The credit repair industry is undergoing a significant transformation with the advent of AI credit repair software. This revolutionary technology is changing how individuals and businesses approach credit improvement. AI credit repair software offers unparalleled efficiency and accuracy, making it an indispensable tool for both professionals and those engaged in do-it-yourself credit repair.

Start Today and Explore the Features Firsthand!

What is AI Credit Repair Software?

AI credit repair software is a cutting-edge solution that leverages artificial intelligence to analyze credit reports, identify errors, and generate customized dispute letters.

This technology has quickly become the best credit repair software available, outperforming traditional methods in both speed and accuracy. AI credit repair software can process vast amounts of information in seconds, identifying patterns and discrepancies that might take hours for a human to spot.

For businesses, this translates to increased efficiency and the ability to handle more clients, while individuals benefit from a more thorough and effective do-it-yourself credit repair process.

The Power of Adaptive Learning in Credit Repair Business Software

One of the most impressive features of AI credit repair software is its ability to learn and adapt. Unlike static software solutions, AI-powered systems continually refine their strategies based on the outcomes of previous disputes. This means that the best AI credit repair software doesn’t just automate existing processes; it enhances them over time.

For credit repair business software, this adaptive learning capability translates to improved success rates in disputes and more efficient use of resources. It allows businesses to handle increasingly complex cases while maintaining high levels of accuracy and compliance.

Key Benefits of AI Credit Repair Software

AI credit repair software offers numerous advantages that make it the best credit repair software for both businesses and individuals. It provides an efficiency boost by scanning credit reports in seconds and automatically detecting potential errors or discrepancies.

The software enhances accuracy by utilizing advanced algorithms to ensure precision in identifying reportable items, reducing the risk of overlooking critical information. Scalability is another key benefit, allowing businesses to handle a larger volume of clients without proportionally increasing staff.

For those engaged in do-it-yourself credit repair, the software offers professional-level tools and insights, making the process more manageable and effective.

Understanding AI Credit Repair Software: A Game-Changer in Credit Improvement

AI credit repair software represents a paradigm shift in the credit repair industry. It’s not just another tool, but a comprehensive solution that’s redefining what’s possible in credit improvement. This technology is particularly beneficial for credit repair businesses, offering unprecedented efficiency and accuracy.

How AI Credit Repair Software Works?

AI credit repair software operates through a sophisticated process that begins with data input and analysis. The software scans credit reports using advanced algorithms to identify potential errors and disputable items. It then develops a customized strategy for addressing each issue, making it the best credit repair software for tailored solutions.

The AI generates dispute letters and other necessary documentation automatically, a key feature of top-tier credit repair business software. As responses come in from creditors and bureaus, the software updates case status and suggests next steps, showcasing why it’s considered the best AI credit repair software.

Advantages Over Traditional Methods

Compared to traditional credit repair methods, AI credit repair software offers significant advantages. It dramatically reduces the time required to analyze credit reports and generate dispute letters. The software’s accuracy in identifying disputable items far exceeds human capabilities, ensuring that no opportunities for improvement are missed.

For businesses, credit repair business software powered by AI allows for handling a much larger volume of cases without a proportional increase in staff. Even for individuals pursuing do-it-yourself credit repair, AI software provides expert-level analysis and strategy that would be difficult to achieve manually.

Start Today and Explore the Features Firsthand!

Integration with Existing Systems

Modern AI credit repair software is designed to integrate seamlessly with existing business systems. This integration capability makes it an ideal choice for businesses looking to upgrade their credit repair business software.

The best credit repair software solutions offer APIs and built-in integrations with popular CRM and business management tools. This allows for a smooth transition and enables businesses to leverage their existing data and workflows while benefiting from the advanced capabilities of AI.

Do-It-Yourself Credit Repair vs. AI-Assisted: A Comparative Analysis

The choice between do-it-yourself credit repair and AI-assisted solutions is a crucial decision for individuals and businesses alike. While both approaches have their merits, the advent of AI credit repair software has significantly changed the landscape. Understanding the differences is key to making an informed decision about which path to take.

The DIY Approach to Credit Repair

Do-it-yourself credit repair involves personally reviewing credit reports, identifying errors, and managing the dispute process. This method requires a significant time investment and a steep learning curve to understand credit laws and regulations.

While it can be effective for simple cases, do-it-yourself credit repair often struggles with complex issues or managing multiple disputes simultaneously. The lack of advanced tools and expertise can also lead to missed opportunities for improvement.

The AI-Assisted Advantage in Credit Repair

AI-assisted credit repair, powered by AI credit repair software, offers several benefits that address the challenges of the DIY approach. It saves time through automation, a key benefit of credit repair business software.

The best AI credit repair software provides comprehensive analysis, reducing the risk of missed opportunities. It comes with built-in knowledge of relevant laws and best practices, ensuring compliance and effectiveness.

For businesses, AI-assisted solutions offer the ability to manage multiple cases efficiently, making it the best credit repair software for scaling operations.

