Navigating the aftermath of identity theft can be challenging, especially when it comes to repairing your credit. In this crucial period, taking informed steps towards credit repair after identity theft is essential for reclaiming your financial stability. This article serves as a concise guide, providing you with essential advice to efficiently restore your credit and secure your financial future after such a breach.

Let’s embark on the path to recovery and turn this unfortunate event into a story of resilience and determination, focusing on credit repair after identity theft.

Recognizing the Impact of Identity Theft

When someone steals your personal information and pretends to be you, that’s identity theft. This bad news can mess up your credit, which is like your financial report card. Imagine finding out someone took your report card and filled it with grades you didn’t earn! That’s what happens to your credit report when identity theft strikes.

How Does Identity Theft Hurt Your Credit?

Imagine one day you want to buy something big and important, like a car. The salesperson looks at your credit and says, “Sorry, your credit score is too low.” But wait, you always pay bills on time! How could this happen? Well, if a thief has been using your name to spend money and not pay it back, that’s like getting a bunch of F’s on your report card. Suddenly, companies get nervous about lending you money or might make you pay more for it.

The First Signs of Trouble

So, how do you know if you’ve been hit by identity theft? Keep an eye out for these red flags:

- Bills for things you didn’t buy showing up in your mailbox.

- Calls about debts that aren’t yours.

- Your bank statements have weird charges.

- You try to file your taxes and find out someone already did it using your name.

If you see any of these things, it’s like a big, flashing stop sign telling you something’s wrong with your credit.

Why Fixing Your Credit is Super Important?

If your credit report gets messed up because of identity theft, it’s super important to fix it that’s what we call “credit repair after identity theft.” It’s like cleaning up your report card so it shows the real you, not the pretend-you the thief made up. When your credit report is clean, buying things on credit is easier and cheaper, and you don’t have to worry as much about someone else messing up your money plans.

Initial Response and Damage Control

So, you’ve spotted some warning signs and think you might be dealing with identity theft. What now? Well, it’s time to act fast, like a superhero swooping in to save the day your day to save your credit from the bad guys!

Quick! Sound the Alarm!

The first thing to do is tell the right people that your information might be in a thief’s hands. Here’s your action plan:

Call the Credit Bureaus

Ring up the three big credit bureaus Equifax, Experian, and TransUnion. Tell them you need a fraud alert on your credit report. This alert is like a big “Beware of Dog” sign that makes lenders double-check if it’s really you who’s asking to borrow money.

Get Your Credit Reports

You can get your credit reports for free once you place a fraud alert. These reports are like a detailed list of everything the thief might have messed with. Look through them carefully. If something looks fishy, it could be the thief’s doing.

Report to the Feds

Yes, you should actually tell the government. The Federal Trade Commission (FTC) is like a coach for dealing with identity theft. You can report it on their website, IdentityTheft.gov, and they’ll help you make a game plan.

Call Your Bank and Credit Card Companies

Let them know what’s up. They can watch your accounts for more strange stuff and replace your cards if needed.

Put Up Some Walls

After you’ve told everyone, it’s time to put up some defenses. If you think someone might steal from you, you’d lock your doors, right? It’s the same with your credit.

Freeze Your Credit

Ask the credit bureaus for a credit freeze. It’s free, and it locks your credit reports so no one can open new accounts in your name. It’s like a big, icy wall that keeps the thieves out.

Change Your Passwords

Make new, strong passwords for all your online accounts. If the thief has your old passwords, they’re like keys to doors you just locked. New passwords make sure those doors stay shut.

Remember, the faster you act, the less the thief can mess up your credit. It’s all about not giving them any chances to make things worse. This is your credit repair after identity theft superhero moment go save the day!

Navigating the Credit Repair Journey

Once you’ve put up your defenses against identity theft, it’s time to start fixing what’s been broken. Think of this part like going on a treasure hunt, where the treasure is your good credit score, and you’re the brave explorer.

