Credit repair can be a daunting task, especially when dealing with inaccurate information on credit reports. However, with the advent of AI dispute letters, the process has become more efficient and effective. In this article, we will delve into the different types of AI dispute letters Factual, Consumer Law, and Metro 2 and explore how to use them to improve credit scores.

Additionally, we’ll answer some frequently asked questions to provide a comprehensive understanding of this innovative approach.

What Are AI Dispute Letters?

AI credit dispute letters are automated dispute letters generated using artificial intelligence to address inaccuracies on credit reports. These letters can significantly streamline the credit repair process, making it easier to dispute errors and improve credit scores.

By automating the creation of dispute letters, credit repair professionals can save time and enhance accuracy. The use of AI ensures that each letter is tailored to the specific issues of the credit report in question.

Types of Automated Dispute Letters

There are three main types of AI credit dispute letters: Factual dispute letters, Consumer law dispute letters, and Metro 2 dispute letters. Each type serves a different purpose and is suitable for addressing various kinds of inaccuracies.

Understanding the differences between these types is crucial for effective credit repair.

Choosing the right type of dispute letter can significantly impact the success of your credit repair efforts.

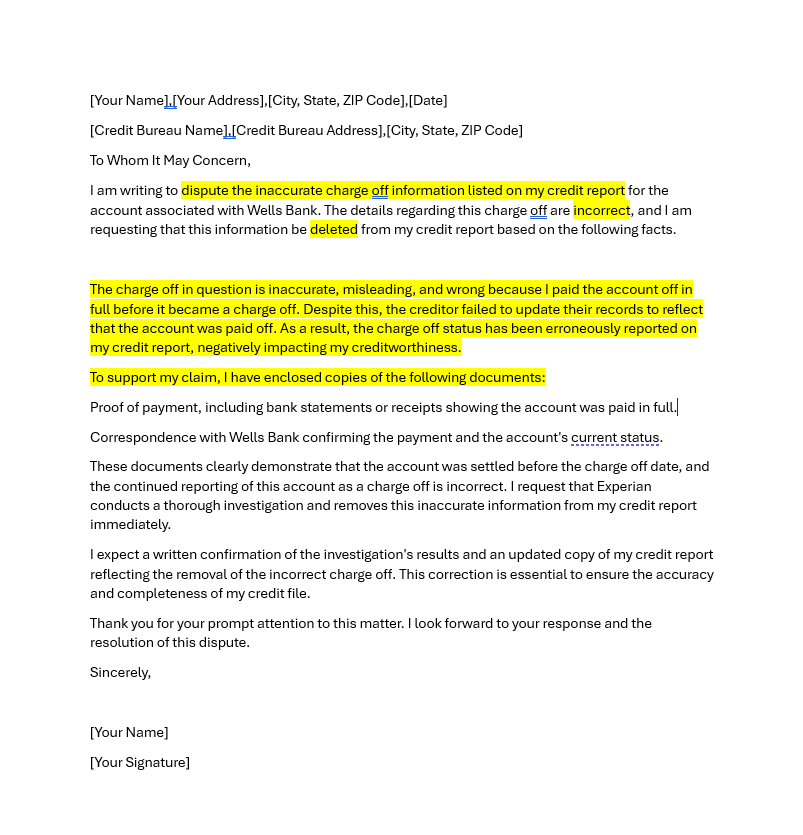

What Are Factual Dispute Letters?

Factual dispute letters focus on disputing specific errors with concrete evidence. These letters address inaccuracies such as incorrect account details, balances, or dates. They rely on hard evidence to prove inaccuracies, making them a powerful tool for straightforward errors. Factual dispute letters are ideal when the error is clear and easily verifiable.

Benefits of Factual Dispute Letters

- Accuracy: Factual dispute letters target precise errors with supporting documentation, ensuring that the corrections made to the credit report are accurate and verifiable. By providing clear evidence, these letters make it difficult for credit bureaus to deny the dispute, leading to a higher success rate in correcting inaccuracies.

- Clarity: These letters provide clear and straightforward evidence to correct inaccuracies, making it easy for credit bureaus to understand and process the dispute. The clarity of the evidence presented helps expedite the resolution process.

- Effectiveness: Often leads to quick resolution due to the solid evidence provided. Factual dispute letters are particularly effective because they present undeniable proof of the inaccuracies, compelling credit bureaus to take corrective action promptly.

When to Use Factual Dispute Letters?

Use factual dispute letters when you can clearly identify and prove inaccuracies. For example, incorrect account balances, wrong dates, or unrecognizable accounts are all suitable cases. These letters are best for situations where the facts are indisputable and can be backed up with documentation. They are particularly useful for resolving simple, clear-cut errors on a credit report.