Making the Right Choice for Your Credit Repair Needs

The decision between do-it-yourself credit repair and AI-assisted solutions depends on several factors. For individuals with simple credit issues, the DIY approach might suffice. However, for those dealing with complex credit problems or businesses handling numerous clients, AI credit repair software offers significant advantages.

The best credit repair software provides a balance of control and automation, allowing users to leverage AI capabilities while maintaining oversight of the process. Ultimately, the choice depends on the complexity of credit issues, volume of cases, available time and resources, and long-term goals.

Start Today and Explore the Features Firsthand!

Selecting the Best AI Credit Repair Software for Your Needs

Choosing the right AI credit repair software is a critical decision that can significantly impact the success of your credit repair efforts. With numerous options available, it’s essential to understand what features and capabilities to look for. The best credit repair software should align with your specific needs, whether you’re an individual or a business.

Key Factors to Consider

When selecting credit repair software for business or personal use, several factors should be considered. Look for software with a proven track record of accurately identifying disputable items. User-friendliness is crucial, as the interface should be intuitive even for those without extensive technical knowledge.

The best AI credit repair software should offer customization options to fit your specific needs or business model. Integration capabilities with other business tools are important for seamless operations. Reliable customer support and regular updates to stay current with industry changes are also essential features of top credit repair business software.

Evaluating Software Capabilities

The capabilities of AI credit repair software can vary significantly between different providers. Look for software that offers comprehensive credit report analysis, automated dispute letter generation, and case tracking features.

The best credit repair software should provide detailed analytics and reporting functionality, allowing you to track progress and identify areas for improvement.

For businesses, scalability is a crucial factor – the software should be able to handle an increasing volume of clients as your business grows. Security features are also paramount, given the sensitive nature of credit information.

Cost Considerations

While price shouldn’t be the only factor, it’s important to consider the cost-effectiveness of AI credit repair software. Compare the features offered with the pricing structure to ensure you’re getting value for money.

Some providers offer tiered pricing for credit repair business software, allowing you to start with basic features and upgrade as your needs grow. For individuals considering do-it-yourself credit repair, look for software that offers a good balance of features and affordability.

Remember that investing in the best credit repair software can lead to better results and time savings in the long run.

Start Today and Explore the Features Firsthand!

Implementing AI Credit Repair Software in Your Business: Strategies for Success

Integrating AI credit repair software into your business operations is a strategic move that can transform your credit repair process. Successful implementation requires careful planning and execution. The right approach can help you maximize the benefits of this technology and stay ahead in the competitive credit repair industry.

Planning the Integration

Before implementing AI credit repair software, assess your current processes and identify areas where AI can bring the most value. Choose credit repair business software that aligns with your business goals and existing systems.

Develop a detailed plan for integrating the new software, setting realistic timelines and milestones. Communicate the changes to your team early and address any concerns they may have about adopting new technology.

Training and Adaptation

Proper training is crucial when implementing AI credit repair software. Ensure that all team members understand not just how to use the tools, but also the underlying principles of AI-assisted credit repair.

Consider a phased approach to implementation, starting with a pilot program before full-scale rollout. This allows you to iron out any issues and build confidence in the new system. Regularly review and optimize your workflows to fully leverage the capabilities of your new credit repair software for business.

Maximizing the Benefits

To get the most out of your AI credit repair software, focus on leveraging its data insights to make informed decisions. Use the efficiency gained from automation to provide faster, more personalized service to your clients.

The scalability of AI credit repair software allows you to take on more clients without proportionally increasing staff – use this to grow your business strategically. Stay informed about updates and new features in your credit repair business software to ensure you’re always using it to its full potential.

The Future of Credit Repair: AI and Beyond

The credit repair industry is on the cusp of a technological revolution, with AI credit repair software leading the charge. As AI continues to evolve, we can expect even more advanced features and capabilities in credit repair business software. The future promises more personalized, efficient, and effective credit repair solutions.

Emerging Trends in AI Credit Repair Software

The next generation of AI credit repair software is likely to incorporate more advanced predictive analytics, offering insights into future credit score changes based on current actions. Natural language processing could enable more human-like communication with clients, enhancing the user experience.

We may also see deeper integration with financial planning tools, allowing for more comprehensive credit management solutions. These advancements will further cement AI credit repair software as the best credit repair software available.

Start Today and Explore the Features Firsthand!

Impact on the Credit Repair Industry

As AI credit repair software becomes more sophisticated, it will likely reshape the credit repair industry. We may see a shift towards more automated, AI-driven services, with human experts focusing on complex cases and strategy development. This could lead to more affordable and accessible credit repair services for consumers.

For businesses, the best credit repair software will be those that can adapt quickly to these changes, offering cutting-edge features while maintaining compliance with evolving regulations.

Preparing for the Future

To stay competitive in this evolving landscape, credit repair professionals should stay informed about advancements in AI credit repair software. Continuously updating skills and knowledge will be crucial.

For those engaged in do-it-yourself credit repair, keeping abreast of new AI-powered tools can provide a significant advantage. Businesses should be prepared to invest in the latest credit repair business software to maintain their edge in an increasingly technology-driven industry.