Step #1: Spot the Mess

Grab your credit reports and look at them like they’re maps. Mark all the places where the thief left marks these are things you didn’t do. These marks could be new accounts you didn’t open or big buys you didn’t make.

Step #2: Write to the Credit Bureaus

Now, you’ve got to tell the credit bureaus about the mess. Write them a letter keep it simple, like sending a note to your teacher when something’s wrong. Tell them what’s not yours and ask them to take it off your report. This is called “disputing.” You’re basically saying, “Hey, this isn’t right, and I need you to fix it.”

Step #3: Talk to Your Bank and Credit Card Companies

Just like you told the credit bureaus, you need to tell your bank and credit card folks about the bad marks. If someone took a shopping trip with your card number, you’ve got to let the card company know that wasn’t you. They can help clean off those wrong marks.

Learn how to Healing Your Finances: A Step-by-Step Guide to Credit Repair for Medical Debt

Keep a Sharp Eye on Things

After you’ve sent your letters, don’t just wait around. Keep checking your credit reports to see if the marks you complained about are gone. Sometimes it takes a few letters back and forth, like when you’re trying to explain something tricky to a friend. Be patient but keep checking!

Save All Your Notes and Letters

Keep all the letters you send and get, just like you’d keep important homework. They’re proof that you’re working hard to fix your credit. If someone asks, “Did you really try to fix this?” you can show them all your work.

Understanding Your Rights

When it comes to credit repair after identity theft, you’ve got rights kind of like how you have rules in school that help keep everything fair. Knowing these rights is like having a secret code to help you get your credit back on track.

Your Credit Repair Shield: The FCRA

The Fair Credit Reporting Act (FCRA) is like a big shield that protects you. It says that the information on your credit report needs to be correct, and if it’s not, you have the right to fix it. This is super important because you want your credit report to tell the truth about you, especially after identity theft.

The Right to Dispute Errors

Just like you can raise your hand in class if something doesn’t seem right, you can tell the credit bureaus if you see a mistake on your credit report. This is called disputing. When you dispute something, the credit bureaus have to check it out and fix it if you’re right.

The Right to a Credit Freeze

A credit freeze is like putting your credit in a safe where no one can touch it. If you’re worried about identity thieves opening new accounts in your name, you can freeze your credit. This stops anyone from getting new credit while you’re fixing things up.

Time to Fix Mistakes

If something’s wrong on your credit report, the credit bureaus have to look into it usually within 30 days. Think of it like a countdown to get things right. They have to tell you what they find out, so you’re not left wondering.

Knowing your rights is a big deal when you’re dealing with credit repair after identity theft. It’s like having a rulebook for a game you need to know the rules to play well and win. And when it comes to your credit, you definitely want to win!

Rebuilding Your Credit Post-Identity Theft

Okay, so you’ve done the hard work of cleaning up your credit report after identity theft. High five! But what’s next? Think of it like a game where you’ve beat the big boss (the identity thief), and now you’re ready to level up (that’s rebuilding your credit).

Start Fresh and Move Smart

When you’re rebuilding your credit, it’s like starting a new chapter in your favorite book. You want everything to go smoothly, right? So, here’s how to make your credit score happy again:

Pay Bills on Time, Every Time: Your credit score loves it when you pay bills when they’re due. It’s like feeding a pet do it regularly, and it’ll be your best friend.

Budget Like a Boss: Keep track of your money like you’re the boss of a candy store. Know what you’re spending and make sure you’re not using too much credit. Not too little, not too much just right.

Get a Secured Credit Card: This is a special kind of credit card that’s easier to get and can help build your credit back up. Think of it as training wheels for your credit score.

Keep an Eye on Your Credit Score: Just like you check your game scores, check your credit score often. If it’s going up, you’re doing things right. If not, it’s time to change your game plan.

Build Credit with Confidence

As you’re rebuilding, remember to take it slow. Don’t rush out and get a bunch of new credit cards. That’s like trying to run before you’ve learned to walk again after a big fall. Take it one step at a time.

