In a world where credit scores can significantly impact your financial opportunities, many individuals find themselves stuck in a cycle of low scores and frustrating outcomes. The credit repair industry is filled with promises and pitfalls, leaving countless people unsure of what steps to take. However, the good news is that you don’t always need to rely on expensive agencies to see results.

With a bit of knowledge and commitment, you can take control of your credit destiny and improve your score on your own. From understanding your credit report to mastering strategic payment techniques, every step you take can propel you closer to that coveted higher score.

In this article, we will outline 7 proven steps you can implement today to repair your credit yourself and unlock a brighter financial future—fast!

Start Today and Explore the Features Firsthand!

Understand the Importance of Your Credit Score

Credit scores serve as a reflection of an individual’s creditworthiness, playing a critical role for lenders in their decisions to extend loans. They directly impact the credit limits and interest rates offered to borrowers. A strong credit score opens the door to more favorable financing options and reduced interest rates, ultimately leading to significant savings on borrowed amounts.

Among the various factors that influence credit scores, payment history stands out as the most significant, constituting 35% of a FICO score and 40% of a VantageScore. Additionally, maintaining a credit utilization ratio—ideally below 30%—is essential, as it accounts for up to 30% of the overall FICO score.

This ratio indicates the amount of debt owed compared to the total credit available. A robust credit history not only enhances your credit score but also increases your attractiveness to lenders, affecting decisions regarding loans, rental applications, insurance rates, and utility services.

Obtain and Review Your Credit Reports

Request free annual copies of your credit reports from Experian, Equifax, and TransUnion at Annual Credit Report. Reviewing your report helps identify inaccuracies like unfamiliar accounts or wrongly reported late payments that can harm your score. It includes personal info, active and closed accounts (up to 10 years), and inquiry details.

Federal law ensures access to a free report, but checking your score might incur fees. Since each bureau collects data differently, it’s essential to review all three reports for discrepancies.

Start Today and Explore the Features Firsthand!

Access Free Credit Reports

When accessing your credit reports, take the time to download and print each one for easy comparison. Once you have your reports in front of you, meticulously review each page. Here’s what to focus on:

- Personal Information: Ensure that your name, address, social security number, and employment details are accurate. Errors in this section can lead to confusion and potential issues with loan approvals.

- Account Information: Check both active and closed accounts. Confirm that accounts listed belong to you and that there are no accounts opened in your name without your authorization (a sign of identity theft). Pay close attention to payment history, balances, and credit limits.

- Inquiries: Look for hard inquiries, which occur when a lender checks your credit report for lending decisions. Too many hard inquiries in a short period can negatively impact your score.

- Discrepancies and Errors: Keep an eye out for any inaccuracies, such as incorrect balances, missed payments reported in error, or duplicate accounts. Document each discrepancy as you go through your reports.

If you discover any inaccuracies, be sure to challenge them with the appropriate credit bureau. You can submit a dispute online or via mail.

Identify Key Factors Affecting Your Score For Steps to Repair Your Credit

Understanding the key factors that influence your credit score is essential for anyone looking to improve their financial standing, especially if you’re aiming to secure a mortgage. Credit scores are calculated based on various elements, and knowing these can help you take targeted steps to enhance your score.

Here are the primary factors that affect your credit score:

- Payment History (35%): This is the most significant factor in your credit score calculation. It reflects whether you’ve made your payments on time, including credit cards, loans, and other bills. Late payments, defaults, and bankruptcies can severely impact this aspect of your score. To maintain a healthy score, strive to pay your bills on time, and consider setting up automatic payments or reminders.

- Credit Utilization (30%): This ratio measures how much credit you are using compared to your total available credit. Ideally, you should aim to keep your credit utilization below 30%. High utilization rates can signal to lenders that you may be over-relying on credit, potentially leading to a lower score. To improve this factor, consider paying down existing balances and keeping credit card balances low.

- Length of Credit History (15%): This factor considers how long your credit accounts have been active. A longer credit history can positively influence your score, as it provides lenders with a more comprehensive view of your credit behavior over time. If you have older accounts, keeping them open, even if they’re not used frequently, can be beneficial.

- Types of Credit in Use (10%): Having a mix of different types of credit—such as revolving credit (credit cards) and installment loans (car loans, mortgages)—can positively impact your score. However, it’s important not to take on debt that you don’t need just to diversify your credit mix. Use credit responsibly and only take on loans that fit your financial situation.

- Recent Credit Inquiries (10%): Each time you apply for new credit, a hard inquiry is recorded on your credit report. While one or two inquiries may have a minimal effect, multiple inquiries in a short period can signal to lenders that you may be a higher risk. It’s advisable to limit credit applications and only seek new credit when necessary.