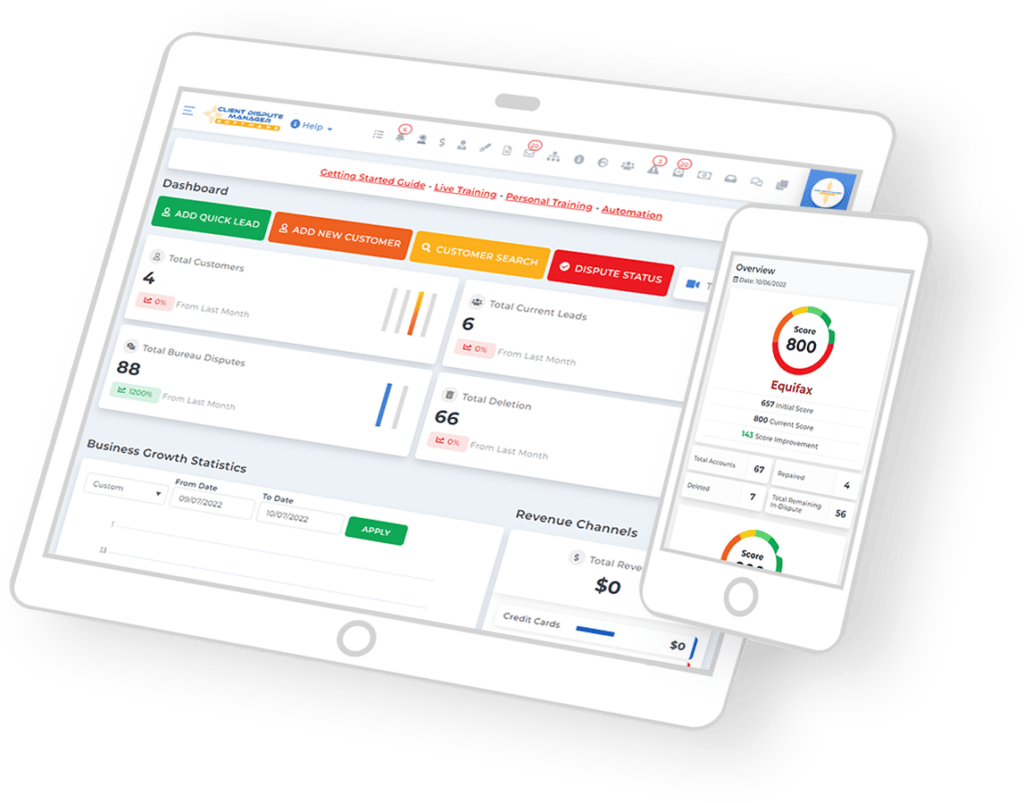

Client Dispute Manager Software: Enhancing Credit Repair Business Software

In the realm of credit repair business software, Client Dispute Manager Software has emerged as a crucial component. This specialized tool integrates seamlessly with AI credit repair software to streamline the dispute process and enhance client management. By leveraging such software, credit repair businesses can significantly improve their efficiency and client satisfaction rates.

Start Today and Explore the Features Firsthand!

Features of Client Dispute Manager Software

Client Dispute Manager Software typically includes a range of features designed to simplify the dispute process. It often provides a centralized dashboard for managing multiple client cases simultaneously, making it an essential part of any comprehensive credit repair business software suite. Key features of Client Dispute Manager Software often include:

- Centralized Client Dashboard: A user-friendly interface that allows credit repair professionals to manage multiple client cases from a single screen. This dashboard typically displays key information such as client details, dispute status, upcoming tasks, and recent activities, enabling efficient case management and quick decision-making.

- Automated Dispute Letter Generation: Utilizes templates and AI credit repair software insights to create customized dispute letters for each client. This feature saves time, ensures consistency, and allows for personalization based on the specific details of each case, improving the effectiveness of disputes.

- Real-Time Progress Tracking: Provides up-to-date information on the status of each dispute, allowing both credit repair professionals and clients to monitor progress. This feature often includes visual representations like progress bars or status indicators, enhancing transparency and client engagement.

- AI Integration Capabilities: Seamlessly integrates with AI credit repair software to leverage advanced analysis and prediction capabilities. This integration enhances dispute strategies, improves accuracy in identifying disputable items, and increases overall efficiency of the credit repair process.

- Client Portal for Self-Service: Provides clients with secure access to their case information, allowing them to view progress, upload documents, and communicate with their credit repair professional. This feature empowers clients, increases transparency, and reduces the workload on credit repair professionals for routine information requests.

Conclusion

AI credit repair software has emerged as a game-changing solution in the credit repair industry, offering unprecedented efficiency and accuracy for both businesses and individuals. As the best credit repair software continues to evolve, we can expect even more sophisticated features that will further streamline the credit repair process and improve outcomes.

For credit repair businesses, adopting credit repair business software powered by AI could be the key to scaling operations and staying competitive in an increasingly tech-driven landscape.

Meanwhile, individuals engaged in do-it-yourself credit repair can now access professional-level tools and insights, making the process more manageable and potentially more successful. As we move forward, those who embrace AI credit repair software will be best positioned to navigate the complexities of credit repair and achieve their financial goals more effectively.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!