Are you struggling with a low credit score or trying to establish credit for the first time? You’re not alone, and there’s a powerful solution: credit builder loans. These innovative financial tools are designed to help you build credit fast, without the usual catch-22 of needing good credit to get credit.

In this guide, we’ll explore how credit builder loans work, compare the best options available, and show you how to use them effectively to boost your credit score. Whether you’re a recent graduate, new to credit, or rebuilding your financial profile, you’ll discover how these loans to build credit can open doors to better financial opportunities.

Let’s dive in and unlock the potential of credit builder loans to transform your financial future!

Start Today and Explore the Features Firsthand!

What is a Credit Builder Loan?

A credit builder loan is a unique financial product specifically created to help people build or rebuild their credit. Unlike traditional loans, with a credit builder loan, you don’t receive the money upfront.

Instead, the loan amount is held in a savings account while you make regular payments. This structure makes credit builder loans an excellent option for those looking to build credit with a loan.

By making timely payments, you demonstrate responsible credit behavior, which is reported to credit bureaus, helping to establish a positive credit history.

How Do Credit Builder Loans Work?

Credit builder loans operate differently from traditional loans. When you take out a credit builder loan, the lender deposits the loan amount into a savings account. You then make fixed monthly payments over a set term, typically 12 to 24 months. As you make these payments, the lender reports your payment activity to the major credit bureaus.

This reporting is crucial, as it helps build your credit. Once you’ve completed all payments, you receive the money that was initially set aside, effectively combining credit building with forced savings.

Why Choose a Credit Builder Loan?

Credit builder loans offer several advantages for those looking to improve their credit. First, they’re specifically designed for credit building, making them accessible to people with poor or no credit history.

Second, the regular reporting to credit bureaus helps establish a positive payment history, a crucial factor in credit scoring.

Third, credit builder loans often come with lower interest rates compared to other credit building loans. Lastly, the forced savings aspect provides an additional financial benefit, helping you build up a lump sum while improving your credit.

The Best Loans to Build Credit Fast

When it comes to building credit fast, not all loans are created equal. Credit builder loans stand out as effective tools for improving your credit score quickly. Let’s explore some of the top options available in the market.

Self Credit Builder Loans

Self offers flexible credit builder loans with terms ranging from 12 to 24 months. They report to all three major credit bureaus, enhancing the loan’s impact on your credit score. Self’s user-friendly mobile app makes it easy to track your progress and manage your loan.

With Self, you can choose your monthly payment amount based on your budget, making it a versatile option for those looking to build credit with a loan. Their credit builder loans also come with a savings component, allowing you to build your credit while setting aside money for the future.

Start Today and Explore the Features Firsthand!

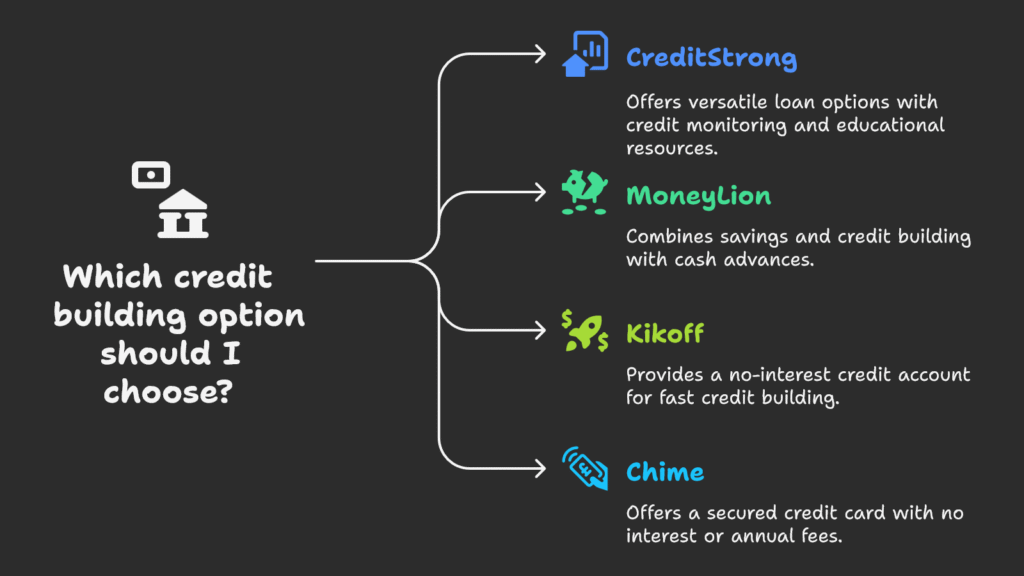

CreditStrong: A Versatile Credit Building Loan Option

CreditStrong provides various credit builder loan options, including plans specifically designed for faster credit building. They offer both secured and unsecured options, making them a versatile choice for different financial situations. CreditStrong’s credit building loans come with credit monitoring and educational resources, helping you understand and improve your credit.

Their loans report to all three major credit bureaus, maximizing the positive impact on your credit score. With flexible terms and loan amounts, CreditStrong caters to a wide range of credit-building needs.

MoneyLion Credit Builder Plus: Combining Savings and Credit

MoneyLion’s Credit Builder Plus program takes a unique approach by combining a credit builder loan with a low-interest personal loan. This innovative structure gives you access to some funds immediately while still helping you build credit. The program also includes features like credit monitoring and cash advances, making it a comprehensive financial tool.

MoneyLion reports to all three major credit bureaus, ensuring your credit-building efforts are widely recognized. Their credit building loans also come with a built-in savings component, helping you improve your overall financial health.

Kikoff Credit Account: An Alternative Approach to Building Credit

While not technically a loan, Kikoff’s Credit Account functions similarly to a credit builder loan. It provides a $500 line of credit and reports to major credit bureaus, helping you build credit with responsible use. Kikoff doesn’t charge interest, making it an affordable option for credit building.

Their unique approach allows you to build credit fast without the commitment of a traditional loan. Kikoff’s Credit Account can be an excellent stepping stone for those new to credit or looking to rebuild their credit profile.

Chime Credit Builder Secured Credit Card: Building Credit Without a Traditional Loan

Chime’s Credit Builder Secured Credit Card works like a credit builder loan, with no interest and no credit check required. Your spending limit is based on the amount you deposit, giving you control over your credit line.

Chime reports to all three major credit bureaus and doesn’t charge annual fees, making it an excellent option for building credit. This card allows you to build credit with a loan-like product while enjoying the flexibility of a credit card. It’s particularly useful for those who want to build credit while making everyday purchases.

Choosing the Right Credit Builder Loan

Selecting the best credit builder loan for your needs requires careful consideration. It’s essential to evaluate various factors to ensure you choose a loan that aligns with your financial goals and situation.

Loan Terms and Interest Rates: Finding the Best Deal

When comparing credit builder loans, pay close attention to the loan terms and interest rates. Look for loans with terms that fit your budget and timeline, typically ranging from 12 to 24 months. Interest rates on credit builder loans are generally lower than those on traditional personal loans to build credit, but they can still vary between lenders.

Consider how the interest rate will affect the overall cost of building your credit. Remember, the goal is to build credit fast while minimizing your expenses. Some lenders offer more flexible terms, allowing you to adjust your monthly payments or loan duration to better suit your financial situation.

Reporting Practices and Fees: Maximizing Credit Impact

To get the most out of your credit builder loan, ensure the lender reports to all three major credit bureaus – Equifax, Experian, and TransUnion. This comprehensive reporting maximizes the positive impact on your credit score. Be aware of any fees associated with the loan, such as application fees, monthly administrative fees, or early payoff penalties.

These fees can add to the overall cost of the loan, so factor them into your decision when comparing different options. Some credit building loans may offer fee waivers or discounts for setting up automatic payments or meeting certain criteria, so look out for these potential savings.

Accessibility and Additional Features: Beyond Basic Credit Building

Look for a credit builder loan provider that doesn’t require a hard credit check to apply, as hard inquiries can temporarily lower your credit score. Many credit builder loan providers use only soft credit pulls, which don’t affect your credit score.

Consider any additional features offered by the lender, such as credit score monitoring, financial education resources, or flexible payment options.

While these features shouldn’t be the primary factor in your decision, they can provide added value and support as you work to improve your credit. Some lenders may also offer loans to help build credit with unique features like interest refunds for on-time payments or graduated credit limits.

Start Today and Explore the Features Firsthand!

Maximizing the Benefits of Your Credit Builder Loan

Once you’ve chosen a credit builder loan, it’s crucial to use it effectively to build credit fast. Implementing the right strategies can help you make the most of your loan and achieve your credit-building goals more quickly.

Timely Payments and Credit Monitoring: The Keys to Success

The most critical factor in building credit with your credit builder loan is making all payments on time. Payment history accounts for about 35% of your FICO score, so consistent, on-time payments can significantly boost your credit. Set up automatic payments or reminders to ensure you never miss a due date.

Additionally, regularly monitor your credit report to track your progress and catch any errors. Many credit builder loan providers offer free credit monitoring as part of their service. Take advantage of this to watch your score improve over time and stay motivated in your credit-building journey.

Complementary Credit-Building Strategies: Boosting Your Efforts

While a credit builder loan is an excellent tool, it’s even more effective when combined with other credit-building methods. Consider using a secured credit card in addition to your loan to diversify your credit mix.

Becoming an authorized user on a family member’s credit card can also help boost your credit profile. If you’re wondering, “Does paying student loans build credit?”, the answer is yes. If you have student loans, making timely payments on them alongside your credit builder loan can further enhance your credit-building efforts.

Remember, a diverse credit mix can positively impact your credit score.

Patience and Responsible Financial Behavior: Long-Term Credit Health

Building credit takes time, so it’s important to be patient and maintain responsible financial habits throughout your credit builder loan term and beyond.

Avoid applying for multiple loans or credit cards while building credit, as each application typically results in a hard inquiry on your credit report. Focus on managing your credit builder loan responsibly and practicing good financial habits like budgeting and saving.

These behaviors will not only help you build credit fast but also set you up for long-term financial success. Remember, the goal is not just to improve your credit score, but to develop sustainable financial practices that will benefit you in the long run.

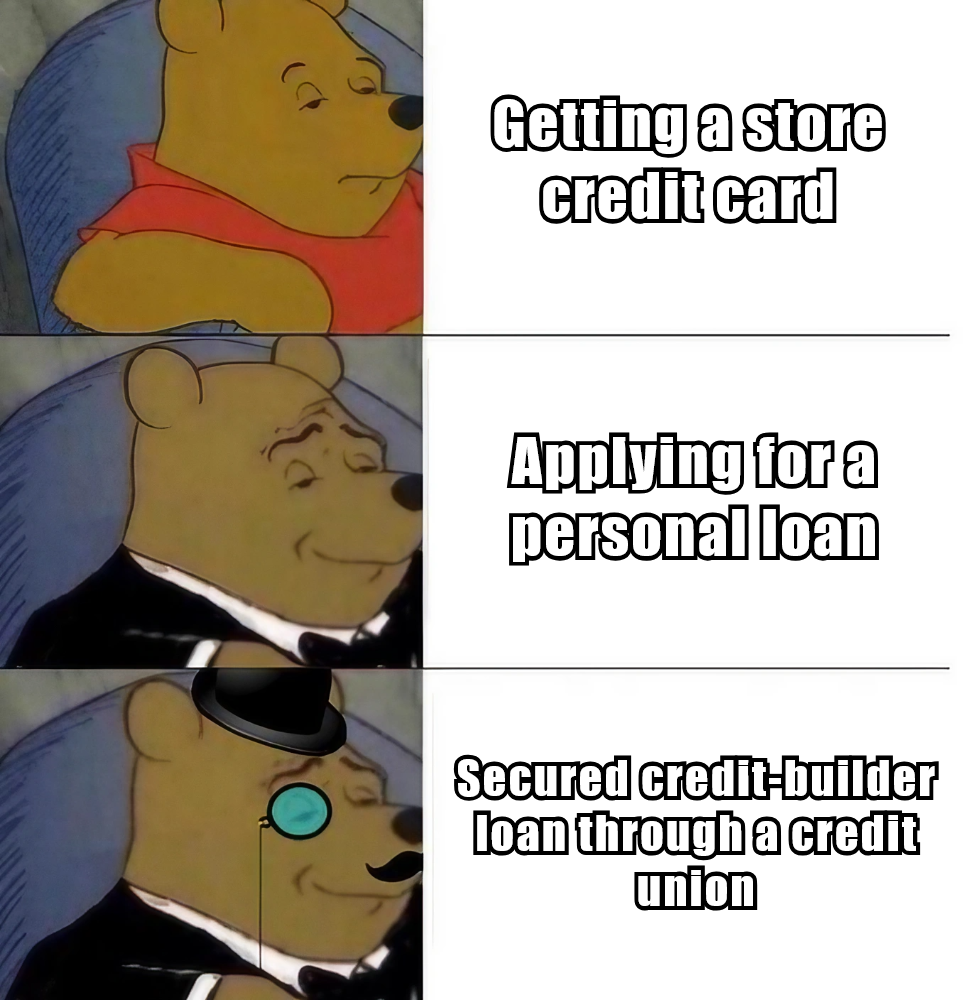

Other Types of Loans That Build Credit

While credit builder loans are excellent tools for improving your credit, they’re not the only option. Other types of loans can also help you build credit when managed responsibly. Let’s explore some alternatives.

Do Personal Loans Build Credit? Understanding Their Impact

Personal loans build credit when managed responsibly, offering another avenue for credit improvement. Unlike credit builder loans, personal loans to build credit provide funds upfront, which can be useful if you need to make a large purchase or consolidate debt.

These loans contribute to your credit mix and payment history, two important factors in credit scoring.

However, qualifying for personal loans to build credit may be more challenging if you have a low credit score. It’s important to carefully consider the terms and your ability to repay before taking out a personal loan for credit-building purposes.

Does Paying Student Loans Build Credit? Leveraging Education Debt

Many people wonder, “Does paying student loans build credit?” The answer is yes. Student loans are a form of installment credit, and making regular, on-time payments can significantly boost your credit score over time.

Like credit builder loans, student loans contribute to your payment history and credit mix. They often have long repayment terms, which can help establish a lengthy credit history. However, it’s crucial to manage student loans responsibly, as missed payments can severely damage your credit.

If you’re struggling with payments, consider options like income-driven repayment plans rather than defaulting on your loans.

Start Today and Explore the Features Firsthand!

The Impact of Credit Builder Loans on Your Credit Score

Understanding how credit builder loans affect your credit score can help you set realistic expectations and track your progress. These loans can influence various aspects of your credit profile, contributing to overall credit improvement.

Payment History and Credit Mix: Positive Factors for Credit Growth

Credit builder loans primarily impact your credit through payment history and credit mix. Each on-time payment on your loan is reported to the credit bureaus, helping to establish a positive payment history. This is crucial as payment history accounts for about 35% of your FICO score.

Additionally, adding a credit builder loan to your credit profile improves your credit mix, which makes up about 10% of your score. A diverse credit mix shows lenders that you can manage different types of credit responsibly. These positive impacts make credit builder loans effective tools to build credit fast.

New Credit and Credit Utilization: Balancing Short-Term and Long-Term Effects

When you first take out a credit builder loan, it may cause a small, temporary dip in your credit score due to the new credit inquiry and account.

However, this effect is typically short-lived and outweighed by the long-term benefits of the loan. Unlike credit cards, credit builder loans don’t factor into your credit utilization ratio, which is beneficial if you’re trying to keep your credit utilization low.

Over time, as you make payments and your loan balance decreases, you may see a gradual improvement in your credit score. This balance of short-term and long-term effects makes credit builder loans a strategic choice for those looking to improve their credit profile.

Conclusion

By understanding and utilizing credit builder loans effectively, you can take control of your financial future and build the credit score you need to achieve your goals. Whether you’re an entrepreneur looking to secure business funding or an individual aiming to qualify for better loan terms, a strong credit history is key.

Start your credit-building journey today with a credit builder loan and watch your financial opportunities expand. Remember, the best loans to build credit are those that you can manage responsibly and consistently over time.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!