Example Scenario: Using Factual Dispute Letters

Imagine you’ve paid a bill, but it’s still showing as unpaid on your credit report. You can use a factual dispute letter to correct this error by providing proof of payment. This approach ensures that the credit bureau has all the necessary information to update your report accurately. By presenting clear evidence, you increase the likelihood of a successful dispute resolution.

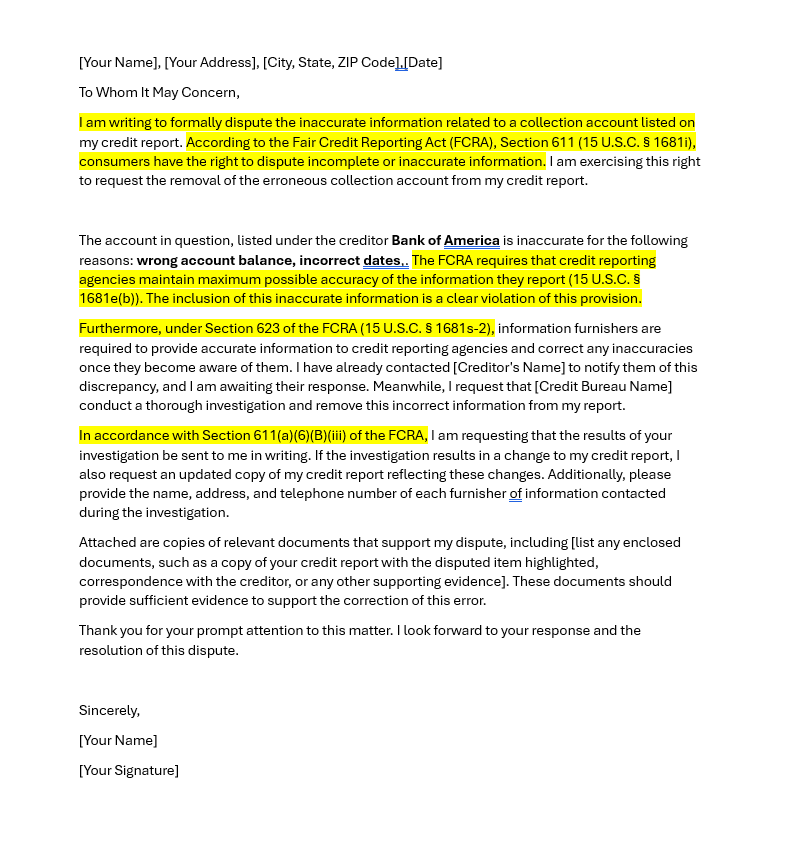

What Are Consumer Law Dispute Letters?

Consumer law dispute letters leverage consumer protection laws to dispute inaccuracies. These letters emphasize the legal rights of consumers, making them a powerful tool for addressing violations.

They are based around the laws that protect consumers, such as the Fair Credit Reporting Act. These letters highlight the legal obligations of creditors and credit bureaus to maintain accurate information.

Benefits of Consumer Law Dispute Letters

- Empowerment: Emphasizes consumer legal rights. By leveraging consumer protection laws, these letters empower individuals to take control of their credit repair process. Knowing their legal rights gives consumers the confidence to challenge inaccuracies effectively.

- Effectiveness: Particularly useful in cases of legal violations by creditors or collectors. These letters can compel creditors and credit bureaus to correct inaccuracies due to the potential legal repercussions of not complying with consumer protection laws.

- Legal Leverage: Uses the weight of consumer protection laws to strengthen the dispute. By citing specific laws and regulations, consumer law dispute letters add a layer of authority and urgency to the dispute, increasing the likelihood of a favorable outcome.

When to Use Consumer Law Dispute Letters?

Use consumer law dispute letters when there are legal violations, such as breaches of consumer protection laws or violations by creditors or collectors. These letters are ideal for situations where your rights as a consumer have been infringed upon.

They are effective when you need to remind creditors and credit bureaus of their legal obligations. This approach can compel them to correct inaccuracies due to the potential legal repercussions.

Example Scenario: Using Consumer Law Dispute Letters

If a credit bureau or creditor has reported inaccurate information in violation of consumer rights, a consumer law dispute letter can address these violations effectively.

For instance, if a creditor fails to remove an account that was supposed to be deleted, citing the Fair Credit Reporting Act in your dispute letter can help rectify the situation. By highlighting legal violations, you can ensure that your rights are upheld and the necessary corrections are made.

What Are Metro 2 Dispute Letters?

Metro 2 dispute letters focus on compliance with industry standards. They address whether the reporting and investigation of credit information comply with Metro 2 standards. These standards ensure that credit information is reported accurately and consistently.

Metro 2 dispute letters are particularly useful for complex issues that may not be straightforward factual inaccuracies.

Benefits of Metro 2 Dispute Letters

- Compliance Focus: Targets compliance issues rather than just factual errors. By focusing on compliance, these letters address systemic issues in the credit reporting process, ensuring that all parties adhere to industry standards.

- Complexity Handling: Suitable for complex cases. Metro 2 dispute letters are ideal for disputes that involve multiple layers of reporting and verification, making them effective for addressing intricate credit report issues.

- Industry Standards: Ensures that credit reporting adheres to recognized standards. By emphasizing compliance with industry standards, these letters help maintain the integrity of the credit reporting system.

When to Use Metro 2 Dispute Letters?

Use Metro 2 dispute letters for complex issues or compliance-related disputes. These letters are ideal when the dispute is about adherence to industry standards rather than specific factual errors. They are effective for addressing issues that involve multiple layers of reporting and verification. This type of letter is suitable for cases where the credit reporting process itself may be flawed.

Example Scenario: Using Metro 2 Dispute Letters

For complex reporting issues where a creditor’s information does not comply with industry standards, a Metro 2 dispute letter is appropriate to address these compliance issues. For example, if a creditor consistently reports incorrect account statuses, a Metro 2 dispute letter can be used to highlight these compliance failures.

By focusing on industry standards, you can address systemic issues that affect your credit report.

Choosing the Right AI Credit Dispute Letters

When selecting the right dispute letter, consider the nature of the inaccuracy. Is it a factual error, a legal violation, or a compliance issue? Understanding the root cause of the inaccuracy will help you choose the most effective dispute letter. Each type of letter serves a specific purpose and is suited to different types of inaccuracies.

Guidelines for Selection

- Factual Dispute Letters: Use for clear, provable inaccuracies. These letters are ideal for addressing straightforward errors that can be easily documented.

- Consumer Law Dispute Letters: Use for legal violations. These letters are powerful tools for addressing situations where consumer protection laws have been breached.

- Metro 2 Dispute Letters: Use for complex compliance issues. These letters are best suited for disputes involving intricate reporting standards and compliance failures.

Generating AI Dispute Letters with Client Dispute Manager

- Log In to The Software: Access your Client Dispute Manager account. Ensure you have all necessary credentials to log in securely.

- Navigate to the Dispute Manager Section: Find the section for generating automated dispute letters. This is typically labeled clearly in the software interface.

- Select the Dispute Letter Type: Choose between factual dispute letters, consumer law dispute letters, and Metro 2 dispute letters. The software will guide you through the selection process.

- Generate the Letter: Follow the prompts to create your AI-generated dispute letter. The software will automate much of the process, ensuring that the letter is tailored to the specific inaccuracies on the credit report.

Benefits of Using Client Dispute Manager

- Automated Dispute Letters: Save time with automated dispute letters generation. The software can generate multiple letters quickly and accurately, making the dispute process more efficient.

- Comprehensive Tools: Access a range of tools to manage and track disputes. The software includes features for tracking the status of disputes, managing client information, and more.

- User-Friendly Interface: Easy to navigate and use, even for beginners. The intuitive design of the software ensures that users can quickly learn how to generate and manage dispute letters.

Frequently Asked Questions (FAQs)

What Is An AI Dispute Letter?

An AI dispute letter is an automated letter generated using artificial intelligence to address inaccuracies on credit reports. These letters are tailored to the specific issues of the credit report, making them highly effective.

How Do Factual Dispute Letters Differ From Consumer Law Dispute Letters?

Factual dispute letters address specific inaccuracies with concrete evidence, while consumer law dispute letters leverage consumer protection laws to dispute inaccuracies. Factual letters rely on documentation, whereas consumer law letters emphasize legal rights.

When Should I Use A Metro 2 Dispute Letter?

Use a Metro 2 dispute letter for complex compliance issues or when the dispute is about adherence to industry standards rather than specific factual errors. These letters are ideal for addressing systemic issues in credit reporting.

Can AI Dispute Letters Improve My Credit Score?

Yes, by effectively disputing inaccuracies on your credit report, AI credit dispute letters can help improve your credit score. These letters increase the chances of correcting errors, which can positively impact your credit rating.

How Do I Get Started With AI Dispute Letters?

Start by taking advantage of the free 30-day trial of the Client Dispute Manager software, which includes access to AI credit repair letters and comprehensive training. This trial provides a risk-free opportunity to explore the software and see how it can benefit your credit repair efforts.

Conclusion

Understanding and utilizing AI credit dispute letters factual dispute letters, consumer law dispute letters, and Metro 2 dispute letters can greatly enhance your credit repair efforts.By choosing the right type of dispute letter, you can effectively address inaccuracies and improve credit reports.

Don’t forget to click the link for your free 30-day trial of the Client Dispute Manager Software and start using these powerful AI tools today. With the right tools and knowledge, you can take control of your credit repair process and achieve better results.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Below Is More Content For Your Review: