In the fast-paced world of credit repair, having a well-structured credit repair workflow is essential for success. Managing multiple clients, tracking disputes, and staying organized can quickly become overwhelming without the right system in place.

The key to efficiency lies in leveraging credit repair workflow automation and software solutions that streamline operations, improve accuracy, and save valuable time.

Whether you’re an independent professional or managing a growing business, optimizing your credit repair workflow can help you stay ahead in this competitive industry.

Start Today and Explore the Features Firsthand!

The Importance of Time Management in the Credit Repair Process

The credit repair process is inherently detail-oriented, requiring meticulous attention to each client’s unique situation. From analyzing credit reports to drafting dispute letters and following up with creditors, the tasks can seem endless. Without proper organization and credit repair efficiency, it’s easy to become overwhelmed.

This lack of efficient time management can lead to a cascade of issues: missed deadlines, overlooked details in credit reports, delayed responses to clients, decreased client satisfaction, and ultimately, limited business growth.

By mastering time management and leveraging credit repair software, you can overcome these challenges and take your credit repair business to new heights.

Transforming Your Workflow with Credit Repair Software

Credit repair software is designed to automate and streamline many of the time-consuming tasks associated with the credit repair process. Let’s explore how it can revolutionize your workflow:

Centralized Client Management for Enhanced Credit Repair Efficiency

One of the biggest time-savers is having all your client information in one place. Credit repair software typically offers secure client portals, easy-to-access client profiles, document storage and organization, and automated reminders for follow-ups and deadlines.

This centralization eliminates the need to juggle multiple spreadsheets or paper files, saving you precious time and reducing the risk of errors in the credit repair process.

Automated Credit Report Analysis for Improved Credit Repair Productivity

Manually reviewing credit reports is not only time-consuming but also prone to human error. Credit repair software can import credit reports from major bureaus, automatically identify potential errors or discrepancies, and generate detailed analysis reports.

This automation ensures a thorough and consistent review process for every client, significantly enhancing your overall credit repair efficiency.

Streamlined Dispute Letter Generation

Crafting effective dispute letters is an art, but it doesn’t have to be a time sink. Many credit repair software solutions offer templates for various dispute scenarios, customizable letter content, and automatic population of client and creditor information.

These features allow you to generate professional, personalized dispute letters in a fraction of the time it would take to write them from scratch, dramatically improving your credit repair productivity.

Comprehensive Progress Tracking and Reporting

Keeping clients informed about their progress is crucial for maintaining trust and satisfaction. Credit repair software typically includes real-time status updates, automated progress reports, and visual representations of credit score improvements.

These features not only save you time in creating reports but also help keep your clients engaged and motivated throughout the credit repair process.

Start Today and Explore the Features Firsthand!

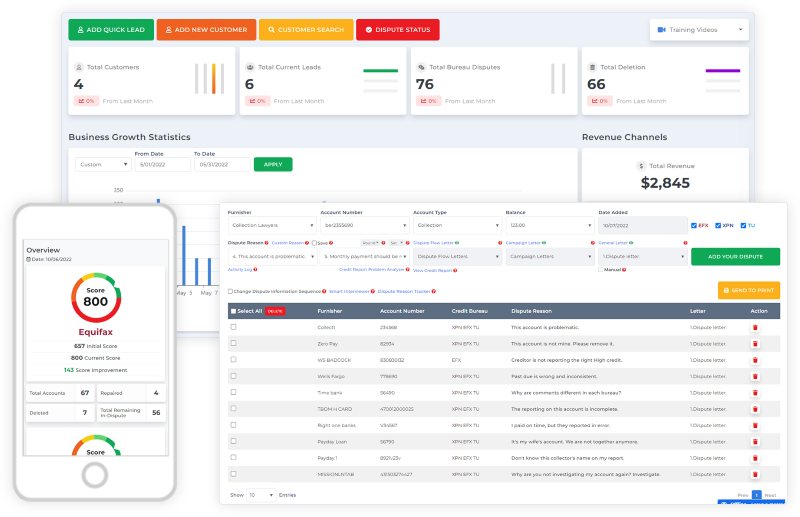

Leveraging Client Dispute Manager Software for Enhanced Credit Repair Efficiency

One of the most critical components of credit repair software is the Client Dispute Manager Software. This feature is designed to streamline the dispute process, a core element of any credit repair business. Let’s explore how Client Dispute Manager Software can significantly boost your credit repair productivity and efficiency.

Centralized Dispute Tracking

Client Dispute Manager Software provides a centralized platform to track all disputes for each client. This centralization allows you to view the status of all disputes at a glance, prioritize disputes based on deadlines or importance, and track the progress of each dispute through various stages of the credit repair process.

By having all this information in one place, you can manage your workload more effectively and ensure that no dispute falls through the cracks.

Automated Dispute Letter Generation

One of the most time-consuming aspects of the credit repair process is drafting dispute letters. Client Dispute Manager Software automates this process by providing customizable templates for different types of disputes, automatically populating letters with client and creditor information, and allowing for easy customization to address specific dispute details.

This automation can dramatically increase your credit repair productivity, allowing you to handle more disputes in less time.

Progress Tracking and Reporting

Client Dispute Manager Software often includes robust tracking and reporting features. These allow you to monitor the progress of each dispute in real-time, generate reports on dispute resolution rates, and identify trends in dispute types or creditor responses.

These insights can help you refine your credit repair process, focusing on strategies that yield the best results for your clients.

Integration with Credit Bureau Communication

Many advanced Client Dispute Manager Software solutions offer direct integration with credit bureau communication systems. This feature can streamline the process of submitting disputes to credit bureaus, automate the receipt and processing of bureau responses, and reduce manual data entry and potential errors.

By automating these communications, you can significantly enhance your credit repair efficiency and ensure more timely responses to bureau inquiries.

Client Portal Access

Some Client Dispute Manager Software includes a client-facing portal. This feature allows your clients to view the status of their disputes in real-time, upload documents related to their disputes, and communicate with you directly about specific items.

This level of transparency can improve client satisfaction and reduce the time you spend on client communications, further boosting your credit repair productivity.

Start Today and Explore the Features Firsthand!

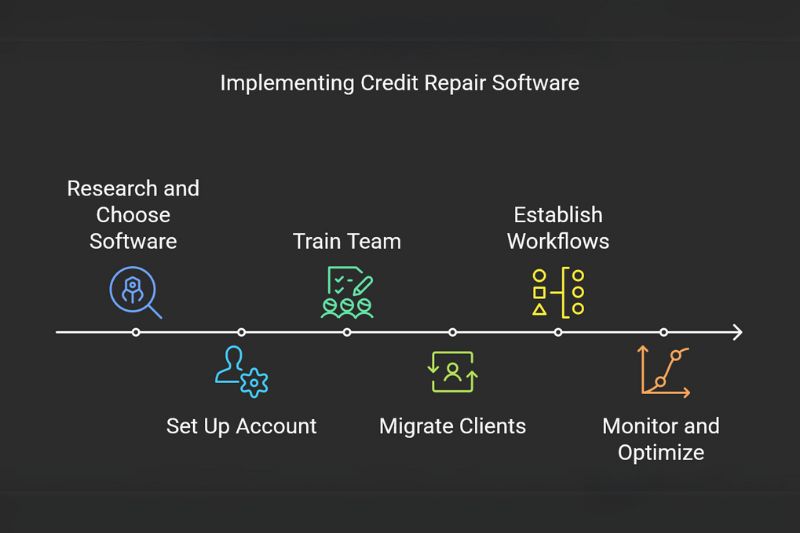

Implementing Credit Repair Software: A Step-by-Step Guide to Boost Credit Repair Efficiency

Now that we’ve explored the benefits, let’s walk through how to effectively implement credit repair software in your business:

- Research and Choose the Right Software: Look for solutions that offer the features most relevant to your credit repair process needs. Consider factors like ease of use, customer support, and scalability.

- Set Up Your Account: Once you’ve chosen a software, invest time in properly setting up your account. This includes customizing settings, importing existing client data, and familiarizing yourself with the interface to maximize credit repair efficiency.

- Train Your Team: If you have employees, ensure they’re thoroughly trained on how to use the credit repair software. This initial investment in training will pay off in increased credit repair productivity down the line.

- Migrate Existing Clients: Start by moving your current clients into the new system. This is an excellent opportunity to review and update their information, ensuring a smooth transition in the credit repair process.

- Establish New Workflows: Develop new processes that leverage the software’s features. For example, create a standard operating procedure for onboarding new clients that incorporates the automated tools at your disposal.

- Monitor and Optimize: Regularly review how the credit repair software is impacting your business. Look for areas where you can further streamline your credit repair process or take advantage of underutilized features to boost credit repair efficiency.

Start Today and Explore the Features Firsthand!

Maximizing Credit Repair Productivity with Advanced Software Strategies

To truly master time management with credit repair software, consider these advanced strategies:

Leverage Integration Capabilities for Seamless Credit Repair Automation

Many credit repair software solutions can integrate with other business tools like CRM systems, email marketing platforms, or accounting software. Take advantage of these integrations to create a seamless workflow across all aspects of your credit repair process.

Utilize Batch Processing to Enhance Credit Repair Efficiency

Look for opportunities to process similar tasks in batches. You might set aside a specific time each week to review all new credit reports or generate dispute letters for multiple clients at once.

This approach can help you maintain focus and reduce the time lost in switching between different types of tasks, significantly improving your credit repair productivity.

Implement Automation Rules for a Streamlined Credit Repair Process

Most credit repair software allows you to set up automation rules. These can include automatic follow-ups with clients after a certain period, alerts for significant changes in a client’s credit score, scheduled credit report pulls, and automatic assignment of tasks to team members based on predefined criteria.

Frequently Asked Questions (FAQs)

How Much Time Can I Really Save By Using Credit Repair Software?

While the exact time savings can vary, many credit repair specialists report saving 20-30 hours per week by implementing software solutions. This time can then be reinvested in growing your business or providing more personalized service to clients.

Is Credit Repair Software Secure?

Reputable credit repair software providers prioritize security, often using bank-level encryption to protect client data. However, it’s important to do your due diligence and choose a provider with a strong track record in data security for your credit repair process.

Can Credit Repair Software Help Me Stay Compliant With Industry Regulations?

Yes, many credit repair software solutions are designed with compliance in mind. They often include features like audit trails, consent tracking, and up-to-date letter templates that adhere to current regulations. However, it’s still important to stay informed about legal requirements and use the software as a tool to support your compliance efforts.

Can Credit Repair Software Help Me With Marketing My Business?

Many credit repair software solutions like Client Dispute Manager Software include marketing features such as email campaign tools, referral tracking, and even website builders. These can be valuable assets in growing your client base and promoting your credit repair services.

Conclusion

In conclusion, mastering time management through the use of credit repair software can transform your business, allowing you to help more clients, increase credit repair efficiency, and drive growth.

By centralizing client management, automating key processes, and leveraging advanced features like Client Dispute Manager Software, you can streamline your credit repair workflow and focus on what really matters helping your clients achieve their credit goals.

Remember, the key to success is not just in adopting the software, but in continually optimizing your credit repair process to make the most of its capabilities. Are you ready to take your credit repair business to the next level with software solutions and boost your credit repair productivity?

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!