Start Today and Explore the Features Firsthand!

Dispute Inaccuracies in Your Credit Reports: Best Steps To Repair Credit

Once you have a clear understanding of the key factors affecting your credit score, the next step is to ensure the accuracy of the information reported in your credit reports. Mistakes occur frequently and can have an adverse impact on your credit score.

Here’s how to tackle inaccuracies effectively:

Gather Supporting Documentation

Begin by obtaining copies of your credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. You are entitled to one free report from each bureau every year, which can be accessed at Annual Credit Report. Thoroughly review each report for any discrepancies, such as incorrect personal information, unfamiliar accounts, or outdated negative items.

Once you identify potential errors, it’s crucial to gather supporting documentation to substantiate your claims. This may include:

- Bank Statements: If there are discrepancies related to account balances or payment history, provide your most recent bank statements.

- Payment Receipts: If you made a timely payment that’s being reported as late, attach copies of your receipts or electronic payment confirmations.

- Correspondence: Collect any communications with creditors, especially if you’ve disputed charges or made arrangements to settle accounts.

- Identity Verification: If inaccuracies relate to personal information (like an incorrect name or address), have documents ready that prove your identity, such as a utility bill or government-issued ID.

Submit Dispute Letters

After you have gathered your supporting documentation, it’s time to submit dispute letters to the credit bureaus regarding the inaccuracies you found on your credit reports. A well-crafted dispute letter is essential to effectively communicate your concerns and initiate the correction process.

Begin by explicitly stating your intention to dispute particular information listed in your credit report. Include your full name, current address, and any prior addresses that may be relevant. Indicate which credit bureau you are contacting and provide your credit report number if you have it on hand. Be clear and specific about each item you believe to be erroneous. For instance:

- Identify the specific account under dispute.

- Articulate precisely why you think the information is inaccurate.

- Note any supporting documentation you are enclosing with your letter

Start Today and Explore the Features Firsthand!

Attach Supporting Documentation

Be sure to include copies, but not the original versions, of all the supporting documents you have gathered. This is essential as it strengthens your case and provides crucial evidence for the credit bureau’s investigation process. Make absolutely certain that all documentation is clear and easily readable, and label them appropriately to match the specific claims mentioned in the body of your letter.

Send Off Your Dispute Letter

Once you have finished your dispute letter and gathered all necessary supporting documents, it’s time to send them out. Use certified mail for this purpose, as this method provides you with the ability to track the delivery of your letter.

Additionally, it ensures that you receive confirmation of when your documents were officially received by the credit bureau, giving you peace of mind throughout the process.

Establish Positive Financial Habits

Once you have successfully contested inaccuracies on your credit report, the next step is to establish positive financial habits that will not only aid in boosting your credit score but also maintain it over the long haul.

Here are some essential practices to incorporate into your daily financial life:

Always Pay Bills on Time

The most significant factor influencing your credit score is undoubtedly your payment history. To ensure you never miss a due date for credit cards, loans, and various other bills, consider setting reminders on your phone or utilizing automatic payments.

It’s important to understand that even a single late payment can inflict considerable harm on your score. By establishing a consistent payment routine, you will gradually enhance your creditworthiness over time.

Create a Budget

Budgeting is an excellent strategy that helps you manage your finances effectively by keeping your spending in check and ensuring you have sufficient funds allocated for necessary payments.

Make it a practice to track your monthly expenses, categorize them into different sectors, and stick to your budget rigidly to avoid the risk of accumulating debt. You can also use budgeting apps or digital tools designed to assist in managing your finances more effectively.

Start Today and Explore the Features Firsthand!

Reduce Credit Card Balances

Your credit utilization ratio, which reflects how much credit you are currently using compared to your total available credit limit, plays a crucial role in determining your credit score. Aim to keep this credit utilization below 30%. Moreover, if possible, consider paying off credit card balances in full each month to maintain the best credit health.

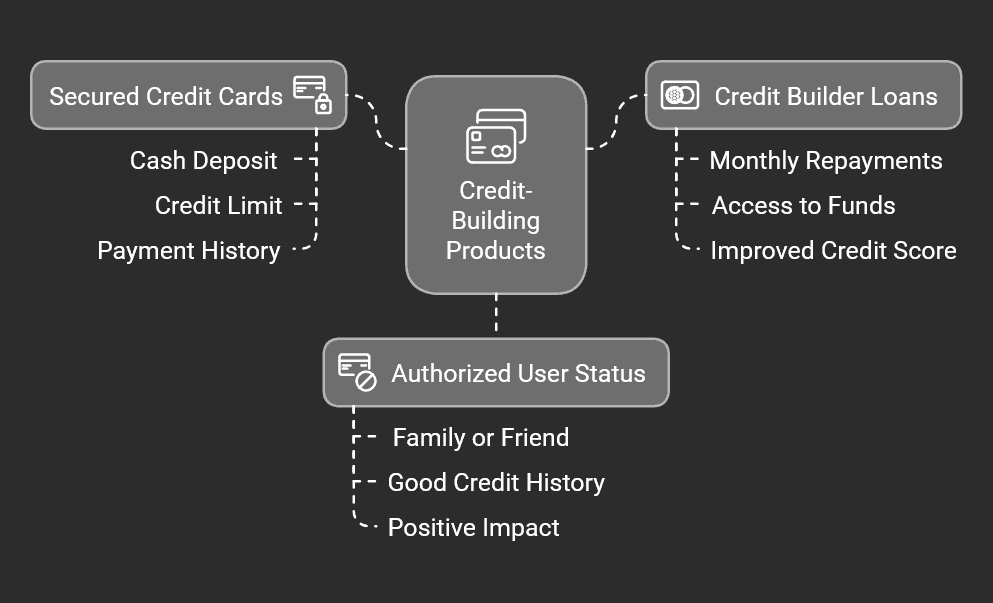

Utilize Credit-Building Products

Engaging with credit-building products is a proactive way to improve your credit profile. These products can help create a foundation for a positive credit history. Here are a few effective options:

Secured Credit Cards

Secured credit cards necessitate a cash deposit that effectively establishes your maximum credit limit. This specific type of credit card is particularly beneficial for individuals who are either trying to build or rebuild their credit profile. The appealing aspect is that these cards actively report your payment history to key credit bureaus.

By responsibly managing this card making modest purchases and ensuring that you pay off the entire balance each month you can create a consistent and positive payment history that ultimately influences your credit score in a favorable way.

Credit Builder Loans

A credit builder loan is specifically structured to assist you in enhancing your credit score over time. When you decide to take out this type of loan, the amount you borrow is securely held in a bank account until the loan has been paid off in full.

Your monthly repayment activity is reported to credit bureaus, which can significantly improve your overall payment history. Once you have successfully completed the repayment period, you will not only gain access to the funds you originally borrowed but also enjoy the added benefit of an improved credit score.

Become an Authorized User

If you have a family member or close friend whom you trust and who has a good standing credit history, you may want to consider asking them if they would be willing to add you as an authorized user on their credit card account.

This mutual arrangement means that you will be allowed to use their credit card, benefiting from their responsible credit usage, which can positively impact your own credit score, provided they maintain good payment habits.

Avoid Unnecessary New Credit Applications

Applying for new credit can sometimes seem like a quick fix to improve your credit score. However, making several applications in a short period can raise red flags with lenders, signaling that you are in financial distress. Each time you apply for credit, a hard inquiry is made on your credit report, which can temporarily lower your score. To navigate this process wisely, consider the following strategies:

Start Today and Explore the Features Firsthand!

Do Your Research

Before applying for any new credit, thoroughly investigate your options. Look for credit offers that align with your current credit profile. Various lenders have different criteria for approval; therefore, selecting those more likely to extend credit to you can help minimize hard inquiries. Use pre-qualification tools provided by many lenders that let you check your eligibility without impacting your credit score.

Limit Your Applications for Credit

Aim to limit your credit applications to one or two over a six-month period. Spacing out applications helps to ensure that you don’t overwhelm your credit profile with multiple inquiries at once. Additionally, this approach can help when searching for the best loan or credit card options, as it allows you to take the time to assess each opportunity without rushing the decision.

Focus on Existing Credit

Instead of constantly searching for new credit opportunities, it’s essential to prioritize and manage the credit you already have. By concentrating on your current credit cards, loans, and other credit accounts, you can develop better habits and potentially see improvements in your overall credit score over time.

Conclusion

Repairing your credit may seem daunting, but with the right steps, it’s entirely achievable. By understanding the key factors affecting your score, reviewing and disputing errors on your credit reports, and adopting positive financial habits like paying bills on time and managing credit utilization, you can take control of your financial future. Tools like secured credit cards and credit-builder loans can further support your efforts.

Improving your credit requires patience and consistency, but the rewards—better financial opportunities, lower interest rates, and greater peace of mind—are well worth it. With dedication and the strategies outlined, you can build a healthier credit profile and unlock a brighter financial future.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: