Have you ever looked at your credit report and thought, “Wait a minute… something’s not right”? Maybe there’s a late payment you’re sure you made on time or an account you don’t even recognize. You’re not alone.

Mistakes like these are more common than people think, and they can seriously damage your credit score.

The good news? You don’t need to be a financial expert or hire an expensive service to fix them. With the right tools, you can take control of your credit yourself.

That’s where DIY credit repair software comes in.

These programs are designed to help you find errors, send disputes, and track your progress all in one place. Some even use smart AI technology to guide you step by step.

In this guide, we’ll show you how this kind of software works, who it’s for, and how to choose the one that fits your credit goals.

Let’s dive in.

Key Takeaways:

- DIY credit repair software helps individuals fix mistakes on their credit reports without hiring costly services, offering tools to dispute errors, track progress, and learn about credit.

- It’s designed for everyday users, entrepreneurs, and aspiring credit repair professionals—giving flexibility, control, and education while avoiding high fees.

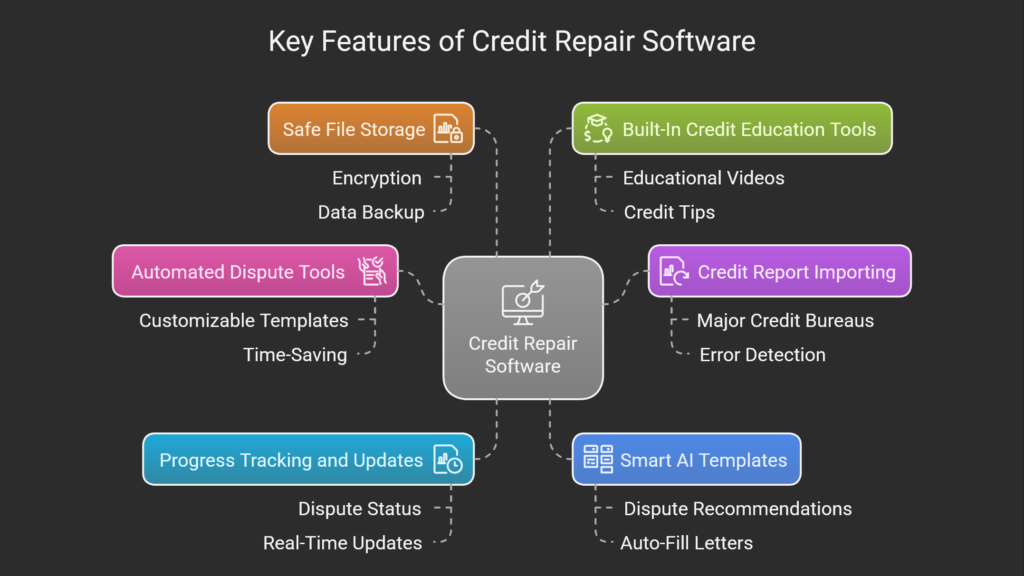

- Key features include automated dispute tools, direct credit report importing, progress tracking, AI-powered templates, secure storage, and built-in credit education.

- Users should avoid software that makes false promises, lacks legal compliance, or offers poor customer support, as these can cause harm or waste time.

- Client Dispute Manager Software stands out as a trusted solution with an all-in-one dashboard, AI tools, compliance focus, business-ready features, and strong support option.

Start Today and Explore the Features Firsthand!

What is DIY Credit Repair Software and How Does It Work?

DIY credit repair software is a tool that helps people fix mistakes on their credit reports without hiring a professional service.

It’s made for everyday users, so you don’t need any special skills or experience to get started.

Here’s how it usually works:

- You upload or connect your credit report.

- The software scans your report for errors, like late payments, duplicate accounts, or accounts that aren’t yours.

- It gives you tools and templates to write dispute letters.

- You track your results and see updates when changes happen.

Some of the best credit repair software also uses artificial intelligence (AI) to help guide your decisions.

For example, AI might suggest the best type of dispute to file based on the error it finds or give you tips on what documents to include.

What makes DIY credit repair tools different from hiring someone is that you stay in full control. You choose what to dispute, when to do it, and how to follow up. That means you also learn more about how credit works along the way.

It’s a smart option for anyone who wants to save money, fix credit issues on their own time, and build financial confidence step by step.

Who Should Use DIY Credit Repair Software?

DIY credit repair software isn’t just for one type of person—it’s for anyone who wants more control over their financial health.

Whether you’re trying to fix errors on your credit report, prepare for a big financial decision, or even learn how the credit system works, this kind of software can help.

Here are some people who can benefit the most:

- Individuals with Credit Issues: If you’ve been denied a loan or credit card, or you’re just tired of high interest rates, using this software can help you take action and correct report errors.

- Entrepreneurs and Small Business Owners: Your personal credit often impacts your ability to get business funding. Fixing errors and improving your credit can open new financial doors for your business.

- People Looking to Learn About Credit: Many programs offer educational tools that teach you about credit scores, reports, and how to build better credit habits.

Aspiring credit repair professionals: If you’re interested in starting a business in the credit repair industry, using the software for personal experience is a great first step.

The beauty of DIY credit repair is that it’s flexible. You can move at your own pace, focus on what matters to you, and avoid the high fees that come with professional services.

If you’ve ever thought, “I wish I could fix my credit, but I don’t know where to start,” this software was made for you.

Start Today and Explore the Features Firsthand!

Key Features to Look For in the Best Credit Repair Software

Not all credit repair tools are the same. To get the best results, it’s important to pick software that matches your needs and gives you the right tools. Here are the top features to look for:

Automated Dispute Tools in DIY Credit Repair Software

One of the most important features of DIY credit repair software is the ability to create and send dispute letters automatically. Instead of writing letters by hand or figuring out the format yourself, the software offers templates that are easy to customize.

You simply choose the reason for the dispute, fill in a few details, and the letter is ready to go. This feature saves time and removes the guesswork.

It also helps make sure the letters are professional and complete. With automation, you’re less likely to miss key steps or details. This is a must-have for anyone wanting to fix their credit efficiently and confidently.

Credit Report Importing in Credit Report Repair Software

A powerful credit report repair software lets you connect to all three major credit bureaus Equifax, Experian, and TransUnion and import your reports directly.

This saves you from the time-consuming process of gathering reports manually. Having all your information in one place makes it easier to compare and spot errors.

It also reduces the chance of missing important problems. Some tools even highlight negative items for quick review.

By pulling your reports automatically, this feature helps you take action faster and more accurately.

Start Today and Explore the Features Firsthand!

Progress Tracking and Updates in the Best Credit Repair Software

The best credit repair software keeps you informed every step of the way. Progress tracking tools show which disputes you’ve sent, which are in progress, and which items have been corrected. This kind of visibility builds confidence and keeps you motivated.

You won’t be left wondering if your actions are working. Real-time updates give you a clear view of what’s changing in your credit report.

Organized dashboards and alerts make it easy to stay on top of everything, so you never miss a beat.

Smart AI Templates in the Best AI Credit Repair Software

Today’s best AI credit repair software uses artificial intelligence to make your work easier and smarter. These tools can analyze your credit reports and recommend which items to dispute first.

They might even suggest the best reason for the dispute based on common patterns and legal guidelines.

Some software can auto-fill letters with details pulled from your reports. This not only saves time but helps reduce human errors. If you’re new to DIY credit repair, AI-powered tools can give you extra confidence as you learn the process.

Safe File Storage in Credit Repair Business Software

If you’re using credit repair business software or managing personal disputes, protecting private data is a must.

Look for programs that offer secure document storage with strong encryption. This keeps your letters, identity information, and credit files safe from hackers or breaches.

Some tools even back up your data automatically. This feature builds trust and helps you stay compliant with data protection standard especially important if you’re using credit repair software for business.

Built-In Credit Education Tools for DIY Credit Repair

Great DIY credit repair software doesn’t just help you fix issues it also helps you understand how credit works.

Look for tools that include short videos, simple tips, and easy-to-read articles on topics like credit scores, payment history, and dispute rights.

These features make the process educational, not just transactional.

When you learn as you go, you’re more likely to build strong credit habits that last. This makes the software a long-term investment in your financial future.

Start Today and Explore the Features Firsthand!

Mistakes to Avoid When Choosing Credit Report Repair Software

When picking a credit report repair software, it’s just as important to know what to avoid as it is to know what to look for. Choosing the wrong tool can waste time, money, and even hurt your credit if you’re not careful.

Falling for "Too Good to Be True" Promises

Be cautious of software that claims it can “instantly fix your credit” or “guarantee results.” These kinds of promises are not only misleading they can also violate credit laws.

No one can legally remove accurate negative items from your report, no matter what a tool or company claims. Good DIY credit repair software is built to help you identify mistakes and go through the proper dispute process.

It offers tools, templates, and support but it won’t wipe your credit clean overnight. Think of it like a helpful guide, not a miracle fix. Real results take time, effort, and accuracy, and the best software helps you do things the right way.

Overlooking Compliance and Legal Support

Not all tools follow the rules. Make sure the software is compliant with credit laws like the Fair Credit Reporting Act (FCRA). These laws protect your rights and outline the proper way to dispute errors on your credit report.

Using software that isn’t legally compliant could cause more harm than good, especially if it encourages you to take shortcuts. Look for tools that explain the dispute process clearly and help you stay within legal boundaries.

Some programs include built-in tips, reminders, and step-by-step guidance to help you follow the right process. This not only protects your credit but also helps you avoid trouble down the line.

Legal support features add an extra layer of protection for both beginners and experienced users alike.

Not Checking for Customer Support

You may have questions or need help during the process, especially if you’re using the software for the first time. Good credit report repair software should offer reliable support by chat, email, or phone.

This support acts as a safety net when you’re unsure about the next steps. Some tools even provide detailed help centers or tutorial videos to walk you through common tasks.

Having someone to reach out to can reduce stress and keep you moving forward.

Without access to support, you may end up stuck or make avoidable mistakes. Solid customer service makes the experience smoother and gives you peace of mind that help is there when you need it most.

Why Client Dispute Manager Software is Trusted as One of the Best Credit Repair Software?

When it comes to choosing the best credit repair software, many users trust Client Dispute Manager Software because of its powerful features, ease of use, and dedication to compliance.

Whether you’re just starting with DIY credit repair or building a credit repair business, this tool was designed with you in mind.

What makes it stand out?

- All-in-One Dashboard: Manage disputes, track progress, import credit reports, and store documents—all from one place.

- AI-powered Tools: Smart automation helps you create personalized dispute letters based on the errors in your report.

- Built-in Credit Education: Learn about credit repair laws, best practices, and how to build strong financial habits.

- Compliance-focused Design: Built to follow key regulations like the Fair Credit Reporting Act (FCRA) and the Credit Repair Organizations Act (CROA).

- Business Ready Features: Ideal for entrepreneurs using credit repair software for business, with client tracking, branding tools, and more.

- Support When You Need It: Get help via tutorials, chat, or phone when you’re stuck or just want guidance.

Client Dispute Manager isn’t just about fixing credit—it’s about giving users the tools and confidence to do it right. Whether you’re repairing your own report or helping others, this software is built to support your success at every step.

Start Today and Explore the Features Firsthand!

Frequently Asked Questions (FAQs)

What Is DIY Credit Repair Software and How Does It Work?

DIY credit repair software is a self-service tool that helps you fix credit report errors without hiring a company. You connect your credit reports, review issues, and generate dispute letters automatically.

Some programs, like Client Dispute Manager Software, use artificial intelligence to guide you on which disputes to prioritize and how to follow up for faster, compliant results.

Who Should Use DIY Credit Repair Software?

It’s ideal for individuals with errors on their reports, small business owners who want control over their credit health, and entrepreneurs interested in learning the credit repair process.

The article highlights that beginners benefit most because the software simplifies disputes and teaches how credit systems work through guided steps and built-in education modules.

What Features Should I Look for in the Best Credit Repair Software?

Look for:

- Automated dispute tools with editable templates

- Real-time progress tracking and report importing

- AI-driven letter generation and dispute recommendations

- Data encryption and safe file storage

- Built-in credit education and compliance support

What Mistakes Should I Avoid When Choosing Credit Repair Software?

Avoid tools that:

- Promise instant or guaranteed results (violates FCRA and FTC rules)

- Lack compliance guidance or legal documentation

- Have poor customer support or no progress tracking

- Always choose platforms that emphasize lawful dispute processes and data protection. Client Dispute Manager Software meets these standards by following FTC and CROA compliance requirements.

Where Can I Start Using Client Dispute Manager Software for DIY Credit Repair?

You can start a free 30-day trial directly on the Client Dispute Manager Software website. The software offers automation, AI-driven dispute tools, credit education, and compliance safeguards.

Whether you’re fixing your own credit or managing multiple clients, it gives you everything you need to repair credit efficiently and responsibly.

Conclusion

Taking control of your credit can feel overwhelming, but the right tools make it easier. DIY credit repair software helps you fix errors, understand your credit, and take charge of your financial future. It’s not about quick fixes—it’s about smart, steady progress.

Start small, stay consistent, and use every feature your software offers. Whether you’re working on your personal goals or exploring credit repair software for business, each step brings you closer to confidence and control.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- What Are the Main Features of Credit Repair Software?

- Revolutionizing Financial Recovery: The Rise of Automation in Credit Repair