Talk to Credit Pros When You Need To

Sometimes, things can get confusing, or you might feel stuck. That’s totally okay. Just like asking a teacher for help, sometimes you might need to talk to a credit repair expert. They’re like guides who can help you find your way on your credit journey.

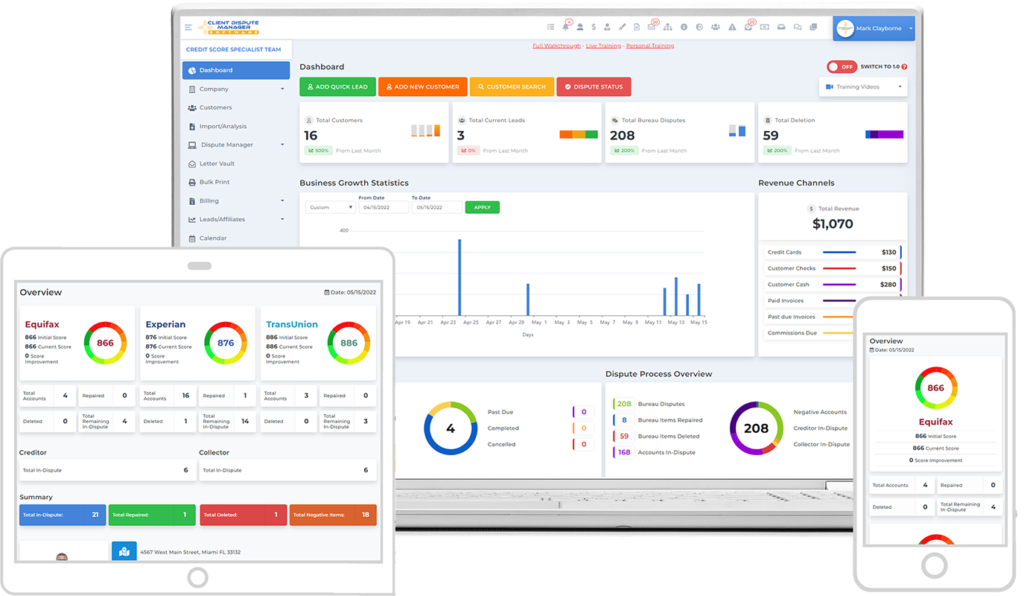

Employing Client Dispute Manager Software

Now, let’s talk about a secret weapon in your “credit repair after identity theft” toolkit. It’s like having a smart robot buddy who helps you fix your credit. This buddy is called Client Dispute Manager Software.

What's This Software All About?

Client Dispute Manager Software is like a super-organized helper for your credit repair journey. It keeps track of all your letters, disputes, and the replies you get from credit bureaus and creditors. Imagine it like a filing cabinet that’s got superpowers, making sure you never lose anything and always know what’s going on.

How Can It Help You?

- Keep Your Stuff Neat: This software keeps all your important papers in one place. No more lost letters or forgetting who you talked to about your credit.

- Save Time: Instead of writing the same thing over and over, the software helps you make dispute letters fast. It’s like having a homework machine that does all the boring parts for you.

- Stay on Track: It reminds you when to check your credit reports or when it’s time to send a follow-up letter. It’s like a personal coach for your credit repair game.

- Know What Works: The software can even show you what’s working best, so you can keep doing that. It’s like in video games when you find out which moves score the most points.

Making Disputes Easier

Disputing mistakes on your credit report can feel like a big homework project. But with Client Dispute Manager Software, it’s like having all the answers to the test. It guides you through each step, so you don’t have to guess what to do next.

A Tool for Victory

Think of this software as your trusty sidekick in the battle against identity theft damage. With it, you can go from being the victim to being the hero of your credit score story. So, if you want to make credit repair after identity theft a whole lot easier, consider giving this software a chance to help you out.

Conclusion

And just like that, you’re ready to tackle credit repair after identity theft. Remember, with the right steps and a little patience, you can clean up your credit report and come out on top. Use tools like Client Dispute Manager Software to make the journey easier. Stay sharp, stay informed, and take back your credit. You’ve got this now; go on and claim your victory!