Dealing with medical debt can be as stressful as the health issues that caused it. But there’s hope and help in the form of credit repair for medical debt a lifeline for those looking to reclaim their financial health. As a Credit Repair Specialist with years of experience, I’ve crafted this guide to simplify the process.

Whether you’re facing errors on your credit report or struggling to negotiate with collectors, the following steps are designed to clear your credit and help you breathe easier. Let’s embark on this journey toward financial recovery together.

Understanding Medical Debt and Credit Scores

What is Medical Debt?

Medical debt is the money you owe for health care you received. It’s not the same as credit card debt or a loan because most times, you didn’t choose to get sick or hurt. This kind of debt can surprise you. When you can’t pay those bills right away, they might be sent to a debt collector, and that’s when it can show up on your credit report.

How Does Medical Debt Affect Your Credit Score?

Your credit score is like a report card for how you handle money you borrow. When a medical bill is unpaid and it goes to collections, it can lower your score. A lower score can make it hard to get loans or good interest rates.

But, the good news is, medical debt is treated a bit differently than other debts. For one thing, it usually doesn’t show up on your credit report until it’s been unpaid for 180 days. That gives you more time to sort it out.

The Power of Knowing

When it comes to credit repair for medical debt, knowing what’s on your credit report is powerful. By looking at your report, you can see if there are any mistakes or if a bill you paid is still showing up as unpaid. Everyone can get a free credit report each year from the three big credit bureaus. This is your starting line for fixing your credit.

Mistakes Can Happen

Sometimes, there might be a mistake. Maybe your insurance should have paid a bill, but it didn’t. Or maybe you already paid the bill, but it still shows that you owe money. It’s important to fix these mistakes because they can hurt your credit score.

Taking the First Step

Fixing your credit starts with checking your credit reports for any medical debt that shouldn’t be there. If you find something wrong, you can take steps to correct it. It might take some time and effort, but it’s important for your financial health. Just like we take care of our bodies, we need to take care of our credit too.

Moving Forward

Now that you understand how medical debt can affect your credit, and how to spot any issues, you’re ready to move on to the next steps. This guide will help you learn how to talk to debt collectors, make a plan to pay off your debt, and get your credit score back up. It’s all part of the credit repair for medical debt process.

By staying informed and proactive, you can manage medical debt and protect your credit score. Remember, a healthy credit score is within reach, and it starts with understanding how medical debt plays a role. Let’s keep going and learn how to tackle this together.

Step 1: Get the Lowdown on Your Credit Report

Scoop Up Your Credit Report

Kick off your credit repair for medical debt journey by grabbing your credit report from the big three bureaus: Experian, Equifax, and TransUnion. It’s free once a year, and it’s your map to find and fix credit score dings.

Spot Medical Debt Markers

Look carefully for any medical debt listed. It might be hiding under ‘collections’—a spot that can drag your credit score down if not handled right. Finding these markers is like finding where the trouble spots are in a game.

Check for Slip-Ups

Mistakes on your report can happen, and they can stick to your credit like gum on a shoe. Make sure the medical debt listed is yours and the amounts look right. If something’s wonky, that’s what we need to clean up.

Say Bye to Old Debts

Debts older than seven years should be ancient history on your report. If they’re still hanging around, we’ll get the credit bureaus to erase them. It’s like telling an old campfire story it’s time for it to end.

Know Your Rights

You’ve got rights under the Fair Credit Reporting Act (FCRA). This act says your report should be spot on. If it’s not, you can challenge it think of it as calling a foul in a sports game.

Take Notes Like a Pro

As you go through your report, take notes like you’re the star player of the credit game, keeping track of points to score later. This is your playbook for the credit repair for medical debt game plan.

Once you’ve done Step 1, you’re all set with the basics. You know what’s on your credit report, and you’re ready to tackle those medical debts head-on. Stick with me, and we’ll go through this step by step. With some smarts and a bit of elbow grease, we’ll work on healing your credit score from those medical debt bruises.

Step 2: Your Credit Game, Your Rules

Team Up With the FCRA

Understanding the Fair Credit Reporting Act (FCRA) is like knowing the rules of the credit game. This act is a set of rules to make sure your credit report plays fair. When it comes to credit repair for medical debt, think of the FCRA as your coach, making sure the game is played right.

Call Out the Credit Fouls

If you spot something off in your report, like a medical bill that’s not yours, the FCRA is your whistle to call a foul. You’ve got the right to challenge any errors and get them fixed. It’s like a referee making sure no one cheats you on your credit score.

Stay in the Know

Knowledge is power, and the FCRA gives you the playbook. Keep an eye out for any wrong medical debt because, under these rules, you can get them corrected. With the FCRA on your side, you’re not just playing the credit game, you’re aiming to win it.

Step 3: Tackling Mistakes Head-On

Become a Credit Detective

When it comes to credit repair for medical debt, if you find a boo-boo on your credit report, it’s time to play detective. Disputing errors is like telling the teacher when there’s a mix-up with your test score. You point it out, and they fix it.

Dispute Like a Champ

Disputing is just a fancy word for arguing your case. You tell the credit bureaus, “Hey, this isn’t right!” Send them a letter or use their online tools. It’s like calling a timeout in a game when you see a slip-up.

Keep Your Eye on the Ball

After you dispute, the bureaus have to look into it. They’ve got about 30 days, like a shot clock in basketball. You aim to get any mistakes cleared so your credit score can bounce back up.

Follow Through

Just like in sports, follow-through matters. Keep a copy of your dispute letter or confirmation. That way, if there’s a question later, you’ve got proof you played by the rules and made your shot at cleaning up your credit report.

Step 4: Chatting Up Those Who Hold the Debt

Talk It Out with Creditors

When you’re on the road to credit repair for medical debt, sometimes you got to talk directly to the folks you owe like a timeout for a game plan. Reach out to the creditors or collection agencies nicely; think of it as asking for extra help at dinner. You want them to pass you the peas, not throw them!

Keep It Cool with Collectors

Dealing with collection agencies can be like a tough game of dodgeball. Keep your cool, stick to the facts, and remember, you’re in control of the conversation. Ask them to prove you owe what they say you do, and if they can’t, you might dodge that debt.

Aim for a Win-Win

If the debt’s legit but you can’t pay up all at once, try to make a deal. It’s like trading cards; you give a little, they give a little. Offer what you can afford to pay. Sometimes, they’ll take less, and that’s a score for both of you.

Get It in Writing

Always get agreements in writing, like a rulebook for your deal. This is your proof if they forget the play you both agreed on. With everything written down, you’re keeping your credit repair game tight and right.

Step 5: Finding a Helping Hand for Your Bills

Digging for Gold in Assistance Programs

Sometimes, credit repair for medical debt is like a treasure hunt; there are programs and help, but you have to find them. Look for payment assistance or charity care programs; it’s like finding a hidden power-up in a video game that gives your wallet a break.

Ask the Pros for Help

Hospital financial counselors can be like guides in a jungle of medical bills. They know the paths to programs that can cut down what you owe. Don’t be shy ask them to show you the way. It’s like asking a teacher for help with a challenging math problem. Learn how you can

Streamline Your Credit Repair Process with Cutting-Edge Software for Professionals.

Charity Care Might Be Your Ace

If you’re really strapped for cash, charity care programs can be a home run. They might cover part or all of your bill if you qualify. It’s like getting a scholarship for school because you need it, and you count.

Paperwork Is Your Passport

Get ready to fill out some forms, it’s the key to unlocking these helps. It’s a bit like filling out a permission slip for a field trip. Do it right, and you get to go on the trip; in this case, the trip is away from debt land.

Step 6: Crafting Your Payback Strategy

Be the Boss of Your Bills

Taking control of credit repair for medical debt means setting up a game plan to pay it back. Think of it as being the coach of your own financial team. You need a good playbook that’s your repayment plan. It lays out how you’ll tackle each dollar you owe, little by little.

Break It Down into Plays

Don’t let the total number freak you out. Break down that big scary number into smaller, bite-sized pieces. It’s like eating a pizza slice by slice you can’t gobble it all at once, but piece by piece, you’ll get it done.

Make a Money Move

Decide how much you can pay each month, kind of like deciding how much pocket money you can spend on snacks. Stick to what you can handle without going broke. If you can pay a bit more sometimes, like finding extra coins in the couch, do it.

Talk to the Team

If you’re working with a hospital or a creditor, let them know your plan. They’re part of your team now, and you gotta keep them in the loop. It’s like letting your teammates know the next play so everyone’s on the same page.

Keep Your Eye on the Prize

Stick to your plan like glue, and watch your monthly debt shrink. Keep your goal in sight, like the scoreboard showing you’re about to win. And remember, every payment is a step towards a victory dance no more debt and a credit score that keeps climbing.

Step 7: Keep an Eye on Your Credit Score While Battling Medical Bills

Playing Defense with Your Credit Report

When fixing your credit, checking your credit report is like being a goalie. You gotta watch out for any surprise moves, or in this case, mistakes that could sneak onto your report and score against you. Keep an eye on it, especially as you’re paying off medical debt.

Set Up Alerts: Be the First to Know

Just like setting an alarm for game day, set up alerts on your credit accounts. This way, you’re the first to know if something changes. It’s a heads-up play that can keep you ahead in the credit repair game.

Regular Checkups for Your Credit Health

Just like you need regular check-ups at the doctor, your credit score needs them too. Make it a habit, maybe every month or so, to peek at your score. It’s part of staying healthy, financially speaking.

Celebrate the Small Wins

Every time you pay down a bit of that medical debt and see your credit score rise, do a little victory dance. Small wins add up to big comebacks in the credit world. It’s like leveling up in a game the more you play, the better you get.

Keep the Momentum Going

Don’t let up. Just like in sports, the game isn’t over until the final whistle. Keep paying, keep monitoring, and keep your spirits high. Before you know it, you’ll be crossing the finish line with a healthier credit score and zero medical debt holding you back.

Considerations for Severe Medical Debt:

When Your Wallet Feels the Squeeze

If you’re staring down a mountain of medical bills, feeling like David against Goliath, don’t sweat it. Big debts can feel scary, but remember, there’s a game plan for even the toughest opponents.

Finding Allies in the Fight

Look for help where you can. There are programs and pros who are ready to stand in your corner and help you take on even the heftiest medical debts. It’s like having a tag-team partner in a wrestling match.

Stay Sharp and Stay Informed

Knowledge is power, especially when it comes to credit repair for medical debt. Learn about the moves you can make to protect your credit, like negotiating bills or seeking financial aid. It’s like knowing the other team’s playbook so you can outsmart them.

Keep Your Head in the Game

Don’t let big numbers knock you down. Stay focused, stick to your strategy, and remember that patience is part of the play. With time and the right moves, you can get back to a winning financial score

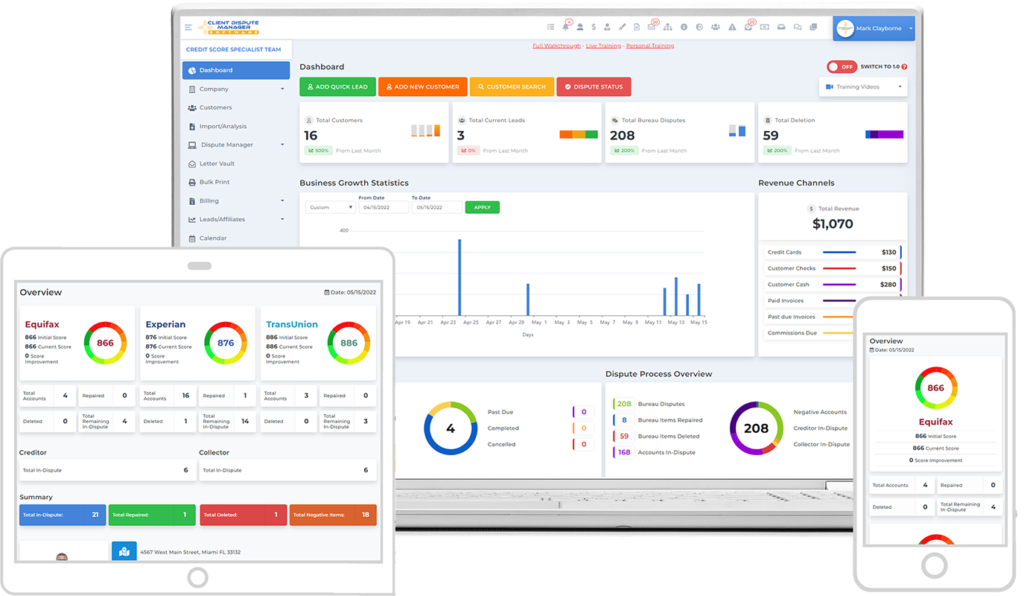

Leveraging Technology: Client Dispute Manager Software in Credit Repair

Up Your Credit Game with Smart Tools

In the world of credit repair, especially when dealing with medical debt, having the right tools can make all the difference. Think of the Client Dispute Manager Software as your personal credit repair coach, giving you the strategies and plays you need to win.

Streamline Your Strategy

This isn’t just any tool; it’s like having a Swiss Army knife for credit repair. With Client Dispute Manager Software, managing your disputes becomes a breeze, keeping everything organized and on track—because when it comes to repairing credit, staying organized is half the battle.

Score Points with Efficiency

Let this software do the heavy lifting for you. It’s designed to help you spot errors, send dispute letters, and follow up with creditors all without breaking a sweat. This means more time to focus on the game plan without getting bogged down in the details.

Keep an Eye on the Prize

With all your information and progress in one place, monitoring your journey out of medical debt is easier than ever. It’s like having a scoreboard that you can check anytime to see how close you are to your credit goals.

Conclusion

There is a simple guide to tackling credit repair for medical debt. Remember, consistency is key. Use the tools and knowledge you’ve gained to check your credit, dispute errors, and communicate effectively with creditors. With patience and the right approach, your credit can heal just as you have.

Keep a close eye on your progress, and don’t hesitate to leverage resources like the Client Dispute Manager Software to stay on top of your game. Stay the course, and you’ll find your financial health on the mend quickly. Here’s to a brighter, more secure financial future!

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.