Set reminders to avoid late payments

These habits may seem simple, but they are powerful when it comes to fixing credit after repossession. Maintaining these good behaviors helps lenders rebuild their trust in you and plays a crucial role in rebuilding credit after repossession.

Over time, these consistent actions can lead to long-term credit recovery success.

AI Credit Repair Software: A Smarter Way to Fix Credit After a Repo

Technology is transforming the credit repair process. Instead of manually managing disputes, deadlines, and documents, you can let software do the heavy lifting.

This is especially valuable if you’re trying to fix credit after repossession and need a reliable, organized system to handle complex tasks.

By using AI credit repair software, you’re not only saving time—you’re also improving your chances of success in rebuilding credit after repossession.

What Is AI Credit Repair Software and How It Works?

AI credit repair software is designed to take the guesswork out of fixing your credit after repossession. It uses automation and intelligent workflows to simplify every step of the process, from identifying errors to launching disputes.

These tools are particularly helpful for individuals rebuilding credit after repossession who want to move quickly and efficiently. By using smart dispute templates and analytics, the software can guide users toward the most effective actions.

Some of the powerful features include:

- Importing your credit reports from all three major bureaus

- Identifying errors, late payments, and negative items automatically

- Suggesting the best dispute flow for each type of issue

- Organizing and tracking dispute responses across all three bureaus in one place

With these features, AI credit repair software gives you a structured and effective plan to fix credit after repossession and regain control over your financial future.

Client Dispute Manager Software: The Ultimate Tool to Fix Credit After Repossession

Client Dispute Manager Software is one of the most trusted tools in the credit repair industry. It helps users fix credit after repossession by simplifying the entire dispute process and offering automated support tailored to repossession cases.

This makes it a powerful choice for anyone rebuilding credit after repossession, whether you’re working on your own profile or running a credit repair business. It helps users:

- Create custom dispute letters based on the type of account (e.g., auto loans)

- Use pre-set dispute flows specifically designed for repossessions

- Track dispute progress and updates from bureaus

- Stay compliant with CROA and FTC regulations

- Manage client profiles and dispute histories from one central dashboard

- Schedule and automate dispute follow-ups and reminders

- Generate reports to track performance and credit improvement over time

- Access built-in dispute templates and legal compliance tools for faster processing

Whether you’re fixing your own credit or helping others, it streamlines the process and boosts your chances of success. With its specialized features and tailored dispute flows, Client Dispute Manager Software stands out as a go-to solution for those aiming to fix credit after repossession.

It’s especially valuable for entrepreneurs and professionals focused on rebuilding credit after repossession efficiently and legally.

Final Tips to Fix Credit After Repossession

As you reach the final stage of your credit recovery journey, it’s important to reflect on the progress you’ve made and the strategies that work best for your situation.

Fixing your credit after repossession isn’t just about removing negative marks it’s about creating new, positive habits that stick.

Whether you’re using AI credit repair software or taking the DIY route, consistency and patience will be your biggest allies in rebuilding credit after repossession.

Common Mistakes to Avoid When Trying to Fix Credit After Repossession

Avoiding common pitfalls is essential when working to fix credit after repossession. These common errors can delay your credit recovery, waste valuable time, or lead to further damage to your credit profile.

Being informed and intentional about your actions especially when using tools like AI credit repair software gives you a strategic edge. Staying clear of these missteps is critical to successfully rebuilding credit after repossession.

Here are a few key mistakes to avoid:

- Ignoring the Repo and Hoping it Disappears: Repossession won’t fall off your report quickly, and inaction delays recovery. It’s essential to address it head-on with a focused plan to fix credit after repossession.

- Disputing without Proof or Strategy: Credit bureaus require evidence, and vague disputes are often rejected. Use AI credit repair software to organize documentation and streamline your dispute process.

- Opening Too Many New Accounts too Quickly: This may signal financial desperation and further lower your score. Instead, focus on quality over quantity by selectively opening accounts that contribute positively to rebuilding credit after repossession.

- Missing Payment Deadlines: Late or missed payments can undo the progress you’ve made. Timely payments are critical to fix credit after repossession.

- Failing to Monitor Your Credit: Without regular checks, you might miss errors or changes that affect your score. Monitoring tools, often built into AI credit repair software, help track improvements and spot new issues fast.

Conclusion

Repossession isn’t the end it’s a detour. You now know how to fix credit after repo using legal strategies, smart tools, and consistent effort. From disputing errors to rebuilding your credit score step by step, the path to recovery is absolutely possible.

Use tools like AI credit repair software and Client Dispute Manager Software to make the process smoother and more effective.

You’ve got this. Start now and take control of your financial future today.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Below Is More Content For Your Review: